Correction of Accounting Errors

advertisement

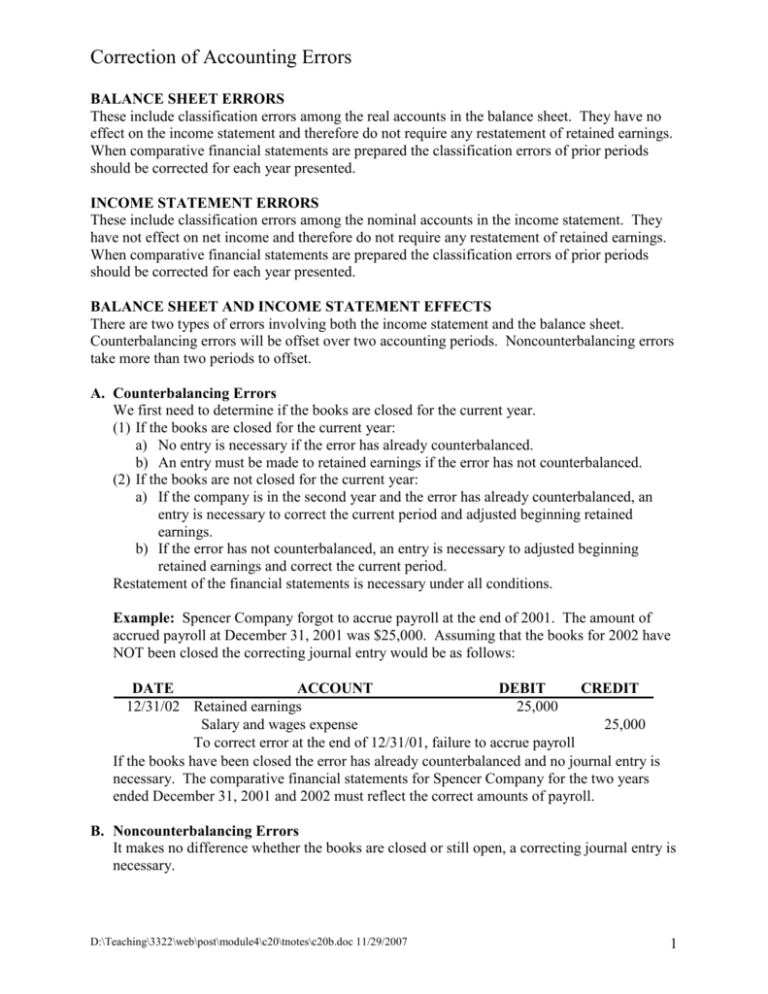

Correction of Accounting Errors BALANCE SHEET ERRORS These include classification errors among the real accounts in the balance sheet. They have no effect on the income statement and therefore do not require any restatement of retained earnings. When comparative financial statements are prepared the classification errors of prior periods should be corrected for each year presented. INCOME STATEMENT ERRORS These include classification errors among the nominal accounts in the income statement. They have not effect on net income and therefore do not require any restatement of retained earnings. When comparative financial statements are prepared the classification errors of prior periods should be corrected for each year presented. BALANCE SHEET AND INCOME STATEMENT EFFECTS There are two types of errors involving both the income statement and the balance sheet. Counterbalancing errors will be offset over two accounting periods. Noncounterbalancing errors take more than two periods to offset. A. Counterbalancing Errors We first need to determine if the books are closed for the current year. (1) If the books are closed for the current year: a) No entry is necessary if the error has already counterbalanced. b) An entry must be made to retained earnings if the error has not counterbalanced. (2) If the books are not closed for the current year: a) If the company is in the second year and the error has already counterbalanced, an entry is necessary to correct the current period and adjusted beginning retained earnings. b) If the error has not counterbalanced, an entry is necessary to adjusted beginning retained earnings and correct the current period. Restatement of the financial statements is necessary under all conditions. Example: Spencer Company forgot to accrue payroll at the end of 2001. The amount of accrued payroll at December 31, 2001 was $25,000. Assuming that the books for 2002 have NOT been closed the correcting journal entry would be as follows: DATE ACCOUNT DEBIT CREDIT 12/31/02 Retained earnings 25,000 Salary and wages expense 25,000 To correct error at the end of 12/31/01, failure to accrue payroll If the books have been closed the error has already counterbalanced and no journal entry is necessary. The comparative financial statements for Spencer Company for the two years ended December 31, 2001 and 2002 must reflect the correct amounts of payroll. B. Noncounterbalancing Errors It makes no difference whether the books are closed or still open, a correcting journal entry is necessary. D:\Teaching\3322\web\post\module4\c20\tnotes\c20b.doc 11/29/2007 1 Correction of Accounting Errors Example: Spencer Company purchased a machine on January 1, 2000 for $100,000. The machine had an estimated salvage value of $10,000 and a service live of 9 years. Spencer Company uses the straight-line method to depreciate all of its assets. The company incorrectly expensed the equipment as an expense in the year of purchase. The error was discovered in 2002. Assuming that the books for 2002 are still open the following journal entry would be required to correct this error. DATE ACCOUNT 12/31/02 Equipment Depreciation expense Retained earnings Accumulated depreciation DEBIT 100,000 10,000 CREDIT 80,000 30,000 To correct for error made in 2000 when the equipment was purchased and expensed Analysis of error: Cost of equipment Salvage value Depreciable base Service life Annual deprecation Years to December 31, 2001 Accumulated deprecation Book value at December 31, 2001 Depreciation expense for 2002 Accumulated deprecation 100,000 10,000 90,000 9 10,000 2 20,000 100,000 20,000 80,000 10,000 30,000 If the 2002 books are closed the following journal entry would be made to correct the error made in 2000. DATE ACCOUNT DEBIT CREDIT 12/31/02 Equipment 100,000 Retained earnings 70,000 Accumulated depreciation 30,000 To correct for error made in 2000 when the equipment was purchased and expensed Again, it is important to note that if comparative financial statements are prepared the correct amounts for equipment, accumulated depreciation and depreciation expense are to be reported for each year presented. D:\Teaching\3322\web\post\module4\c20\tnotes\c20b.doc 11/29/2007 2