Unit 4 Powerpoint-

advertisement

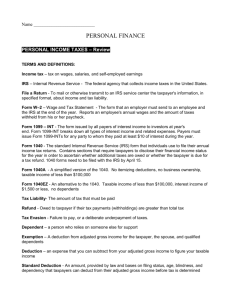

Chapter 7 Federal Income Tax "In this world nothing is certain but death and taxes.“ - Benjamin Franklin Lesson 7.1 Our Tax System GOALS Discuss the purpose of taxes, different types of taxes, and the history of taxes in the United States. Describe components of the tax system, including the IRS, the power to tax, and paying your fair share. Types of Taxes Revenue Taxes (money) collected from citizens and businesses Largest source is income taxes Other sources include social security, unemployment insurance, inheritance, estate and property taxes, and import duties. Types of Taxes “Ability-to-Pay Principle” Theory that people with higher incomes should pay more, lower incomes pay less Progressive taxes Federal income taxes More you make, the higher percentage of income you pay in taxes Types of Taxes Regressive taxes Sales tax Fixed percentage, so the smaller your income the greater percentage of your income it taxes to pay Types of Taxes Example of Regressive Tax Low income ($10,000 per year) Buy stereo for $2000 Pay $2000(.06) = $120 in sales tax $120/$10,000 = .012 or 1.2% of income High income ($80,000 per year) Still pay $120 in sales tax for stereo $120/$80,000 = .0015 or 0.15% of income Types of Taxes Proportional taxes Also called “flat taxes” Tax rate stays the same regardless of the amount Property taxes are a good example Percentage is the same if home is $150,000 or $1.5 million Components of the Tax System The IRS Internal Revenue Service Headquarters in Washington, DC 7 regional offices Established to collect taxes and enforce tax laws www.irs.gov Components of the Tax System The power to tax Congress has power to levy Proposals to increase may come from President, Dept. of Treasury or Congressmen Components of the Tax System Paying your fair share Tax brackets Tax ranges that increase as income increases Taxes increase when government needs more money to balance budget All citizens are expected to prepare and file tax returns (voluntary compliance) Components of the Tax System Tax evasion “Willful failure to pay taxes” Audit IRS examines your tax returns Up to 7 years prior History of Taxes Revolutionary War No direct income tax Constitution stated “option to tax” but not individuals directly Paid for by contributions from France War of 1812 had a temporary income tax Government didn’t collect taxes, but didn’t provide services either History of Taxes Civil War 1862 Lincoln instituted a progressive income tax on wages After war, income tax removed 16th Amendment to Constitution 1909 introduced first permanent income tax Ratified by ¾ of states in 1913 History of Taxes World War I Financed by income taxes Social Security Act As a result of the Great Depression, government expanded 1935 as part of FDR’s “New Deal” created the IRS History of Taxes World War II Taxes raised to pay for war Set precedence to pay for growing government Lesson 7.2 Filing Tax Returns GOALS Define and discuss the significance of exemptions, dependents, and taxable and nontaxable income on tax returns. Prepare Forms 1040EZ and 1040A. Filing Status Single person Married person filing a joint return Married person filing a separate return “Head of household” Qualifying widow(er) With a dependent child Exemptions Exemptions Amount subtracted from income for each person who “depends” on you to live Don’t pay tax on this amount Personal exemption Exempt yourself and spouse, if filing jointly Dependent exemption Not limited to children Receives more than ½ living expenses from you Gross Income All the income you receive Wages, salaries, and tips Interest income Dividend income Unemployment compensation Social security benefits Alimony Money paid to former spouse Taxable to receiver, deductible to payer Others – lottery winnings, gambling, rental income, etc. Gross Income Child support Money paid by other parent to pay for child’s living expenses Not taxable to person that receives Not deductible for person that pays Adjusted Gross Income Gross income – Adjustments Adjusted gross income Taxable Income Gross income – Adjustments Adjusted gross income – Deductions – Exemptions Taxable income Deductions Itemize If you itemize (list) your deductions, use Form 1040 You’d list your deductions on Schedule A Common deductions Medical/Dental Expenses State/Local Income Taxes Property Taxes Home Mortgage Interest Gifts to Charity Losses from Theft or Property Damage Moving Expenses Deductions Standard Deduction Not many deductions, then best to take standard deduction Subtract set amount from adjusted gross income without having to itemize Individual deductions don’t add up to standard deduction – take standard! Deductions Exemptions Talk about when we complete tax forms Basically, how many people live with you Taxable Income Amount used to determine amount of federal income tax due Preparing to File Who must file? Those listed on P185 in your text Even if your gross income is less than stated amount, file a tax return so you can get a refund! May have to file if… Claimed as dependent on someone else’s return Owe special taxes Earned $400+ from self-employment Earned $100+ from a church organization that doesn’t pay social security taxes Preparing to File When to file? April 15 of the following year If 4/15 falls on a weekend, then following Monday File late – pay penalties Know you are going to be late, file for an extension Short form or long form? 400+ tax forms and schedules 1040EZ, 1040A and 1040 are most common Select based on income, deductions and complexity of tax situation Preparing to File Where to begin? Save receipts for itemized deductions all year Save pay stubs and check W-2 when you receive towards end of January Gather all documents Form 1099 DIV Form 1099 INT W-2 from each employer Determine if you will itemize Make sure you save originals or copies of EVERYTHING when you are finished Preparing to File Filing electronically 1040EZ and 1040A may be submitted electronically Owe taxes, pay online with credit card Quicker receipt of refund Make sure you print a copy of your return to save! Form 1040EZ According to book… Use 1040EZ if you have taxable income less than $50,000 NOW LIMIT IS $100,000!! Single or married filing jointly Under age 65 No dependents Interest income of $1500 or less Form 1040EZ EXAMPLE 1 Darby L. Russell, 843 Thorn St., Sewickley, PA 15143. Social Security Number: 155-46-7819 Does not want to contribute to presidential campaign fund Single and claims herself as exemption Earned $24,500 last year as a financial analyst, plus $650 in interest income Taxes withheld were $3,500 Form 1040EZ EXAMPLE 2 Rudder L. Healey, 1402 Bentley Ridge Blvd, Lancaster, PA 17603 Social Security Number: 125-14-4447 Does want to contribute to presidential campaign fund Single and claims himself as exemption Earned $9,500 last year as a waiter, plus $900 in tips – he works part-time while going to college He has interest earnings of $100 Taxes withheld were $479 Form 1040A According to book… Taxable income less than $50,000 NOW LIMIT IS $100,000!! Capital gains distributions, but no other capital gains or losses Form 1040A Only tax credits… Child Tax Education Earned Income Child and Dependent Care Expenses Adoption Expenses Retirement Savings Contributions Form 1040A Only deductions… IRA Contributions Student Loan Interest Educator Expenses Higher Education Tuition and Fees No itemized deductions! Form 1040 Taxable income of $50,000 or more NOW LIMIT IS $100,000!! Itemized deductions Self-employment income Income from sale of property