Army-Pay-Class

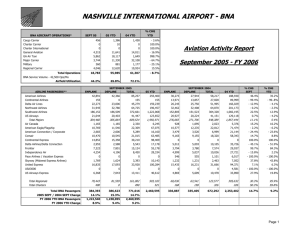

advertisement

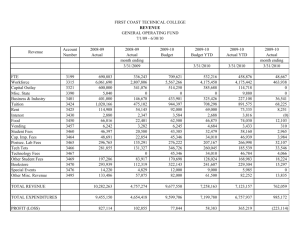

Army Pay & Allowances How much will you make? Types of Pay & Allowances Basic (Base) Pay = Salary (monthly); depends upon Pay Grade (Rank) & Years of Service. Basic Allowance for Subsistence (BAS) = Additional pay for food/rations, etc. Basic Allowance for Housing (BAH); formerly BAQuarters • Only those who live Off-Post (not in government housing or BOQ). • Based upon rates with and with-out dependents. • Includes deviations based upon cost of living (Variable Housing Allowance). • Non-Taxable. Special Duty/Skills & Incentive Pay: • Flight Pay (on “Flight Status”) = $125 - $840 per month. • Jump Pay (on “Jump Status”) = $150 per month • Hostile Fire Pay/Imminent Danger Pay (Combat Pay) = $225 per month. • Demolition Pay & Dive Pay (must be in duty position). Cost of Living Adjustment (COLA) = Pay adjustment for living overseas in a high-cost area (includes Hawaii). BASIC ENTRY: Officer (2LT/O1 vs. PVT/E2) 2LT (less than 2 years) = $2828.40 per month = $33,940.80 / year PV2 (less than 2 years) = $1671.30 per month = $20,055.60 / year AFTER 3 YEARS: Officer (1LT/O2 vs. SPC/E4) 1LT/O2 (Over 3 years) = $4274.40 per month = $51,293 / year SPC/E4 (Over 3 years) = $2157.30 per month = $25,888 / year BAS BAH (only if you live OFF-POST) SMP in ROTC E-5 pay ! Typically, one drill weekend includes four (4) drill periods $183.84 / weekend drill (< 4 months) $198.80 / weekend drill (< 4 months) Types of Deductions (Pay) – Federal Income Taxes (based upon W-2 Form). – FICA - Social Security Taxes. – FICA – Medicare. – OPTIONAL Deductions: – Serviceman Group Life Insurance (SGLI) premium ($17.25/mo for $250,000 worth). – Family SGLI premium ($2.50/month for $50,000). – Any previous overpayment or debt owed to the Army/Government. Types of Allotments (Pay) – U.S. Savings Bonds ($25 = $50). – Investments (Mutual Funds). – Life Insurance (additional Commercial life insurance). – Army Emergency Relief (AER); helps Soldiers in your unit. – Combined Federal Campaign (CFC); charitable contributions. – Alimony/Child Support. Additional “INCOME” NO Medical or Dental expenses while on Active Duty (you). - Pay minimal amount for spouse & children coverage. MOVING Expenses (FREE military moves – don’t have to pay movers): - Per Diem (daily rate for meals & incidentals). - Temporary Lodging Expenses (off-set having to use a hotel/motel). - Mileage Reimbursement (per mile). - Dislocation Allowance (money to defer costs of moving). - Do-It-Yourself (DITY) move (make $$ by saving the government $$). TAX Savings (not included in taxable income): - BAH & BAS is NON-taxable! - Other special income is typically NON-taxable - Only Base Pay is taxable. “Business Trips” (TDY) – is paid for (lodging, meals, incidentals, & transportation) Tuition Assistance (TA) for Education. Additional Benefits 30 days of LEAVE (vacation) per year (accumulated @ 2.5 days/month). - can accumulate up to 60 days. Federal Holidays OFF (often a 4-day weekend). Liberal PASS policy (time-off) for good conduct or special considerations. RECREATION: Gyms, pools, recreation facilities, ball-fields, bowling alley’s, auto-craft shops, wood-working shops, arts & crafts shops, golf courses, shooting ranges, horse stables, fishing ponds/lakes, movie theaters…. SCHOOLS: Elementary & Middle Schools for children. CHURCHES on-post. PX & COMMISSARY. D A B C D E F G H I J K L M N O LEAVE & EARNINGS STATEMENT (LES) DEFENSE FINANCE AND ACCOUNTING SERVICE MILITARY LEAVE AND EARNINGS STATEMENT NAME (Last, First, MI) SOC. SEC. NO. GRADE PAY DATE YRS SVC ETS BRANCH ADSN/DSSN PERIOD COVERED ALEXANDER, DAVID R. 294668456 O1 050608 00 888888 ARMY 4844 1-30 JUN 05 ENTITLEMENTS Type Amount Type Amount Type FEDERAL TAXES FICA-SS FICA-MEDICARE SGLI for $250,000 FAMILY SGLI MID-MONTH PAY $555.00 $111.00 $99.00 $16.25 $10.00 $1012.12 BOND ALLOTMENT AER CFC TRICARE DENTAL INSURANCE ALLOT BASE PAY BAS BAH (W/O) $2343.60 $183.99 $480.90 DEDUCTIONS ALLOTMENTS Amount $25.00 $50.00 $25.00 $25.00 $23.00 $45.00 SUMMARY +Amt Fwd .00 +Tot Ent - Tot Ded - Tot Allt = Net Amt - Cr Fwd = EOM Pay $3008.49 $1803.37 $193.00 $1012.12 .00 $1012.12 +1.5 Days x per Month TOTAL $3008.49 BF Bal Ernd 5.0 5.0 Used Cr Bal 0.0 0.0 $1803.37 ETS Bal Lv Lost Lv Paid 0.0 0.0 0.0 Use/Lose EAVE ICA AXES PAY DATA Wage Period BAQ Type REMARKS: Soc Wage YTD BAQ Depn VHA Zip Soc Tax YTD Rent Amt Med Wage YTD Share Stat YTD ENTITLE 3008.49 HTTPS://mypay.dfas.mil Savings Bond Purchased Price $50.00 Bond issued this month Bank Ft. Campbell FCU Other “NOTES” as deemed by DFAS or the Army $193.00 FED TAXES Wage Period Wage YTD 3008.49 3008.49 0.0 Med Tax YTD JFTR Depns STATE St Wage Period TAXES 2D JFTR BAS Type M/S Ex M 01 Wage YTD Add’l Tax .00 M/S Tax YTD 555.00 Ex Charity YTD YTD DEDUCT PAID 2 x per MONTH ! Tax YTD PACIDN Direct Deposit • You will be required to establish a Direct Deposit account (checking or savings) for ALL your Military pay to be deposited into. • You may elect to keep that account throughout your career (I did) or move it as you move from location to location (PCS). • Recommend that you also open a “local” account (checking and/or savings/ATM) when you PCS to a new duty station (if you keep your DD somewhere else). • Recommend elect to receive a Mid-Month Pay & and End-of-Month Pay option. • Even TDY/travel, and other payments will be DD. • My Example: $125 into Savings every pay / rest into Checking. Leadership Responsibilities Review the LES of your Soldiers: • Check & verify the number of LEAVE days (“Use/Lose” or “In-the-Hole”). • Check & verify the Mid-Month & End-ofMonth Pay (“No Pay Due”). • Unit Commander’s Finance Report (UCFR). Save your LES’s Comparative Salaries JOB TITLE SALARY EDUCATION Bricklayer $37,000 need to find a company or school that sets up apprenticeships Elementary Teacher $32,500 (starting) Bachelor’s Degree & Elementary Teaching Certification Nurse (LPN) $32,00 - $42,000 Vocational Degree in Licensed Practical Nursing Truck Driver $30,000 certain tests and examinations HVAC Mechanic $28,500 An Associate’s degree or equivalent formal training in HVAC repair & maintenance Dental Assistant $26,000 (starting) Associate Degree or Certificate as a Dental Assistant Retail Sales Clerk $15,500 in order to move beyond this position into managerial roles, you will want to gain a degree in Business Management Hair Stylist $15,000 (starting) Associate or Vocational Degree in Barbering or Hairstyling Bartender $11,000 formal bar tending & serving courses from a local education center.