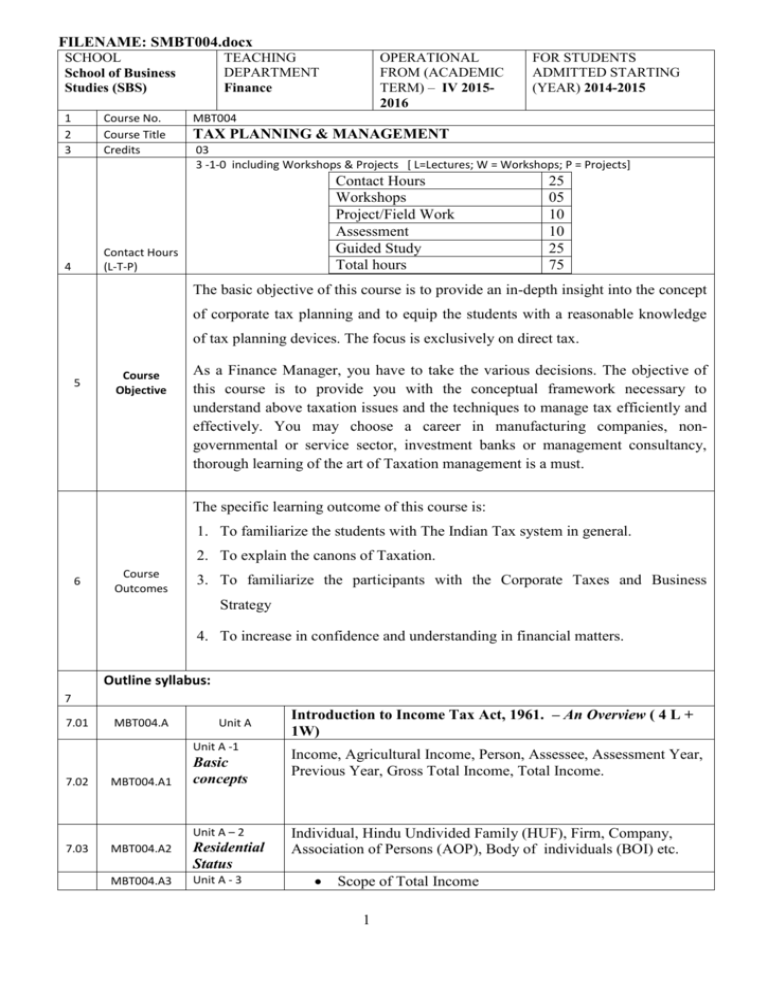

FILENAME: SMBT004x SCHOOL School of Business Studies

advertisement

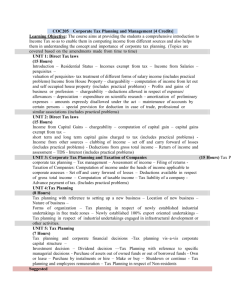

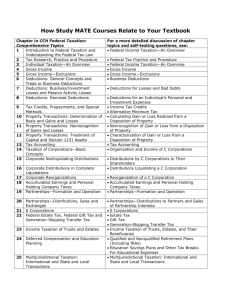

FILENAME: SMBT004.docx SCHOOL School of Business Studies (SBS) 1 2 3 Course No. Course Title Credits TEACHING DEPARTMENT Finance FOR STUDENTS ADMITTED STARTING (YEAR) 2014-2015 MBT004 TAX PLANNING & MANAGEMENT 03 3 -1-0 including Workshops & Projects [ L=Lectures; W = Workshops; P = Projects] Contact Hours Workshops Project/Field Work Assessment Guided Study Total hours Contact Hours (L-T-P) 4 OPERATIONAL FROM (ACADEMIC TERM) – IV 20152016 25 05 10 10 25 75 The basic objective of this course is to provide an in-depth insight into the concept of corporate tax planning and to equip the students with a reasonable knowledge of tax planning devices. The focus is exclusively on direct tax. 5 Course Objective As a Finance Manager, you have to take the various decisions. The objective of this course is to provide you with the conceptual framework necessary to understand above taxation issues and the techniques to manage tax efficiently and effectively. You may choose a career in manufacturing companies, nongovernmental or service sector, investment banks or management consultancy, thorough learning of the art of Taxation management is a must. The specific learning outcome of this course is: 1. To familiarize the students with The Indian Tax system in general. 2. To explain the canons of Taxation. 6 Course Outcomes 3. To familiarize the participants with the Corporate Taxes and Business Strategy 4. To increase in confidence and understanding in financial matters. Outline syllabus: 7 7.01 MBT004.A Unit A Unit A -1 Basic concepts 7.02 MBT004.A1 7.03 MBT004.A2 Residential Status MBT004.A3 Unit A - 3 Unit A – 2 Introduction to Income Tax Act, 1961. – An Overview ( 4 L + 1W) Income, Agricultural Income, Person, Assessee, Assessment Year, Previous Year, Gross Total Income, Total Income. Individual, Hindu Undivided Family (HUF), Firm, Company, Association of Persons (AOP), Body of individuals (BOI) etc. Scope of Total Income 1 Incidence of Tax 7.05 MBT004.B Unit B Unit B - 1 7.06 MBT004.B1 Tax Planning Unit B – 2 7.07 MBT004.B2 Taxation of Companies & Tax planning Unit B – 3 7.08 MBT004.B3 Dividend Tax 7.09 MBT004.C Unit C Unit C – 1 7.10 MBT004.C1 Income under the head of Salary Unit C – 2 7.11 MBT004.C2 Special provisions for tax planning Unit C – 3 7.12 MBT004.C3 7.13 MBT004.D 7.14 MBT004.D1 Total Income and tax computation Unit D Unit D – 1 Tax Planning for new business Exempted Income Agricultural Income & its tax treatment Introduction to Tax Planning (4 L+2W) Meaning, objectives, per-cautions in tax planning, Limitations of tax planning, Tax evasion, Tax avoidance, Tax management Computation of tax liability and tax liability of companies; Minimum Alternative Tax. Dividend tax – When the additional tax should be paid? Basis of charge Employee Remuneration and Tax Planning - (4L+2W) Meaning of Employee Remuneration, Allowances, Perquisites, Deductions etc. Special provisions for tax planning relating to Employee’s remunerations from the point of view of Employer and Employee. Computation of Taxable Salaries, and tax liability on employee remuneration. Tax Planning and Managerial Decisions (5L+3W) Tax Planning for new business with reference to location, nature and form of organization of new business Unit D – 2 7.15 MBT004.D2 7.16 MBT004.D3 7.17 MBT004.E Tax Planning relating to capital structure decision, dividend policy Tax and bonus shares Planning relating to Financial Management Unit D – 3 Tax Planning in respect of own or lease, Make or Buy decisions, Tax Repair, Replace, Renewal or Renovation and Shut-down or Planning Continue Decisions &Tax issues relating to Amalgamation relating to various corporate decisions. Unit E Tax Management – (3L+2W) 2 Payments covered by TDS Schemes When and how tax is to be deducted at source from various incomes; Tax collection at source – who is responsible to collect tax at source. Tax compliance about the tax deductions and collection at source. Liability to advance tax – when to arise; Advance payment of tax Due dates of payment of advance tax; Tax compliance about the advance payment of tax. Unit E – 3 Time for filing return of income When return of loss should be filied? Types of Return Unit E – 1 7.18 MBT004.E1 Tax Deductions and Collection at Source Unit E – 2 7.19 7.20 MBT004.E2 MBT004.E3 Filing of Return & Assessments 8 8.1 8.11 8.12 8.13 8.14 8.15 8.16 8.2 8.3 Course Evaluation Course work: 30 % Attendance No Homework 10 % : 05 Assignments following by viva. Quizzes 5 % : One quiz Projects 10 % : One group projects on analytical of financial information on the assigned companies – 10 % Presentations 5% : Individual Any other (give details and weight) MTE 20 % - one mid-term examination End-term examination: 50 % closed book examination 9 References Dr.Vinod Singhania & Dr Monica Singhania - Direct Taxes Planning & 9.1 9.2 Text book Other references Management by Taxman Publications Pvt., Ltd., Latest publication - Dr.Vinod Singhania & Monica Singhania - Direct Taxes by Taxman Publications Pvt., Ltd., Latest publication - Ahuja Girish, Dr. Gupta Ravi, Simplified Approach to Corporate tax, Planning and Management, Bharat Law House Pvt. Ltd., New Delhi - Dr. H.C. Mehrotra and Dr. S.P.Goyal - Corporate Tax Planning and Management; Sahitya Bhawan Publications, Agra Newspaper, Magazines and Journals The Tax Law Weekly Chartered Accountants Today Economic Times, Business Line, Business Standard. Journal of Finance. Business India, Business Today. 3 Management Accountant. Chartered Accountant. Chartered Finance Analyst. Journal of Accounting and Finance Mapping of Outcomes vs. Topics Outcome no. → Syllabus topic↓ 1 2 3 MBT004.A MBT004.A1 MBT004.A2 MBT004.A3 MBT004.B √ √ √ MBT004.B1 √ √ MBT004.B2 √ √ MBT004.B3 MBT004.C √ √ 4 MBT004.C1 √ √ MBT004.C2 √ √ MBT004.C3 MBT004.D √ √ MBT004.D1 √ MBT004.D2 √ MBT004.D3 MBT004.E √ MBT004.E1 √ √ MBT004.E2 √ √ MBT004.E3 √ √ Facilitator – Dr. (CMA, CS) P. K. Aggarwal Head of Finance Ext.No. – 9143 Maid Id. – pradeep.aggarwal@sharda.ac.in drpkafin@gmail.com 4