Corporate Finance

advertisement

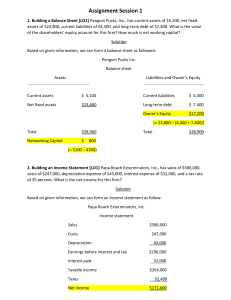

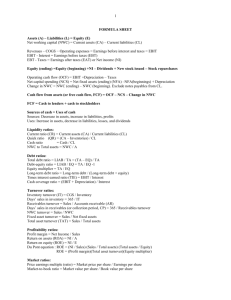

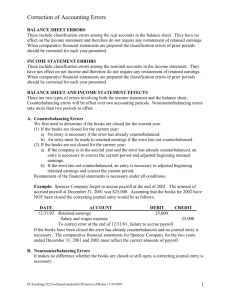

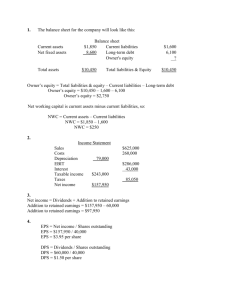

Corporate Finance Lecture Two – Financial Statements Learning Objectives 1. Explain the foundations of the balance sheet and income statement 2. Use the cash flow identity to explain cash flow. 3. Provide some context for financial reporting. 4. Recognize and view Internet sites that provide financial information. 2.1 Financial Statements • Four main financial statements: – – – – Balance sheet Income Statement Statement of Retained Earnings Statement of Cash Flow • Our focus.. – Interrelationship between the balance sheet and the income statement – – The process by which these statements can be used to project a firm’s future cash flows, 2.1 Financial Statements (continued) (A) Balance Sheet • Represents the assets owned by the company and the claims against those assets • Based on the accounting identity: Assets Liabilities + Owners’ Equity (2.1) Figure 2.1 Balance sheet 2.1 (A) Balance Sheet Has 5 main sections: 1. Cash account • Where did the $65 million decline come from? 2. Working capital accounts • Net working capital = Current assets – Current liabilities (2.2) 3. Long-term asset accounts • Plant and equipment; land and buildings • Gross value – accumulated depreciation = Net value 4. Long-term liabilities (debt) accounts • Loans maturing in over 1 year 5. Ownership accounts • Shareholders’ equity • Retained earnings—accumulated total since inception 2.1 (B) The Income Statement • Shows the expenses and revenues generated by a firm over a past period, typically a quarter or a year. • Net income = Revenues – expenses (2.3) • EBIT = Revenues – operating expenses (2.4) 2.1 (B) Income Statement example Figure 2.2 2.1 (B) The Income Statement (continued) • Net income is not the same as cash flow • Firm earned an income of $5,642 million • Cash account decreased by 65 million • 3 reasons: • Accrual accounting • Non-cash expense items --depreciation • Preference to classify interest expense as part of financial cash flow 2.1 (C) The Statement of Retained Earnings Figure 2.4 2.2 Cash Flow Identity and the Statement of Cash Flows The cash flow identity states that the cash flow on the left-hand side of the balance sheet is equal to the cash flow on the right-hand side of the balance sheet. CASH FLOW CASH FLOW FROM ASSETS = TO CREDITORS CASH FLOW + TO OWNERS Figure 2.5 Cash Flow Identity and components 2.2 (A) The First Component: Cash Flow From Assets 3 components: • Operating cash flow (OCF) • Net capital spending (NCS) • Change in net working capital (∆NWC) • Cash flow from assets = OCF – NCS - ∆NWC OCF = EBIT + Depreciation – Taxes NCS = End. Net – Beg. Net + Depreciation Fixed Assets Fixed Assets ∆NWC=Ending NWC – Beginning NWC 2.2 (A) The First Component: Cash Flow From Assets (continued) OCF = EBIT + Depreciation – Taxes Figure 2.3 2.2 (A) The First Component: Cash Flow From Assets (continued) NCS = End. Net – Fixed Assets Beg. Net + Fixed Assets Depreciation NCS= ($11,961 - $10,788) + $1,406 = $2,579 2.2 (A) The First Component: Cash Flow From Assets (continued) ∆NWC=Ending NWC – Beginning NWC Net working capital for 2007 = $9,130 - $6,860 = $2,270 Net working capital for 2006 = $10,454 - $9,406 = $1,048 Change in NWC = $2,270 - $1,048 = $1,222 2.2 (A) The First Component: Cash Flow From Assets (continued) • Putting it all together…. • Cash flow from Assets = OCF – NCS - ∆ NWC =$7,287-$2,579-$1,222 =$3,486 2.2 (B) The Second Component: Cash Flow To Creditors Cash Flow to Creditors = Interest Expense Net New Borrowing from Creditors Net New Borrowing = Ending Long-term Liabilities Beginning Long-Term Liabilities Cash Flow to Creditors = $239 (-$378) $617 2.2 (C) The Third Component: Cash Flow To Owners Cash flow to owners = Dividends - Net new borrowing owners = $2,869 = $2,869 - $0 from 2.2 (C) Putting It All Together: The Cash Flow Identity Cash flow from assets = cash flow from creditors + cash flow to owners $3,486 = $617 + $2,869 2.3 Financial Performance Reporting • Annual reports to shareholders • Quarterly (10-Q) and annual (10-K) reports filed with the SEC – Regulation Fair Disclosure (Reg. FD) – Notes to the Financial Statements 2.4 Financial Statements on the Internet • EDGAR (www.sec.gov/edgar.shtml) • Yahoo! Finance (http://finance.yahoo.com.) • Many, many more websites with wealth of information Additional Problems with Answers Problem 1 Balance Sheet. Chuck Enterprises has current assets of $300,000, and total assets of $750,000. It also has current liabilities of $125,000, common equity of $250,000, and retained earnings of $85,000. How much longterm debt and fixed assets does the firm have? Additional Problems with Answers Problem 1 (Answer) Current Assets + Fixed Assets = Total Assets $300,000+Fixed Assets = $750,000 Fixed Assets = $750,000 - $300,000 = $400,000 Total Assets = Current Liabilities + Long-term debt +Common equity + Retained Earnings $750,000 = $125,000 + Long-term debt + $250,000 + 85,000 Long-term debt = $750,000 - $125,000-$250,000 $85,000 Long-term debt = $290,000 Additional Problems with Answers Problem 2 Income Statement. The Top Class Company had revenues of $925,000in 2009. Its operating expenses (excluding depreciation) amounted to $325,000, depreciation charges were $125,000, and interest costs totaled $55,000. If the firm pays a marginal tax rate of 34 percent, calculate its net income after taxes. Additional Problems with Answers Problem 2 (Answer) Revenues Less operating expenses = EBITDA Less depreciation = EBIT Less interest expenses = Taxable Income Less taxes (34%) = Net Income after taxes $925,000 325,000 600,000 125,000 475,000 55,000 420,000 142,800 277,200 Additional Problems with Answers Problem 3 Retained Earnings: The West Hanover Clay Co. had, at the beginning of the fiscal year, November 1, 2009, retained earnings of $425,000. During the year ended October 31, 2010, the company generated net income after taxes of $820,000 and paid out 35 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained earnings. Additional Problems with Answers Problem 3 (Answer) Statement of Retained Earnings for the year ended October 31, 2010 Balance of Retained Earnings, 11/1/2009……….$425,000 Add: Net income after taxes, 10/31/2010………. $820,000 Less: Dividends paid for year-end 10/31/2010…$287,000 Balance of Retained Earnings, 10/31/2010….. $958,000 Additional Problems with Answers Problem 4 Working Capital: D.K. Imports, Incorporated reported the following information at its last annual meeting: Cash and cash equivalents = $1,225,000; Accounts payables = $3,200,000 Inventory = $625,000; Accounts receivables = $3,500,000; Notes payables = $1,200,000; Other current assets = $125,000. Calculate the company’s net working capital. Additional Problems with Answers Problem 4 (Answer) Net Working Capital = Current Assets – Current Liabilities (Cash & Cash Equivalents + Accts. Rec. + Inventory + other current assets) (Accounts Payables + Notes Payables) ($1,225,000+$3,500,000+$625,000+$125,000) ($3,200,000+$1,200,000) $5,475,000 - $4,400,000 Net Working Capital $1,075,000 Additional Problems with Answers Problem 5 Cash Flow from Operating Activities: The Mid-American Farm Products Corporation provided the following financial information for the quarter ending September 30, 2009: Depreciation and amortization $75,000 Net Income $225,000 Increase in receivables $95,000 Increase in inventory $69,000 Increase in accounts payables $80,000 Decrease in marketable securities $34,000. What is the cash flow from operating activities generated during this quarter by the firm? Additional Problems with Answers Problem 5 (Answer) Net Income 225,000 Add depreciation and amortization 75,000 Add decrease in marketable securities 34,000 Add increase in accounts payables 80,000 Less increase in accounts receivables 95,000 Less increase in inventory 69,000 Cash flow from operating activities $250,000