Solution to Homework Problem for Chapter 6

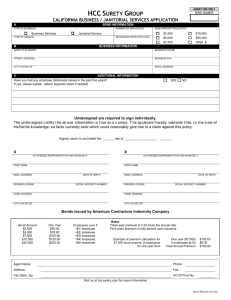

advertisement

Page 1 SOLUTION TO HOMEWORK PROBLEMS FOR CHAPTER 6 1. Given the following information that the real, risk-free rate of return is 2% and annual inflation expected next year is 3%, what should be the interest rate on a 1-year U.S. T-Bill? U.S. T-Bill DRP=0, LP=0 , MRP= 0 rRF = 2+3=5% 2. a. Average annual inflation premium (IP) for 1 year = 4% b. Average annual inflation premium (IP) for 2 years = (4+4.25)/2=4.125% c. Average annual inflation premium (IP) for 3 year = [4+(2*4.25)]/3=4.1667% d. Average annual inflation premium (IP) for 4 years =[4+(3*4.25)]/4=4.1875% e Average annual inflation premium (IP) for 5 years =[4+(4*4.25)]/5=4.2000% f. Average annual inflation premium (IP) for 7 years =[4+(4*4.25)+(2*4.5)]/7=4.2857% g. Average annual inflation premium (IP) for 10 years ==[4+(4*4.25)+(5*4.5)]/10=4.3500% 3. MRP = 0.1 *(t-1)%, where t=# of years to maturity a. 0.1*(1-1)=0% b. 0.1(2-1)=0.1% c. 0.1*(8-1)=0.7% d. 0.1*(15-1)=1.4% e. 0.1*(20-1)=1.9% f. 0.1*(30-1)=2.9% Page 2 4. You are given the following information about interest rates and risk-premiums: The real, risk-free rate of return is 2.5%. The average annual inflation expected over the next 10, 20 and 30 years are, respectively, 3.5%, 4.5% and 5% The Default Risk Premium for AA+ rated corporate bonds is 1.5% The Liquidity Premium for AA+ rated corporate bonds is 1% Maturity Risk Premium is found from MRPt = 0.1 * (t-1)%, where t=# of years to maturity Remember that U.S. Treasury securities have no default or liquidity risk. What should be the interest rate on : a. b. c. d. e. f. DRP =0; LP=0 r=2.5+3.5+0.9= 6.9% 20-year U.S. Treasury bond? DRP =0; LP=0 r=2.5+4.5+1.9=8.9% 30-year U.S. Treasury bond? DRP =0; LP=0 r=2.5+5.0+2.9=10.4% 10-year corporate bond? DRP =1.5%; LP=1% r= 2.5+3.5+1.5+1+0.9=9.4% 20-year corporate bond? DRP =1.5%; LP=1% r= 2.5+4.5+1.5+1+1.9=11.4% 30-year corporate bond? DRP =1.5%; LP=1% r= 2.5+5.0+1.5+1+2.9=12.9% 10-year U.S. Treasury bond?