Financial Management - RN Patel Ipcowala School of Law & Justice

advertisement

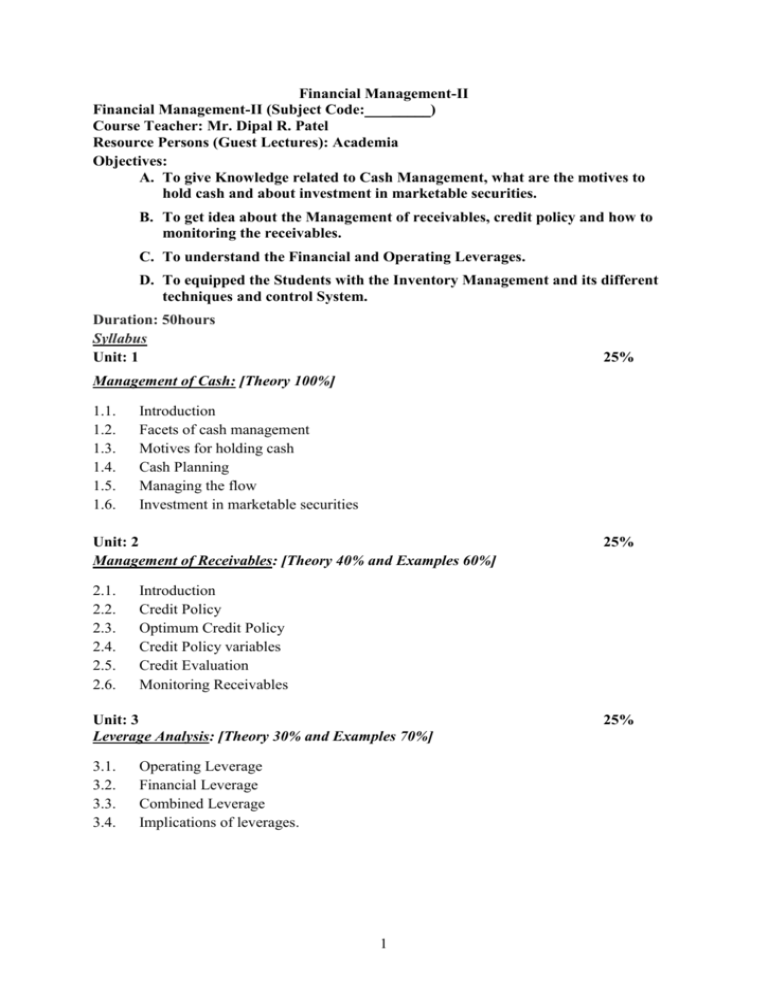

Financial Management-II Financial Management-II (Subject Code: _____) Course Teacher: Mr. Dipal R. Patel Resource Persons (Guest Lectures): Academia Objectives: A. To give Knowledge related to Cash Management, what are the motives to hold cash and about investment in marketable securities. B. To get idea about the Management of receivables, credit policy and how to monitoring the receivables. C. To understand the Financial and Operating Leverages. D. To equipped the Students with the Inventory Management and its different techniques and control System. Duration: 50hours Syllabus Unit: 1 25% Management of Cash: [Theory 100%] 1.1. 1.2. 1.3. 1.4. 1.5. 1.6. Introduction Facets of cash management Motives for holding cash Cash Planning Managing the flow Investment in marketable securities Unit: 2 Management of Receivables: [Theory 40% and Examples 60%] 2.1. 2.2. 2.3. 2.4. 2.5. 2.6. Introduction Credit Policy Optimum Credit Policy Credit Policy variables Credit Evaluation Monitoring Receivables Unit: 3 Leverage Analysis: [Theory 30% and Examples 70%] 3.1. 3.2. 3.3. 3.4. 25% Operating Leverage Financial Leverage Combined Leverage Implications of leverages. 1 25% Unit: 4 Inventory Management: [Theory 30% and Examples 70%] 4.1. 4.2. 4.3. 4.4. 4.5. Introduction Nature of Inventories Need to hold inventories Objectives of inventory management Inventory management techniques i Economic Order Quantity(EOQ) 4.6. Inventory Control Systems i ABC Inventory Control System ii Just-in-time (JIT) Systems Evaluation: Internal 50 Marks (Theory) --TWO Hour Examination External 50 marks (Theory) –TWO Hour Examination Reference Books 1. 2. 3. 4. 5. Financial Management : I. M. Pandey Financial Management : Prasanna Chandra Financial Management : Khan & Jain Financial Management : P.V.Kulkarni Financial Management : S. N. Maheshwari 2 25%