Sourirajan Patent Damages - American Intellectual Property Law

advertisement

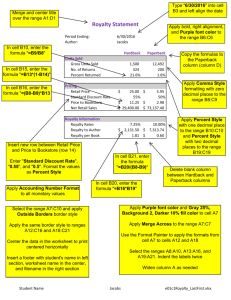

American Intellectual Property Law Association Patent Damages Ranga Sourirajan IP Practice in Japan Committee Pre-Meeting Washington, DC Firm Logo October 23, 2013 AIPLA1 1 Patent Damages • 28 U.S.C. 284 Upon finding for the claimant the court shall award [] damages adequate to compensate for the infringement, but in no event less than a reasonable royalty . . . together with interest and costs . . . [T]he court may increase the damages up to three times . . . • Damages – Actual Damages: Lost Profits, Established Royalty – Reasonable Royalty Firm Logo AIPLA2 2 Actual Damages • Lost Profits – Difference between “but for” profits and “actual” profits – Patentee must prove: (1) demand for patented product (2) absence of noninfringing alternatives (3) patentee’s ability to make and sell additional units; and (4) reasonable estimation of patentee’s profit rate – E.g. price erosion (impact on sales, lower actual prices) • Established Royalty – Royalty payment sufficiently prevalent and accepted – Royalty rate must be: (1) paid prior to infringement (2) paid by sufficient number of persons (3) uniform (4) not set under threat of suit or settlement (5) covers comparable set of rights Logo orFirm uses AIPLA3 3 Reasonable Royalty • Methodologies – – – – – – Georgia-Pacific Hypothetical Negotiation Analytical Approach 25% Rule Nash Bargaining Consumer Surveys/Conjoint Surveys Cost Savings/Incremental Benefits and Cost of Non-Infringing Alternatives Firm Logo AIPLA4 4 Georgia-Pacific Hypothetical Negotiation • Hypothetical negotiation between patentee and infringer over use of invention at the time of first infringement • Patent valid and infringed • Link royalty rate to proper royalty base • Damages expert uses “comparable” agreement related to subject matter of patent-in-suit • “baseline” royalty = “comparable” agreement rate • Expert evaluates “baseline” royalty considering GeorgiaPacific factors to compute “final” rate • Reasonable Royalty = “final” rate * total sales of infringing product Firm Logo AIPLA5 5 Georgia-Pacific Hypothetical Negotiation • Lucent v. Gateway (Fed. Cir. 2009) – $561M = 8% royalty; MSFT argued $6.5M lump-sum – Lucent relied on 8 prior license agreements – Technology of license agreements not similar to one litigated; no evidence patented method was basis for consumer demand – “nothing wrong with using market value of entire product” so long as royalty rate is proportional of base represented by patented feature • ResQNet v. Lansa (Fed. Cir. 2010) – Can’t rely on non-comparable licenses to inflate royalty Firm Logo agreement pertinent to reasonable royalty – Settlement AIPLA6 6 Analytical Approach • Infringer’s own internal profit projections for infringing item at time of first infringement • Royalty rate = projected net profit % - industry net profit • Reasonable royalty = royalty rate * infringer’s actual sales • TWM Mfg. Co. v. Dura Corp., 789 F.2d 895 (Fed. Cir. 1986) – reasonable royalty damages rate of 30% Firm Logo AIPLA7 7 25% Rule • “baseline” royalty = 25% of profit margin of infringing product • Expert evaluates “baseline” royalty considering GeorgiaPacific factors to compute “final” rate • Reasonable Royalty = “final” rate * total sales of infringing product • Uniloc kills 25% Rule • WhitServe, LLC v. Computer Packages, Inc. (Fed. Cir. 2012) – Vacates 16-19% rate using 25% as starting point – Expert failed to explain how Georgia-Pacific factors affected 25% Firm Logo AIPLA8 8 25% Rule • Uniloc v. Microsoft (Fed. Cir. 2011) – Expert used internal MSFT document which placed “product keys” value $10-$10,000 – Used $10, 25% rule of thumb “baseline” royalty of $2.50/license – $565M = $2.50 * 226M sales 2.9% royalty on $19B gross revenue; Jury awarded $388M – DCT: grants new trial because product activation feature not basis of consumer demand for MS Office and Windows and hence, improper use of $19B EMV – Fed. Cir.: “25% rule of thumb” is fundamentally flawed; can’t consider EMV for minor patent improvements even by Firm Logo asserting low enough royalty rate AIPLA9 9 Nash Bargaining • Parties split incremental profits of licensing evenly 50/50 if neither licensor or licensee can monetize without license • Not a 50/50 split if infringer has noninfringing alternatives or patent owner can produce patented technology • Reasonable estimate of disagreement profits, relative bargaining power of parties • Oracle v. Google (N.D. Cal. 2011) – Expert suggested Google pay $1.4B - $6.1B based on Nash Bargaining – Judge Alsup rejects report; facts not tied to solution, no evidence to show warranted assumptions Firm Logo • Suffolk Techs. LLC v. AOL Inc. (E.D. Va. 2013) – 50/50 split of profits not adequately tied to facts 10 AIPLA 10 Consumer Surveys • Survey respondents evaluate several product profiles with different bundles of attributes • Compute quantitative values of individual product features from statistical analysis of respondents’ choices • i4i Ltd. P’shp v. Microsoft Corp. (Fed. Cir. 2010) – 2% of MS Word purchasers used XML format feature • IP Innovation v. Red Hat (E.D. Tex. 2010) – Online user forum statements not related to patented technology • Apple v. Motorola (N.D. Ill. 2012) – Judge Posner: “Dummy! You haven’t estimated the [feature’s] value” Firm Logo • TV Interactive Data Corp. v. Sony Corp. (N.D. Cal. 2013) – Conjoint survey to apportion value of patented feature 11 AIPLA 11 Incremental Benefits, Non-Infringing Alternatives’ Costs • Expert testifies regarding costs of non-infringing alternatives and benefits of patented feature • Brandeis Univ. v. Keebler Co. (N.D. Ill. 2013) – Judge Posner: Plaintiff’s expert can testify re difficulty in implementation of non-infringing alternative and benefits of patented invention – Precludes def. expert’s testimony: not an expert on consumer demand • TQP Dev. LLC v. Merrill Lynch & Co., Inc. (E.D. Tex. 2012) – Judge Bryson: Denies Motion to Exclude damages expert on noninfringing alternatives Firm Logo 12 AIPLA 12 Royalty Base • Entire Market Value (EMV) – – – – Invention is substantial basis of consumer demand for product Royalty base = entire value of accused product Lucent Techs., Inc. v. Gateway, Inc. (Fed. Cir. 2009) AVM Tech., LLC v. Intel Corp. (D. Del. 2013) • Live testimony to determine if Intel processor is SSU or dynamic logic circuit • Smallest Saleable Unit (SSU) Value – – – – Apportion value of smallest saleable patent-practicing component Royalty base = cumulative value of smallest saleable components LaserDynamics, Inc. v. Quanta Computer, Inc. (Fed. Cir. 2012) Tomita Tech. USA, LLC v. Nintendo Co. (S.D.N.Y. 2013) • Grants remittitur on $30M damages to $15M; expert used EMV for 3DS • Firm 3DS Logo is SSU but patented tech used only in 2 features of gaming system 13 AIPLA 13 NPE Deterrence • Attorney Fees – SCOTUS Cert. grant: Octane Fitness v. Icon Health Fitness and Highmark v. Allcare Health Mgmt. – Taurus IP, LLC v. DaimlerChrysler Corp. (Fed. Cir. 2013) • State Attorney Generals – Nebraska AG bar on law firm representing NPE – Vermont, Minnesota AG actions against MPHJ Tech. Investments LLC based on state consumer protection laws • Civil Racketeer Influenced and Corrupt Organizations Act (RICO) claim – FindTheBest.com, Inc. v. Lumen View Tech. LLC (S.D.N.Y. 2013) • Pending Congressional Bills • White House Office of Science & Tech. Policy (OSTP) Firm Logo • FTC Study on Patent Assertion Entity (PAE) 14 AIPLA 14 Conclusion • Pendulum swinging against NPE • Damages jurisprudence—evolving Firm Logo 15 AIPLA 15 Thanks for your attention! Questions? Firm Logo 16 AIPLA 16