Document

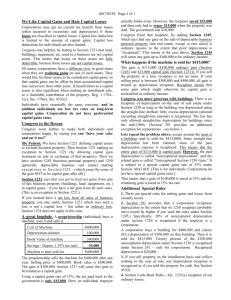

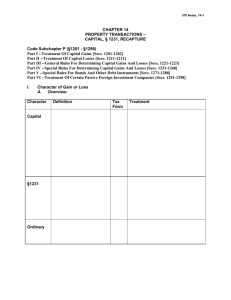

advertisement

ACC 570 Chapter 14 Solutions 71. Net § 1231 gains must jump a final hurdle before being netted with capital transactions. The net § 1231 gain must exceed the sum of nonrecaptured net § 1231 losses recognized in the five most recent preceding years. The years 2005 through 2007 have a combined nonrecaptured net § 1231 loss of $83,000. The $83,000 nonrecaptured § 1231 loss is partially absorbed by the 2008 $42,000 § 1231 gain and the 2009 $30,000 § 1231 gain. Thus, $11,000 of the nonrecaptured § 1231 loss remains for offset against the 2010 $41,000 § 1231 gain. Year 2005 2006 2007 2008 2009 2010 73. a. Ordinary (18,000) (33,000) (32,000) 42,000 30,000 11,000 -0-030,000 Gray has $42,000 of ordinary income due to § 1245 recapture and $7,000 of § 1231 loss. Asset Sold For Less Adjusted Basis Gain or Loss Character Rack $75,000 $30,000 ($100,000 – $70,000) $45,000 All ordinary income due to § 1245 recapture $5,000 $12,000 ($35,000 – $23,000) ($7,000) § 1231 loss $60,000 $53,000 ($87,000 – $34,000) $7,000 All ordinary income due to § 1245. Forklift Bin b. Capital Since Gray does not have a net §1231 gain, none of the gains are capital. 76. a. Store cost 2006 cost recovery rate 2007 cost recovery rate 2008 cost recovery rate 2009 cost recovery rate 2010 cost recovery rate (.02564 × 5.5/12) Total recovery rate Total cost recovery Adjusted basis ($400,000 – $41,032) of building b. Selling price Adjusted basis ($358,968 + $100,000) Recognized loss $400,000 .01391 .02564 .02564 .02564 .01175 ×.10258 $ 41,032 $358,968 $385,000 (458,968) ($ 73,968) Since the retail store building was real estate used in business, it is a § 1231 asset. None of the loss is § 1250 gain because the property was sold for a loss. Therefore, all of the loss is § 1231 loss, and there is no unrecaptured § 1250 gain. pp. 14-41 to 14-44 BONUS! What if the store was sold for $550,000 Selling price Adjusted basis ($358,968 + $100,000) Recognized gain (§1231) $550,000 (458,968) $ 91,032 78. a. Land: Condemnation proceeds Allocable basis Realized and recognized § 1231 loss $25,000 (40,000) ($15,000) Truck: Depreciation taken: $3,491 ($6,000 – $2,509). Adjusted basis: $2,509. Realized gain: $3,500 – $2,509 = $991. Recognized gain: $991 ordinary income under § 1245. Rowing machine: Realized and recognized gain = Amount realized – Adjusted basis of machine on date of sale = $3,900 – $0 = $3,900. Section 1245 recapture = Amount of depreciation claimed ($5,200) or gain recognized ($3,900), whichever is less = $3,900. Apartment building: Realized gain = Amount realized – Adjusted basis = $200,000 – $124,783 = $75,217. Section 1231 gain recognized = $75,217. No § 1250 recapture is recognized because the taxpayer used the straight-line method of depreciation. Of the $75,217 § 1231 gain, $25,217 is unrecaptured § 1250 gain because the depreciation taken of $25,217 ($150,000 cost – $124,783 basis) is less than the $75,217 recognized gain. Yacht: Personal casualty loss (without regard to the 10% of AGI limitation) = Fair market value at date of theft – Insurance proceeds – Floor = $19,600 – $12,500 – $100 = $7,000. Auto: Realized loss = Amount realized – Adjusted basis = $9,600 – $20,800 = $11,200. The loss relates to a personal use asset. Therefore, it is not recognized. Trampoline: $6,000 business casualty loss is deductible for AGI. The casualty loss is measured by the adjusted basis of the property at the time of the theft. There is no $100 or 10% of AGI floor for a business casualty. Section b. Item Land Truck Rowing machine Building Yacht Auto Trampoline Recognized Gain/Loss ($15,000) 991 3,900 75,217 (7,000) -0(6,000) Section 1245 Recapture Casualty and Theft Loss 1231 Gain ($15,000) $ 991 3,900 75,217 ($7,000) (6,000) $4,891 Ordinary income Adjusted gross income computation: Other sources Ordinary income from depreciation recapture, as above Long-term capital gain, as above Business casualty loss, as above Adjusted gross income $60,217 $6,000 Net Gain: business loss Receives for AGI; LTCG No Net treatment personal loss ** from AGI* $402,000 4,891 60,217 (6,000) $461,108 *None of the personal use activity property casualty loss is deductible from AGI because 10% of the $461,108 AGI is greater than the casualty loss of $7,000. **Of the $60,217 §1231 gain, $25,217 is unrecaptured § 1250 gain. Thus, the $60,217 § 1231 gain is comprised of $25,217 of unrecaptured § 1250 gain (i.e., 25% gain) and $35,000 of 0%/15% gain. 79. a. If the property is residential real property, the gain is all § 1231 Selling price of building Cost of building Total depreciation Adjusted basis Gain on sale $89,000 $50,000 (12,000) (38,000) $51,000 25% gain (unrecaptured § 1250) 15% gain $12,000 $39,000 b. Residential rental buildings acquired in 1986 were eligible for ACRS. If ACRS was used, §1250 would recapture the excess depreciation as ordinary income. Since buildings acquired after 1986 must use straight-line depreciation, no recapture exists. BONUS! LET’S REWORK PART A FOR A C CORPORATION. Selling price of building Cost of building Total depreciation Adjusted basis Gain on sale $89,000 $50,000 (12,000) § 1250 ordinary income = § 291 additional recapture 20% x remaining gain, up to $12,000 of gain (20% x 12,000) Balance of gain = § 1231 gain (38,000) $51,000 $ 0 2,400 48,600 38. 54. 77. All the assets are capital assets because they do not fit any of the items listed in § 1221 as not capital assets. The antique truck is a ‘‘collectible. Therefore, the $5,000 loss ($42,000 sale price – $47,000 basis) is a long-term capital loss that would first be netted against any 28% long-term capital gain. The Blue Growth Fund $16,000 gain ($28,000 sale price – $12,000 basis) is a long-term capital gain that is potentially taxable at 0% and/or 15%. The Orange bonds are sold for a $7,250 gain ($42,000 proceeds – $750 interest income – $34,000 basis). The gain is a long-term capital gain potentially taxable at 0% and/or 15%. The sale of the Green stock results in a $2,000 ($11,000 sale price – $13,000 basis) short-term capital loss because the stock was held one year or less. The $750 interest income is includible in Eric’s gross income pp. 14-4, 14-5, and 14-20 to 1425 The holding period of property received in a like-kind exchange includes the holding period of the property given up if the property given up is a capital asset or a § 1231 asset. The vacant land held by Cherie was held for investment; therefore, it was a capital asset. Consequently, the holding period for the apartment building begins on April 10, 2006, the date the vacant land was acquired by Cherie. The holding period of the apartment building was long term when it was sold on November 22, 2010. p. 14-16 a. The gain on the sale of the building is subject to § 1250 depreciation recapture because it is residential real estate acquired after 1975 and before January 1, 1987, on which accelerated depreciation was taken. The gain from the sale is $345,000, $0 is ordinary income due to § 1250, and there is $345,000 § 1231 gain. Selling price of building Cost of building 1986–2005 accelerated depreciation (1.000 × $350,000) 2006–2010 depreciation Jan. 20, 2010 adjusted basis Gain on sale 1986–2005 straight-line depreciation ($350,000 × 1.0) Additional depreciation ($350,000 – $350,000) Remaining gain b. $345,000 $350,000 (350,000) (–0–) (–0–) $345,000 $350,000 (–0–) $345,000 The land is also a § 1231 asset because it was part of the residential real estate. However, there is no recapture because it was not depreciated. The § 1231 gain from the sale of the land is $400,000 ($500,000 selling price – $100,000 adjusted basis). pp. 14-38 to 14-41 and 14-45 81. The property is a § 1231 asset for Harriet because it is depreciable property used in her business and held more than a year. At the time of the gift to Harriet, the property has § 1245 depreciation recapture potential equal to the depreciation taken by the donor of $67,000. Harriet could not depreciate the property because the carryover basis to her was zero. When she sells the property for $13,000, the entire gain is § 1245 depreciation recapture gain because of the “taint” when she received the property. p. 14-46 and Example 63 82. The property is a § 1231 asset for Trent because it is depreciable property used in his business and held more than a year. Trent’s basis for the asset is its fair market value at the date of his father’s death, or $432,000. The father’s depreciation recapture taint is extinguished at the father’s death. However, Trent takes $123,000 of the depreciation after acquiring the property. Trent has a gain of $73,000 [$382,000 sales price in 2010 – ($432,000 basis equal to fair market value at father’s death – $123,000 depreciation taken by Trent)], all of which is treated as ordinary income due to § 1245. pp. 14-40 and 14-46 83. When depreciable tangible property is contributed to charity, the contribution is limited to the fair market value of the property reduced by the § 1245 depreciation recapture potential. Since the depreciation recapture potential ($400,000) is greater than the fair market value at the date of gift ($233,000), there is no charitable contribution deduction. p. 14-46 84. The corporation has a carryover of Dedriea’s basis and depreciation recapture potential because this is a “tax-free” incorporation contribution. The property had an adjusted basis of $135,000 ($566,000 cost – $431,000 depreciation) at the date of contribution. It had an adjusted basis of $35,000 ($135,000 – $100,000 corporate depreciation) at the time of its sale. The $53,000 gain ($88,000 – $35,000) is all recaptured as ordinary income by § 1245. pp. 14-40 and 14-47 85. Magenta’s distribution of the property as a dividend to its shareholder is a taxable transaction for Magenta. Magenta had a zero adjusted basis for the property; it took $100,000 (the property’s cost) of deprecation on it. The entire $40,000 fair market value at the date of distribution is taxable as ordinary income due to § 1245 depreciation recapture. pp. 14-40 and 14-48