Kroger - Tony Gauvin's Web Site

advertisement

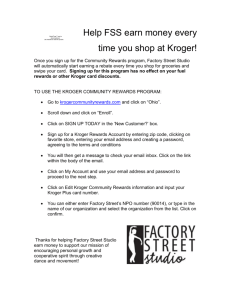

A Strategic Management Case Study Monday, April 7, 2008 ® 2008, Tony Gauvin, UMFK 1 Overview Who we are, What we sell, Where we are A Brief history of Kroger Value Statement Mission and Vision External Assessment - EFE Matrix - CPM Matrix Internal Assessment - Financial Condition - IFE Matrix 7-Apr-08 Strategy Formulation - SWOT Matrix - Space Matrix - IE Matrix - Grand Strategy Matrix - Matrix Analysis - QSPM Matrix Strategic Planning for the Future EPS/EBIT Decisions/Implementation/Eval uation Kroger 2006 Update ® 2008, Tony Gauvin, UMFK 2 Who we are • • • • • Headquartered in Cincinnati, Ohio, The Kroger Co. is one of the largest retailers in the United States based on annual sales, holding the #26 ranking on the Fortune 100 list. Kroger was founded in 1883 and incorporated in 1902. At the end of fiscal 2006, Kroger operated (either directly or through its subsidiaries) 2,468 supermarkets, 631 of which had fuel centers. Approximately 39% of these supermarkets were operated in Company-owned facilities, including some Company-owned buildings on leased land. See Section II of this Fact Book for more information about our supermarket operations, and Section III for more information about our supermarket fuel centers. In addition to supermarkets, Kroger operates (either directly or through its subsidiaries) 779 convenience stores and 412 fine jewelry stores. Subsidiaries operated 687 of the convenience stores, while 92 were operated through franchise agreements. Approximately 44% of the convenience stores operated by subsidiaries were operated in Company-owned facilities. The Company also manufactures and processes some of the food for sale in its supermarkets. As of February 3, 2007, the Company operated 42 manufacturing plants. All of the Company’s operations are domestic. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 3 Key facts • Kroger operates – 2468 supermarkets • 631 have fuel centers • 1900 have pharmacy – 779 Convenience Stores – 412 fine Jewelry stores – 42 Manufacturing plants • • • • 15 Daires,3 ice cream plants and 2 cheese plants 7 Bakeries 3 Beverage plants 3 Meat Packing plants – 44 Distribution Centers in 3 tier • Local (200 mile) • Higher value slow turn, H&BA items (350 mile) • Seasonal and promotions 7-Apr-08 ® 2008, Tony Gauvin, UMFK 4 What We Sell 7-Apr-08 ® 2008, Tony Gauvin, UMFK 5 Where We Are 7-Apr-08 ® 2008, Tony Gauvin, UMFK 6 Brand Strategy • Private Selections – Gourmet and upscale • Meet or beat national brands • Banner Brand – “Try It, Like, It or get the National Brand Free” • Equal or better to corresponding consumer goods • Value – Good quality at an affordable price 7-Apr-08 ® 2008, Tony Gauvin, UMFK 7 History 1883: Bernard H. Kroger and B.A. Branagan open the Great Western Tea Co., the beginning of the Kroger Co. empire. Kroger is the first grocer to advertise in newspapers. 1884: Branagan sells Kroger his share of the business for $1,500. 1885: The company expands to four stores in Cincinnati, making the company one of the first chain store operations in America. 1901: It becomes the first store to bake its own bread. 1902: With 40 stores and a factory in Cincinnati, Kroger incorporates and changes the company's name to Kroger Grocery and Baking Co. Kroger buys Nagel Meat Markets and Packing House, and makes the grocery stores the first to include meat departments. 1912: Kroger makes his first long-distance expansion, buying 25 stores in St. Louis, Missouri. The company buys a fleet of trucks, enabling Kroger to move into Detroit, Michigan, Indianapolis, Indiana, and Springfield and Toledo, Ohio. 1920: The company purchases Piggly-Wiggly stores in Ohio, Tennessee, Michigan, Kentucky, Missouri, and Oklahoma and buys most of Piggly-Wiggly's corporate stock. The public begins to accuse food chains of driving small merchants out of business by using unfair business practices. 1928: Kroger sells his shares in Kroger for more than $28 million. William Albers becomes president. 1929: Kroger stores number 5,575. 1930: Morrill introduces the Kroger Food Foundation, making it the first grocery store company to test food scientifically in order to monitor the quality of products. Kroger manager, Michael Cullen, suggests opening bigger self-service supermarkets, but Kroger executives disagree. 1930: Cullen leaves Kroger and forms the first supermarket, King Kullen, in Jamaica, New Jersey. It introduces frozen foods and shopping carts. The Kroger Food Foundation invents a way of processing beef without chemicals so that it remains tender, calling the product "Tenderay" beef. 1940: Kroger sells its stock in Piggly-Wiggly stores. 1946: The company changes it’s name to the Kroger Co. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 8 History 1947: Kroger opens its first egg processing plant in Wabash, Indiana, to further ensure egg quality. Hall merges the 45 private-label brands into one Kroger brand, and introduces the blue and white logo. 1948: Kroger joins six other firms to establish the Top Value Stamp Co., trying to bring customers into the stores with stamp collecting promotions. 1952: Kroger sales top $1 billion. 1960: The company begins its expansion into the drugstore business. It buys Sav-on drugstore chain and makes its owner, James Herring, the head of the drugstore division. 1961: The first SupeRx drugstore opens next to a Kroger food store in Milford, Ohio. 1963: Sales reach $2 billion. 1971: Enforcing antitrust laws, the Federal Trade Commission proposes a consent order that requires the company to divest itself of three discount food departments. Kroger settles without admitting any violation of antitrust laws, but sells three food departments. FTC prohibits company from purchasing any food store or department in nonfood stores in which the purchase would lessen the competition in that city or county. The government begins to control prices of products. 1972: To increase the accuracy and speed of checkout systems, Kroger, in partnership with RCA, becomes the first grocery company to test electronic scanners to read prices on products under actual working conditions. Kroger introduces an advertising promotion that compares their prices with its competitors' on 150 products a week; the figures are based upon surveys of housewives. 1974: Net profits of the top food chains are up 57%, despite government controlled prices. The FTC reveals illegal business practices of several chains, including Kroger. The company settles out of court on an antitrust claim for fixing beef prices. The FTC sues Kroger for violations of its 1973 trade rule, which forces stores to stock a sufficient supply of specials to meet anticipated demand and to give rainchecks when supplies run out. 1977: Kroger consents to the FTC order. 1978: The FTC rules that Kroger slogans like "Documented Proof: Kroger leads in lower prices" are unfair and deceptive because the items surveyed excluded meats, produce, and house brands. A controversy ensues when the Council of Wage and Price Stability expresses concern that tougher standards for Kroger might prevent the dissemination of food price information in the future. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 9 History 1981: The company acquires Treasury Drug Stores from J.C. Penney Co. Kroger begins marketing its Cost Cutter brand products. 1983: Absorbs Dillion Companies, Inc. and begins to operate stores coast-to-coast. Kroger settles out of court with the FTC. 1984: Kroger and Wetterau form a grocery wholesaler for Michigan called FoodLand Distributors. 1985: Hook Drugs, Inc. merges with Kroger. Acquires Price Savers Wholesalers, Inc. and M&M Supermarkets, Inc.. Dillion Cos., Inc. purchases Turkey Hill Dairy, Inc. 1986: The company sells most of its interest in Hook and SupeRx drug chains to Hook-SupeRx, Inc. (HSI), a privately held company, for approximately $415 million. 1987: Kroger sells more of its drug stores to Hook-SupeRx, Inc for $88 million. In total, the company has sold approximately 658 stores. 1988: Kroger faces takeover bids from the Dart Group Corp. and from Kohlberg Kravis Roberts, whose highest bid tops $5 billion. Kroger rejects the bids. To ward off the buyout, CEO Everingham and president Joseph Pichler borrow $4.1 million to pay a special dividend to stockholders and to buy additional shares for an employee stock plan, which is increased by 30%. 1990: The company sells to K-Mart its equity interest in Price Savers Wholesale, Inc. Kroger makes its first major acquisition since 1988 by purchasing Great Scott! supermarkets in Michigan. 1991: Kroger now operates 1,263 food stores and 940 convenience stores, and owns 37 processing plants, including 11 bakeries, 15 dairies, and facilities for processing cheese and various other dairy products. Sales reach $21.3 billion, and net income is $101 million. 1993: Kroger, seeking to capitalize on positive views of low-interest credit cards, begins issuing its own co-branded credit cards. Acquires 11 Houston-area supermarkets from AppleTree Markets Inc. Kroger loses $12.2 million for the year. 1994: Kroger secures a credit agreement for a seven-year $1.75 billion revolving loan, increasing available monies for capital expenditures from $500 million to $650 million annually. Sell seven of its stores to Delchamps Inc., and buys two from Delchamps. Earns $242 million on sales of $22.9 billion. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 10 History 1995: David B. Dillion is named president, CEO, and a director of Kroger. Annual earnings rise to $302 million on sales of $23.9 billion. 1996: Kroger is the largest supermarket chain in the U.S. 1998: Kroger and Fred Meyer Inc. announce plans to merge into Kroger-Fred Meyer, the first coast-to-coast food retail operation in the U.S. The $12 billion deal will result in the creation of a $43 billion industry giant with 3,400 stores, including supermarkets, convenience stores, jewelry stores, and supercenters, spanning 31 states. 1999 July: Kroger announces its plans to partner with US Bancorp to introduce a new co-branded credit card for Kroger customers. 1999: Kroger completes its merger with Fred Meyer, a former grocery powerhouse with a combined $43 billion in annual sales. 2000 May: Kroger announces its plans to partner with PlanetU, the online promotions network for the consumers good industry, to offer U-pons, Internet coupons for dozens of popular national brands, on Kroger's Web site. 2000: Kroger teams up with Priceline Webhouse Club to let customers use the Internet to name their own price for groceries at more than 2,300 Kroger-owned stores around the country. 2001: Sales exceed $50 billion for the first time ever. Kroger launches a restructuring that includes 1,500 layoffs and the consolidation of division operations in Nashville, Tennessee, into offices in Louisville, Kentucky, and Atlanta, Georgia. 2002: Kroger acquires 18 Raley's units, which it plans to convert to Food 4 Less or Smith's units; 17 Albertson's stores in the Houston, Texas, and surrounding areas; and seven Winn-Dixie supermarkets in Dallas, Texas. The firm is largest retail grocery store operator in the U.S. 2004: Kroger begins construction on new Kroger Marketplace stores in Ohio and Smith Marketplace stores in Utah. The Marketplace format, which includes general merchandise, is intended to allow the firm to better compete with retail giants like Wal-Mart. 2005 Jan.: The firm posts a fiscal year loss of $100 million, despite a 5% increase in revenues to $56.4 billion. 2005 Oct.: Kroger enters a bidding war for Albertsons, a struggling chain that put itself up for sale two months ago. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 11 Values • Honesty : – • Integrity : – • Reflecting a workplace that includes a variety of people from different backgrounds and cultures, diversity of opinions and thoughts. Safety : – • Valuing opinions, property and perspectives of others. Diversity : – • Living our values in all we do, unified approach to how we do business and treat each other. Respect for Others : – • Doing the right things, telling the truth. Watching out for others, being secure and safe in your workplace. Inclusion : – 7-Apr-08 Your voice matters, working together works, encouraging everyone’s involvement, being the best person you can be. ® 2008, Tony Gauvin, UMFK 12 Mission Statement Actual “OUR MISSION is to be a leader in the distribution and merchandising of food, health, personal care, and related consumable products and services. By achieving this objective, we will satisfy our responsibilities to shareowners, associates, customers, suppliers, and the communities we serve. We will conduct our business to produce financial returns that reward investment by shareowners and allow the Company to grow. Investments in retailing, distribution and food processing will be continually evaluated for their contribution to our corporate return objectives. We will constantly strive to satisfy the needs of customers as well as, or better than, the best of our competitors. Operating procedures will increasingly reflect our belief that the organization levels closest to the customer are best positioned to serve changing consumer needs. We will provide all associates and customers with a safe, friendly work and shopping environment and will treat each of them with respect, openness, honesty and fairness. We will solicit and respond to the ideas of our associates and reward their meaningful contributions to our success. We value America’s diversity and will strive to reflect that diversity in our work force, the companies with which we do business, and the customers we serve. As a Company, we will convey respect and dignity to all individuals. We will encourage our associates to be active and responsible citizens and will allocate resources for activities that enhance the quality of life for our customers, our associates and the communities we serve.” 7-Apr-08 ® 2008, Tony Gauvin, UMFK 13 Vision Proposed Our vision is to be America’s supermarket, and to continue to provide innovation and unparalleled value to our customers, employees, and shareholders. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 14 External Assessment 7-Apr-08 ® 2008, Tony Gauvin, UMFK 15 Opportunities 1. 2. 3. 4. 5. 6. 7. Supermarket sales of drugs grew 6.9% to $27 billion in 2004. Wal-Mart has a large, recruitable low-paid, nonunion workforce. Organic food sales are up 19.5% annually over the last 5 years. Hispanic shoppers spend $117/week vs. $87/week average on groceries. Hispanic population growth rate = 13% = 4X average. Margins for private-label products are 35-45% vs. 27% for national brands. 87% of consumers have tried private-label products. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 16 Threats 1. 2. 3. 4. 5. 6. 7. 8. Traditional drugstores are focusing on customer service and merchandising. Mail-order pharmacies are the fastest-growing format in the industry (up 17.9%). Health plans allow larger supplies of drugs for Mail-order pharmacies. Drug price inflation has led to illegal drug importation. Supercenters are dominating the market share of grocery sales. Wal-Mart is tops in logistics technology. Labor costs account for >50% of operating expenses. Price pressure was the cause of the Southern California strikes. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 17 EFE Matrix Weight Rating Weighted Score Supermarket sales of drugs grew 6.9%. 0.07 3 0.21 Large, low-paid Wal-Mart workforce. 0.05 1 0.05 Organic food sales are up 19.5% annually. 0.05 3 0.15 Hispanics spend 34.5% more than average on groceries. 0.10 2 0.20 Hispanic population growth rate is 4 times the average. 0.08 2 0.16 Higher margins for private-label products. 0.05 4 0.20 87% of consumers have tried private-label products. 0.05 4 0.20 Key External Factors Opportunities 7-Apr-08 ® 2008, Tony Gauvin, UMFK 18 EFE Matrix Threats Drugstores focusing on service and merchandise. 0.10 2 0.20 Mail-order pharmacies are the fastest-growing format. 0.08 3 0.24 Mail-order pharmacies can dispense larger prescriptions. 0.07 2 0.14 Drug price inflation has led to illegal drug importation. 0.05 1 0.05 Supercenters are dominating grocery sales. 0.10 3 0.30 Wal-Mart is tops in logistics technology. 0.10 4 0.40 Labor costs account for >50% of operating expenses. 0. 10 2 0.20 Price pressure caused Southern California strikes. 0.05 2 0.10 TOTAL 1.00 7-Apr-08 ® 2008, Tony Gauvin, UMFK 2.80 19 CPM Kroger Critical Success Factors Albertsons Safeway Wal-Mart Weight Rating Weighted Score Rating Weighted Score Rating Weighted Score Rating Weighted Score Market share 0.10 3 0.30 2 0.20 2 0.20 4 0.40 Financial position 0.10 3 0.30 1 0.10 3 0.30 4 0.40 Growing markets 0.05 3 0.15 2 0.10 3 0.15 4 0.20 Multiple formats 0.05 4 0.20 3 0.10 2 0.10 2 0.10 Customer database 0.05 4 0.20 3 0.15 3 0.15 1 0.05 Price competitive 0.15 3 0.45 2 0.30 2 0.30 4 0.60 Name recognition 0.10 3 0.30 2 0.20 2 0.20 4 0.40 Organized labor 0.15 2 0.30 2 0.30 2 0.30 4 0.60 Distribution system 0.05 3 0.15 2 0.10 2 0.10 4 0.20 Customer service 0.10 4 0.40 3 0.30 3 0.30 1 0.10 Consumer loyalty 0.05 4 0.20 3 0.15 3 0.15 1 0.05 Employee satisfaction 0.05 3 0.15 4 0.20 3 0.15 1 0.05 TOTAL 1.00 7-Apr-08 3.10 2.25 ® 2008, Tony Gauvin, UMFK 2.40 3.15 20 Key Points • Increasing organic and natural food selections helped to exploit that opportunity (growth in Hispanic populations) • Kroger’s strong private-label brands are a real boon to the bottom line • Kroger has online prescription fulfillment and mail order of prescriptions • Kroger must partner with drug makers to help reduce drug costs in order to curb importation • Kroger has maintained its market share against low-priced supercenters, • Kroger’s 3-tiered logistics system is a strong rival to the Wal-Mart machine • The overall score of 2.8 indicates an above-average job in responding to external forces. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 21 Internal Assessment 7-Apr-08 ® 2008, Tony Gauvin, UMFK 22 Stock Performance 7-Apr-08 ® 2008, Tony Gauvin, UMFK 23 Income Statement (Jan, 2006) (In millions, except per share amounts) Sales THE KROGER CO. CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended January 28, 2006, January 29, 2005, and January 31, 2004 2005 (52 weeks) $ 60,553 2004 (52 weeks) $ 2003 (52 weeks) 56,434 $ 53,791 Merchandise costs, including advertising, warehousing, and transportation, excluding items shown separately below 45,565 42,140 39,637 Operating, general and administrative 11,027 10,611 10,354 661 680 657 Depreciation and amortization 1,265 1,256 1,209 Goodwill impairment charge — 904 471 Asset impairment charges — — 120 Operating Profit 2,035 843 1,343 Interest expense 510 557 604 1,525 286 739 567 390 454 Rent Earnings before income tax expense Income tax expense Net earnings (loss) $ 958 $ (104 ) $ 285 Net earnings (loss) per basic common share $ 1.32 $ (0.14 ) $ 0.38 Average number of common shares used in basic calculation Net earnings (loss) per diluted common share 724 $ Average number of common shares used in diluted calculation 7-Apr-08 1.31 731 ® 2008, Tony Gauvin, UMFK 736 $ (0.14 736 747 ) $ 0.38 754 24 Balance Sheet (Jan, 2006) THE KROGER CO. CONSOLIDATED BALANCE SHEETS January 28, 2006 (In millions) January 29, 2005 ASSETS Current assets Cash and temporary cash investments $ 210 $ 144 Deposits In-Transit 488 506 Receivables 680 661 6 167 4,886 4,729 Receivables - Taxes FIFO Inventory LIFO Credit (400 ) (373 Prefunded employee benefits 300 300 Prepaid and other current assets 296 272 6,466 6,406 11,365 11,497 2,192 2.191 459 397 Total current assets Property, plant and equipment, net Goodwill, net Other assets Total Assets 7-Apr-08 $ ® 2008, Tony Gauvin, UMFK 20,482 $ 20,491 25 Balance Sheet (2005) THE KROGER CO. CONSOLIDATED BALANCE SHEETS LIABILITIES Current liabilities Current portion of long-term debt including obligations under capital leases and financing obligations Accounts payable $ 554 $ 71 3,550 3,598 Accrued salaries and wages 742 659 Deferred income taxes 217 286 Other current liabilities 1,652 1,721 Total current liabilities 6,715 6,335 6,651 7,830 27 70 6,678 7,900 843 841 1,856 1,796 16,092 16,872 Long-term debt including obligations under capital leases and financing obligations Face value long-term debt including obligations under capital leases and financing obligations Adjustment to reflect fair value interest rate hedges Long-term debt including obligations under capital leases and financing obligations Deferred income taxes Other long-term liabilities Total Liabilities 7-Apr-08 ® 2008, Tony Gauvin, UMFK 26 Balance Sheet (2005) THE KROGER CO. CONSOLIDATED BALANCE SHEETS SHAREOWNERS’ EQUITY Preferred stock, $100 par, 5 shares authorized and unissued — — Common stock, $1 par, 1,000 shares authorized: 927 shares issued in 2005 and 918 shares issued in 2004 927 918 2,536 2,432 Additional paid-in capital Accumulated other comprehensive loss (243 Accumulated earnings (202 4,573 Common stock in treasury, at cost, 204 shares in 2005 and 190 shares in 2004 (3,403 Total Shareowners’ Equity $ ® 2008, Tony Gauvin, UMFK 20,482 ) 3,620 ) (3,149 4,390 Total Liabilities and Shareowners’ Equity 7-Apr-08 ) 3,619 $ 20,491 27 ) Financial Ratios November 2005 KR ABS SWY WMT Industry Market Cap: 13.93B 8.79B 10.38B 204.01B 893.98M Employees 289,000 241,000 191,000 1,700,000 6.47K Qtrly Rev Growth (yoy): 6.80% 0.20% 7.20% 10.10% 5.30% Revenue (ttm): 58.36B 41.30B 37.76B 305.37B 2.58B Gross Margin (ttm): 23.81% 27.97% 29.03% 23.02% 27.08% EBITDA (ttm): 3.10B 2.44B 2.26B 22.70B 147.21M Operating Margins (ttm): 3.13% 3.12% 3.52% 5.87% 3.41% -15.00M 510.00M 590.40M 10.80B 27.98M EPS (ttm): -0.021 1.374 1.313 2.569 1.16 P/E (ttm): N/A 17.36 17.6 19.08 17.76 PEG (5 yr expected): 1.5 2.57 1.88 1.19 1.86 P/S (ttm): 0.24 0.21 0.28 0.68 0.25 Net Income (ttm): ABS = Albertson's Inc. SWY = Safeway Inc. WMT = Wal-Mart Stores Inc. Industry = Grocery Stores 7-Apr-08 ® 2008, Tony Gauvin, UMFK 28 Financial Ratios Entity Market Cap ROE % Debt/ Equity Price to Book Net Profit Margin (mrq) Grocery Stores 53.17B 10 0.012 5.46 1.1 Kroger Co. 14.19B -0.367 1.842 3.635 1.414 Safeway Inc. 10.48B 13.47 1.35 2.211 1.369 Whole Foods Market Inc. 9.84B 11.682 0.014 7.275 0.812 Albertson's Inc. 8.76B 9.455 1.222 1.59 1.05 Distribucion y Servicio S.A. 2.23B 7.436 0.733 2.425 1.112 The Great Atlantic & Pacific Tea Co. 1.22B 79.924 0.371 1.596 27.302 Casey's General Stores Inc. 1.14B 10.294 0.287 2.341 2.427 Weis Markets Inc. 1.13B 10.382 0 1.902 2.553 7-Apr-08 ® 2008, Tony Gauvin, UMFK 29 Financial Ratios • Trending not Done – I ran out of time! 7-Apr-08 ® 2008, Tony Gauvin, UMFK 30 Net Worth Analysis (Jan, 2006) 1. Stockholders’ Equity + Goodwill = 4,390 + 2,191 $ 6,581 2. Net income x 5 = 958 x 5= $ 4,790 3. Share price = $18.47/EPS 1.32 = 0.76 x Net Income 958 = $ 13,404 4. Number of Shares Outstanding x Share Price = 731 x $18.47 = $ 13,502 $9,569 Method Average 7-Apr-08 ® 2008, Tony Gauvin, UMFK 31 Strengths 1. 2. 3. 4. 5. 6. 7. A high-quality asset base with leading market shares in many of the nation’s largest and fastest growing markets. Broad geographic diversity and multiple retail formats that allow Kroger to meet the needs of virtually every customer. An extensive collection of consumer data generated from our customer loyalty cards plus a unique partnership with dunnhumby. A successful track record of competing head-to-head against supercenters. Outstanding private-label products that have earned industryleading market share. The financial strength and resources to build Kroger’s business for the future. A prominent reputation in charitable giving and community involvement. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 32 Weaknesses 1. 2. 3. 4. Operates under two dozen banners. Only owns 35% of store property. Workforce is 71% unionized. Jewelry stores are 11% of stores, but account for less than 1% of revenue. 5. Has not issued dividends since 1988. 6. Negative net income in 2004. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 33 IFE Matrix Key Internal Factors Weight Rating Weighted Score A high-quality asset base with leading market shares in many of the nation’s largest and fastest growing markets. 0.05 3 0.15 Broad geographic diversity and multiple retail formats that allow Kroger to meet the needs of virtually every customer. 0.10 4 0.40 An extensive collection of consumer data generated from our customer loyalty cards plus a unique partnership with dunnhumby. 0.10 4 0.40 A successful track record of competing head-to-head against supercenters. 0.05 3 0.15 Outstanding private-label products that have earned industry-leading market share. 0.10 4 0.40 The financial strength and resources to build Kroger’s business for the future. 0.05 4 0.20 A prominent reputation in charitable giving and community involvement. 0.05 4 0.20 A high-quality asset base with leading market shares in many of the nation’s largest and fastest growing markets. 0.10 3 0.30 Broad geographic diversity and multiple retail formats that allow Kroger to meet the needs of virtually every customer. 0.05 3 0.15 An extensive collection of consumer data generated from our customer loyalty cards plus a unique partnership with dunnhumby. 0.05 3 0.15 Strengths 7-Apr-08 ® 2008, Tony Gauvin, UMFK 34 IFE Matrix Key Internal Factors Weight Rating Weighted Score 0.1 1 0.10 0.05 2 0.10 0.1 1 0.10 Jewelry stores are 11% of stores, but account for less than 1% of revenue. 0.05 2 0.10 Has not issued dividends since 1988. 0.05 2 0.10 TOTAL 1.00 Weaknesses Operates under two dozen banners. Only owns 35% of store property. Workforce is 71% unionized. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 2.90 35 Matrix Analysis 7-Apr-08 ® 2008, Tony Gauvin, UMFK 36 SWOT Matrix Strengths – S 1. A high-quality asset base 2. Broad geographic diversity and multiple retail formats 3. An extensive collection of consumer data 4. A successful track record of competing head-to-head against supercenters. 5. Outstanding private-label products 6. Financial strength and resources 7. Reputation for charitable giving and community involvement. Weaknesses – W 1. Operates under two dozen banners. 2. Only owns 35% of store property. 3. Workforce is 71% unionized. 4. Jewelry stores are 11% of stores, but account for less than 1% of revenue. 5. Has not issued dividends since 1988. 6. Negative net income in 2004. Opportunities – O 1. Supermarket sales of drugs up 2. Low-paid Wal-Mart workforce 3. Organic food sales growth 4. High level of Hispanic spending 5. Hispanic population growth rate 6. High Margins for private-labels 7. High demand for private labels SO Strategies 1. More pharmacies in stores (S1,O1) 2. Organic private-label (S9,O3-6-7) 3. Hispanic private-label (S9, O4-5) 4. Hispanic format (S4-5, O4-5) 5. Take Wal-Mart’s best employees (S10, O2) 6. New stores in Hispanic hot spots (S4, O5) WO Strategies 1. Hybridize banners & push Kroger brands (W1, O6-7) 2. Replace some jewelry stores with organic markets (W4, O3) Threats – T 1. Drugstore service/merchandise focus 2. Growth of mail-order pharmacies 3. Larger prescription rules for MOP’s 4. Illegal drug importation 5. Supercenters dominate grocery sales 6. Wal-Mart logistics technology 7. Labor >50% of operating expenses 8. Price pressure caused labor strikes ST Strategies 1. Match drugstore offerings of service & merchandise. (S1-5, T1) 2. Grow online pharmacy business (S6-10, T2) 3. New stores in non union areas (S4, T7) 4. VP of unions (S10, T7-8) 5. Stress customer service in all operations (S6-7, T1-5-7) WT Strategies 1. More hybrid banner supercenter-type stores (W1, T5) 2. Buy store property and save money (W2, T7-8) 3. Divert jewelry store funds into online pharmacy (W4, T2) 7-Apr-08 ® 2008, Tony Gauvin, UMFK 37 Space Matrix Financial Strength ( FS) Net Income Current Ratio Los s in E PS in 2005 High deb t to capital ratio Low bookvalue per s hare Financial Strength ( FS) Average Competitive Advantage ( CA) #1 or #2 in mos t major markets Dive rs ified w ith four diffe ren t op erations Priva te label s hare of sales is 24.6% W ebsite pharmacy sales grew 1 8% in 2004 Control over Sup pliers a nd Distributors Competitive Advantage ( CA) Average 1 3 1 1 1 Environmental Stability (ES) Hisp anic gro th rate is 14% High ene rgy prices Aggress ive labor unions Mail order pharmacie s increasing sales Supercenters dominate grocery sales -1 -5 -6 -6 -6 1.4 Environmental Stability (ES) Average -5 -2 -1 -1 -1 -2 -1.4 Industry Strength (IS) Retail drug chains strong go wth Superma rket dru g sales con tinue to grow O rga nic food sales up 19% in last 5 years Custome rs continue to use private brands Labo r cost total >50% of op erating expens es 6 6 6 5 1 Industry Strength (IS) Average 5 y-axis = FS + ES = 1.4 + (-5.0) = -3.6 x-axis = CA + IS = -1.4 + (+5.0) = 3.6 7-Apr-08 ® 2008, Tony Gauvin, UMFK 38 Space Matrix FS Conservative Aggressive 6 5 4 3 2 1 CA -6 -5 -4 -3 -2 -1 1 2 3 4 5 6 IS -1 -2 -3 -4 -5 -6 Defensive 7-Apr-08 ES ® 2008, Tony Gauvin, UMFK Competitive 39 GSM Rapid Market Growth Quadrant II Quadrant I Weak Competitive Position Strong Competitive Position Albertsons Kroger SafeWay Wal-Mart Quadrant III Quadrant IV Slow Market Growth 7-Apr-08 ® 2008, Tony Gauvin, UMFK 40 BCG data All of the Company’s operations are domestic. The Kroger Co. # of Stores % of Revenue Supermarkets Convenience Stores Jewelry Stores (A) Other (B) Total 2,468 779 412 N/A 3,659 94% 5% <1% <1% 100% Market Share 1 0.1 0.1 ? (A) Includes 122 locations operated inside our supermarkets and 290 in shopping malls. (B) Represents sales by Kroger’s manufacturing plants to outside customers. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 41 BCG Matrix Relative Market Share Position Industry Sales Growth Rate High 1.0 Medium .50 Low 0.0 High +20 Stars II Question Marks I Cash Cows III Dogs IV Medium 0 Low -20 7-Apr-08 ® 2008, Tony Gauvin, UMFK 42 IE Matrix Hold and Maintain EFE Scores High 3-4 Medium 2-2.99 Low 1-1.99 7-Apr-08 Strong 3-4 I IV VII IFE Scores Average 2-2.99 1 Weak 1-1.99 II III V VI VIII IX ® 2008, Tony Gauvin, UMFK 43 Matrix analysis Alternative Strategies BCG IE SPACE GRAND COUNT Forward Integration x x 2 Backward Integration x x 2 Horizontal Integration x x 2 Market Penetration x x 3 Market Development x x 2 Product Development x x 3 x x Concentric Diversification x 1 Conglomerate Diversification x 1 Horizontal Diversification x 1 x 2 Joint Venture x Retrenchment Divestiture Liquidation 7-Apr-08 ® 2008, Tony Gauvin, UMFK 44 QSPM Strategic Alternatives A - Diversification of Private Label Natural and Ethnic Products B - Replace Convenience & Jewelry Stores with Fuel Centers Opportunities Key Factors A B Weight AS TAS AS TAS Supermarket sales of drugs growth 0.07 --- --- --- --- Large, low-paid Wal-Mart workforce 0.05 --- --- --- --- Organic food sales are up 0.05 4 0.20 1 0.05 Hispanics spend more than average 0.10 4 0.40 1 0.10 High Hispanic pop. growth rate 0.08 4 0.32 2 0.16 High margins for private-label 0.05 4 0.20 1 0.05 Popularity of private-label products 0.05 4 0.20 1 0.05 Threats 1.32 0.41 Drugstore focus on service and merchandise 0.10 --- --- --- --- Mail-order pharmacy (MOP) growth 0.08 3 0.24 1 0.08 MOP’s dispense larger prescriptions 0.07 --- --- --- --- Illegal drug importation 0.05 --- --- --- --- Supercenters dominate grocery sales 0.10 3 0.30 4 0.40 Wal-Mart logistics technology 0.10 2 0.20 3 0.30 Labor >50% of operating expenses 0.10 2 0.20 4 0.40 Labor strikes 0.05 2 0.10 4 0.20 7-Apr-08 ® 2008, Tony Gauvin, UMFK 1.04 1.38 45 Strenghts QSPM Quality asset base 0.05 --- --- --- --- Leading market shares 0.10 4 0.40 3 0.30 In large and growing markets 0.10 4 0.40 3 0.30 Geographic diversity 0.05 4 0.20 3 0.15 Multiple retail formats 0.10 4 0.40 2 0.20 Consumer database 0.05 4 0.20 3 0.15 Dunnhumby partnership 0.05 --- --- --- --- Competitive with supercenters 0.10 3 0.30 4 0.40 Outstanding private-label products 0.05 4 0.20 1 0.05 Financial strength 0.05 4 0.20 2 0.10 Weaknesses 2.30 1.65 Too many banners 0.1 --- --- --- --- Too much leased property 0.05 --- --- --- --- Unionized workforce 0.1 2 0.20 4 0.40 Many low-revenue jewelry stores 0.05 1 0.05 4 0.20 No dividends in nearly 20 years 0.05 --- --- --- --- Sum Total Attractiveness Score 7-Apr-08 ® 2008, Tony Gauvin, UMFK 0.25 0.60 4.91 4.04 46 EPS/EBIT • EPS-EBIT Analysis for Kroger Company (assume $1,000 million is needed) • Figures in millions (fiscal year: 2002) • $ Amount Needed: $ 3,000M – Stock Price: $ 18 – Tax Rate: 40% – Interest Rate: 5% – # Shares Outstanding: 725.5M 7-Apr-08 ® 2008, Tony Gauvin, UMFK 47 EPS/EBIT Analysis EBIT Interest EBT Taxes EAT # Shares EPS EBIT Interest EBT Taxes EAT # Shares EPS Common Stock Financing Recession Normal Boom $500,000,000 $1,500,000,000 $3,000,000,000 0 0 0 500,000,000 1,500,000,000 3,000,000,000 200,000,000 600,000,000 1,200,000,000 300,000,000 900,000,000 1,800,000,000 892,166,667 892,166,667 892,166,667 0.34 1.01 2.02 70 Percent Stock - 30 Percent Debt Recession Normal Boom $500,000,000 $1,500,000,000 $3,000,000,000 45,000,000 45,000,000 45,000,000 455,000,000 1,455,000,000 2,955,000,000 182,000,000 582,000,000 1,182,000,000 273,000,000 873,000,000 1,773,000,000 842,166,667 842,166,667 842,166,667 0.32 1.04 2.11 Recession $500,000,000 150,000,000 350,000,000 140,000,000 210,000,000 725,500,000 0.29 Debt Financing Normal $1,500,000,000 150,000,000 1,350,000,000 540,000,000 810,000,000 725,500,000 1.12 Boom $3,000,000,000 150,000,000 2,850,000,000 1,140,000,000 1,710,000,000 725,500,000 2.36 70 Percent Debt - 30 Percent Stock Recession Normal Boom $500,000,000 $1,500,000,000 $3,000,000,000 105,000,000 105,000,000 105,000,000 395,000,000 1,395,000,000 2,895,000,000 158,000,000 558,000,000 1,158,000,000 237,000,000 837,000,000 1,737,000,000 775,500,000 775,500,000 775,500,000 0.31 1.08 2.24 Conclusion: Kroger Company should use debt financing to raise the $ 3,000 million on the High EBIT estimate; however, should consider using stock financing on the Low EBIT. 7-Apr-08 ® 2008, Tony Gauvin, UMFK 48 Recommendations 1. Diversification of Private Label Natural and Ethnic Products 1. Combination of Market Penetration & Product Development 2. Replace Convenience & Jewelry Stores with Fuel Centers 1. Get rid of the dogs and build a new star 3. Bomb Wal-Mart (Just Joking!) 7-Apr-08 ® 2008, Tony Gauvin, UMFK 49 Implementation • Build new factories and retool existing to manufacture Ethnic (Hispanic) and Natural foods in desired locations close to targeted geographic markets – 10 @ $250 Million • Create a new national marketing campaign to inform public on new product – $500 Million 7-Apr-08 ® 2008, Tony Gauvin, UMFK 50 Evaluation Quarterly & Yearly Financial Statements Annual strategic meetings of division management and corporate management 7-Apr-08 ® 2008, Tony Gauvin, UMFK 51 Kroger 2006 • Number 26 on Fortune 500 (US Companies) – Dropped from 18 – Wal-Mart is Number 2 • 183th largest Company in the World – Wal-Mart is 10th – Carrefour is 88th • Sales projected at $65 Billion – Steady increases • Net Profit Margin 1.7% – Better than last year but still down from 2.5% in 2002 • 7-Apr-08 ® 2008, Tony Gauvin, UMFK 52 Impact of Fuel Centers 7-Apr-08 ® 2008, Tony Gauvin, UMFK 53 Questions? 7-Apr-08 ® 2008, Tony Gauvin, UMFK 54 Sources of Information • The 2006 Kroger Fact Book – http://www.thekrogerco.com/finance/financialinfo_reportsandstat ements.htm • Kroger Case study notes – Alen Badal: The Union Institute – Henry Jackson McGill, Francis Marion University • History from Notable Corporate Chronologies, Online Edition, Thomson Gale, 2006 • Datamonitor – The Kroger Co. – Food Retail in the United States – Global Food Retail 7-Apr-08 ® 2008, Tony Gauvin, UMFK 55