Franchise Owner

advertisement

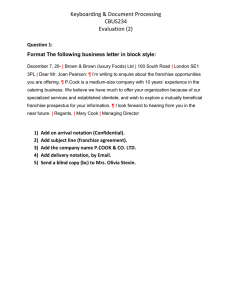

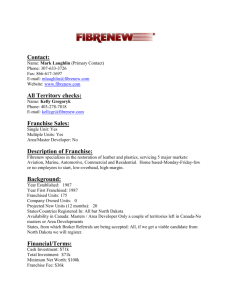

Agenda • • • • • Background Franchise concept Process and funding Myths and Realities Lessons Learned Cheryl Wadeson Independent Business vs. Franchise Independent Business Owner Franchise Owner Brand Awareness Unknown Established brand Control/Autonomy Total freedom Play by their rules Cost Can start up on a shoestring budget, Control over investment decisions and timing Upfront franchise fee, ongoing Royalty and Advertising fees, Franchisor dictates remodels How to run your business Build it from scratch They give you the playbook, training and coaching Operational Resources Go it alone Total freedom Tried and tested business – with an established system and support (training, real estate, advertising, product development, supplier network) Source: ”Independent Business or Franchise? How to Decide”, Curtis Kroeker, Inc., June 2013 What Does it Take to Become a Franchisee? Franchise Fee + Start Up Investment + Royalty Fee $27K $100K - $200K 6% $45K $1M - $3M 2% - 5% $15K $250K 8% $40K $215K 6% $5K $250K 3% Source: www.entrepreneur.com 2013 Franchise 500 Why Cold Stone? Paying for a Franchise • #1 - You are selling yourself • Getting an SBA loan: – You need good credit – 15-25% cash for a down payment – May require collateral – 10 – 25 year repayment terms – Patriot Express loans Myth: Franchise Owners are Rich! Sales COGS 14% Salaries 23% 4% 4% Rent Royalties/Ad Other 9% 22% 9% Utilities Taxes/Fees 15% Profit Successes and Lessons Learned Working Capital Human Relations Know Yourself