Finite Math Exam: Chapter 5 - Financial Mathematics

advertisement

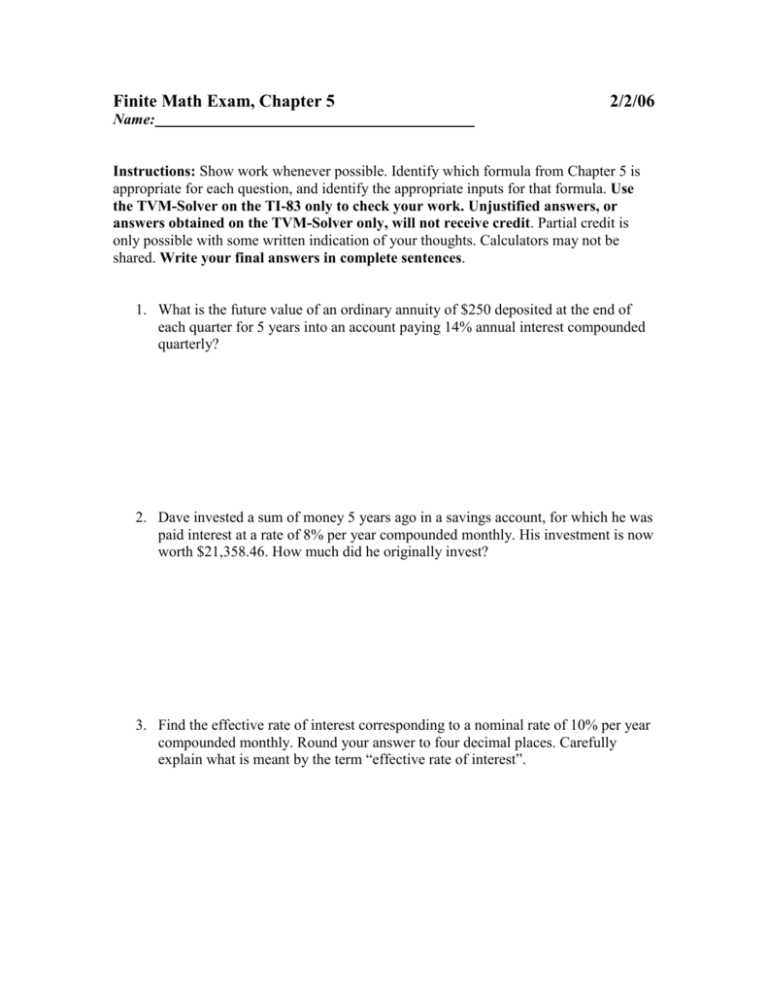

Finite Math Exam, Chapter 5 2/2/06 Name: Instructions: Show work whenever possible. Identify which formula from Chapter 5 is appropriate for each question, and identify the appropriate inputs for that formula. Use the TVM-Solver on the TI-83 only to check your work. Unjustified answers, or answers obtained on the TVM-Solver only, will not receive credit. Partial credit is only possible with some written indication of your thoughts. Calculators may not be shared. Write your final answers in complete sentences. 1. What is the future value of an ordinary annuity of $250 deposited at the end of each quarter for 5 years into an account paying 14% annual interest compounded quarterly? 2. Dave invested a sum of money 5 years ago in a savings account, for which he was paid interest at a rate of 8% per year compounded monthly. His investment is now worth $21,358.46. How much did he originally invest? 3. Find the effective rate of interest corresponding to a nominal rate of 10% per year compounded monthly. Round your answer to four decimal places. Carefully explain what is meant by the term “effective rate of interest”. 4. A health club offers to let you join for a down payment of $50 and payments of only $36 at the end of each month for 3 years. When you read the fine print, you discover that the interest rate is 18% per year compounded monthly. What is the cash price of the health club membership (if you choose to “pay it all off” today)? What is the total amount that you would pay to the health club, including the down payment and all monthly payments, if you chose the financing option? 5. Find the accumulated amount at the end of five years on a $1200 bank deposit paying 7.5% simple interest per year. 6. Find the accumulated amount after 4 years if $2000 is invested at 8% per year compounded semiannually. 7. The Swensons plan to make payments of $4000 into a time certificate account on the last day of this and every year until their retirement in 30 years. How much will they have in the account when they retire if the account earns 11% interest per year compounded annually? (Round your answer to the nearest dollar.) 8. Find the present value of an ordinary annuity of 24 payments of $50 each made monthly and earning interest at 9% per year compounded monthly. Carefully explain what is meant by the “present value” of this annuity. 9. Natalie and Addison decide to make a $30,000 down payment on a $150,000 home. Compute the monthly payment for the $120,000 mortgage if the loan is 8.8% per year compounded monthly for 35 years. How much interest is paid on this loan if it is paid on schedule? 10. A young man is the beneficiary of a trust fund established for him 21 years ago at his birth. If the original amount placed in trust was $10,000, how much will he receive if the money has earned interest at the rate of 8% per year compounded quarterly?

![Practice Quiz 6: on Chapter 13 Solutions [1] (13.1 #9) The](http://s3.studylib.net/store/data/008331662_1-d5cef485f999c0b1a8223141bb824d90-300x300.png)