Chapter 2

advertisement

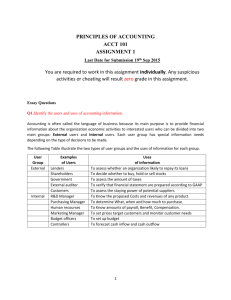

Financial Statements LEARNING OBJECTIVES 1. Explain the foundations of the balance sheet and income statement 2. Use the cash flow identity to explain cash flow. 3. Provide some context for financial reporting. 4. Recognize and view Internet sites that provide financial information. 2.1 Financial Statements Four main financial statements: Balance sheet Income Statement Statement of Retained Earnings Statement of Cash Flow Our focus.. Interrelationship between the balance sheet and the income statement The process by which these statements can be used to project a firm’s future cash flows 2.1 Financial Statements (A) The Balance Sheet Represents the assets owned by the company and the claims against those assets Based on the accounting identity: Assets Liabilities + Owners’ Equity (2.1) Figure 2.1 Balance sheet 2.1 Balance Sheet Has five main sections: 1. Cash account 2. Where did the $65 million decline come from? Working capital accounts 3. Net working capital = Current assets – Current liabilities (2.2) Long-term asset accounts 4. Plant and equipment; land and buildings Gross value – accumulated depreciation = Net value Long-term liabilities (debt) accounts 5. Loans maturing in over one year Ownership accounts Shareholders’ equity Retained earnings—accumulated total since inception 2.1 The Income Statement • Shows the expenses and revenues generated by a firm over a past period, typically a quarter or a year. • Net income = Revenues – expenses (2.3) • EBIT = Revenues – operating expenses (2.4) 2.1 Income Statement 2.1 The Income Statement Net income is not the same as cash flow Firm earned an income of $5,642 million Cash account decreased by $65 million 3 reasons: Accrual accounting Noncash expense items --depreciation Preference to classify interest expense as part of financial cash flow 2.2 Cash Flow Identity The cash flow identity states that the cash flow on the left-hand side of the balance sheet (the cash generated by the company) is equal to the cash flow on the right-hand side of the balance sheet (the cash flow given to the lenders and owners of the company). CASH FLOW FROM ASSETS CASH FLOW TO CREDITORS + CASH FLOW TO OWNERS Figure 2.5 Cash Flow Identity and components 2.2 The First Component: Cash Flow From Assets Three components: Operating cash flow (OCF) Net capital spending (NCS) Change in net working capital (∆NWC) Cash flow from assets = OCF – NCS - ∆NWC OCF = EBIT + Depreciation – Taxes NCS = End. Net Fixed Assets – Beg. Net Fixed Assets + Depreciation ∆NWC=Ending NWC – Beginning NWC 2.2 The First Component: Cash Flow From Assets OCF = EBIT + Depreciation – Taxes OCF = Net Income + Depreciation + Interest Expense 2.2 The First Component: Cash Flow From Assets (continued) NCS = End Net Fixed Assets – Beg Net Fixed Assets + Depreciation NCS= ($11,961 - $10,788) + $1,406 = $2,579 2.2 The First Component: Cash Flow From Assets ∆NWC = Ending NWC – Beginning NWC Net working capital for 2007 = $9,130 - $6,860 = $2,270 Net working capital for 2006 = $10,454 - $9,406 = $1,048 Change in NWC = $2,270 - $1,048 = $1,222 2.2 The First Component: Cash Flow From Assets Putting it all together…. Cash flow from Assets = OCF – NCS - ∆ NWC = $7,287 - $2,579 - $1,222 = $3,486 Versus Net Income of $5,642 2.2 The Second Component: Cash Flow To Creditors Cash Flow to Creditors = Interest Expense Net New Borrowing from Creditors Net New Borrowing = End Long-term Liabilities Beg Long-Term Liabilities Cash Flow to Creditors = $239 - (-$378) = $617 2.2 The Third Component: Cash Flow To Owners Cash flow to owners = Dividends - Net new borrowing from owners = $2,869 = $2,869 - $0 2.2 Putting It All Together: The Cash Flow Identity CASH FLOW FROM ASSETS CASH FLOW TO CREDITORS + CASH FLOW TO OWNERS $3,486 $617 + $2,869 The company generated $3,486 million and it was distributed to the lenders ($617 million) and the owners ($2,869 million) 2.3 Financial Performance Reporting Annual reports to shareholders Quarterly (10-Q) and annual (10-K) reports filed with the SEC Regulation Fair Disclosure (Reg. FD): Companies must release all material information to all investors at the same time. – Notes to the Financial Statements: A wealth of information about the firm 2.4 Financial Statements on the Internet EDGAR (www.sec.gov/edgar.shtml) Yahoo! Finance (http://finance.yahoo.com.) Many, many more Web sites with rich stores of information ADDITIONAL PROBLEMS WITH ANSWERS Problem 1 Balance Sheet. Chuck Enterprises has current assets of $300,000, and total assets of $750,000. It also has current liabilities of $125,000, common equity of $250,000, and retained earnings of $85,000. How much long-term debt and fixed assets does the firm have? ADDITIONAL PROBLEMS WITH ANSWERS Problem 1 Current Assets + Fixed Assets = Total Assets $300,000 + Fixed Assets = $750,000 Fixed Assets = $750,000 - $300,000 = $450,000 Total Assets ≡ Current Liabilities + Long-term debt Common equity + Retained Earnings $750,000 = $125,000 + Long-term debt + $250,000 + 85,000 Long-term debt = $750,000 - $125,000-$250,000 - $85,000 Long-term debt = $290,000 ADDITIONAL PROBLEMS WITH ANSWERS Problem 2 Income Statement. The Top Class Company had revenues of $925,000 in 2009. Its operating expenses (excluding depreciation) amounted to $325,000, depreciation charges were $125,000, and interest costs totaled $55,000. If the firm pays a average tax rate of 34 percent, calculate its net income after taxes. ADDITIONAL PROBLEMS WITH ANSWERS Problem 2 Revenues Less operating expenses = EBITDA Less depreciation = EBIT Less interest expenses = Taxable Income Less taxes (34%) = Net Income after taxes $925,000 325,000 600,000 125,000 475,000 55,000 420,000 142,800 277,200 ADDITIONAL PROBLEMS WITH ANSWERS Problem 3 Retained Earnings: The West Hanover Clay Co. had, at the beginning of the fiscal year, November 1, 2009, retained earnings of $425,000. During the year ended October 31, 2010, the company generated net income after taxes of $820,000 and paid out 35 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained earnings. ADDITIONAL PROBLEMS WITH ANSWERS Problem 3 Statement of Retained Earnings for the year ended October 31, 2010 Balance of Retained Earnings, 11/1/2009……….$425,000 Add: Net income after taxes, 10/31/2010………. $820,000 Less: Dividends paid for year-end 10/31/2010…$287,000 Balance of Retained Earnings, 10/31/2010….. $958,000 ADDITIONAL PROBLEMS WITH ANSWERS Problem 4 Working Capital: D.K. Imports, Incorporated reported the following information at its last annual meeting: Cash and cash equivalents = $1,225,000; Accounts payables = $3,200,000 Inventory = $625,000; Accounts receivables = $3,500,000; Notes payables = $1,200,000; Other current assets = $125,000. Calculate the company’s net working capital. ADDITIONAL PROBLEMS WITH ANSWERS Problem 4 Net Working Capital = Current Assets - Current Liabilities (Cash & Cash Equivalents + Accts. Rec. + Inventory + other current assets) - (Accounts Payables + Notes Payables) ($1,225,000+$3,500,000+$625,000+$125,000) ($3,200,000+$1,200,000) $5,475,000 - $4,400,000 Net Working Capital =$1,075,000 ADDITIONAL PROBLEMS WITH ANSWERS Problem 5 Cash Flow from Operating Activities: The Mid-American Farm Products Corporation provided the following financial information for the quarter ending September 30, 2009: Depreciation and amortization = $75,000 Net Income = $225,000 Increase in receivables = $95,000 Increase in inventory = $69,000 Increase in accounts payables = $80,000 Decrease in marketable securities = $34,000. What is the cash flow from operating activities generated during this quarter by the firm? ADDITIONAL PROBLEMS WITH ANSWERS Problem 5 Net Income Add depreciation and amortization Add decrease in marketable securities Add increase in accounts payables Less increase in accounts receivables Less increase in inventory $225,000 75,000 34,000 80,000 95,000 69,000 Cash flow from operating activities $250,000