Chapter 7

advertisement

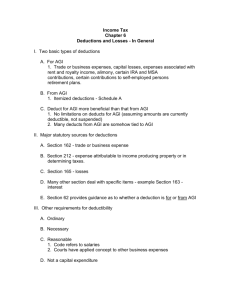

Income Tax Chapter 7 (Itemized Deductions) I) Medical Expenses (Section 213) A) Expenditures for the diagnosis, cure, mitigation, treatment or prevention of disease or B) Any treatment that affects a part or function of the body. (not unnecessary cosmetic surgery) 1. Recent ruling--smoking cessation costs now qualify. C) The cost of qualified long-term care is also included as a medical expense. D) Subject to a 7.5% of AGI Floor E) Capital expenditures may sometimes qualify 1. Medical expense to the extent the expense exceeds the increase in value of the property. 2. Costs of operating or maintaining the assets also qualify. F) Transportation expenses to or from 1. Mileage @ 10 cents per mile, air fare, train, etc. a. Food (50%) and lodging while en-route are deductible if primarily for and essential to medical care. 2. Lodging up to $50 per night per person while away from home. G) Generally deductible in the year paid. H) Insurance reimbursements reduce amount of expense 1. If received in subsequent year, may be income. (Tax benefit rule) I) Expenditures must be on behalf of taxpayer, spouse or dependent 1. Special rule for not meeting gross income test or joint return test 2. Special rule for noncustodial parent in divorce situations J) Medical Savings Accounts (MSA’s)(Year 2000 is the last year available unless congress extends) 1. Taxpayer makes tax deductible (Type A) contributions to MSA 2. Earnings on MSA are not included in income in current year 3. Distributions used to pay medical expenses not covered by related high-deductible policy are not included in income. a. Distributions used for other than medical expenses are taxable and subject to 15% penalty if made before age 65, death or disability. 4. Established in conjunction with high-deductible insurance policies a. Deductibles between $1500-$2250 for individuals, $3000-$4500 for families 5. Deductible contributions are limited to 65% of the policy deductible for individuals and 75% for families 6. Four year pilot program began in 1997. II) Taxes A) Importance of "tax" vs. "fee" classification B) Examples of deductible taxes 1. State and local income taxes 2. Personal property taxes (advalorem) 3. Real estate taxes (domestic or foreign property) a. Prorate between buyer/seller for year of sale C) Examples of nondeductible taxes 1. Social security taxes 2. Federal income taxes 3. Estate and inheritance taxes 4. Special assessment taxes - add to basis of property 5. Excise taxes III) Interest A) Must be a charge for the use of money B) Generally deductible in year paid (cash basis) 1. Cannot "prepay" (exception "points" on principal residence) C) Must segregate your interest into the following classes(How was borrowing used – allocated appropriately?) D) 1. Business interest - deduct for AGI 2. Investment interest a. Interest to buy or carry investment property other than property subject to passive activity rules. (i.e. rental property) b. Limited to NET investment income i. Considers investment expenses. a) Smaller of: 1) Investment expenses or 2) Miscellaneous itemized deductions after 2% limit. ii. Investment property includes property producing portfolio income -- interest, dividends c. Investment income can include capital gains attributable to disposition of property held for investment (forfeit right to use alternative tax calculations on LTCG) 3. Qualified residence interest: a. Debt must be secured by the residence b. Acquisition indebtedness of up to $1,000,000 on debt used to acquire, construct, or substantially improve the qualified residence. c. Home equity loan interest is fully deductible, if loan is limited to lesser of: FMV of residence reduced by acquisition indebtedness, or $100,000 i. Otherwise, only such portion of loan interest is deductible d. Interest on a maximum of two "qualified residences" will count i. Must meet personal use test of Section 280A if property is rented at all. 4. Passive interest 5. Personal interest a. Any interest which does not fall into any of the above categories b. Not deductible, generally. c. Beginning in 1998, a portion of student loan interest can be deducted, subject to phase-out for “higher-income” taxpayers. Maximum deduct for 2000 is $2000. (Type A deduct) IV) Charitable Contributions A) Payment must be a gift and made to a qualifying domestic organization. B) Deductible in year paid (or in carryover year if limitations exceeded) C) Substantiation rules for contributions of $250 or more. D) Contribution donation can be in form of property (does not have to be money) 1. No deduction for services contributed or for the use of property (out of pocket costs - deduct) a. Form 8283 must be filed if value of non-cash donations exceeds $500. 2. Contribution deduction is generally measured by F.M.V. of property donated a. Ordinary income property exception i. Deduction is FMV less ordinary income which would result b. Exception for capital gain property (long-term gain property) i. Tangible personal property given to a public charity and put to unrelated use. Deduction is FMV less the long term gain ii. Capital gain property given to a private nonoperating foundation -- must also reduce donation by long-term capital gain element. E) Contribution ceilings 1. 50% of AGI for cash donations and ordinary income property to public charities. 2. 30% of AGI limit for long-term gain property given to a public charity and gifts of cash and ordinary income property to private nonoperating foundations a. Taxpayer can elect to reduce long-term gain property by amount of long-term gain and include in 50% pot. 3. 20% of AGI limit for long-term gain property donated to private nonoperating foundation 4. Watch for interplay between 30% and 50% limitations where both exist in a given year. 5. 5 year carryover of excess deductions. a. carryovers are subject to the same percentage limitation. V) Other Itemized deductions A) Personal casualty and theft losses greater than 10% AGI (Chapter 8) B) Miscellaneous deductions subject to 2% AGI floor -1. Unreimbursed employee business expense 2. Tax preparation fees 3. Union and professional dues 4. Job hunting expenses 5. Safe deposit box fees 6. Work uniforms 7. Appraisal fee for tax purposes etc. C) Miscellaneous deductions not subject to 2% AGI floor 1. Gambling losses to extent of winnings 2. Impairment related work expenses for handicapped employees 3. Unrecovered investment in an annuity contract VI) Overall limitation on itemized deductions A) Reduction applies when AGI exceeds a specific threshold of $128,900. ($126,600 for 1999, 124,500 for 1998, 121,200 for 1997, 117,950 for 1996 and 114,700 for 1995) B) Amount of reduction is lesser of: 1. 3% of AGI over threshold, or 2. 80% of "covered" itemized deductions a. Covered includes all itemized except medical expenses, investment interest, casualty/theft losses, and wagering losses (to extent of gains)