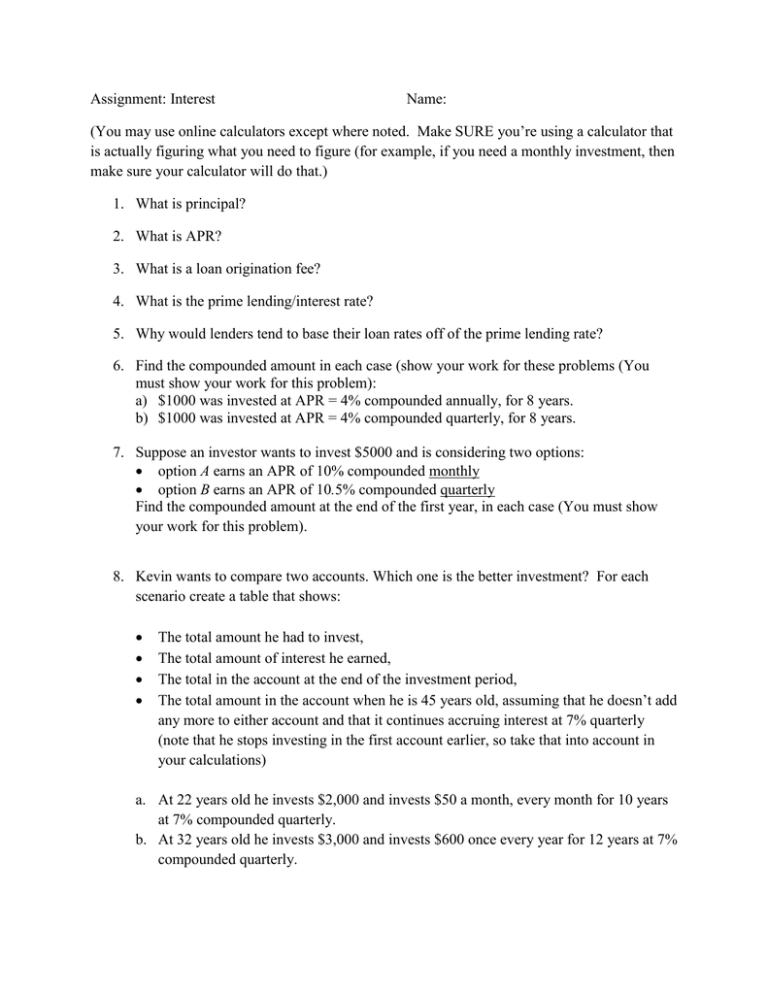

Assignment: Interest Name:

advertisement

Assignment: Interest Name: (You may use online calculators except where noted. Make SURE you’re using a calculator that is actually figuring what you need to figure (for example, if you need a monthly investment, then make sure your calculator will do that.) 1. What is principal? 2. What is APR? 3. What is a loan origination fee? 4. What is the prime lending/interest rate? 5. Why would lenders tend to base their loan rates off of the prime lending rate? 6. Find the compounded amount in each case (show your work for these problems (You must show your work for this problem): a) $1000 was invested at APR = 4% compounded annually, for 8 years. b) $1000 was invested at APR = 4% compounded quarterly, for 8 years. 7. Suppose an investor wants to invest $5000 and is considering two options: option A earns an APR of 10% compounded monthly option B earns an APR of 10.5% compounded quarterly Find the compounded amount at the end of the first year, in each case (You must show your work for this problem). 8. Kevin wants to compare two accounts. Which one is the better investment? For each scenario create a table that shows: The total amount he had to invest, The total amount of interest he earned, The total in the account at the end of the investment period, The total amount in the account when he is 45 years old, assuming that he doesn’t add any more to either account and that it continues accruing interest at 7% quarterly (note that he stops investing in the first account earlier, so take that into account in your calculations) a. At 22 years old he invests $2,000 and invests $50 a month, every month for 10 years at 7% compounded quarterly. b. At 32 years old he invests $3,000 and invests $600 once every year for 12 years at 7% compounded quarterly. 9. Describe which of the scenarios in question 8 is the better value and why. 10. A debt of $550 due in 4 years is to be paid in 2 installments. The first of payment of $200 to be paid immediately. The installment will be paid in 4 years to include the remaining principal and interest. The APR is 6% compounded quarterly. Create and accurately label a time vs. payment graph of this scenario. Make sure that you include all elements including: Starting amount due The first payment The quarterly compounding interest The final payment