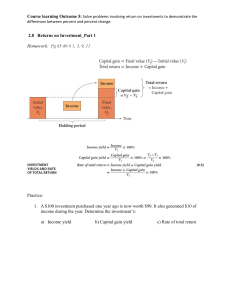

Case 1. A treasury bond that matures in 10 years has a yield of 6%. A 10-year corporate bond has a yield of 8%. Assume that the liquidity risk premium on the corporate bond is 0.5%. What is the default risk premium on the corporate bond? Corporate Bond Yield= Risk-Free Rate + Default Risk Premium + Liquidity Risk Premium Rearrange formula to solve for the default risk premium: Default Risk Premium=Corporate Bond Yield−Risk-Free Rate−Liquidity Risk Corporate Bond Yield = 8% Risk-Free Rate (Treasury Bond Yield) = 6% r10 = 6% rc10 = 8% LP = 0.5% DRP = 8% - 6% -0.5% = 1.5% Case 2. Due to a recession, expected inflation this year is only 3%. However, the inflation rate in Year 2 and thereafter is expected to be constant at some level above 3%. Assume that the expectations theory holds and the real risk-free rate (r*) is 2%. If the yield on 3-year Treasury bonds is equal to 1-year yield plus 2%, what inflation rate is expected after Year 1? Given : Expected inflation this year = 3% Real risk-free rate (r*) = 2% Solution: 𝑟 𝑡 = 𝑟 *+𝐼𝑃𝑡 + 𝐷𝑅𝑃𝑡 + 𝑀𝑅𝑃𝑡 𝑟 1 = r* + 𝐼𝑃1 r1 = 2% + 3% r1 =5% r3 = r1+ 2% r3 = 5% + 2% r3 =7% Formula for r3: r3= r* +𝐼𝑃3 7%= r* +𝐼𝑃3 7% = 2% +𝐼𝑃3 𝐼𝑃3 = 7% - 2% 𝐼𝑃3 =5% 𝐼𝑃3 = (𝐼1 + 𝐼2 + 𝐼3) 3 5% = (3% + 2𝐼) 3 3𝑥(5% = (3% + 2𝐼) ) 3 15% = 3% + 2I 2I = 15% - 3% 2I = 12% 2𝐼 12% = 2 2 I = 6% Case 3. A company’s 5-year bonds are yielding 7.75% per year. Treasury bonds with the same maturity are yielding 5.2% per year, and the real risk-free rate (r*) is 2.3%. The average inflation premium is 2.5%; and the maturity risk premium is estimated to be 0.1 x (t – 1) %, where t = number of years to maturity. If the liquidity premium is 1%, what is the default risk premium on the corporate bonds? rc5 = 7.75% r5 = 5.2% LP= 1% DRP = 7.75% - 5.2% - 1% = 1.55% Case 4. An investor in Treasury Securities expects inflation to be 2.5% in Year 1, 3.2% in year 2, and 3.6% each year thereafter. Assume that the real risk-free rate is 2.75% and that this rate will remain constant. Three-year Treasury securities yield 6.25%, while 5-year treasury securities yield 6.80%. what is the difference in maturity risk premiums (MRPs) on the two securities, that is, MRP5 – MRP3? R* = 2.75% 2.5% + 3.2% + 3.6% 𝐼𝑃3 = = 3.1% 3 2.5% + 3.2% + 3.6%(3) 𝐼𝑃5 = = 3.3% 5 R3 = 6.25% MRP3 = 6.25% - 2.75% - 3.1% = 0.40% R5 = 6.80% MRP5 = 6.80% -2.75% -3.3% =0.75% MRP5- MRP3 = 0.75%-0.40% = 0.35%