QUARTERLY FACT SHEET 12.31.2015

Ultra®

TICKERS Investor class: TWCUX | Institutional class: TWUIX | A class: TWUAX | C class: TWCCX | R class: AULRX | R6 class: AULDX

Goal and Strategy

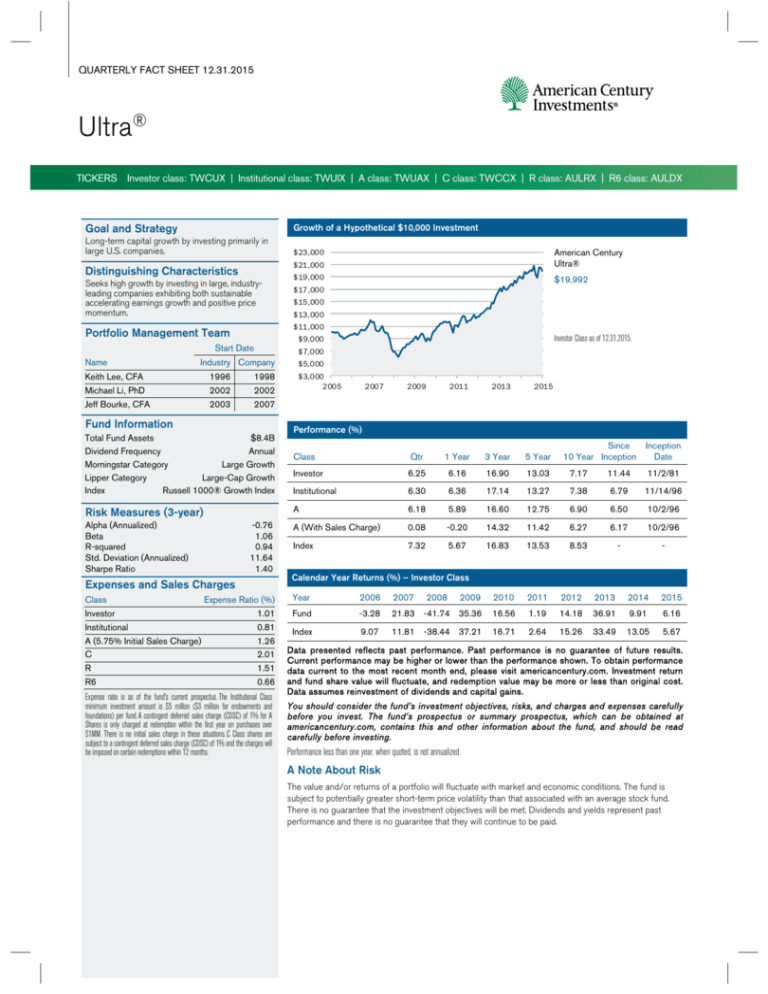

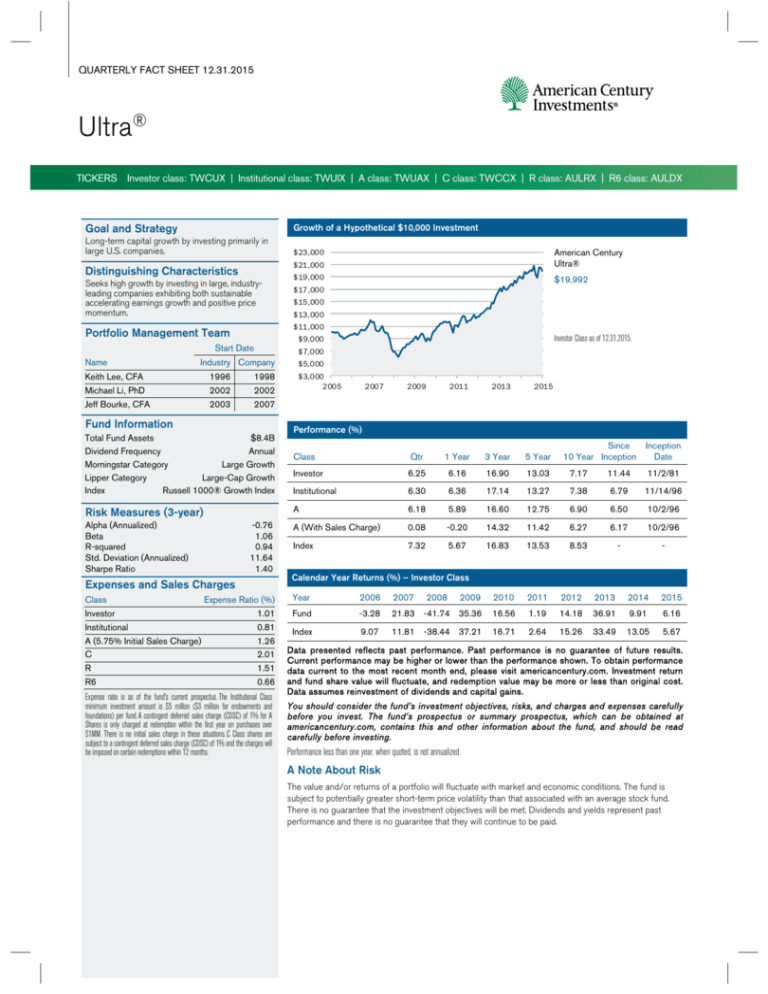

Growth of a Hypothetical $10,000 Investment

Long-term capital growth by investing primarily in

large U.S. companies.

$23,000

Distinguishing Characteristics

Seeks high growth by investing in large, industryleading companies exhibiting both sustainable

accelerating earnings growth and positive price

momentum.

$19,992

$17,000

$15,000

$13,000

Investor Class as of 12.31.2015.

$7,000

Industry Company

Keith Lee, CFA

1996

1998

Michael Li, PhD

2002

2002

Jeff Bourke, CFA

2003

2007

Fund Information

$5,000

$3,000

2005

2007

2009

2011

2013

2015

Class

Qtr

1 Year

3 Year

5 Year

Investor

6.25

6.16

16.90

13.03

7.17

11.44

11/2/81

Institutional

6.30

6.36

17.14

13.27

7.38

6.79

11/14/96

A

6.18

5.89

16.60

12.75

6.90

6.50

10/2/96

A (With Sales Charge)

0.08

-0.20

14.32

11.42

6.27

6.17

10/2/96

Index

7.32

5.67

16.83

13.53

8.53

-

-

Performance (%)

Total Fund Assets

$8.4B

Annual

Dividend Frequency

Large Growth

Morningstar Category

Large-Cap Growth

Lipper Category

Index

Russell 1000® Growth Index

Risk Measures (3-year)

Alpha (Annualized)

Beta

R-squared

Std. Deviation (Annualized)

Sharpe Ratio

-0.76

1.06

0.94

11.64

1.40

Since

10 Year Inception

Inception

Date

Calendar Year Returns (%) – Investor Class

Expenses and Sales Charges

Investor

Institutional

A (5.75% Initial Sales Charge)

C

R

R6

$19,000

$9,000

Start Date

Class

American Century

Ultra®

$11,000

Portfolio Management Team

Name

$21,000

Expense Ratio (%)

Year

2006

2007

2009

2010

2011

2012

2013

2014

2015

1.01

0.81

1.26

2.01

1.51

0.66

Fund

-3.28

21.83 -41.74 35.36

16.56

1.19

14.18

36.91

9.91

6.16

Index

9.07

11.81 -38.44 37.21

16.71

2.64

15.26

33.49

13.05

5.67

Expense ratio is as of the fund's current prospectus. The Institutional Class

minimum investment amount is $5 million ($3 million for endowments and

foundations) per fund.A contingent deferred sales charge (CDSC) of 1% for A

Shares is only charged at redemption within the first year on purchases over

$1MM. There is no initial sales charge in these situations. C Class shares are

subject to a contingent deferred sales charge (CDSC) of 1% and the charges will

be imposed on certain redemptions within 12 months.

2008

Data presented reflects past performance. Past performance is no guarantee of future results.

Current performance may be higher or lower than the performance shown. To obtain performance

data current to the most recent month end, please visit americancentury.com. Investment return

and fund share value will fluctuate, and redemption value may be more or less than original cost.

Data assumes reinvestment of dividends and capital gains.

You should consider the fund’s investment objectives, risks, and charges and expenses carefully

before you invest. The fund’s prospectus or summary prospectus, which can be obtained at

americancentury.com, contains this and other information about the fund, and should be read

carefully before investing.

Performance less than one year, when quoted, is not annualized.

A Note About Risk

The value and/or returns of a portfolio will fluctuate with market and economic conditions. The fund is

subject to potentially greater short-term price volatility than that associated with an average stock fund.

There is no guarantee that the investment objectives will be met. Dividends and yields represent past

performance and there is no guarantee that they will continue to be paid.

Ultra®

QUARTERLY FACT SHEET 12.31.2015

Portfolio Characteristics1

Fund

Index

75

-

$170.1B

$143.5B

Equity Holdings

Weighted Average

Market Cap

Sector Weights1 (%)

Portfolio Weight vs. Index

2.93

1.21

1.02

Price/Earnings Ratio

23.23x

22.49x

4.76x

4.90x

Price/Book Ratio

0.78

-0.04

1

Investment Blend (%)

Domestic Stock

-0.38

95.15

Foreign Stock

Cash And Cash Alternatives

-0.77

-1.10

2.82

-1.65

2.03

-1.99

Top Ten Holdings 1 (%)

-4

0

Sector

Fund

Index

Information Technology

31.44

28.51

Health Care

17.73

16.52

Consumer Discretionary

22.41

21.39

Energy

1.43

0.65

Utilities

0.00

0.04

Industrials

10.52

10.90

Financials

4.73

5.50

Consumer Staples

9.80

10.90

Materials

1.94

3.59

Telecommunication Services

0.00

1.99

4

Apple Inc

8.72

Alphabet Inc

5.63

Morningstar Rating – Investor Class

Amazon.com Inc

4.49

Morningstar Category – Large Growth

Overall

3 Year

5 Year

10 Year

Starbucks Corp

3.58

Rating

Facebook Inc

3.18

# of Funds

1,542

1,542

1,326

933

Gilead Sciences Inc

3.08

Visa Inc

2.97

Costco Wholesale Corp

2.96

Celgene Corp

2.73

MasterCard Inc

2.71

Total Percent in Top 10 Holdings

40.05

The holdings listed should not be considered recommendations to purchase

or sell a particular security. Equity holdings are grouped to include common

shares, depository receipts, rights and warrants issued by the same company.

Fund holdings subject to change.

1

As of 11/30/2015.

For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on a Morningstar Risk-Adjusted Return measure that accounts for

variation in a fund’s monthly performance (including the effects of sales charges, loads and redemption fees), placing more emphasis on downward variations and rewarding

consistent performance. The Overall Morningstar Rating™ for a fund is derived from a weighted average of the performance figures associated with its three-, five- and tenyear (if applicable) Morningstar Rating™ metrics. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the

next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause

slight variations in the distribution percentages.) Past performance is no guarantee of future results.

Lipper Rankings – Investor Class

Lipper Category – Large-Cap Growth

Fund

Percentile

1 Year

3 Year

5 Year

10 Year

287/668 216/615 187/545 237/389

43%

36%

35%

61%

Lipper rankings are based on average annual total returns. All of the mutual fund performance information contained in this table was supplied by Lipper, a

Reuters Company, subject to the following: Copyright 2016© Reuters. All rights reserved. Any copying, republication or redistribution of Lipper content, including

by caching, framing or similar means, is expressly prohibited without prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the

content, or for any actions taken in reliance thereon.

DUE TO MARKET VOLATILITY, CURRENT PERFORMANCE MAY BE DIFFERENT THAN THE FIGURES SHOWN.

©2016 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither

Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index (the 3,000 largest publicly traded U.S. companies based on total market capitalization). The Russell 1000® Growth Index measures the

performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. Created by Frank Russell Company, indices are not investment products available for purchase.

Key Terms: Alpha/3yr (annualized) - Shows how a fund did relative to what would have been expected given the fund's Beta and the performance of the benchmark index. For example, an alpha of 1.4 means that the fund outperformed its estimated

return (based on market activity alone) by 1.4%. Beta measures the volatility of the fund, as compared to that of the overall market. The market’s beta is set at 1.00; a beta higher than 1.00 is considered to be more volatile than the market, while a beta

lower than 1.00 is considered to be less volatile. Weighted average market capitalization is the average of the weighted capitalizations of a portfolio’s holdings. Price/Earnings ratio (P/E) is the ratio of a stock’s price to its earnings per share.

Price/Book ratio (P/B) is the ratio of a stock’s price to its book value per share. R2 - (R-squared) is a statistic that indicates how much of a fund’s fluctuations were attributable to movements in the fund’s benchmark index. Sharpe Ratio measures

the potential reward offered by a mutual fund relative to its risk level. Developed by William Sharpe, the ratio uses a fund's standard deviation and its excess return to determine reward per unit of risk. The higher the sharpe ratio, the better the fund's

historical risk-adjusted performance. Std. Deviation/3yr (annualized) - Defines how widely returns varied from an average over a given period of time. A higher standard deviation means a more volatile fund. For example, a fund with a standard deviation

of 6 and an average annual return of 10% saw annualized monthly returns fall within 6 percentage points of that average (or between 4% and 16%) two-thirds of the time.

Fund Facts are provided by FactSet Research Systems, Inc.

American Century Investment Services, Inc., Distributor

©2016 American Century Proprietary Holdings, Inc. All rights reserved.

IN-FFS-88013 1601

Non-FDIC Insured • May Lose Value • No Bank Guarantee

Rev 0 1/13/2016 8:26:39 AM-EQ