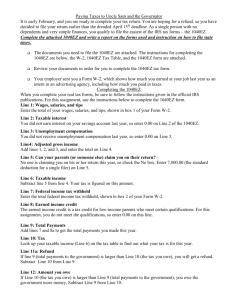

Mr. Burns-Personal Finance 14.2 Preparing an Income tax Return SWBT- describe the types of federal income tax forms 1- What does the W2 list? 477 It reports your total wages for the year and the amount of federal, state, and other taxes withheld from your paycheck. 2- If you are single and less than 65 years old, how much money can you make and not be required to file income tax in the book? (477) Less than $8,850 3-What are the five filing status categories? (477-478) Single Married, filing a joint return, Married, filing separate returns, Head of household, Qualifying widow or widower 4-If you cannot file your taxes by April 15th, what should you do? (478) you can file Form 4868 5-How much extra time does filling an extension give you to complete your taxes? (478) 4 month 6-What happens if you do not file a required tax return? (478) 7-What is the simplest tax form? (478) Form 1040EZ 8-Too be able to file a 1040EZ, what are the 6 requirements? (478) 9- What are the 7 requirements to be able to file the 1040A? 10-Look at the 1099-INt form on page 482. How much interest income did James Irving make last year? 45.00 11-Looking at the 1040EZ on page 484-485 what are the total Wages and salaries for James Irving? 10,250 12- Looking at the 1040EZ on page 484-485 what is the total refund they are getting? 832 13- Looking at the 1040EZ on page 484-485 what is the taxable income? 5,445 14- Looking at the 1040EZ on page 484-485 what is tax that you owe? 543 15- Looking at the 1040EZ on page 484-485 how much money was withheld from their pay? 4,850 16. What are the 7 states that do not have a state income tax? (487) Alaska Florida Nevada South Dakota Texas Washington Wyoming 17- What is a tax audit? (491) a detailed examination of your tax return by the IRS. T 18-Why does the IRS do audits? (491) to determine whether taxpayers are paying all of their required taxes. 19- Name one way that you can reduce your tax liability. (493) FOR QUESTION 8 FOR QUESTION 9 Your taxable income is less than $100,000. You are single or Your taxable income is less than $100,000. You are single or married married (filing a joint tax return). You are under age 65. You claim (filing a joint tax return). You are under age 65. You claim no no dependents. Your income consisted of only wages, salaries, dependents. Your income consisted of only wages, salaries, and tips, and tips, and no more than $1,500 of taxable interest. You will not and no more than $1,500 of taxable interest. You will not itemize itemize deductions, claim any adjustments to income, or claim deductions, claim any adjustments to income, or claim any tax credits. any tax credits.