Military 1 - Illinois Legal Advocate

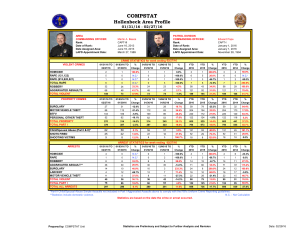

advertisement

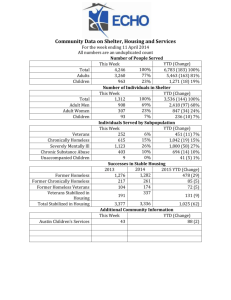

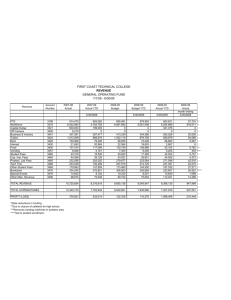

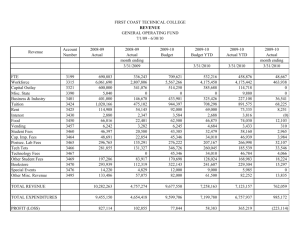

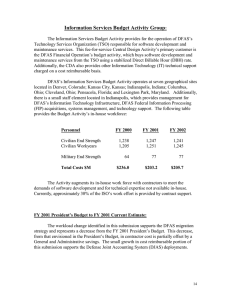

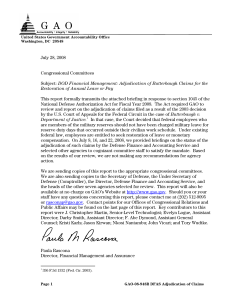

MILITARY ISSUES IN FAMILY LAW KIMBERLEY KLEIN POWER power.law@att.net Servicemembers Civil Relief Act 50 U.S.C. App. Sec 501 et seq. • Primary remedy – “stay of proceedings” for at least 90 days as the result of a request made either by the service member or on the judge’s own motion. – current military duties materially affect ability to appear – a date when the service member can appear – statement that military duties prevent appearance from commanding officer – statement that military leave is not authorized at the time • Section 521 covers members who have not made an appearance. This request does NOT equate to entering a general appearance. • Section 522 for those that have had notice but need a stay. Servicemembers Civil Relief Act 50 U.S.C. App. Sec 501 et seq. • Other provisions: – reduction to 6% for pre-service loans or obligations (especially important for guard/reserves called to active duty – prohibits landlords from evicting a service member or his her family members without a court order if the rent is below $1200 per month – allows service members to terminate a pre-service lease for dwelling, professional, business, agricultural, or similar lease and extends coverage to leases entered into by active duty personnel who receive orders for a permanent change of station or deployment of 90 days or more – motor vehicle leases: terminated if called to active duty or deployed for 180 days or more; terminated if permanent change of station to an overseas location – prohibits foreclosing – Requires certain employers to reinstate reservist/guard when returned from duty/deployment. Defense Finance and Accounting Service (DFAS) • www.dfas.mil – Provides pay charts, forms, and frequently asked questions. • Leave and Earnings Statement (LES) – www.dfas.mil/militarypay/militaryemploymentverification • Provides manuals on how to read the Leave and Earnings Statements of different services. • Basic Allowance For Subsistence (BAS) – Tax free allowance • Basic Housing Allowance (BHA) – Tax free allowance • http://perdiem.hqda.pentagon.mil/perdien/ • Cost of Living Allowance (COLA) – Overseas is tax free – US is taxable DEFENSE FINANCE AND ACCOUNTING SERVICE MILITARY LEAVE AND EARNINGS STATEMENT NAME (Last, First, MI) Doe, John ID SOC. SEC. NO. xxxxxx ENTITLEMENTS Type A B C D E F G H I J K L M N O TOTAL BASE PAY BAS BAH GRADE E7 PAY DATE 830615 YRS SVC 23 DEDUCTIONS Amount Type 3732.60 272.26 1207.00 FEDERAL TAXES FICA-SOC SECURITY FICA-MEDICARE SGLI AFRH TSP MID-MONTH-PAY ETS 070909 BRANCH AF ADSN/DSSN 4027 PERIOD COVERED 1-30 SEP 06 ALLOTMENTS Amount Type 338.80 231.42 54.12 29.00 .50 223.96 2042.28 DISCRETIONARY ALT SUMMARY +Amt Fwd .00 +Tot Ent 5211.86 -Tot Ded 2920.08 -Tot Allt 250.00 Amount 250.00 =Net Amt 2041.78 -Cr Fwd =EOM Pay 5211.86 2920.08 250.00 DIEMS 830615 .00 2041.78 RETPLAN HIGH 3 LEAVE BF Bal 60.0 FICA TAXES Wage Period 3732.60 PAY DATA BAQ Type W/DEP THRIFT SAVINGS PLAN (TSP) Base Pay Rate 6 REMARKS: Ernd 30.0 Used 27 Cr Bal 63.0 ETS Bal 91.5 Soc Wage YTD 37154.40 BAQ Depn CHILD VHA Zip 62225 Base Pay Current .00 Lv Lost .0 Lv Paid 40.0 Use/Lose 3.0 50975.34 IF TSP ELECTION AMT EXCEEDS NET AMT Wage YTD 35586.68 M / S S E x 0 3 Add'l Tax .00 Tax YTD 4135.07 Soc Tax YTD 2303.57 Med Wage YTD 37154.40 Med Tax YTD 538.72 STATE TAXES St IL Wage Period .00 Wage YTD .00 M/S S Ex 01 Tax YTD .00 Rent Amt 590.00 Share 1 Stat R JFTR Depns 0 2D JFTR BAS Type Charity YTD .00 TPC PACIDN Spec Pay Rate 0 Spec Pay Current .00 TSP YTD Deductions 1567.72 YTD ENTITLE Wage Period 3508.64 FED TAXES YTD DEDUCT Inc Pay Rate 0 Inc Pay Current .00 Deferred 1567.72 Bonus Pay Rate 0 Bonus Pay Current .00 Exempt .00 8798.58 CANNOT CONTACT UCC, CONTACT AFPC PRC AT DUE, TSP WILL NOT BE DEDUCTED. 1-800-435-9941 OR HTTP://ASK.AFPC.RANDOLPH. -USSDP CONTRIBUTIONS ARE PROCESSED MANUALLY AF.MIL. AS AN ALLOTMENT OF PAY. INFO ON MYPAY IS -EFF 1 OCT 05, BAH RULES CHANGED AND MANY UPDATED MONTHLY AFTER EOM PAYROLL IS PROCESS- ASSIGNED TO USAFE WERE ERRONEOUSLY PAID. ED AND USSDP TOTALS ARE UPDATED. PLEASE DFAS-DE IS POSTING, THEN SUSPENDING A DEBT ALLOW 60 DAYS TO VIEW YOUR ACCOUNT ON MYPAY. AND WILL APPLY FOR A MASS REMISSION FOR ALL. -REQUEST YOUR BALLOT FOR NOV 7 ELECTIONS! NOTHING IS REQUIRED FROM THE AFFECTED MBRS. CONTACT YOUR VOTING ASSISTANCE OFFICER OR -UPDATE YOUR TRICARE ENROLLMENT WHEN YOU PCS. VISIT WWW.FVAP.GOV. USED LEAVE BALANCE ADJUSTED. -EXCITING OPPORTUNITIES AWAIT! BECOME A CURRENT MONTH LEAVE BALANCE ADJUSTED. CAREER ENLISTED AVIATOR. VISIT VIRTUAL-MPF CHARGE LEAVE 060905-060908(252) RETRAINING & HTTPS://WWW.A3A5.HQ.AF.MIL/A3O/ BAH BASED ON W/DEP, ZIP 62225 A3OT/A3OTA/CEA/CEA.HTM FOR ADDITIONAL INFO. BANK PENTAGON FEDERAL CREDIT UN -HURRICANE SEASON IS HERE. IF YOU EVACUATE, ACCT # xxxxxxx CONTACT YOUR UNIT CC. ALL AF,ANG AND AD WHO WWW.DOD.MIL/DFAS DFAS Form 702, Jan 02 RETIREE ACCOUNT STATEMENT STATEMENT EFFECTIVE DATE DEC 02, 2005 NEW PAY DUE AS OF JAN 03, 2006 SSN XXX-XX-XXXX PLEASE REMEMBER TO NOTIFY DFAS IF YOUR ADDRESS CHANGES DFAS-CL POINTS OF CONTACT DEFENSE FINANCE AND ACCOUNTING SERVICE US MILITARY RETIREMENT PAY PO BOX 7130 LONDON KY 40742-7130 COMMERCIAL (216) 522-5955 TOLL FREE 1-800-321-1080 TOLL FREE FAX 1-800-469-6559 myPay https://myPay.dfas.mil 1-877-363-3677 MSG JOHN DOE USAF RET 100 Military Lane SWANSEA IL 62226-2427 PAY ITEM DESCRIPTION ITEM GROSS PAY VA WAIVER SBP COSTS TAXABLE INCOME OLD NEW 1,381.00 579.00 6.93 795.07 1,437.00 602.00 7.22 827.78 ITEM ALLOTMENTS/BONDS OL D NEW 341. 54 341.54 NET PAY 486.24 453. 53 PAYMENT ADDRESS YEAR TO DATE SUMMARY ( FOR INFORMATION ONLY) DIRECT DEPOSIT TAXABLE INCOME: FEDERAL INCOME TAX WITHHELD: 9,540.84 .00 TAXES FEDERAL WITHHOLDING STATUS: TOTAL EXEMPTIONS: SINGLE 05 SURVIVOR BENEFIT PLAN (SBP) COVERAGE SBP COVERAGE TYPE: CHILD COST: CHILD(REN) ONLY 7.22 THE ANNUITY PAYABLE IS 55% OF YOUR ANNUITY BASE AMOUNT. DFAS-CL 7220/148 (Rev 03-01) ANNUITY BASE AMOUNT: 55% ANNUITY AMOUNT: CHILD DOB: ALLOTMENTS AND BONDS ALLOTMENT TYPE INSURANCE MISC DISCRETIONARY INSURANCE INSURANCE PAYEE AFBA, THE 5 STAR ASSOC SOUTHWEST BANK OF ST TRICARE PRIME - NORTH RETIRED DENTAL PLAN AMOUNT 9.80 200.00 38.34 93.40 ARREARS OF PAY BENEFICIARY INFORMATION THE FOLLOWING BENEFICIARIES ARE ON RECORD: NAME DOE JOHN SR. DOE JANE SHARE 50.00 50.00 MESSAGE SECTION YOUR NEW PAY INCLUDES A 4.1% COST OF LIVING INCREASE. *** YOUR RETIREE ACCOUNT STATEMENT AND ANY RETIRED PAY TAX FORMS (1099RS) FOR 2005 HAVE BEEN COMBINED INTO THIS ENVELOPE. PLEASE USE THESE TAX FORMS WHEN FILING YOUR 2005 TAX RETURN. *** YOUR VA WAIVER WAS CHANGED DUE TO RECENT LEGISLATION. *** DO YOU WANT TO VIEW YOUR ACCOUNT AND TAX STATEMENTS ON-LINE AND MAKE PAY ACCOUNT CHANGES? *** VISIT MYPAY AT HTTPS://MYPAY.DFAS.MIL TO EITHER OBTAIN OR CHANGE YOUR PERSONAL IDENTIFICATION NUMBER (PIN). *** GET YOUR INCOME TAX REFUND IN HALF THE TIME BY USING IRS E-FILE WITH A DIRECT DEPOSIT INTO YOUR BANK ACCOUNT. *** AS A RESULT OF RECENT LEGISLATION, THERE IS CURRENTLY AN OPEN ENROLLMENT FOR THE SURVIVOR BENEFIT PLAN THAT WILL RUN UNTIL SEPTEMBER 30, 2006. REFER TO OUR WEB SITE AT http://www.dod.mil/dfas/ FOR MORE INFORMATION AND TO OBTAIN AN OPEN ENROLLMENT DFAS-CL 7220/148 (Rev 03-01) RELATIONSHIP FATHER MOTHER