Chapter 6

advertisement

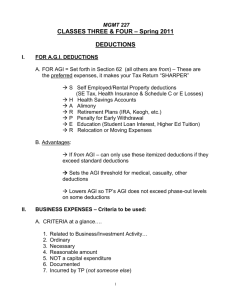

Income Tax Chapter 6 Deductions and Losses - In General I. Two basic types of deductions A. For AGI 1. Trade or business expenses, capital losses, expenses associated with rent and royalty income, alimony, certain IRA and MSA contributions, certain contributions to self-employed persons retirement plans. B. From AGI 1. Itemized deductions - Schedule A C. Deduct for AGI more beneficial than that from AGI 1. No limitations on deducts for AGI (assuming amounts are currently deductible, not suspended) 2. Many deducts from AGI are somehow tied to AGI II. Major statutory sources for deductions A. Section 162 - trade or business expense B. Section 212 - expense attributable to income producing property or in determining taxes. C. Section 165 - losses D. Many other section deal with specific items - example Section 163 interest E. Section 62 provides guidance as to whether a deduction is for or from AGI III. Other requirements for deductibility A. Ordinary B. Necessary C. Reasonable 1. Code refers to salaries 2. Courts have applied concept to other business expenses D. Not a capital expenditure 1. Determination as to whether something is a capital expenditure is similar to financial accounting rules. 2. Code does provide some situations where capital expenditures may be deducted currently. E. Incurred by taxpayer on taxpayer's obligation IV. When to deduct A. Cash basis - generally when paid 1. Cannot substantially prepay an expense 2. Cannot deduct if it would result in a distortion of income 3. Payment of items with borrowed funds permits current deduction. B. Accrual basis 1. Must meet all events test and economic performance test a. Recurring item exception to economic performance test C. Proper substantiation. V. Certain disallowance possibilities A. Payments in violation of public policy- fines, illegal bribes, etc. B. Political contributions 1. Lobbying expenses - generally only local issues (city/county) where proposed legislation has a direct interest to the taxpayer can be deducted. C. Investigation of a business 1. If already engaged in a similar business - deduct 2. If new business and it is acquired - capitalize and amortize over 60 months 3. If new business is not acquired - not deductible 4. New guidance in Rev. Rul. 99-23. D. Trade or business vs. hobby 1. Hobby expenses only deductible to extent of hobby income 2. Presumptive rule - if activity does not show a profit in at least 3 out of 5 consecutive years, it is a hobby (2 of 7 for horses) 3. Nine relevant factors of Reg. Section 1.183 4. Note order of deductibility of expenses for hobbies. 5. Hobby expenses (other than those which are deductible anyway i.e., interest, taxes) are miscellaneous itemized deductions deductible on Schedule A. (Those expenses deductible anyway are deducted on Schedule A in their respective Sections e.g. taxes) E. Rental of vacation homes 1. Questions to evaluate Was property rented less than 15 days? If no, must consider if personal use test is met Was property used for personal purposes for more than the greater of 1) 14 days or 2) 10% or rental period. If yes - personal use test is met. Expenses are limited to rental income. Expenses must be allocated between personal and rental use (a) Taxes allocated to personal use deductible on Schedule A and interest allocated to personal use deductible on Schedule A if this property selected as second residence. If no - personal use test is not met. Treat as regular rental property (assuming profit motive exists). Expenses not limited to income (subject to passive loss limits) however, still must prorate expenses for any personal use. (a) Interest allocated to personal use is not deductible as qualified residence interest. 2. Principal residence converted to rental (a) Per Section 280 A (d) (3), the period it is used as a personal residence will not be counted as days of personal use during a "qualified rental period." F. Related party losses and transactions 1. Losses from sales and exchanges of property between related parties (a) Disallowed loss can be used to reduce gain on subsequent disposal 2. See page 6-25 for list of "related parties" a. Watch for Aconstructive ownership@ rules. 3. Accrued expenses--essentially the corporation is on a cash basis for these expenses. G. Expenses relating to tax exempt income 1. Such as interest paid on money borrowed to buy or carry municipal bonds 2. Foreign earned income - if excluded, employee business expense are non deductible. 3. Ministers employee expenses where housing allowance is utilized, (may lose a portion of the deductions since housing allowance is tax exempt)