Winter 2015Instructor: Qin Lian, Ph.D.

advertisement

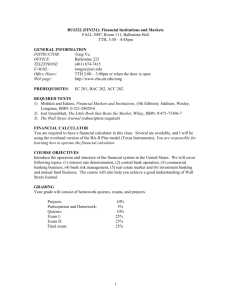

COURSE SYLLABUS Intermediate Financial Management FINC 319 Winter 2015 Instructor: Office: Office Hours: Class Time: Office Phone: E-mail: Qin Lian, Ph.D. Room 215 MWF 8:30 am-11:00 am, Tu 9:00 am-11:30 am or by appointment MWF 11:00 am-12:15 pm @ Room 112 (318) 257- 3593 qlian@latech.edu Course Objectives This course is a capstone finance course. We will address many important issues facing corporate managers, including 1) capital budgeting analysis; 2) cost of capital and capital structure analysis; 3) corporate payout policy; and 4) working capital management. The primary goal for this class is to solidify your understanding of basic finance and broaden your understanding of applying the basic finance concepts in practices. Course Webpage: Moodle Prerequisites: FINC 318. Textbook: Essentials of Corporate Finance by Ross, Westerfield & Jordan – 8th edition. Reading materials (Recommended): Wall Street Journal Required Materials A pocket financial calculator (of your choice, such as Hewlett-Packard HP-17, HP-10, HP-19 or the Texas Instruments BA-II Plus) is required. Some instructions for financial calculators are available at http://www.tvmcalcs.com/calculator_index. There will be no sharing of calculators in the course. Please bring your calculator to each class. Course Policies 1. Attendance & Participation Students are expected to attend class on time and actively participate in class by asking and answering questions. Please refrain from behavior that distracts other students (answering cell phones, text messaging, any other cell phone using, etc.). Attendance will be taken each class period as required by Board of Regents policy. Arriving 15 minutes late or longer, as well as leaving more than 15 minutes early, counts as one absence. When you miss class, ask a classmate (not me) to debrief you. You are responsible for all missed material. 2. Homework Homework is assigned through McGraw-Hill’s Connect. All homework on Connect closes 15 minutes before the class on due date. There will be approximately one graded Syllabus for Intermediate Financial Management, FINC319, Winter 2015 1 homework assignment for each chapter. You can try practice homework unlimited times with no time limit before the due time. You will receive the answers and solutions right away. You have three attempts for the graded homework. I will keep the highest score as your grade for each graded homework. No late homework will be accepted regardless of reasons. One of your lowest scores for homework will be dropped to calculate your homework grade. This course requires a paid access to McGraw-Hill’s Connect. Your Connect code can be purchased one of several ways: 1. As part of the package with your text purchased from the bookstore 2. If you buy a used book, you can purchase Connect online at the course homepage: 3. If you purchase Connect online, you will have the option of purchasing Connect or ConnectPlus. ConnectPlus includes an interactive eBook, while Connect does not. 4. NOTE: You can register in Connect and have access without a code for a limited time period (typically three weeks). How to register for Connect 1. Go to your Connect home page: http://connect.mcgraw-hill.com/class/qinlian_winter_2015_finc319 2. Click on the "Register Now" link on the student menu found on your instructor's course homepage. 3. Enter your email address TIP: If you already have a McGraw-Hill account, you will be asked for your password and will not be required to create a new account. 4. Enter a registration code or choose Buy Online to purchase access online 5. Follow the on-screen directions 6. When registration is complete, click on Go to Connect Now 7. You are now ready to use Connect 3. Quizzes Quizzes will cover all material assigned and/or covered since the previous regular quiz/exam. Failure to attend class the day of an in-class quiz will result in a zero for that quiz. There will be no make-up quizzes. I will not answer questions or emails regarding the date of quizzes. 4. Exams There will be three close-book exams. Missed exams will receive a 0. Exams must be taken at the scheduled time unless extreme circumstances. The student must receive approval from the instructor before the regularly scheduled exam. 5. Assignments You need to prepare a short summary of a news article (e.g., from WSJ, Economist, Business Week, and etc). The news article is about the financial and business decision of a company of your choice. The financial and business decision should be related to topics covered in this course, such as a company’s cost of capital, capital structure decision, capital budgeting decision, dividend policy, investment policy, and etc. (see tentative Syllabus for Intermediate Financial Management, FINC319, Winter 2015 2 course outline for more information). You will discuss it in class. The discussion should be no more than 5 minutes. Your summary must be typed and turned in to me on the day you present it. Also send me the link of the original article and briefly state your choice of company and its chosen policy in the class day (9:00 p.m. CST) before your presentation date. Failure to do it will affect your overall grade for the assignment. Note for summary: (a) Provide a condensed version of a longer article for the purpose of attracting the reader to read the complete document. (b) Give the overall, big picture and a few important details. (c) Do not copy sentences from different sections of the article to mix together. (d) Do not simply summarize each section without overall sense of the article. (e) Summarize the article in your own words. (f) Do not add your own opinions about the topic in the summary. However, you are welcome to add your thoughts and comments in a separate paragraph. Format for the assignment: Last Name: (e.g., Lian) First Name: (e.g., Qin) Term: (Fall 2011) Article Title: (e.g., The Great American Bond Bubble) Source: (e.g., August 18, 2010, pg. A‐17) Summary: Discussion: (optional) 6. Students with Disabilities Students with disabilities who believe that they may need accommodations in this class are encouraged to share these concerns and requests with the instructor as soon as possible. 7. Basis for Assigning Course Grades Activity Point 1. Exam 1 100 pts. 2. Exam 2 100 pts. 3. Exam 3 100 pts. 4. Attendance & Participation 20 pts. 5. Assignment 10 pts. 6. Homework average 50 pts. 7. Quiz average 20 pts. TOTAL……………………………… 400 pts. The following percentage grading scale will be used to determine your course grade: Grade cutoffs for A, B, C, D are 360, 320, 280, and 240 respectively. Grades are rounded to the nearest percent (i.e. 239.5 rounds to 240 while 239.4 rounds to 239) Note: I may give a maximum of 5 points for participation based on my observation of your understanding of class materials and in-class participation. I do not email grades and I do not give out grades over the telephone. Syllabus for Intermediate Financial Management, FINC319, Winter 2015 3 8. Appeals Process You may dispute exam/quiz items that you missed by giving me a typewritten appeal within one week of exam/quiz returns. In your appeal, include your name, the exam/quiz and the question you are referring to, and indicate the answer you chose and why you think that answer was as good or better than the one I chose as correct. After one week has passed, I will not address previous quizzes and exams. 9. Campus Emergency Policies In case of a campus-wide disaster that requires campus closure for an extended period, the remaining course will be delivered through the online communication and instructional tools available in the campus Moodle course management system. The faulty member will make all the materials required to continue coursework available at the Moodle site. 10. Other policies Each student is responsible for checking on course website on weekly basis. No provision for make-up exams and extra credits. I make an extra effort to treat each student with the same consideration. Cheating is not tolerated. Failure to follow the instructions given by the instructor during a test will result in a failing grade on the course. Further discipline measures may be pursued through the college. This is not simply something you do in a class, but an indication of your overall character. Course Outline Module I. Risk and Return ~ Chapters 10, 11 Market efficiency Diversification Module II. Capital Budgeting ~ Chapters 8, 9 Decision Criteria Project Analysis Module III. Capital Structure ~ Chapters 12, 13, 15 Cost of Capital Capital Structure Raising Capital Module IV. Payout Policy and Other Topic~ Chapters 14, 16, 17 Dividend Policy Short-term Finance and Planning Cash and Liquidity Management Exam 1 (Dec 19, 2014, in class, chapters 10, 11, 8) Exam 2 (Jan 30, 2015, in class, chapters 9, 12, 13, 15) Final Exam (Feb 27, 2015, in class, chapters 14, 16, 17) * Please note this is a tentative syllabus and changes may be necessary as the quarter unfolds. All changes will be announced in class. Syllabus for Intermediate Financial Management, FINC319, Winter 2015 4