Release Date: 12-31-2015

Vanguard

International Growth Adm VWILX

....................................................................................................................................................................................................................................................................................................................................................

Benchmark

Overall Morningstar Rating™

Morningstar Return

Morningstar Risk

MSCI ACWI Ex USA Growth

NR USD

QQQ

Average

High

Out of 323 Foreign Large Growth Investments. A fund's overall Morningstar Rating, based on its risk-adjusted

return, is a weighted average of its applicable 3-, 5-, and 10-year Ratings. See disclosure for details.

Investment Information

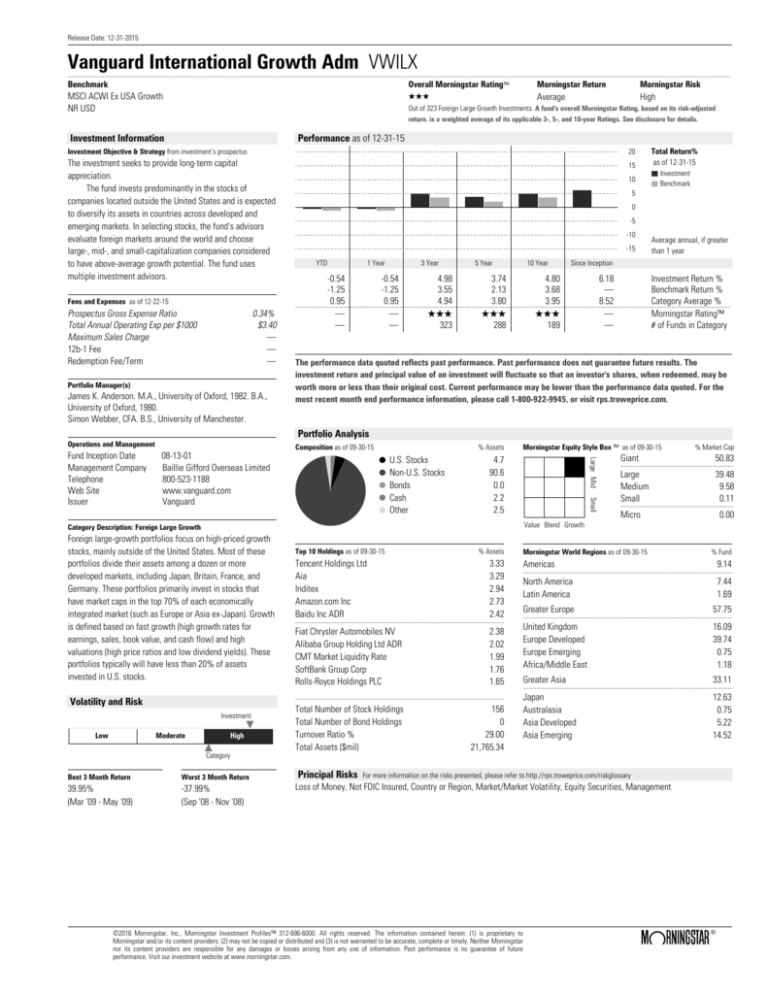

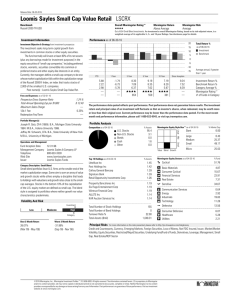

Performance as of 12-31-15

Investment Objective & Strategy from investment’s prospectus

20

The investment seeks to provide long-term capital

appreciation.

The fund invests predominantly in the stocks of

companies located outside the United States and is expected

to diversify its assets in countries across developed and

emerging markets. In selecting stocks, the fund's advisors

evaluate foreign markets around the world and choose

large-, mid-, and small-capitalization companies considered

to have above-average growth potential. The fund uses

multiple investment advisors.

15

Fees and Expenses as of 12-22-15

Prospectus Gross Expense Ratio

Total Annual Operating Exp per $1000

Maximum Sales Charge

12b-1 Fee

Redemption Fee/Term

0.34%

$3.40

.

.

.

Portfolio Manager(s)

James K. Anderson. M.A., University of Oxford, 1982. B.A.,

University of Oxford, 1980.

Simon Webber, CFA. B.S., University of Manchester.

5

0

-5

-10

-15

YTD

1 Year

3 Year

5 Year

10 Year

Average annual, if greater

than 1 year

Since Inception

-0.54

-0.54

4.98

3.74

4.80

6.18

Investment Return %

-1.25

-1.25

3.55

2.13

3.68

.

Benchmark Return %

0.95

0.95

4.94

3.80

3.95

8.52

Category Average %

................................................................................................................................................................................................................

.

.

.

Morningstar Rating™

QQQ

QQQ

QQQ

.

.

323

288

189

.

# of Funds in Category

The performance data quoted reflects past performance. Past performance does not guarantee future results. The

investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be

worth more or less than their original cost. Current performance may be lower than the performance data quoted. For the

most recent month end performance information, please call 1-800-922-9945, or visit rps.troweprice.com.

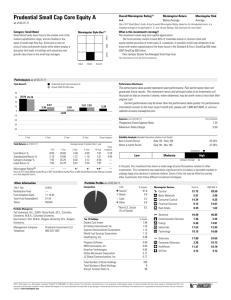

% Assets

Morningstar Equity Style Box ™ as of 09-30-15

4.7

90.6

0.0

2.2

2.5

Small

U.S. Stocks

Non-U.S. Stocks

Bonds

Cash

Other

Large Mid

08-13-01

Baillie Gifford Overseas Limited

800-523-1188

www.vanguard.com

Vanguard

Composition as of 09-30-15

Value Blend Growth

Category Description: Foreign Large Growth

Foreign large-growth portfolios focus on high-priced growth

stocks, mainly outside of the United States. Most of these

portfolios divide their assets among a dozen or more

developed markets, including Japan, Britain, France, and

Germany. These portfolios primarily invest in stocks that

have market caps in the top 70% of each economically

integrated market (such as Europe or Asia ex-Japan). Growth

is defined based on fast growth (high growth rates for

earnings, sales, book value, and cash flow) and high

valuations (high price ratios and low dividend yields). These

portfolios typically will have less than 20% of assets

invested in U.S. stocks.

Top 10 Holdings as of 09-30-15

Tencent Holdings Ltd

Aia

Inditex

Amazon.com Inc

Baidu Inc ADR

% Assets

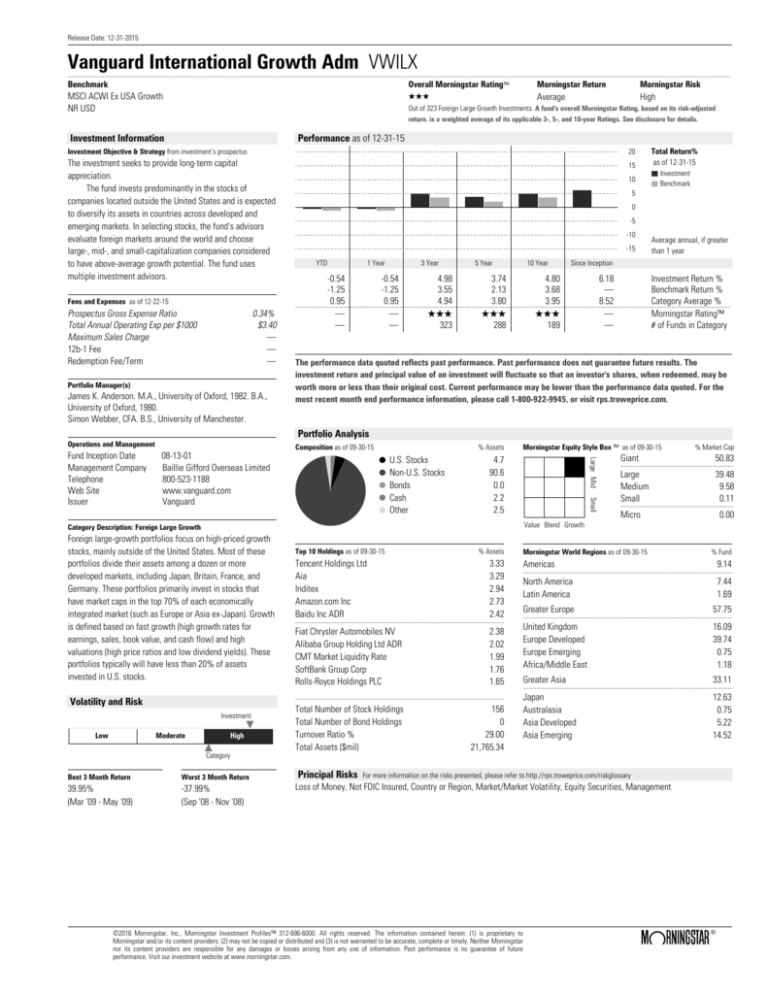

Investment

Moderate

High

Category

Best 3 Month Return

Worst 3 Month Return

39.95%

(Mar '09 - May '09)

-37.99%

(Sep '08 - Nov '08)

Total Number of Stock Holdings

Total Number of Bond Holdings

Turnover Ratio %

Total Assets ($mil)

Principal Risks

50.83

Large

Medium

Small

39.48

9.58

0.11

..........................................................

..........................................................

Micro

Morningstar World Regions as of 09-30-15

0.00

% Fund

Americas

9.14

North America

Latin America

7.44

1.69

Greater Europe

57.75

2.38

2.02

1.99

1.76

1.65

United Kingdom

Europe Developed

Europe Emerging

Africa/Middle East

16.09

39.74

0.75

1.18

...........................................................................................................

Fiat Chrysler Automobiles NV

Alibaba Group Holding Ltd ADR

CMT Market Liquidity Rate

SoftBank Group Corp

Rolls-Royce Holdings PLC

% Market Cap

Giant

3.33

3.29

2.94

2.73

2.42

...........................................................................................................

Volatility and Risk

Low

Investment

Benchmark

Portfolio Analysis

Operations and Management

Fund Inception Date

Management Company

Telephone

Web Site

Issuer

10

Total Return%

as of 12-31-15

156

0

29.00

21,765.34

...........................................................................................................

...........................................................................................................

Greater Asia

33.11

Japan

Australasia

Asia Developed

Asia Emerging

12.63

0.75

5.22

14.52

...........................................................................................................

For more information on the risks presented, please refer to http://rps.troweprice.com/riskglossary

Loss of Money, Not FDIC Insured, Country or Region, Market/Market Volatility, Equity Securities, Management

©2016 Morningstar, Inc., Morningstar Investment Profiles™ 312-696-6000. All rights reserved. The information contained herein: (1) is proprietary to

Morningstar and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar

nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future

performance. Visit our investment website at www.morningstar.com.