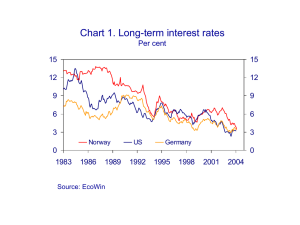

Charts - Norges Bank

advertisement

Norges Bank Executive Board meeting 21 September 2005 1 Norges Bank Prices for crude oil and gasoline in the US Crude oil: USD per barrel; Gasoline: cents per gallon Daily figures. Jan 05 – Sept 05 300 80 Spot 250 70 Crude oil (right-hand scale) 1-Pos (October) 200 60 150 50 3-Pos (December) 100 Jan 40 Feb Mar Apr May Jun Jul Aug Sep Source: EcoWin/ NYMEX 2 Norges Bank USA Consumer Sentiment Index, Monthly figures 120 120 110 110 100 100 90 90 80 70 2000 Mid-month 16/9 80 70 2001 2002 2003 2004 2005 Source: EcoWin / University of Michigan 3 Norges Bank Developments in 10-year government bond yields and oil prices Per cent and USD per barrel 80 5.0 Crude oil (right-hand scale) 4.5 4.0 US 70 60 Norway 50 3.5 Germany 3.0 Jan 40 Feb Mar Apr May Jun Jul Aug Sep Sources: Bloomberg and Norges Bank 4 Norges Bank CPI/HICP in the US, the euro area, Germany, the UK and Japan. Percentage change on same month previous year 4 3 4 Euro area 3 US 2 2 1 1 Germany UK 0 0 Japan -1 -1 -2 1999 -2 2000 2001 2002 2003 2004 2005 Source: EcoWin / National statistics 5 Norges Bank Consumer prices in the Nordic countries Percentage rise on same month previous year 4 4 Sweden (UND1X) 3 3 Denmark* Sweden (UND1X excl. energy) 2 2 Finland* 1 1 Norway (CPI-ATE) 0 0 * CPI excl. energy, food, alcohol and tobacco -1 2002 -1 2003 2004 2005 Source: EcoWin / National statistics 6 Norges Bank Interest rate expectations for the US, the euro area, the UK and Sweden 5 5 4 UK 4 3 Sweden 3 2 1 Euro area US 2 20 Sept 1 9 Aug 0 0 jun 03 des 03 jun 04 des 04 jun 05 des 05 jun 06 des 06 Sources: Reuters and Norges Bank 7 Norges Bank Oil price Brent Blend and futures prices. Daily figures, USD per barrel. Jan 02 – Sept 05 70 70 19 Sept 60 60 24 Jun (IR 2/05) 50 50 40 40 30 30 20 20 10 2002 10 2003 2004 2005 2006 2007 2008 Sources: Telerate, IPE and Norges Bank 8 Norges Bank Oil futures prices USD per barrel light crude. Daily figures. Jan 01 – Sept 05 80 80 70 70 60 60 Delivery in 1 month 50 50 40 40 30 30 Delivery in 6-7 years 20 20 10 2001 10 2002 2003 2004 2005 Source: EcoWin/ NYMEX 9 Norges Bank CPI-ATE Total and broken down into imported and domestically produced goods and services1). Historical price inflation and projections IR 2/05 (broken line). 12-month rise. Per cent 3 2 3 Goods and services produced in Norway (0.7) 2 1 1 0 0 CPI-ATE -1 -1 -2 -2 Imported consumer goods (0.3) -3 -3 -4 1) Norges Bank's projections -5 Dec 03 -4 -5 Apr 04 Aug 04 Dec 04 Apr 05 Aug 05 Sources: Statistics Norway and Norges Bank 10 Norges Bank Unemployed Number of unemployed (LFS), number of registered unemployed and persons on labour market programmes. In thousands. Seasonally adjusted 200 200 Registered unemployed and persons on labour market programmes 175 150 175 150 125 125 100 100 LFS unemployment 75 75 Registered unemployed 50 25 0 1989 50 25 0 1992 1995 1998 2001 2004 Sources: Statistics Norway, the Directorate of Labour and Norges Bank 11 Norges Bank Statistics Norway's wage index Growth on same quarter previous year. Per cent 8 8 Retail trade 6 6 Construction industry Manufacturing 4 4 2 0 1999 Transport and communications 2 Commercial services and property management 0 2000 2001 2002 2003 2004 2005 Source: Statistics Norway 12 Norges Bank Consumer confidence indicator Unadjusted figures 45 45 Total Own financial situation Norwegian economy 30 30 15 15 0 0 -15 -15 -30 1999 -30 2000 2001 2002 2003 2004 2005 Sources: TNS Gallup and Norges Bank 13 Norges Bank Service consumption and airline passengers 4-quarter growth. Per cent 6 30 Service consumption excluding shelter services (left-hand scale) 4 20 2 10 Airline passengers international departures (right-hand scale) 0 -2 2000 0 -10 2001 2002 2003 2004 2005 Sources: Statistics Norway, Avinor and Norges Bank 14 Norges Bank Private consumption and enterprise sector investment in mainland Norway Growth on same quarter previous year. Per cent 20 20 Investment 10 10 0 0 Consumption -10 2000 -10 2001 2002 2003 2004 2005 Source: Statistics Norway 15 Norges Bank Housing prices from real estate business 12-month rise. Monthly figures. Per cent 25 25 20 20 15 15 10 10 5 5 0 0 -5 -5 -10 1998 -10 1999 2000 2001 2002 2003 2004 2005 Sources: Associations of Norwegian real estate agents (NEF, EFF) and Norges Bank 16 Norges Bank Estimated and actual investment in petroleum activities In billions of NOK 100 100 2005 90 90 80 80 2006 2004 70 70 60 2003 60 50 2002 50 40 40 30 30 20 20 May Aug Previous year Nov Feb May Aug Same year Nov Feb Final figures Source: Statistics Norway 17 Norges Bank Total debt (C3) and domestic credit (C2) Per cent. 12-month growth 30 30 25 25 Total debt non-financial enterprises mainland Norway (C3) 20 15 20 Households (C2) 10 Domestic credit to nonfinancial enterprises (C2) 5 0 -5 2000 15 10 5 0 -5 2001 2002 2003 2004 2005 Sources: Statistics Norway and Norges Bank 18 Norges Bank 3-month interest rate differential and import-weighted exchange rate (I-44) 5 A fall in value denotes a depreciating currency. Daily figures 4 88 3 91 I-44 (right-hand scale) 2 1 0 85 94 97 Weighted 3-month interest rate differential (left-hand scale) 8 Aug 2005 100 19 Sept 2005 -1 2002 103 2003 2004 2005 2006 Sources: Norges Bank and Bloomberg 19 Norges Bank Projected CPI-ATE and the output gap in the baseline scenario. Quarterly figures. Per cent. 04 Q1 – 08 Q4 3 3 2 2 1 CPI-ATE 1 0 -1 -2 2004 0 Output gap -1 -2 2005 2006 2007 2008 Sources: Statistics Norway and Norges Bank, IR 2/05 20