ABS Eligibility Assessment Application Forms

advertisement

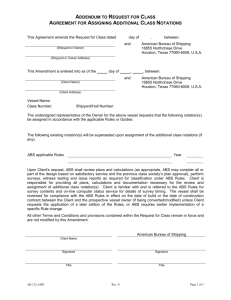

ABS Eligibility Assessment Application Forms - (rev.2015-May) To start the process of the eligibility assessment of an asset-backed security (ABS), a completed application form and all related documents must be submitted to De Nederlandsche Bank (DNB). The ABS Assessment Application Form consists of three parts: Documents, Tranche and Program. The application form and queries relating to this form can be directed to collateral_management@DNB.nl. In addition, please provide a signed cover letter confirming that the information provided in the application form is complete and correct. Please forward a hardcopy of this cover letter via post to DNB (address: Payments and Securities Department, Collateral Management, P.O. Box 98, 1000 AB Amsterdam) and a scanned version to collateral_management@dnb.nl. Please note that when answering a question by referencing the prospectus, a legal opinion or other transaction documents, exact paragraphs and page numbering must be included. It is insufficient to simply state "please see prospectus". All Articles quoted in this eligibility assessment application form refer to the corresponding Articles in Guideline ECB/2014/60 of the ECB of December 19, 2014 on the implementation of the Eurosystem monetary policy framework (recast). This Guideline is also referred to as the General Documentation (GD). General information Date of application Click here to specify the date. Transaction name Click here to enter text. Click here to enter text. Tranche for which eligibility is being sought Click here to enter text. ISIN code Click here to enter text. Denomination of tranche1 Click here to specify the date. Issuance date of the security Click here to specify the date. Maturity date of the security Click here to specify the date. First optional redemption date CSD of issuance Click here to enter text. SSS where the ABS is held Click here to enter text. The diagram of the transaction Click here to specify where this can be found. The ABS are governed by a Master Issuer Click here to choose the applicable. If the ABS Master Issuer has been assessed on eligibility by DNB, and no material changes which have effect on the eligibility have been occurred since, the part 3 Program does not have to be provided. Click here to choose the applicable. Please check the box to confirm that a written declaration which states that all criteria relating to close links are fulfilled is provided ☐ If any material changes occur to the asset backed security which have an impact on the eligibility requirements, DNB shall be informed instantly by the counterparty. Please complete the following prior to submission: Name: Click here to enter text. Position: Click here to enter text. Company: Click here to enter text. Company Address: Click here to enter text. Signature: Click here to enter text. Date:Click here to enter date. 1 In order to be eligible, debt instruments shall be denominated in euro or in one of the former currencies of the Member States whose currency is the euro. ABS Eligibility Assessment Application Form Part 1. - DOCUMENTS Please check the box when the document is provided: Prospectus New Issue Report - Moody’s - Fitch - S&P - DBRS Rating Letter - Moody’s - Fitch - S&P - DBRS Euronext Listing Notice Transaction Legal Opinion Cash Flow Data Loan Level Data Parallel Debt Agreement Issuer Services Agreement ISDA Master Agreement Liquidity Facility Agreement Administration Agreement Issuer Rights Pledge Agreement Swap Confirmation Trust Deed Mortgage Receivables Purchase Agreement Other documents: Click here to enter text Click here to enter text Click here to enter text Click here to enter text Click here to enter text Click here to enter text Click here to enter text ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ☐ ABS Eligibility Assessment Application Form Part 2. - TRANCHE GD Art. 63 Acceptable coupon structures for marketable assets 63.1. Please provide the applicable coupon structure(s): - Click here to specify where this is evidenced in the documentation. Please provide details on any changes to the coupon structure over the lifetime of the transaction - Click here to specify where this is evidenced in the documentation. 63.5. The coupon structure has no issuer optionalities, i.e. during the entire lifetime of the asset, based on a forward- and backward looking perspective. Click here to select the applicable answer Please indicate the coupon frequency: Please indicate the first coupon payment date: Click here to specify the date. Click here to specify the date. Art. 66 – Place of issue of marketable assets 66.1. If Article 66.1 applies and the ABS thus is issued in the EEA with a central bank or with an SSS, has central bank or SSS been positively assessed pursuant to the Eurosystem User Assessment Framework: - Click here to choose one. - Click here to specify where this is evidenced in the documentation. 66.3. If Article 66.3 applies and the ABS thus is issued through the ICSD Euroclear Bank and Clearstream Banking Luxembourg, please provide the following information on the form in which the ABS was issued: - Click here to choose one. - Click here to specify where this is evidenced in the documentation. GD Art. 77 Non-subordination of tranches for asset-backed securities 77.1. The tranches or sub-tranches of the ABS are not subordinated to other tranches of the same issue over the lifetime of the ABS. - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. GD Art. 82 Eurosystem’s credit quality requirements for marketable assets 82.1(b). The tranches or sub-tranches for which eligibility is being sought has a credit assessment provided by at least two public credit ratings, in compliance with, as a minimum, credit quality step 2 (i.e. rating of A-) - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. ABS Eligibility Assessment Application Form Part 3. - PROGRAM If the ABS is governed by a Master Issuer and (i) the ABS Master Issuer has been assessed on eligibility by DNB and (ii) no material changes which have effect on the eligibility have occurred since, this part 3. Program is not required. GD art. 73 - Homogeneity and composition of the cash-flow generating assets 73.1. In order for ABSs to be eligible, all cash-flow generating assets backing the ABS must be homogenous, i.e. it shall be possible to report them according to one of the existing loan level templates which shall be one of the following: - Click here to choose the applicable template. - Click here to specify the European Data Warehouse Code - Click here to specify where this is evidenced in the documentation. 73.3. The ABS must not contain any cash-flow generating assets originated directly by the SPV issuing the ABS: - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. 73.4. The cash-flow generating assets must not consist, in whole or in part, actually or potentially, of tranches of other ABSs2: - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. 73.5. The cash-flow generating assets must not consist, in whole or in part, actually or potentially, of credit-linked notes, swaps or other derivatives instruments, synthetic securities or similar claims3: - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. 73.6. The cash-flow generating assets backing commercial mortgage-backed securities must not contain loans which are at any time structured, syndicated or leveraged4: - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. 73.7. The cash-flow generating assets backing the ABSs must not comprise of leasing receivables with residual value leases5: - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. 2 This criterion shall not exclude ABSs where the issuance structure includes two SPVs and the ‘true sale’ criterion is met in respect of those SPVs so that the debt instruments issued by the second SPV are directly or indirectly backed by the original pool of assets and all cash flows from the cash-flow generating assets are transferred from the first to the second SPV. 3 This restriction shall not encompass swaps used in ABS transactions strictly for hedging purposes. 4 For the purposes of this criterion, ‘structured loan’ means a structure involving subordinated tranches, ‘syndicated loan’ means a loan provided by a group of lenders in a lending syndicate and ‘leveraged loan’ means a loan provided to a company that already has a considerable degree of indebtedness, such as buy-out or take-over-financing, where the loan is used for the acquisition of the equity of a company which is also the obligor of the loan. 5 ABSs that were on the list of eligible assets on 1 May 2015 shall maintain their eligibility until 31 August 2015 GD art. 74 - Geographical restrictions concerning asset-backed securities and cash-flow generating assets 74.1. The issuer of the ABS must be an SPV established in the EEA: - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. 74.2. The cash-flow generating assets must be originated by an originator incorporated in the EEA and sold to the SPV by the originator or by an intermediary incorporated in the EEA6: - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. 74.4. The obligors and the creditors of the cash-flow generating assets must be incorporated, or, if they are natural persons, resident in the EEA: - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. GD art. 75 – Acquisition of cash-flow generating assets by the SPV 75.1. The acquisition of the cash-flow generating assets by the SPV must be governed by the law of a Member State: - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. 75.2. Please provide information on the ‘ true sale’ criterion, i.e. if this eligibility criterion has been satisfied - Click here to select the applicable answer - Click here to specify where this is evidenced in the documentation. GD art. 76 – Assessment of clawback rules for asset-backed securities 76.1. Please specify for each the cash flow generating assets: (a) The respective jurisdicition; and (b) Each of the laws governing the legal instruments constituting each of the cash flow generating assets - Click here to enter text. 76.2. Please provide information on the clawback rules criterion, i.e. if this eligibility criterion has been satisfied. - Click here to enter text. 6 Mortgage trustee or receivables trustee shall be considered to be an intermediary Parties involved in the transaction Please provide for each of the following parties in the transaction: the name, country of incorporation, the jurisdiction of incorporation and MFI code (if applicable): Issuer Click here to enter text (the name, country of incorporation, jurisdiction of incorporation and MFI code (if applicable) Originator Click here to enter text (the name, country of incorporation, jurisdiction of incorporation and MFI code (if applicable) Seller(s)/Transferer(s) Click here to enter text (the name, country of incorporation, jurisdiction of incorporation and MFI code (if applicable) Intermediaries Click here to enter text (the name, country of incorporation, jurisdiction of incorporation and MFI code (if applicable) Obligors Click here to enter text (the name, country of incorporation, jurisdiction of incorporation and MFI code (if applicable) Account bank Click here to enter text (the name, country of incorporation, jurisdiction of incorporation and MFI code (if applicable) Servicer (and back-up servicer, if applicable) Click here to enter text (the name, country of incorporation, jurisdiction of incorporation and MFI code (if applicable) FX-swap counterparty (and back-up Fx-swap counterparty) Click here to enter text (the name, country of incorporation, jurisdiction of incorporation and MFI code (if applicable) Liquidity support provider (and back-up liquidity support providor) Click here to enter text (the name, country of incorporation, jurisdiction of incorporation and MFI code (if applicable) Other parties involved Click here to enter text (the name, country of incorporation, jurisdiction of incorporation and MFI code (if applicable)