401Save Fund Fact Sheet American Funds American Balanced R6

401Save Fund Fact Sheet

American Funds American Balanced R6 : RLBGX

Data as of February 29, 2016

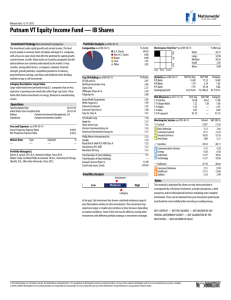

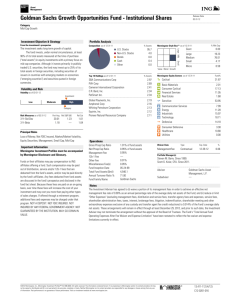

1 Mo 3 Mo YTD

Published Performance

1 yr 3 yr 5 yr 10 yr Since IDFI

Inception Date for Investment

("IDFI" )

Investment

Benchmark / Index

American Funds American Balanced R6

Index: Morningstar Mod Agg Tgt Risk TR USD

Index: Morningstar Mod Tgt Risk TR USD

0.04%

0.19%

0.48%

-3.45% -2.43%

-6.18% -4.45%

-2.66%

-9.28%

-4.05% -2.71% -6.47%

8.34%

4.04%

3.51%

8.69%

4.81%

4.56%

6.60%

N/A

N/A

12.11%

10.03%

8.58%

5/1/2009

Redemption Fees

None

Excessive Trading Restrictions

Per the prospectus, the fund company may impose trade restrictions if individual trade activity ocurrs that warrants action.

A sale of $ 5,000 or more will prohibit any repurchase of $ 5,000 or more for a period of 30 days.

The following section provides links that will take you to these external websites: Morningstar, MSN and MarketWatch.

This is not an endorsement of their ratings or other conclusions about the investment. Rather, these links are provided to facilitate access to certain information about the investment.

MSN Charts

Market Watch

Morningstar Links:

Fund Issuer Provider and Management

Click on the above link to view information regarding to the investment provider and its management.

Prospectus, Summary Prospectus and Reports

Click on the above link and choose the document you would like to view.

Risks and Strategies

Click on the above and choose the Summary Prospectus. This document will provide you with the principal objectives and strategies for the investment, as well as the principal risks.

Assets Composition

Click on the above link to see what assets the fund held as of its most recent filing.

Portfolio Turnover

Click on the above link and in the top right area of the screen you sill see the turnover ratio displayed.

Fees and Expenses

Please note that Morningstar might show an initial sales load. However, all initial sales loads are waived for your plan.

Disclosures

Note: Benchmark information is provided by independent sources, and the benchmarks may not be the same as those used in plan reporting from other providers.

Importance of Diversification: To help achieve long-term retirement security, you should give careful consideration to the benefits of a well balanced and diversified investment portfolio. Allocating your assets among different types of investments can help you achieve a favorable rate of return, while minimizing your overall risk of losing money. This is because market or other economic conditions that cause one category of assets, or one particular security, to perform very well often cause another asset category, or another particular security, to perform poorly. If you invest more than 20% of your retirement savings in any one company or industry, your savings may not be properly diversified. Although diversification is not a guarantee against loss, it is an effective strategy to help you manage investment risk.

warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Copyright Morgan Stanley Capital International, Inc. 2016. All Rights Reserved. Unpublished. PROPRIETARY TO MORGAN STANLEY CAPITAL INTERNATIONAL INC,

Page 1 of 1

3/5/2016 6:33:38 AM Prepared by Trautmann Maher