Chapter 1 – rough notes and thoughts - McGraw-Hill

advertisement

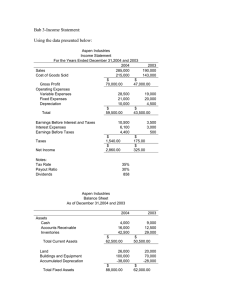

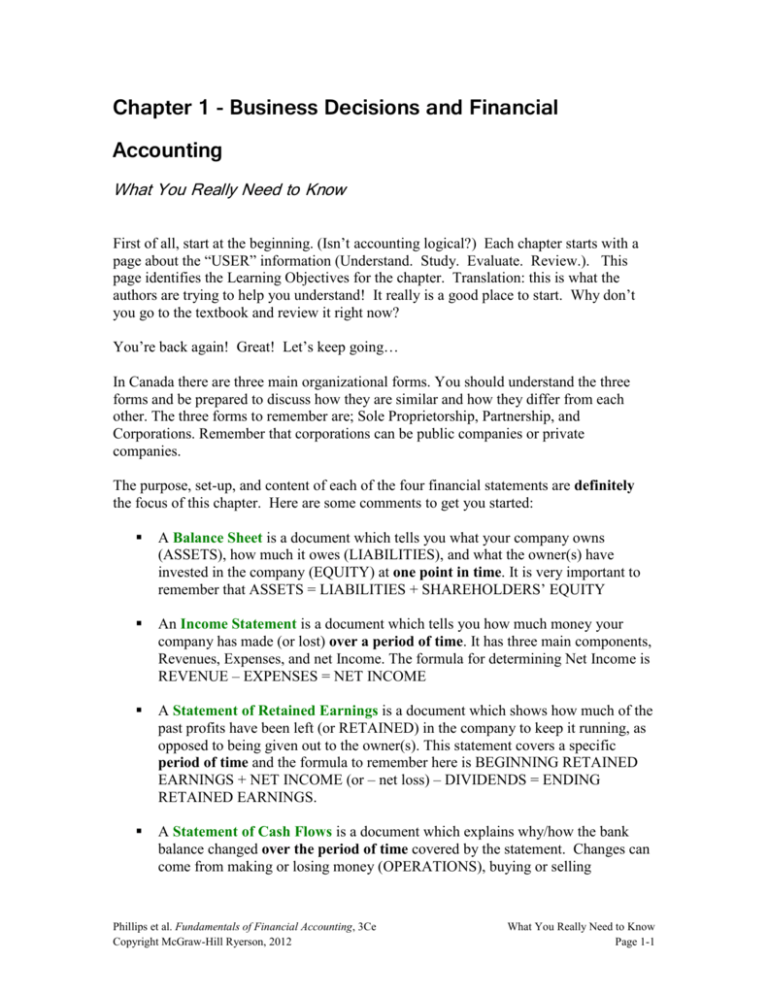

Chapter 1 - Business Decisions and Financial Accounting What You Really Need to Know First of all, start at the beginning. (Isn’t accounting logical?) Each chapter starts with a page about the “USER” information (Understand. Study. Evaluate. Review.). This page identifies the Learning Objectives for the chapter. Translation: this is what the authors are trying to help you understand! It really is a good place to start. Why don’t you go to the textbook and review it right now? You’re back again! Great! Let’s keep going… In Canada there are three main organizational forms. You should understand the three forms and be prepared to discuss how they are similar and how they differ from each other. The three forms to remember are; Sole Proprietorship, Partnership, and Corporations. Remember that corporations can be public companies or private companies. The purpose, set-up, and content of each of the four financial statements are definitely the focus of this chapter. Here are some comments to get you started: A Balance Sheet is a document which tells you what your company owns (ASSETS), how much it owes (LIABILITIES), and what the owner(s) have invested in the company (EQUITY) at one point in time. It is very important to remember that ASSETS = LIABILITIES + SHAREHOLDERS’ EQUITY An Income Statement is a document which tells you how much money your company has made (or lost) over a period of time. It has three main components, Revenues, Expenses, and net Income. The formula for determining Net Income is REVENUE – EXPENSES = NET INCOME A Statement of Retained Earnings is a document which shows how much of the past profits have been left (or RETAINED) in the company to keep it running, as opposed to being given out to the owner(s). This statement covers a specific period of time and the formula to remember here is BEGINNING RETAINED EARNINGS + NET INCOME (or – net loss) – DIVIDENDS = ENDING RETAINED EARNINGS. A Statement of Cash Flows is a document which explains why/how the bank balance changed over the period of time covered by the statement. Changes can come from making or losing money (OPERATIONS), buying or selling Phillips et al. Fundamentals of Financial Accounting, 3Ce Copyright McGraw-Hill Ryerson, 2012 What You Really Need to Know Page 1-1 equipment/buildings (INVESTING), or from borrowing, lending or dealings with the owner(s) (FINANCING). Does that make sense so far? It’s a start. To make these new documents more familiar and add a little more detail, take a moment right now to review the four statements and their format. Right now? Yes. There’s no time like the present. Come back here when you are done! Back again? Great! (If you didn’t leave, then do you promise to review the statements soon?) The textbook covers the four financial statements in much more detail and mentions which accounts are used in each statement. (Stop! Is that another new concept? It was in the tutorial. Think of it this way, accounts are like file folders. They are used to organize similar information.) You do need to know all of the proper terminology eventually! Make yourself a note about the five types of accounts and what they organize. The five types of accounts are; ASSETS, LIABILITIES, REVENUE, EXPENSES, and EQUITY. At the end of each chapter you will find a box titled “Spotlight on IFRS”. IFRS stands for International Financial Reporting Standards which are the required standards for Public Corporations to use when reporting their financial information. These boxes summarize the differences between GAAP (Generally Accepted Accounting Principles) and IFRS. You should always take a peak at these differences. Ok. That’s enough for now. For more hints about what is important, make sure that you read all of the “You Should Know” and “Coach’s Tops” information in the margins of your textbook. One last comment. I promise. When you get tired of reading, take a break and review the information found under the tab called “Understanding the Exhibits”. Exhibit 1.6 is really useful. It is an animated look at how the financial statements fit together and relate to one another. It’s a really good review. One more comment… Just kidding. That’s it for now! Phillips et al. Fundamentals of Financial Accounting, 3Ce Copyright McGraw-Hill Ryerson, 2012 What You Really Need to Know Page 1-2