Does Russia Drive a Ford? Administrative

advertisement

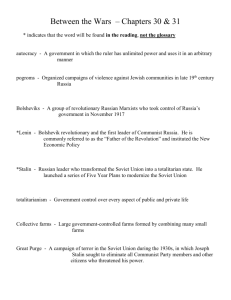

Business-Government Relations at the Local Level in Russia and China Thomas F. Remington Goodrich C. White Professor of Political Science Emory University April 6, 2015 “Soaring dragon, stumbling bear” • 8.8% vs. 1.1% CAGR (Russia 1991-2013, China 1980-2013) • Susan Shirk (1993): “the Soviet strategy of political reform before economic reform produced political chaos and disintegration and a decline in living standards and growth rates” • Dali Yang (1994): “Russia's shock therapy did not produce a sound market economy but instead a sort of anarchic capitalism riddled with corruption” • Minxin Pei (2008): “of course, the big-bang approach has failed miserably in Russia” • Joshua Cooper Ramo (2004): “What is happening in China at the moment is not only a model for China, but has begun to remake the whole landscape of international development, economics, society and, by extension, politics” Strategy or Circumstances? • • • • • Sequencing? (political reform before market reform?) “Shock therapy” vs. incrementalism Different initial conditions “Market-preserving federalism” theory (Weingast et al.) Compared to Russia, China better at protecting property rights: – Decentralization of economic and fiscal power – Competition among localities to achieve growth – Center rewards good economic performance U-form vs. M-form organizational types • Unitary, centralized model of organization (U-form) – Ford Motor Company – Divisions organized around functional responsibilities – Control and coordination at center • Multi-divisional model (M-form) – – – – – GM, Dupont as new types of corporation in 1920s (Chandler 1977) Divisions are multi-functional, target adjacent markets Division managers compete Some redundancy of functions Offsetting benefit-- information about managerial performance • Russia as U-form, China as M-form: explains different outcomes (Maskin, Qian and Xu, 2000; Xian and Xu, 1993; Qian, Roland and Xu, 1996; Xian 2000; Xu 2011; Harrison and Ma 2012; Markevich and Zhuravskaya 2011) Plausibility checks • • • • • • • • • Lenin drew on Kautsky model of centralized German industrial trusts High centralization of Soviet planning, administration under Stalin Maoist ideological emphasis on local initiative Strong tendencies toward “cellular” or “modular” economy in Great Leap, Cultural Revolution; breakdown of much central control in China China’s 1993 civil service reform adopted performance targets to evaluate cadres; economic performance as hard target; now changing? Key: yardstick competition among cadres at same level China: 有 点 到 面-- “from point to surface”-- learn from experiments Russia: “не меряться” – avoid comparisons of officials Regional governors rewarded & punished according to political performance (Reuter & Robinson 2012) Different legacies of central planning: • 1984: China’s central plan covered 30-40% of industrial production • 1984: 55% of Soviet industrial output was produced by enterprises subordinate to central government • Key: Many fewer medium-sized & small enterprises in USSR • Fewer than 46,000 Soviet industrial enterprises; 1500 produced half of all output; more than half of all enterprises employed > 200 • Half of Soviet cities had only one enterprise • China’s economic planning more decentralized; provinces and cities had more diversified economic profiles • More coordination of economic exchange performed by center in USSR than in China China’s central government receives 48% of total tax take, Russia’s 61% The difference a matter of degree, not of kind • Strong mechanisms for central government economic control in China • Wide responsibility, discretion for regional governments in Russia • “Soviet prefects” intervened actively to coordination regional economies in Soviet era (Hough 1969); governors still do • Strong impulse for local initiative, experimentation in Soviet era (eg Ryazan’ fiasco in 1959) Testing the theory • Are local governments in China motivated to improve environment for economic growth through competition more than in Russia? • If so, is the difference manifest in business-government relations? • Testing at 3 levels of analysis: – National differences – Firm-level behavior – Degree of local variation in business conditions • Using World Bank Business Enterprise Surveys—2012 in Russia and China, nearly identical questionnaires – Russia: 4220 firms in 37 regions (most poorer than national average) – China: 2700 firms in 25 cities (but Shanghai drops out); most richer than national average – Nationally-representative samples but carefully matched local samples – Nearly all firms wholly private & domestically owned; ownership type not a variable Hypothesis 1: Cross-national differences Conclusions Results consistent with U-form / M-form theory But case not closed U-form model can induce local competition (cf Stalin campaigns) But competition to produce raw output (вал) in planned economy yielded large negative externalities • Competition to raise growth rates in China has also led to significant negative externalities, such as massive environmental damage • Key: China relies more on performance incentives for local officials to use market forces to induce investment and growth • Findings favor explanations stressing institutional features of environment under conditions of market competition • • • •