Time Value of Money

FP Version 8

University of Phoenix Material

Time Value of Money

Refer: to Ch. 1, “Time Value of Money” section of Personal Finance.

Respond to the following questions in 50 to 100 words each.

1. What is the definition of Time Value of Money? Please define present and future value.

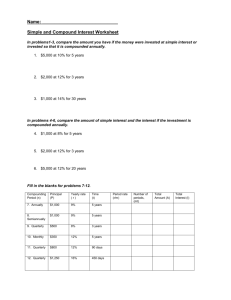

2. How is simple interest calculated? Provide an example of how it would be calculated. For example,

you might use your student loan or a car loan to show this calculation.

For questions 3 – 5, use the Bankrate Compound Interest Calculator

http://www.bankrate.com/calculators/savings/compound-savings-calculator-tool.aspx and input provided

figures, changing the interest rate, and the compounding of the interest rate (annually and quarterly) as

delineated below:

3. You place $1,500 in a savings account earning 3% interest compounded annually. How much will you

have at the end of four years? How much would you have at the end of four years if interest is

compounded quarterly?

4. Change the interest rate to a higher rate. How much will you have at the end of four years if interest is

compounded annually at a rate of 5%? How much would you have at the end of four years if interest

is compounded quarterly?

5. Now change the interest rate to a lower rate. How much will you have at the end of four years if

interest is compounded annually at a rate of 2.5%? How much would you have at the end of four

years if interest is compounded quarterly?

Copyright © 2015 by University of Phoenix. All rights reserved.

1

![Practice Quiz Compound Interest [with answers]](http://s3.studylib.net/store/data/008331665_1-e5f9ad7c540d78db3115f167e25be91a-300x300.png)