Simple & Compound Interest Test Review - High School

advertisement

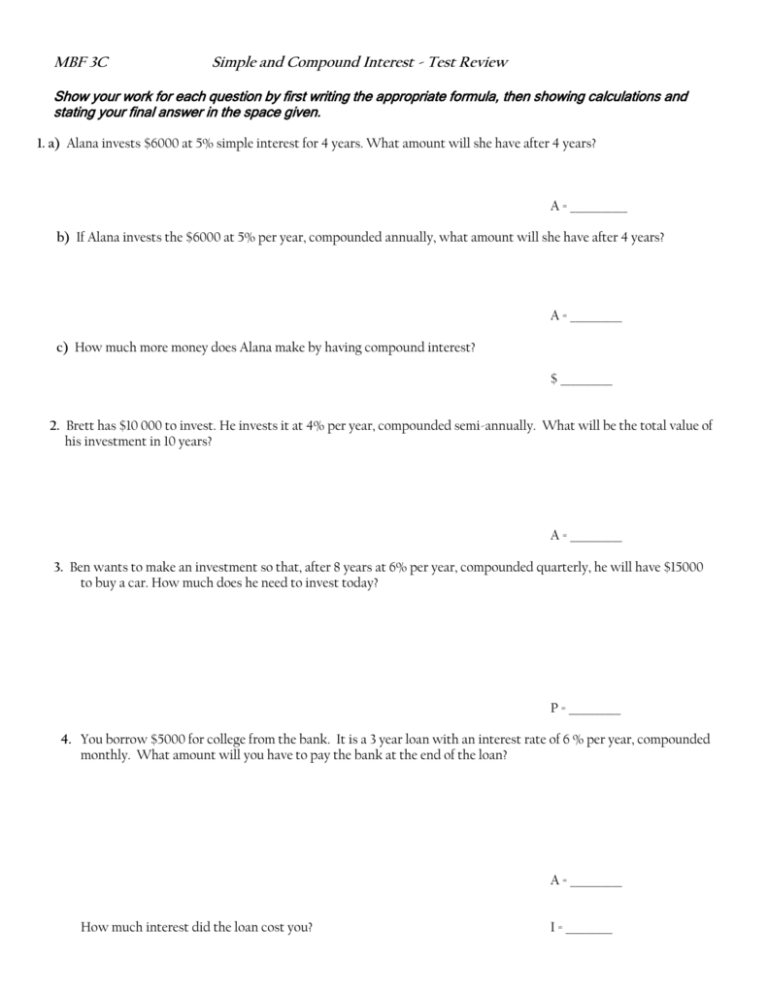

MBF 3C Simple and Compound Interest - Test Review Show your work for each question by first writing the appropriate formula, then showing calculations and stating your final answer in the space given. 1. a) Alana invests $6000 at 5% simple interest for 4 years. What amount will she have after 4 years? A = ___________ b) If Alana invests the $6000 at 5% per year, compounded annually, what amount will she have after 4 years? A = __________ c) How much more money does Alana make by having compound interest? $ __________ 2. Brett has $10 000 to invest. He invests it at 4% per year, compounded semi-annually. What will be the total value of his investment in 10 years? A = __________ 3. Ben wants to make an investment so that, after 8 years at 6% per year, compounded quarterly, he will have $15000 to buy a car. How much does he need to invest today? P = __________ 4. You borrow $5000 for college from the bank. It is a 3 year loan with an interest rate of 6 % per year, compounded monthly. What amount will you have to pay the bank at the end of the loan? A = __________ How much interest did the loan cost you? I = _________ 5. You put $5000 on your credit card to buy a home theatre system. You are not able to pay for it for 3 years. The credit card charges you an interest rate of 21% per year, compounded daily. What will you owe the credit card company at the end of three years? A = __________ How much interest did the purchase cost you? 6. I = __________ How much would you need to invest on your 20th birthday at 8% per year, compounded quarterly, to have $500,000 by your 75th birthday? P = ___________ 7. How long would it take to double $500 dollars at 12%, compounded? a) Yearly 8. b) monthly What interest rate would allow you to double $200 in 4 years, compounded annually?

![Practice Quiz 6: on Chapter 13 Solutions [1] (13.1 #9) The](http://s3.studylib.net/store/data/008331662_1-d5cef485f999c0b1a8223141bb824d90-300x300.png)