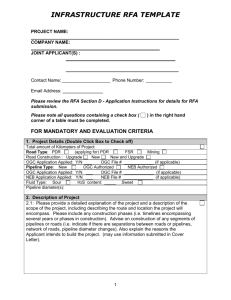

infrastructure rfa initiation checklist

advertisement

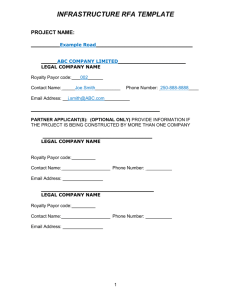

Net Profit Royalty Project RFA Template PROJECT NAME: ______________________________________________ PRODUCER LEGAL NAME: ________________________________________ JOINT APPLICANT(S): __________________________________ ___________________________________ Contact Name: ___________________ Phone Number: __________ Email Address: ________________ Please review the RFA Section D - Application Instructions for details for RFA submission. Please note all questions containing a check box ( corner of a table must be completed. ) in the right hand FOR EVALUATION CRITERIA ORGANIZATION PROFILE 1. Description of Organization Please provide an overview of your organization including mission, objectives and expertise. Please provide: PROJECT DETAILS 2. Description of Project Please provide a detailed description of the project. The description should include an exploitation plan for the drilling and completion of wells and the construction of project infrastructure over 5 years, 10 years, 15 years and the life of the project. Specifics described in the plan should include: - details on land interests and tenure status - information on plans for drilling and completion of wells, including drilling density - information on well authorizations approved or any other applications/approvals from the Oil and Gas Commission - details of seismic information and the drilling and production performance expected for the project for the area, reservoir, and/or pool(s) 1 - a description of the drilling and completion technologies that will be used to develop the project a description of the construction plan for building the project infrastructure details of water-related issues e.g. available water sources for fracing, volumes required, recycling ability, description of available water sources for injection and zones for water disposal Please provide: 3. Reserves, Production Profile and Gas Composition Please provide: - a list of the primary and secondary zones within the proposed project - actual or expected gas analysis, reserves and pressure data for each zone within the proposed project - production profiles of type wells used in determining production volume for the project - data on historical and expected production of oil and natural gas from wells already drilled or to be drilled within the proposed project and specified zone - the expected recovery percentage of the initial oil or natural gas in place - well production profiles used for economic analysis Note: The MEMPR Net Profit Model allows for 5 different type curves. If your project has more than 5 type curves, please provide this further information. Please provide: 4. Project Cost Information Please provide: - an itemized historical cost breakdown for the proposed project (5 year maximum, if available), including seismic costs, allowed capital costs (net of government incentive payments), allowed operating costs and land acquisition costs (note that land acquisition costs are not eligible costs under the Net Profit Royalty Program but is being requested for analysis purposes). - an itemized capital cost budget for the proposed project (e.g. this could include seismic, exploration drilling, exploration completions, development drilling, development completions; and all costs of design, construction, engineering, financing, approvals, materials and installation, and any other applicable costs). - an itemized operating cost forecast for the proposed project, including all costs associated with production, gathering, processing and transporting the products from the project to market (e.g. fixed costs, cost per well, cost per unit of production). 2 - an itemized budget for allowed capital and operating costs outside of the ring fence. Note: The Ministry does not accept contingency, GST, administration and overhead costs as part of the cost estimates. Please refer to the Net Profit Allowable Cost Order of the Administrator for further clarification of costs. (See Appendix B) Please provide: 5. Market Information Please provide the following: - Provide price forecasts for natural gas (at plant gate), oil and natural gas liquids in real (2009) dollars (or provide an inflation forecast if you wish to present in nominal (as spent) dollars). - Describe the destination and/or markets for the products and detail your plans to ensure access to markets for products produced by wells within the project, e.g. pipelines, plants, capacity availability, etc. Please provide: PROJECT BUSINESS CASE 6. Project Internal Rate of Return (Please use the MEMPR Net Profit Model provided in Appendix A) 6.1: Please provide the project's internal rate of return (to the producer after royalties and taxes) under the following two scenarios: Scenario 1: The project is approved as a net profit royalty project and royalty payments to the Province of British Columbia are based on the net profit royalty structure outlined in the Net Profit Royalty Regulation. Project internal rate of return under net profit _________ Scenario 2: The project is not approved as a net profit royalty project and royalty payments to the Province of British Columbia are based on the existing British Columbia royalty programs outlined in the Petroleum and Natural Gas Royalty and Freehold Production Tax Regulation. Project internal rate of return without net profit Notes: 3 _________ The Scenario 1 and Scenario 2 internal rate of return calculations are to be based on a risked net present value cash flow model (using price forecasts provided in the MEMPR Net Profit Model) (ii) Royalty programs to be considered should include the infrastructure, deep and summer drilling credit programs, the marginal and ultra-marginal royalty rate reduction programs and 100% Crown participation in the Producer Cost of Service allowance. (i) 6.2: Please clearly explain how the project fits within the capital plan of your company or companies. Please explain: 6.3: Please provide an explanation of the applicant company’s economic hurdle rate (rate of return) or any other economic or financial method(s) used to determine a project’s economic viability. Please explain and fill in the blank below: Provide Company(s) hurdle rate ________ Please explain: 6.4: Please clearly indicate the likelihood of the project and its timing in the event the project was approved as a net profit royalty project versus not being approved as a net profit royalty project. Demonstrate the degree and timing of whether or when the project would or would not proceed without a net profit royalty project approval. Please indicate: 7. Other Benefits Attributable to the Province 7.1: Please identify how the proposed project “opens up” new areas of British Columbia. Please identify: 4 7.2: Please clearly explain how the proposed project helps reduce footprint (e.g. by providing access to more than one producer in the area; by combining various producers potential applications; by using existing capacity in existing facilities; etc). Please explain: 7.3 Please identify the benefits to British Columbia residents and local residents in the region in which the project will be located, if it is proximal to a populated area. Please identify: 7.4: Please identify other potential benefits. Please identify: 8. Risks and Significant Issues 8.1: Please provide risk information on the chance of success (COS) assumptions on various components of the project, e.g. geological risk and economic risk. Please provide: 8.2: Please identify external risks and significant issues that may delay or pose a hindrance in commencing the proposed project (e.g. cost increases, environmental issues, First Nations consultations, insurance, poor drilling outcomes, changes in corporate focus and capital budgets, scope revision, staff changes, etc.). Please identify: 5 8.3: Please provide details on consultations with First Nations, landowners and stakeholders within or proximal to the proposed project area. If consultations are ongoing, please provide a summary showing meetings held, issues identified, issues resolved and issues yet to be resolved. Please provide: 8.4: Please provide details on consultations with the Oil and Gas Commission regarding logistics of the project. Please provide: 8.5: Please provide any further examples of risk and mitigation (if applicable): Please provide: BEFORE YOU SUBMIT, PLEASE CHECK: HAVE YOU INCLUDED IN YOUR RFA SUBMISSION ….. Cover Page, signed as instructed? Cover Letter? Net Profit Royalty Project RFA Template? Proposed Development Schedule? MEMPR Net Profit Model? Geological? Mapping? I hereby attest that all the above information contained in the RFA submission is true and correct: ______________________________________________ Signature of Authorized Signatory of Designated Applicant 6