general information

advertisement

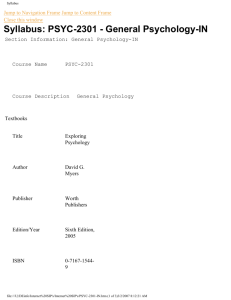

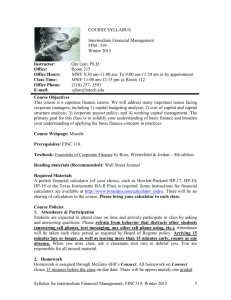

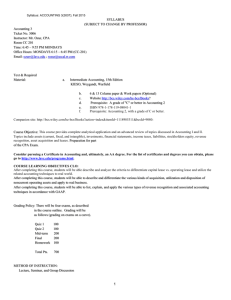

BUS322 (FIN331): Financial Institutions and Markets FALL 2007, Room 111, Ballentine Hall TTH, 3:30 – 4:45pm GENERAL INFORMATION INSTRUCTOR: Tong Yu OFFICE: Ballentine 223 TELEPHONE: (401) 874-7415 E-MAIL: tongyu@uri.edu Office Hours: TTH 2:00 – 3:00pm or when the door is open Web page: http://www.cba.uri.edu/tong PREREQUISITES: EC 201, BAC 202, ACC 202. REQUIRED TEXTS 1) Mishkin and Eakins, Financial Markets and Institutions, (5th Edition); Addison, Wesley, Longman, ISBN: 0-321-28029-6 2) Joel Greenblatt, The Little Book that Beats the Market, Wiley, ISBN: 0-471-73306-7 3) The Wall Street Journal (subscription required) FINANCIAL CALCULATOR You are required to have a financial calculator in this class. Several are available, and I will be using the overhead version of the BA-II Plus model (Texas Instruments). You are responsible for learning how to operate the financial calculator. COURSE OBJECTIVES Introduce the operation and structure of the financial system in the United States. We will cover following topics: (1) interest rate determination, (2) central bank operation, (3) commercial banking business, (4) bank risk management, (5) real estate market and (6) investment banking and mutual fund business. The course will also help you achieve a good understanding of Wall Street Journal. GRADING Your grade will consist of homework quizzes, exams, and projects. Projects: Participation and Homework: Quizzes: Exam I: Exam II: Final exam: 10% 5% 10% 25% 25% 25% 1 BUS 322, Syllabus, continued QUIZZES and EXAMS Quizzes: We have 3 quizzes. The quizzes will be given at the beginning of the class and take you approximately 20 minutes for each quiz. Exams: There will be 3 exams. A legitimate conflict with any of the examinations can only be determined by the instructor. Failure to obtain this approval PRIOR TO THE EXAM will result in a ZERO grade. To attend a make-up exam within one week of the original date of the exam: 1) you contacted the instructor prior to the original exam date, and 2) a legitimate conflict is approved by the instructor. If you are late arriving for a quiz or an exam, you will not be given additional time to complete the quiz. ATTENDENCE Attendance will be taken at the beginning of class. PROJECTS You will form groups up to 5 people to work on the project. Requirement includes an oral presentation and a written report. Specific requirement will be announced later. 20 Percent of the grade will be deducted from total points possible for late work. HOMEWORK You should turn in your homework on time. Please write your answers clearly. If there are multiple pages, please staple them! Homework contains three parts: (1) regular textbook exercises, (2) portfolio analysis, and (3) major financial event analysis. I will provide solutions to homework. You will find some of exam and quiz questions are similar to your homework. Homework schedule has been listed in Syllabus but subject to changes according to course progress. Please submit homework on time. Late homework without an excuse will not be accepted. CHEATING Cheating on exams and quizzes will NOT be tolerated. Please refer to the URI University Manual for policies related to cheating. MISCELLANEOUS Presentation materials used in the class will be made available on-line before the class. I reserve the right to make any modifications in the syllabus. Modifications will be announced in class. You are responsible for the changes announced in class. GRADING SCALE The following scale will be used for grading purposes: 100 - 94 A 93 - 90 A89 - 87 B+ 86 - 84 B 83 - 80 B79 - 77 C+ 76 - 74 C 73 - 70 C67 - 69 D+ 60 - 66 D 0 - 59 F 2 BUS 322, Syllabus, Cont’d COURSE CALENDAR (TENTATIVE) DATE SUBJECT Week of Sep 6 Reading: Introductions and Financial System Chapters 1 & 2 Week of Sep 11 Reading: Basics about Interest Rates Chapter 3 Week of Sep 18 Reading: Homework 1 Duration Chapter 3; Little Book (ch1 – ch5) Week of Sep 25 Reading: Quiz 1 Duration Chapter 3 Week of Oct 2 Reading: Homework 2 Equilibrium Analysis on Interest Rates Chapter 4, Little Book (ch6-ch10) Week of Oct 9 Reading: Exam 1 Term Structure of Interest Rates Chapter 5 Week of Oct 16 Reading: Term Structure of Interest Rates (Cont’d) Chapter 5 Week of Oct 23 Quiz 2 Reading: Financial and Real Estate Markets Week of Oct 30 Reading: Central Banks and Fed Policy Chapters 7 & 8, Little Book (ch11 – ch13) Week of Nov 6 Reading: Homework 3 Exam 2 Commercial Banking Chapters 16, 17, 18 & 20 Week of Nov 13 Reading: Quiz 3 Commercial Banking (cont’d) Chapters 16, 17, 18, 20 Chapters 9, 10, 11 3 BUS 322, Syllabus, continued Week of Nov 20 Reading: Risk Management chapters 24, 25 Week of Nov 27 Reading: Security Firms and Mutual Funds Chapter 21, 23 Week of Dec 4 Group Presentations Final Exam Date to be announced Let’s have a great semester! 4