C17-1 Individual Income Taxes Individual Income Taxes

advertisement

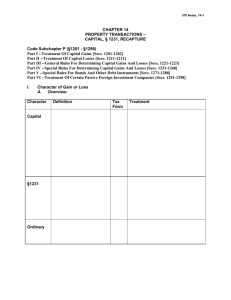

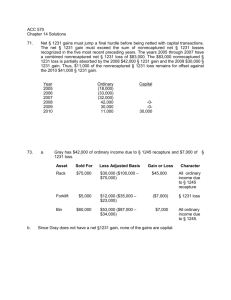

Chapter 17 Property Transactions: §1231 and Recapture Provisions Individual Income Taxes Copyright ©2009 Cengage Learning Individual Income Taxes C17-1 §1231 Assets (slide 1 of 4) • §1231 assets defined – Depreciable and real property used in a business or for production of income and held greater than 1 year – Includes timber, coal, iron, livestock, unharvested crops – Certain purchased intangibles Individual Income Taxes C17-2 §1231 Assets (slide 2 of 4) • §1231 property does not include the following: – Property not held for the long-term holding period – Nonpersonal use property where casualty losses exceed casualty gains for the taxable year – Inventory and property held primarily for sale to customers – Copyrights, literary, musical, or artistic compositions and certain U.S. government publications – Accounts receivable and notes receivable arising in the ordinary course of a trade or business Individual Income Taxes C17-3 §1231 Assets (slide 3 of 4) • If transactions involving §1231 assets result in: – Net §1231 loss = ordinary loss – Net §1231 gain = long-term capital gain Individual Income Taxes C17-4 §1231 Assets (slide 4 of 4) • Provides the best of potential results for the taxpayer – Ordinary loss that is fully deductible FOR AGI – Gains subject to the lower capital gains tax rates Individual Income Taxes C17-5 Special Rules For Certain §1231 Assets (slide 1 of 4) • Timber-Taxpayer can elect to treat the cutting of timber held for sale or for use in business as a sale or exchange • If elected, transaction qualifies under §1231 • Recognized §1231 gain or loss is determined at the time the timber is cut – Equal to difference between timber's FMV as of first day of tax year and the adjusted basis for depletion – If sold for more or less than FMV as of first day of tax year in which it is cut,difference is ordinary income or loss Individual Income Taxes C17-6 Special Rules For Certain §1231 Assets (slide 2 of 4) • Livestock – Cattle and horses must be held 24 months or more and other livestock must be held 12 months or more to qualify under §1231 Individual Income Taxes C17-7 Special Rules For Certain §1231 Assets (slide 3 of 4) • Casualty gains and losses from §1231 assets and from long-term nonpersonal use capital assets are determined and netted together • If a net loss, items are treated separately – §1231 casualty gains and nonpersonal use capital asset casualty gains are treated as ordinary gains – §1231 casualty losses are deductible FOR AGI – Nonpersonal use capital asset casualty losses are deductible FROM AGI subject to the 2% of AGI limitation • If a net gain, treat as §1231 gain Individual Income Taxes C17-8 Special Rules For Certain §1231 Assets (slide 4 of 4) • The special netting process for casualties & thefts does not include condemnation gains and losses – A § 1231 asset disposed of by condemnation receives § 1231 treatment • Personal use property condemnation gains and losses are not subject to the § 1231 rules – Gains are capital gains • Personal use property is a capital asset – Losses are nondeductible • They arise from the disposition of personal use property Individual Income Taxes C17-9 General Procedure for § 1231 Computation (slide 1 of 3) • Step 1: Casualty Netting – Net all recognized long-term gains & losses from casualties of § 1231 assets and nonpersonal use capital assets • If casualty gains exceed casualty losses, add the excess to the other § 1231 gains for the taxable year • If casualty losses exceed casualty gains, exclude all casualty losses and gains from further § 1231 computation – All casualty gains are ordinary income – Section 1231 asset casualty losses are deductible for AGI – Other casualty losses are deductible from AGI Individual Income Taxes C17-10 General Procedure for § 1231 Computation (slide 2 of 3) • Step 2: § 1231 Netting – After adding any net casualty gain from previous step to the other § 1231 gains and losses, net all § 1231 gains and losses • If gains exceed the losses, net gain is offset by the ‘‘lookback’’ nonrecaptured § 1231 losses from the 5 prior tax years – To the extent of this offset, the net § 1231 gain is classified as ordinary gain – Any remaining gain is long-term capital gain • If the losses exceed the gains, all gains are ordinary income – Section 1231 asset losses are deductible for AGI – Other casualty losses are deductible from AGI Individual Income Taxes C17-11 General Procedure for § 1231 Computation (slide 3 of 3) • Step 3: § 1231 Lookback Provision – The net § 1231 gain from the previous step is offset by the nonrecaptured net § 1231 losses for the five preceding taxable years • To the extent of the nonrecaptured net § 1231 loss, the current-year net § 1231 gain is ordinary income – The nonrecaptured net § 1231 losses are those that have not already been used to offset net § 1231 gains • Only the net § 1231 gain exceeding this net § 1231 loss carryforward is given long-term capital gain treatment Individual Income Taxes C17-12 Lookback Provision Example • Taxpayer had the following net §1231 gains and losses: 2006 $ 4,000 loss 2007 10,000 loss 2008 16,000 gain – In 2008, taxpayer’s net §1231 gain of $16,000 will be treated as $14,000 of ordinary income and $2,000 of long-term capital gain Individual Income Taxes C17-13 §1231 Netting Procedure (slide 1 of 2) Net Gain §1231 asset and long-term nonpersonal use capital asset casualty gains minus §1231 asset and long-term nonpersonal use capital asset casualty losses Net Loss Items treated separately: Gains are ordinary income, §1231 asset losses are deductible for AGI, Other losses deductible from AGI Net Gain (add to §1231 gains) §1231 gains minus §1231 losses Net Loss Net Gain Individual Income Taxes C17-14 §1231 Netting Procedure (slide 2 of 2) Net Gain Lookback Provision: Net gain is offset against nonrecaptured net §1231 losses from 5 prior tax years Gain offset by lookback losses is ordinary gain Individual Income Taxes Remaining gain is LTCG C17-15 Depreciation Recapture (slide 1 of 3) • Assets subject to depreciation or cost recovery may be subject to depreciation recapture when disposed of at a gain – Losses on depreciable assets receive §1231 treatment • No recapture occurs in loss situations Individual Income Taxes C17-16 Depreciation Recapture (slide 2 of 3) • Depreciation recapture characterizes gains that would appear to be §1231 as ordinary gain – The Code contains two major recapture provisions • §1245 • §1250 Individual Income Taxes C17-17 Depreciation Recapture (slide 3 of 3) • Depreciation recapture provisions generally override all other Code Sections – There are exceptions to depreciation recapture rules, for example: • In dispositions where all gain is not recognized – e.g., like-kind exchanges, involuntary conversions • Where gain is not recognized at all – e.g., gifts and inheritances Individual Income Taxes C17-18 §1245 Recapture (slide 1 of 3) • Depreciation recapture for §1245 property – Applies to tangible and intangible personalty, and nonresidential realty using accelerated methods of ACRS (placed in service 1981-86) • Recapture potential is entire amount of accumulated depreciation for asset • Method of depreciation does not matter Individual Income Taxes C17-19 §1245 Recapture (slide 2 of 3) • When gain on the disposition of a §1245 asset is less than the total amount of accumulated depreciation: – The total gain will be treated as depreciation recapture (i.e., ordinary income) Individual Income Taxes C17-20 §1245 Recapture (slide 3 of 3) • When the gain on the disposition of a §1245 asset is greater than the total amount of accumulated depreciation: – Total accumulated depreciation will be recaptured (as ordinary income), and – The gain in excess of depreciation recapture will be §1231 gain or capital gain Individual Income Taxes C17-21 Observations on § 1245 • Usually total depreciation taken will exceed the recognized gain – Therefore, disposition of § 1245 property usually results in ordinary income rather than § 1231 gain – Thus, generally, no § 1231 gain will occur unless the § 1245 property is disposed of for more than its original cost • Recapture applies to the total amount of depreciation allowed or allowable regardless of the depreciation method used • Recapture applies regardless of the holding period of the property – If held for < the long-term holding period the entire recognized gain is ordinary income because § 1231 does not apply • Section 1245 does not apply to losses, which receive § 1231 treatment • Gains from the disposition of § 1245 assets may also be treated as passive activity gains Individual Income Taxes C17-22 §1250 Recapture (slide 1 of 2) • Depreciation recapture for §1250 property – Applies to depreciable real property • Exception: Nonresidential realty classified as §1245 property (i.e., placed in service after 1980 and before 1987, and accelerated depreciation used) – Intangible real property, such as leaseholds of § 1250 property, is also included Individual Income Taxes C17-23 §1250 Recapture (slide 2 of 2) • Section 1250 recapture rarely applies since only the amount of additional depreciation is subject to recapture – To have additional depreciation, accelerated depreciation must have been taken on the asset • Straight-line depreciation is not recaptured (except for property held one year or less) – Depreciable real property placed in service after 1986 can generally only be depreciated using the straight-line method • Therefore, no depreciation recapture potential for such property – § 1250 does not apply if the real property is sold at a loss Individual Income Taxes C17-24 Real Estate 25% Gain (slide 1 of 4) • Also called unrecaptured §1250 gain or 25% gain – 25% gain is some or all of the §1231 gain treated as long-term capital gain – Used in the alternative tax computation for net capital gain Individual Income Taxes C17-25 Real Estate 25% Gain (slide 2 of 4) • Maximum amount of 25% gain is depreciation taken on real property sold at a recognized gain reduced by: – Certain §1250 and §1245 depreciation recapture – Losses from other §1231 assets – §1231 lookback losses • Limited to recognized gain when total gain is less than depreciation taken Individual Income Taxes C17-26 Real Estate 25% Gain (slide 3 of 4) • Special 25% Gain Netting Rules – Where there is a § 1231 gain from real estate and that gain includes both potential 25% gain and potential 0%/15% gain, any § 1231 loss from disposition of other § 1231 assets • First offsets the 0%/15% portion of the § 1231 gain • Then offsets the 25% portion of the § 1231 gain – Also, any § 1231 lookback loss • First recharacterizes the 25% portion of the § 1231 gain • Then recharacterizes the 0%/15% portion of the § 1231 gain as ordinary income Individual Income Taxes C17-27 Real Estate 25% Gain (slide 4 of 4) • Net § 1231 Gain Limitation – The amount of unrecaptured § 1250 gain may not exceed the net § 1231 gain that is eligible to be treated as long-term capital gain – The unrecaptured § 1250 gain is the lesser of • The unrecaptured § 1250 gain, or • The net § 1231 gain that is treated as capital gain – Thus, if there is a net § 1231 gain, but it is all recaptured by the 5 year § 1231 lookback loss provision, there is no surviving § 1231 gain or unrecaptured § 1250 gain Individual Income Taxes C17-28 Related Effects of Recapture (slide 1 of 8) • Gifts – The carryover basis of gifts, from donor to donee, also carries over depreciation recapture potential associated with asset – That is, donee steps into shoes of donor with regard to depreciation recapture potential Individual Income Taxes C17-29 Related Effects of Recapture (slide 2 of 8) • Inheritance – Death is only way to eliminate recapture potential – That is, depreciation recapture potential does not carry over from decedent to heir Individual Income Taxes C17-30 Related Effects of Recapture (slide 3 of 8) • Charitable contributions – Recapture potential reduces the amount of charitable contribution deductions that are based on FMV Individual Income Taxes C17-31 Related Effects of Recapture (slide 4 of 8) • Nontaxable transactions – When the transferee carries over the basis of the transferor, the recapture potential also carries over • Included in this category are transfers of property pursuant to the following: – – – – Nontaxable incorporations under § 351 Certain liquidations of subsidiary companies under § 332 Nontaxable contributions to a partnership under § 721 Nontaxable reorganizations – Gain may be recognized in these transactions if boot is received • If gain is recognized, it is treated as ordinary income to the extent of the recapture potential or recognized gain, whichever is lower Individual Income Taxes C17-32 Related Effects of Recapture (slide 5 of 8) • Like-kind exchanges and involuntary conversions – Property received in these transactions have a substituted basis • Basis of former property and its recapture potential is substituted for basis of new property – Any gain recognized on the transaction will first be treated as depreciation recapture, then as §1231 or capital gain • Any remaining recapture potential carries over Individual Income Taxes C17-33 Related Effects of Recapture (slide 6 of 8) • Installment sales – Recapture gain is recognized in year of sale regardless of whether gain is otherwise recognized under the installment method Individual Income Taxes C17-34 Related Effects of Recapture (slide 7 of 8) • Property Dividends – A corporation generally recognizes gain on the distribution of appreciated property to shareholders – Recapture applies to the extent of the lower of the recapture potential or the excess of the property’s FMV over its adjusted basis Individual Income Taxes C17-35 Related Effects of Recapture (slide 8 of 8) • Sales between related parties – Sales of depreciable assets between related parties can cause the total gain to be recognized as ordinary income • Applies to related party sales or exchanges of property that is depreciable in hands of transferee Individual Income Taxes C17-36 If you have any comments or suggestions concerning this PowerPoint Presentation for South-Western Federal Taxation, please contact: Dr. Donald R. Trippeer, CPA trippedr@oneonta.edu SUNY Oneonta Individual Income Taxes C17-37