Working Capital Management

advertisement

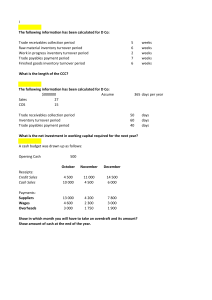

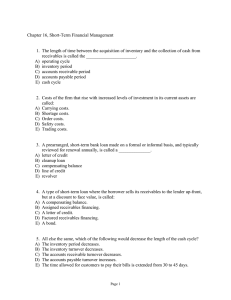

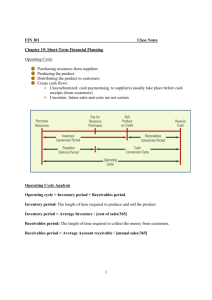

Working Capital Management Cash Management by Imran Khan What is cash conversion cycle? Cash conversion cycle as discussed in the previous lecture emphasize on the length of time between when the firm makes payments and when it receives cash as inflows. Items involved in the Cash Conversion cycle Inventory conversion period: It refers to the average time needed to convert materials into finished goods and then sell these goods out. Inventory conversion period (days)= Inventory/ sales per day How a firm can shorten its Cash Conversion cycle? The cash conversion cycle can be shortened by: • Reducing the inventory conversion period (by processing and selling goods faster). • Reducing the receivables collection period by speeding-up collections. • Increasing the payables deferral period by slowing down the firm’s own payments. Receivables collection period It refers to the average length of time required to convert a company’s receivables into cash or in other words it is the time required to collect cash following a sale. Also known as Days Sales Outstanding (D.S.O) Receivables collection period= receivables sales/365 Payables deferral period It refers to the average length of time between the purchase of labor and materials and the payment of cash for them. Summing up the above items When the three items from the previous slides are summed up, it results in cash conversion cycle. Hence, Inventory conversion period+ receivables collection period- Payables deferral period= Cash conversion cycle Question Medwig Corporation has a DSO of 17 days. The company averages $3500 in credit sales each day. What is the company’s average accounts receivable? Why do firms hold cash? • Cash Management is one of the key areas of Working Capital management. • Firms hold cash for three of the following reasons: Transactions motive: To meet payments including purchases, salaries and taxes arising in the business. Precautionary motive: For safety purpose where cash acts as a cushion to meet unexpected cash needs. Examples of precautionary motive: • Floods, strikes and failure of important customers; • Unexpected slow down in collection of accounts receivable; • Cancellation of some order for goods as the customer is not satisfied • Sharp increase in cost of raw materials. Why do firms hold cash? • Speculative motive: To take advantage of temporary opportunities typically outside the normal course of business such as sudden fall in the price of a raw material. Cash Management • Cash management involves efficient allocation, disbursement and temporary investment of cash. • A cash budget as part of this process tells us how much cash we are likely to have, when we are likely to have it and for how long. Cash Management strategy Objective: Earn reasonable return while taking on very limited credit and liquidity risk. Company should write investment policy statement to manage cash effectively • Describe purpose, authorities, limitations, etc. Passive strategy: Follow pre-defined rules Active strategies: • Match timing of cash inflow and outflow • Other active strategies: Mismatching and laddering (these can be risky) Example A firm which purchases raw materials on credit is required by the credit terms to make payments within 30 days. On its side, the firm allows its credit buyers to pay within 60 days. Its experience has been that it takes, on an average, 35 days to pay its accounts payable and 70 days to collect its accounts receivable. Moreover, 85 days elapse between the purchase of Raw materials and the sale of finished goods, that is to say, the average age of inventory is 85 days. What is the firm’s cash cycle?