responseaccountsreceivable

advertisement

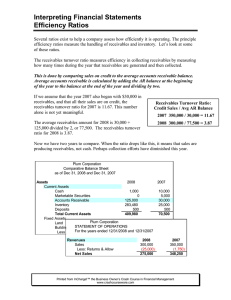

Comparative calendar-year financial data for a company are shown below: Calculate: (1) Accounts receivable turnover for 2008. = Sales/Average receivable =720000/((157500+162500)/2) =4.5 times (2) Days' sales uncollected for 2008. =365/ Accounts receivable turnover =365/4.5 =81 days (3) Inventory turnover for 2008. = COGS/Average inventory =450000/((139500+110500)/2) =3.6 times (4) Days' sales in inventory for 2008. =365/ Inventory turnover =365/3.6 =101 days 1 Jimmy Jack, Inc. is considering relaxing its credit standards in order to meet a competitor's change in credit policy. As a result of the proposed change, sales during the coming year are expected to increase 15%, from 5,000 cars to 5,750 cars, the average collection period is expected to increase from 35 days to 45 days, and bad debts are expected to increase from 2% to 3%. The average sale price per unit is $1,000 and the variable cost per unit is $850. The firm's required return on investment is 10%. Evaluate the proposed change in credit standards and make a recommendation to the business. Show all work. We have to do the cost benefit analysis: Cost of the Investment in receivables= Increase in Interest cost + Increase in Bad debts Increase in interest cost= Interest rate*((New investments in Receivables)- Old Investments in receivables) =10%*(((5750*1000*45)/365)-((5000*1000*35)/365))) =$22945 Increase in Bad Debts =5750*1000*3%-5000*1000*2% =72500 Cost = 22945+72500 =$95445 Benefit= Increase in Profits =New Sales* Contribution Margin – Old Sales* Contribution Margin 2 =5750*(1000-850)-5000*(1000-850) =$112500 Savings= Benefit-Cost =112500-95445 =$17055 = Answer Hence it should accept the policy as the Savings are in positive. 3