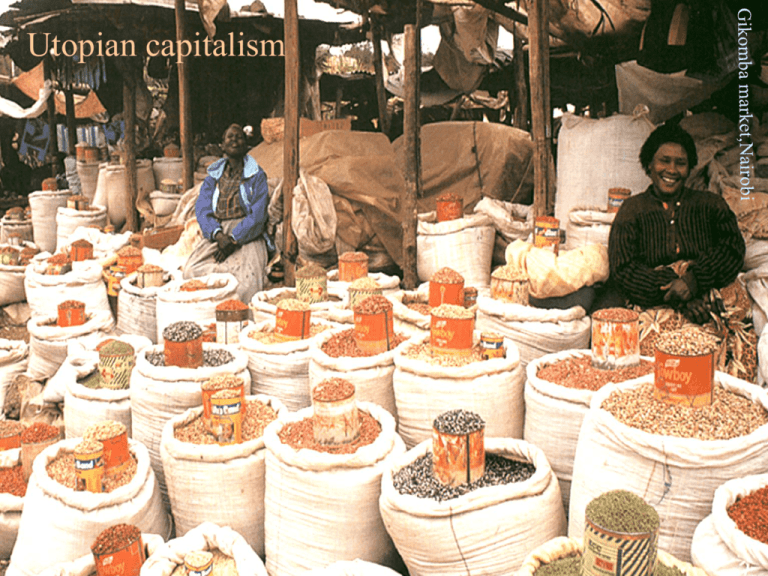

Utopian capitalism

advertisement

Utopian capitalism Inst. of the cap econ (8 lecs) • • • • • • • • Utopian capitalism: two thms (6) Exchange: contracts & power (7) Wages & work (8) Wages & work (continued, with applications) Credit markets and wealth constraints (9) Wealth inequality, economic democracy and asset based redistribution Class and power in competitive equilibrium (10) Mystery lecture (no readings) Evolutionary dynamics (5 lecs) • Institutional innovation (agent based models) (chapter11, excluding 372-81) • Collective action & institutional innovation (12) • The co-evolution of preferences and social structure (13) • Mystery lecture (no readings) • Presentations Research papers to be presented • Brown, Martin, Armin Falk, and Ernst Fehr. 2004. "Relational Contracts and the Nature of Market Interactions." Econometrica. • Krueger, A. & Mas, A. Strikes, Scabs, and Tread Separation: Labor Strife and the Production of Defective Bridgestone/Firestone Tires. Journal of Political Economy 112, 253-289 (2004). • Heckman, James and Y. Rubinstein. 2001. "The importance of noncognitive skills:lessons from the GED testing progam." American Economic Review • Gross, David and Nicholas Souleles. 2002. "Do Liquidity Constraints and Interest Rates Matter for Consumer Behavior? Evidence From Credit Card Data." Quarterly Journal of Economics, 117:1, pp. 149-85 • Banerjee, Abhijit and Esther Duflo. 2002. "Do firms want to borrow more? Testing credit constraints using a directed lending program." MIT. • Banerjee, A ,.M Gertler, and M Ghatak. 2002. "Empowerment and Efficiency: Tenancy Reform in West Bengal." Journal of Political Economy, pp. 239-80. • Craig, Ben and John Pencavel. 1992. "The Behavior of Worker Cooperatives: The Plywood Companies of the Pacific Northwest." American Economic Review, 82:5, pp. 1083-105. • Axtell, Robert L., Joshua M. Epstein, and H. Peyton Young. 2001. "The Emergence of Classes in a Multi Agent Bargaining Model," in Social Dynamics. Steven Durlauf and H. Peyton Young eds. pp. 191-211. A surprising claim: P-efficiency as an emergent property of decentralized interactions among self-interested agents • The problem: allocate two goods to two individuals x + X = 1 y + Y = 1 u = u(x, y) U = U(X, Y) • The allocation must be P-efficient so let lower maximize u = u(x,y) subject to U(1-x,1-y) $ U • ..giving the familiar foc ux/uy = Ux/Uy • NB: lower (or a planner) needs to know upper’s U function (but upper has no motive to reveal this truthfully). • The FT shows that under appropriate conditions maximizing u and U s.t. their budget constraints achieves the same result: ux/uy = px/py = Ux/Uy • Key idea: knowledge of prices is sufficient (Hayek, 1945) • Arrow & Hahn: ‘it is important to know not only whether it is true but whether it could be true’ FT • What is FT.1? • If M, then every CE is P-efficient • What is FT.2? • Im M and C then any P-efficient allocation can be supported as a competitive equilibrium for some assignment of initial endowments Ft.2: if M and C, then any feasible Pefficient allocation is supportable as a CE for some initial endowment Why does it matter that it is true? • Arrow: ‘Any complaints about [the market system’s] operation can be reduced to complaints about the distribution of income ...[but] the price system itself determines the distribution of income only in the sense of preserving the status quo.’ • Roemer: “If the exploitation of the worker seems unfair, it is because one thinks the initial distribution of capital stock, which gives rise to it is unfair” • U.S.Supreme Court “it is impossible to uphold the freedom of contract and the right of private property without … recognizing as legitimate the.. inequalities of fortune that are the necessary result of the exercise of those rights.” • Sen: FT.2 ‘belongs to the revolutionists’ handbook.’ Limitations of the FT? • The Walrasian exchange process is not decentralized: the auctioneer’s prohibition of out-of-equilibrium trading at heterogeneous prices is an essential fiction. • Because the excess demand functions are essentially unrestricted it cannot be shown that from an arbitrary initial endowment the economy converges to some equilibrium (no quasi global stability) • Because (barring implausible conditions) the equilibrium is not unique, knowledge of preferences, endowments and technologies is insufficient to determine outcomes. • Market completeness is empirically false and logically impossible, and even small violations of M dramatically limit the applicability of the FT to policy (2nd best thm) Coase to the rescue! • Coase ‘Theorem’? • Coase replaced the Walrasian auctioneer with a simple hill climbing algorithm: exhaust all mutually beneficial bargains. • Coase: “What I showed… was that in a regime of zero transactions costs… negotiations between the parties would lead to those arrangements being made which would maximize wealth, and this irrespective of the initial assignment of rights.” The problem: Deadheads (Bs) vs nerds (As) 2$ (b-x) 2" (x-a) y+ y- a x* x+ b • The ‘initial assignment of rights’ takes the form of a curfew. • Preferences: u = y - "(a-x)2 v = -y -$(b-x)2 and "+$=1 • A planner: max W = u+v giving the foc 2"(x-a) = 2$(bx) Explain the foc, please. • And the associated optimal curfew: x* = "a + $b • Can private (Coaean) bargaining do as well? • B pays A an amount y to secure A’s agreement to a later curfew or receives y from A in return for an earlier curfew How it works: suppose the initial assignment of the right is to B, then A may pay B an amount y to secure B’s agreement to a earlier curfew. • Slope of A’s indifference loci: ux/uy = 2"(xa) Slope of B’s indifference loci = 2$(b-x) Coasean bargaining • From the initial curfew, b, A and B can bargain to any point along z’rt on the efficient contract locus, which is identical to the bargaining frontier (lower figure) • The resulting y depends on the institutional details of the bargaining framework, but x = x* Limitations of the Coase theorem? • With conventional preferences (e.g. diminishing MU of Y) or wealth constraints P-efficiency but not social efficiency is achieved. • The fact that bargaining costs are never zero is not a limitation of the ‘theorem’ but it does restrict the range of application of many interpretations of it. Too good to be true? Let preferences be concave in income.. • u = u(y + y)- "(a-x)2 v = v(Y - y) -$(b-x)2 • Ecl is now given by 2"(x-a)/u' = 2$(b-x)/v‘ P-efficiency but not s-efficiency • With more general utility fncts the resulting bargain (y,x) is P-efficient but not socially efficient. • Basic insight: initial assignments of property rights will preclude social efficiency if the social optimum is not in the bargaining set (because the outcome of private bargaining must be mutually beneficial) If A’s wealth is limited to y ~ Payment from B to A ecl u+ u a u* x* v* b q z y~ s v r y u t u • The bargaining set is then truncated to bqs and the result of the bargain is Pefficient, but not socially efficient. z uz r q uq u b v s t vs vt v Interpretation • Buchanan and Tullock: ‘If the costs of organizing decisions should be zero, all externalities would be eliminated by voluntary private behavior regardless of the initial structure of property rights. There would, in this case, be no rational basis for state or collective action beyond the initial minimum delineation of the power of individual disposition over resources.’ • Harold Demsetz: ‘it might be thought that a firm which uses slave labor will not recognize all the costs of its activities, since it can have its slave labor by paying subsistence wages only. This will not be true if negotiations are permitted, for the slaves can offer to the firm a payment for their freedom based on the expected return to them of being free men. The cost of slavery can thus be internalized in the calculations of the firm. The transition from serf to free man in feudal Europe is an example of this process.’ Coase’s contribution • A considerable generalization of FT.1 making clear what is required (efficient bargaining, not M and the auctioneer) • Policy implication: remove impediments to efficient bargaining. • Normative implication: distinguish between efficiency and distributive justice as objectives in addressing market failures. (Why should the polluter pay?) Caveats: wealth matters • The hill climbing models do not address the fourth criticism of the FT, namely the unreality of M and hence the problem of market failure. • Where M fails (in credit markets, labor markets, etc) the distribution of endowments and initial assignment of property titles matters for efficiency (more later on this) Caveats: Coase Thm fails where it is most needed • Where for reasons of asymmetric or non verifiable information M fails (and hence the FT also fails) efficient bargaining is also unlikely (Chapter 5). • So the Coase Theorem is likely to be inapplicable exactly where it is needed. Caveats and conclusions • • • • Efficiency without the auctioneer? Markets matter The law of the single price and stochastic exchange Microeconomics without methodological individualism? (Price theory without utility functions?) • The details of market institutions matter • Decentralized allocations that do not rely on markets? Are efficient decentralized allocations utopian? • Models from statistical physics (and related hill climbing algorithms, e.g. Foley, Smale) represent truly decentralized market-like interactions • Foley: ‘agents enter the market knowing only the transactions they view as improving their condition given their endowments, preferences, technology, and expectations; encounter other agents; and make mutually advantageous transactions in a … random fashion.’ • For Coasean reasons, if M, the hill climbing models get to the efficient contract locus (or approximately so) thus vindicating the main normative thrust of FT.1, and supplying the dynamics missing from the Walrasian models. Caveats: markets matter Foley: ‘Walrasian theory seeks to predict the market outcome for every individual, while the statistical approach seeks only to characterize the equilibrium distributions of agents over outcomes, without predicting the fate of specific agents.’ • Because (due to out of equilibrium trading) the stationary allocation is not on a price plane passing through the endowment point, it is not true in these models that ‘the price system itself determines the distribution of income only in the sense of preserving the status quo.’ (Arrow). • Identically endowed agents end up with very unequal outcomes. Single price and stochastic exchange models: class and noise • Two classes (1 worker of which h is employed, and n ownerrs) with Cumulative income % incomes, 0, w and r B’ • Single price assumptions for w and r give the line segments in the Lorenz curve for income. z • Statistical and single price A inequality; the Gini coefficient, ( B C ( = (A+ B+B’)'(A+ B+B’+C) (1-h)/(1+n) 1/(1+ n) 1.0 0 where A'(A+ B+B’+C) and Cumulative income earners % (B+B’)'(A+ B+B’+C) are the ‘single-price’ and ‘statistical’ contributions to the realized gini, respectively. Microeconomics without methodological individualism. • The non Walrasian models of general competitive exchange (note: not ‘equilibrium’) challenge methodological individualism and especially the idea that stationarity of an aggregate property (e.g. a price vector) must be built up from the stationarity of the individual agents. • Gustav Cassel: take well behaved market supply and demand functions as the primatives of economic theory rather than seeking to derive them from individual optimization. • A fish story Market demand and the individual demand function • Source: Galliati, Giulioni, and Kirman. See also Weisbuch, Kirman, and Herreiner. 2000. "Market Organization and Trading Relationships." Economic Journal, 110:463, pp. 411 - 36. Data supplied by authors. 12 quantity 10 8 6 4 2 0 0 2 4 6 8 10 12 400 500 600 price 16 daily average price • The top figure shows the transactions of a single buyer in the Ancona fish market, below is the market demand function for the same period. 14 14 12 10 8 6 4 2 0 0 100 200 300 daily quantity (kg) Price theory without utility? • ...it is sufficient for a solution to the problem of prices if we assume that the demand for each of the commodities in question is fixed once the prices of these commodities are given. No further analysis of demand is needed in connection with the problem of prices. .... The psychological processes underlying this fact have, of course a certain interest for the economist, inasmuch as a knowledge of them helps him to estimate the influence of prices on demand. ...Such studies, however, lie outside the realm of economic theory proper. 80 ...The marginal utility theory, which in no way extends our knowledge of actual processes, is in any case superfluous for the theory of prices. 83 • Cassel, Gustav. 1967. The Theory of Social Economy. New York: Augustus M. Kelley [first German edition published 1923]. The details of market institutions matter. •Standard Ultimatum Game •UG with competition on side of the buyers (respondents) •Competition on side of sellers (proposers) •Prices depend strongly on the number of traders •From Fischbacher, Uris, Christina Fong, and Ernst Fehr. 2005. "Fairness, errors, and the power of competition.“ •Why does fairness matter in bargaining but not in markets? Two ‘sellers’ Standard UG Two ‘buyers’ Additional reading • Hayek, Friedrich A. 1945. "The Use of Knowledge in Society." American Economic Review, 35:4, pp. 519-30. • Kirman, Alan. 1989. "The intrinsic limits of modern economic theory: The emperor has no clothes." Economic Journal, 99:395, pp. 126-39. • Foley, Duncan. 1994. "A statistical equilibrium theory of markets." Journal of Ecomonic Theory, 62:2, pp. 321-45. • Axtell, Robert. 2003. "The complexity of exchange." The Brookings Institution. • Farmer, J. Doyne, Paolo Patelli, and Ilija Zovko. 2004. "The predictive power of zero intelligence in financial markets." Proceedings of the National Academy of Science. Next time • Read chapter 7. • Review discussion questions for ch 7. • Who wants to present Brown, Martin, Armin Falk, and Ernst Fehr. 2004. "Relational Contracts and the Nature of Market Interactions." Econometrica

![Labor Management Relations [Opens in New Window]](http://s3.studylib.net/store/data/006750373_1-d299a6861c58d67d0e98709a44e4f857-300x300.png)