Charts in PowerPoint.

advertisement

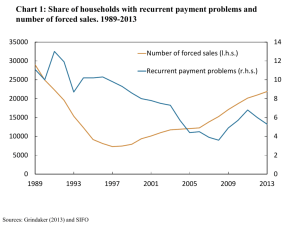

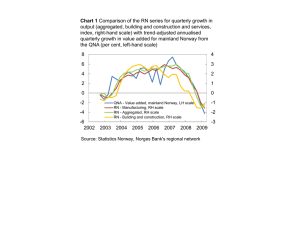

Norges Bank Financial Stability November 2005 Summary Chart 1 Household debt burden 1) in selected countries. Annual figures. 1990 – 2004 250 250 Denmark 200 200 Iceland 150 100 Norway UK US 150 100 Sweden 50 50 1990 1992 1994 1996 1998 2000 2002 2004 Debt as percentage of disposable income. Loan debt as percentage of liquid disposable income for Norway. 1) Sources: OECD, Bank of England, Sveriges Riksbank, Danmarks Nationalbank, Sedlabanki Island and Norges Bank Chart 2 Banks’ Tier 1 capital ratio and pre-tax profit as a percentage of average total assets1). Annual figures.1998 – 2005 1.6 10 Tier 1 capital ratio 9 1.4 (right-hand scale) 8 1.2 7 1.0 6 0.8 5 Profit before loan 4 0.6 losses (left-hand Profit after loan losses 3 scale) (left-hand scale) 0.4 2 0.2 1 0.0 0 1998 1999 2000 2001 2002 2003 2004 20052) 1) Excluding branches of Norwegian banks abroad 2) As of September 2005 Source: Norges Bank Chart 3 Banks’1) lending margins on loans to households and non-financial enterprises. Per cent. Quarterly figures. 02 Q1 – 05 Q3 4 4 Non-financial enterprises 3 2 1 3 2 Households 0 1 0 Mar 02 Sep 02 Mar 03 Sep 03 Mar 04 Sep 04 Mar 05 Sep 05 1) All banks in Norway Source: Norges Bank Chart 4 Credit to mainland Norway. Per cent. Twelvemonth growth. Jan 97 – Sep 05 28 24 Households2) 20 16 Total credit (C3) 12 8 4 Non-financial enterprises1) 0 -4 1997 1998 1999 2000 2001 2002 2003 2004 2005 1) All foreign credit to mainland Norway assumed given to enterprises 2) Household domestic debt Source: Norges Bank 28 24 20 16 12 8 4 0 -4 Chart 5 Equity-to-assets ratio and pre-tax return on equity for companies listed on Oslo Stock Exchange.1) Per cent. Quarterly figures. 04 Q1 – 05 Q2 50 50 40 40 Equity-to-assets ratio 30 30 20 20 10 10 0 0 -10 -10 Return on equity -20 -20 2002 2003 2004 2005 1) Companies registered in Norway with the exception of banks, insurance companies, Statoil and Hydro Sources: Statistics Norway, Statoil, Hydro and Norges Bank Chart 6 Growth in household credit. Estimate with fan chart.1) Quarterly figures. Per cent. 03 Q1 – 08 Q4 15 15 10 10 30% 50% 70% 90% 5 0 2003 5 0 2004 2005 1) The 2006 2007 2008 bands in the fan chart indicate different probabilities for credit growth. The probabilities are among other factors computed based on deviations between estimated and actual credit development during the period 94 Q3 – 05 Q2 Source: Norges Bank Chapter 1 Chart 1.1 Forecasts for real GDP growth in 2005 and 2006 as of May and October 2005. Per cent World 2006 October 2006 May Western Europe 2005 October North America 2005 May Japan China 0 1 2 3 4 5 6 7 8 9 10 Source: Consensus Forecasts Chart 1.2 International equity indices. Index 2005 = 100. Daily figures. 1 Jan 01 – 29 Nov 05 150 150 Europe Stoxx 130 Japan Topix 130 110 110 90 90 70 70 50 Norway OSEBX US S&P 500 30 2001 2002 Source: EcoWin 50 30 2003 2004 2005 Chart 1.3 GDP and stock prices (price indices) in the US. Logarithmic scale. Index 1 Jan 1947 = 100. Monthly figures. Jan 45 – Oct 05 100000 100000 10000 10000 S&P 500 1000 100 1000 GNP 100 10 10 1945 1955 1965 1975 1985 1995 2005 Source: EcoWin Chart 1.4 US: Mortgage rate in per cent. Interest and instalments on mortgages as percentage of disposable income. Monthly figures. Jan 80 – Oct 05 14 13 Debt servicing ratio 12 11 30-year fixed mortgage rate 10 9 8 Floating mortgage 7 rate 6 5 4 1980 1984 1988 1992 1996 2000 2004 Source: EcoWin 14 13 12 11 10 9 8 7 6 5 4 Chart 1.5 Household saving ratio in 2004 in per cent. Total rise in house prices in percentage of disposable income. 99 Q4 – 04 Q4 15 Saving ratio 10 Germany Sweden Japan Norway1) 5 US 0 Canada -5 -10 Australia New Zealand2) -15 -30 0 30 60 90 Rise in house prices 1) Estimated reinvested dividend payments since 2001 excluded from the saving ratio 2) Saving ratio during the financial year March 2003 – March 2004 Sources: OECD, EcoWin, Statistics New Zealand and Norges Bank Chart 1.6 The market for crude oil derivates (NYMEX). Open contracts and non-commercial actors` share. Oil price indices. 95 Q1 = 20. Weekly figures. Week 13 1995 – week 46 2005 2000 100 Number of open contracts (1000, left-hand scale) 1600 1200 Share of noncommercial actors (right-hand scale) 80 60 800 40 400 20 Oil price, spot (right-hand scale) 0 1995 0 1997 1999 Sources: CFTC and EcoWin 2001 2003 2005 Chart 1.7 Developments in some asset classes during substantial falls in share prices 1998 - 2005.1) Indexed, low point = 100. Days before/after low point 112 112 S&P 500, stock index 109 109 106 106 Hedge fund index Bond index, low credit-worthiness 103 100 Government bond index Bond index, high credit-worthiness 97 103 100 97 -40 -30 -20 -10 0 1)Average 10 20 30 of 22 periods with more than a 5 per cent fall in S&P 500. Indices for the US, except the global hedge fund index Sources: EcoWin and Norges Bank Chart 1.8 Sub-indices on the Oslo Stock Exchange during 1998-2000 and 2003-2005. Daily figures 375 375 8 Oct 1998-14 Sept 26 Feb 2003-18 Nov 2005 300 300 225 225 150 150 75 75 0 0 Consum. Energy Finance Health Ind./mat. Source: EcoWin ICT Chart 1.9 Market value by sector on the Oslo Stock Exchange. Billions NOK 1400 Other 1200 IT and telecom. Finance 1000 800 600 Consumer goods Industry and material Energy 400 200 0 30 Sept 2000 31 Oct 2005 Sources: Oslo Stock Exchange and Norges Bank Chart 1.10 Foreign owners’ share on the Oslo Stock Exchange and developments on the Oslo Stock Exchange. Index 31 Dec 95 = 100. Monthly figures. Des 94 – Oct 05 350 300 38 36 34 32 30 28 26 24 22 Foreign owners’ share (right-hand scale) 250 200 150 100 50 0 1995 Oslo Stock Exchange (left-hand scale) 1997 Source: EcoWin 1999 2001 2003 2005 Chart 1.11 Selected valuation indicators for the Norwegian stock market. Monthly figures. Jan.97 – Oct. 05 30 25 30 P/E forward looking 25 P/E historical 20 20 15 15 10 10 5 E/P-10 year government bond rate 5 0 0 -5 -5 jan.97 jan.99 jan.01 jan.03 jan.05 Sources: EcoWin, Thomson Financials and Norges Bank Chart 1.12 Dividend payments and repurchase of shares on the Oslo Stock Exchange in billions of NOK (left-hand scale). Return on equity in per cent. Stock indices, 1984 = 5. Yearly figures. 1984 – 2004 50 40 Repurchase Dividend payments 30 Return on equity (right-hand scale) 20 10 27 21 15 9 Stock indices (left-hand scale) 3 0 -3 1984 1989 1994 1999 Sources: EcoWin and Norges Bank 2004 Box: Are equity prices more volatile in Norway Chart 1 Volatility in the US, European and Norwegian equity markets during 1989-2005. Measured over different time horizons, annualised 0.4 Norway (OSEAX) 0.3 0.2 US (S&P 500) Europe (Stoxx 600) 0.1 0 Day Month Quarter Sources: EcoWin and Norges Bank Year Chart 2 Volatility in the Norwegian equity market based on market value-weighted and equal-weighted indices1). Daily figures. 1989-2004 0.4 0.4 Market value-weighted indices 0.3 0.3 0.2 0.2 0.1 0.1 Equal-weighted indices 0.0 1989 0.0 1991 1)Moving 1993 1995 1997 1999 2001 2003 average over 100 days, non-weighted observations Sources: Bernt Arne Ødegaard (2005): ”Asset Pricing at the Oslo Stock Exchange. ASource Book” and Norges Bank Chart 3 Daily volatility in the US, European and Norwegian equity markets. Daily figures. 1989-2005.1) Annualised. 0.5 0.4 0.5 US (S&P 500) Norway (OSEAX) 0.4 0.3 0.3 0.2 0.2 0.1 0.1 Europe (Stoxx 600) 0 0 Differential against -0.1 1989 Norway2) -0.1 1991 1)Moving 2) Yearly 1993 1995 1997 1999 2001 2003 average over 100 days, non-weighted observations average of differentials against US and Europe Sources: EcoWin and Norges Bank 2005 Chart 4 Daily volatility in selected sub-indices in Norway and US. 1996-2005. Annualised. Per cent ICT Energy Cons. goods Industry/materials Finance Utilities 1) OSEAX S&P 500 Total index 0 5 10 15 20 25 30 35 40 45 1)Utilities excluded for Norway, because of the low number of enterpises Sources: EcoWin and Norges Bank Chapter 2.1 Chart 2.1 Mainland GDP growth, real interest rate1) and oil price 2). Yearly figures. 1987-2008.3) Per cent 12 70 Real interest rate 10 Oil price4) (right-hand scale) 50 8 6 60 40 GDP growth 4 30 20 2 10 0 0 1987 1990 1993 1996 1999 2002 2005 2008 1) 3-month money market rate deflated by inflation measured by the CPI-ATE 2) USD per (Brent Blend) crude oil. Spot price 3) Projections for 2005 - 2008 4) 2005-figures are based on monthly observations until november. Figures for 2006 – 2008 are forward prices per 28 November 2005 Sources: Statistics Norway and Norges Bank Chart 2.2 Credit as a percentage of GDP. Quarterly figures. 87 Q1 – 05 Q3 180 180 Total credit to mainland Norway2 170 170 160 160 150 150 140 140 130 130 120 Credit from domestic sources (C2)2) 110 1987 1) 2) 1990 1993 1996 Percentage of GDP Percentage of mainland GDP Source: Norges Bank 120 Total credit (C3)1) 1999 2002 110 2005 Chapter 2.2 Chart 2.3 Growth in household debt.1) Per cent. Jan 97 – Oct 05 20 15 Mortgage loans Domestic credit to households 20 15 10 10 5 5 Other loans 0 0 -5 1997 1998 1999 2000 2001 2002 2003 2004 2005 -5 1) Twelve-month growth in domestic credit. Four-quarter growth in mortgage loans and other loans Source: Norges Bank Chart 2.4 Household debt as a percentage of disposable income divided into deciles by aftertax income. 1987 – 2003 250 200 250 Decile 10 200 Decile 7-9 150 100 50 1987 Total 150 100 Decile 1-6 1991 1995 1999 Sources: Statistics Norway and Norges Bank 50 2003 Chart 2.5 Housing turnover and housing starts in thousands. 12-month growth in house prices in per cent. The time it takes to sell a dwelling measured in number of days. Monthly figures. Jan 99 – Oct 05 55 45 Housing turnover The time it takes to sell a dwelling 35 25 15 55 45 35 Housing starts House prices 25 15 5 5 -5 1999 2000 2001 2002 2003 2004 2005 -5 Sources: Statistics Norway, ECON, FINN.no, Association of Norwegian Real Estate Agents (NEF), Association of Real Estate Agency Firms (EFF) and Norges Bank Chart 2.6 Transactions in household debt and in financial assets1) by investment instrument. Sum last four quarters. Billions NOK. Quarterly figures. 97 Q1 – 05 Q2 160 160 Transactions in debt 120 120 Other 80 Insurance claims Securities 40 80 40 Bank deposits 0 1997 1) Excluding 0 1999 2001 2003 2005 estimated reinvested dividend payments since 2001 Source: Norges Bank Chart 2.7 Household net financial wealth to income ratio1) incl. and excl. insurance claims.2) Quarterly figures. 87 Q1 – 05 Q2 70 50 30 70 Net financial wealth to income ratio 50 30 10 10 -10 -10 -30 -30 -50 Net financial wealth to income ratio excl. insurance claims -50 -70 -70 1987 1990 1993 1996 1999 2002 2005 Net financial assets as a percentage of disposable income. Disposable income adjusted for estimated reinvested dividend payments since 2001. 2) Break in the series 1995 Q4 1) Sources: Statistics Norway and Norges Bank Chart 2.8 Average after-tax income, debt and gross financial assets1) by age group. 1000 NOK. 2003 900 After-tax income 900 Debt Gross financial assets 600 600 300 300 1) Gross financial assets excl. group insurance claims Source: Statistics Norway Over 79 years 67-79 years 55-66 years 45-54 years 35-44 years 25-34 years 0 under 25 years 0 Chart 2.9 Household saving rate and net financial investment1) as a percentage of disposable income. Yearly figures. 1996 – 2004 10 10 Saving rate 8 6 6 4 4 2 2 0 0 -2 -4 Net financial investments (national accounts) -2 Net financial investments (financial accounts) 1996 1) 8 1998 2000 2002 -4 2004 Excluding estimated reinvested dividend payments since 2001 Source: Statistics Norway and Norges Bank Chart 2.10 Household borrowing and mortgage equity withdrawal1). Billions NOK. Annual figures. 1997 – 2005 160 160 Mortgage equity withdrawal Household borrowing 120 120 80 80 40 40 0 0 1997 1999 2001 2003 2005 2) Mortgage equity withdrawal is measured as change in the stock of mortgages less housing investment 1) 2) Annualised figures based on figures for the first half of 2005 Sources: Statistics Norway and Norges Bank Chart 2.11 Model projections and uncertainty for house prices.1) 4-quarter growth. Per cent. 03 Q1 – 08 Q4 20 20 30% 50% 70% 90% 15 15 10 10 5 5 0 0 -5 -5 -10 2003 -10 2004 2005 2006 2007 2008 1) The bands in the fan chart indicate different probabilities for developments in house prices. The probabilities are computed based on factors such as the deviations between estimated and actual developments in house prices during the period 90 Q2 – 05 Q2 Sources: NEF, EFF, FINN.no, ECON and Norges Bank Chart 2.12 Household debt burden1). Quarterly figures. 87 Q1 – 08 Q4 220 220 200 200 180 180 160 160 140 140 120 120 100 1987 100 1991 1995 1) Loan 1999 2003 2007 debt as a percentage of liquid disposable income (disposable income less the return on insurance claims) Source: Norges Bank Chart 2.13 Household interest burden1) and household borrowing rate after tax. Quarterly figures. 87 Q1 – 08 Q4 12 10 12 Interest burden High interest rate scenario Baseline scenario 8 Low interest rate scenario 10 8 6 6 4 4 Borrowing rate after tax 2 0 1987 Baseline scenario 2 0 1991 1995 1999 2003 2007 Interest expenses after tax as a percentage of liquid disposable income (disposable income less return on insurance claims) plus interest expenses 1) Source: Norges Bank Box: Macroeconomic gap indicators Chart 1 Real house prices1), index, 1819=100, and trend2). Real house price gap. Per cent. 1946-2005 1400 120 1200 Trend (left-hand scale) 1000 800 600 Real house prices (left-hand scale) 60 30 400 200 90 0 Gap (right-hand scale) 0 -30 1945 1955 1965 1975 1985 1995 2005 House price index deflated by consumer price index. Projections for 2005 2) The trend is calculated using a Hodrick-Prescott filter and a recursive method on data for the period 1819-2005 1) Source: Statistics Norway and Norges Bank Chart 2 Credit as a percentage of GDP1) and trend2). Credit gap. Percentage points. 1946-2005 180 120 Credit as a percentage of GDP (left-hand scale) 90 120 60 Trend (left-hand scale) 30 60 0 0 1945 Gap (right-hand scale) 1955 1965 1975 1985 -30 1995 2005 Total credit to municipalities, non-financial enterprises and households measured as a percentage of GDP. From 1995, total credit to mainland Norway as a percentage of mainland GDP (market value). Projections for 2005 2) The trend is calculated using a Hodrick-Prescott filter and a recursive method on data for the period 1819-2005 1) Sources: Statistics Norway and Norges Bank Chart 3 Gross fixed investment as a percentage of GDP1) and trend2). Investment gap. Per cent. 1946-2005 40 90 Trend (left-hand scale) 30 20 60 Gross fixed investment (left-hand scale) 30 10 0 1945 0 Gap (right-hand scale) 1955 1965 1975 1985 -30 1995 2005 Total gross fixed investment excl. changes in inventories/statistical deviations measured as percentage of GDP. From 1970, mainland gross fixed investment as a percentage of mainland GDP (market value). Projections for 2005 2) The trend is calculated using a Hodrick-Prescott filter and a recursive method on data for the period 1819-2005 1) Sources: Statistics Norway and Norges Bank Chapter 2.3 Chart 2.14 Key figures for enterprise sector.1) Annual figures. Per cent. 1989 – 2004 100 80 60 Equity-to-assets ratio (left-hand scale) Borrowing rate2) 20 Pre-tax return om equity Return on total assets 16 12 40 8 20 4 0 0 1989 1991 1993 1995 1997 1999 2001 2003 Public corporations excluding enterprises in the oil and gas industry, finance sector and holding companies 2) Interest expenses as a percentage of total debt 1) Source: Norges Bank Chart 2.15 Return on total assets.1) Average. Per cent All Prop. man. Com. serv. Tele- and data 2004 2003 89-02 Hotel and rest. Retail trade Construction Manufacturing Fish farming Fishing -20 -15 -10 -5 1) Public 0 5 10 15 20 corporations excluding enterprises in the oil and gas industry, financial sector and holding companies Source: Norges Bank Chart 2.16 Predicted bankruptcy probability1) for non-financial enterprises.2) Per cent. Yearly figures. 1989 – 2004 6 6 5 5 80 percentile3) 4 3 2 4 3 Median enterprise 1 2 1 0 0 1989 1991 1993 1995 1997 1999 2001 2003 1) Probability of bankruptcy within three years. The level of bankruptcy probability for 2004 has been adjusted for missing accounts 2) Excluding enterprises in the oil and gas industry and public sector 3) The enterprise with higher bankruptcy probability than 80 per cent of the enterprises and lower bankruptcy probability than 20 per cent of the enterprises Source: Norges Bank Chart 2.17 Risk-weighted debt1) as a percentage of bank debt in selected industries and total2). Annual figures. 1999 – 2004 2.0 2.0 Retail trade 1.5 1.5 Commercial services 1.0 1.0 Property management 0.5 0.0 1999 Total3) Manufacturing4) 2000 2001 2002 2003 0.5 0.0 2004 Risk-weighted debt is calculated as bankruptcy probability multiplied by bank debt for each enterprise and then aggregated for all enterprises 2) The 2004-level has been adjusted for missing accounts 3) Non-financial enterprises excluding enterprises in the oil and gas industry and holding companies 4) Excluding mining 1) Source: Norges Bank Chart 2.18 Growth in credit to mainland nonfinancial enterprises. 12-month growth. Per cent. Monthly figures. Jan 02 – Sep 05 12 12 Domestic credit 8 8 Total credit 4 4 0 0 -4 -4 -8 -8 -12 2002 Credit from foreign sources -12 2003 Source: Norges Bank 2004 2005 Chart 2.19 Enterprises’ assets and financing.1) Stock. Billions of NOK. Yearly figures. 1999 – 2004 4 000 4 000 3 000 3 000 2 000 2 000 1 000 1 000 0 0 -1 000 -1 000 -2 000 -2 000 -3 000 -3 000 -4 000 -4 000 1999 2000 2001 2002 2003 2004 Short-term loans Paid-in equity Tangible fixed assets Fixed financial assets Long-term loans Retained earnings Intangible assets Current assets Public corporations with the exception of enterprises in the oil and gas industry, financial sector and holding companies 1) Source: Norges Bank Chart 2.20 Equity-to-assets ratio.1) Average. Per cent All Property man. Com. serv. Tele and data Hotel and res. Retail trade Construction Manufacturing Fish farming Fishing 2004 2003 89-02 0 1) Public 10 20 30 40 50 corporations with the exception of enterprises in the oil and gas industry, financial sector and holding companies Source: Norges Bank Chart 2.21 Dividend payments in non-financial public corporations1) Annual figures. 1988 – 2004 50 40 10 Share of enterprises with dividend payments in per cent (left-hand scale) 8 30 6 20 4 10 Dividend payments as a percentage of equity (right-hand scale) 2 0 0 1988 1990 1992 1994 1996 1998 2000 2002 2004 1) Except oil/gas, offshore, public sector and holding companies Source: Norges Bank Chart 2.22 Non-financial enterprises’ debt to other sectors. Stock. Billions of NOK. Quarterly figures. 96 Q1 – 05 Q2 500 400 500 Bank loans Bonds and notes Foreign loans 300 400 300 200 200 100 100 Loans from other financial institutions 0 1996 0 1998 Source: Norges Bank 2000 2002 2004 Chart 2.23 Total sales from commercial property in Norway distributed by investor type. Billions of NOK. 2002 – 2005 35 All Other Private Foreigners Property fund Property company Life assurance company Syndicate company 30 25 20 15 10 5 0 2002 1) Annual 2003 2004 2005 1) projections based on actual figures at 2005 3Q Sources: DnB NOR Næringsmegling and Norges Bank Chart 2.24 Pre-tax debt burden in selected industries. Per cent of cash surplus. Yearly figures. 1994 – 2004 600 500 Property management (right-hand scale) Manufacturing1 ) 1200 400 300 800 200 100 0 1994 1) 1600 Commercial services 1996 Excluding mining Source: Norges Bank 1998 Retail trade 2000 2002 400 0 2004 Chart 2.25 The share of enterprises going bankrupt in per cent and interest burden1) in non-financial enterprises2). Yearly figures. 1991― 20083) 1 0.8 Interest burden (right-hand scale) 0.6 0.4 0.2 Bankruptcies (left-hand scale) 0 1991 1994 1997 2000 2003 2006 Interest expenses as a percentage of cash surplus. Cash surplus = value added – labour costs + net capital income 2) Excluding oil and gas sector and shipping abroad 3) Projections for 2005 - 2008 1) Sources: Statistics Norway and Norges Bank 80 70 60 50 40 30 20 10 0 Box: Developments in house prices Chart 1 House prices. Percentage change. Past 10 years and past 5 years. Quarterly figures1) US Past 10 years Denmark Past 5 years Norway Sweden UK Germany 0 50 100 150 200 Calculated using the latest available observation from each country 1) Sources: EcoWin, FINN.no, ECON, NEF and EFF 250 Chart 2 House prices deflated by the house rent index in the CPI, building costs, household disposable income and total wage income. Indexed, 1985=100. Annual figures. 1985-20051) 200 175 150 125 100 75 50 25 0 Deflated by house rents Deflated by building costs Deflated by disposable income Deflated by total wage income 200 175 150 125 100 75 50 25 0 1985 1988 1991 1994 1997 2000 2003 1) Projections for 2005 Sources: Statistics Norway, NEF, EFF, FINN.no, ECON and Norges Bank Chart 3 House prices and calculated contributions from wage income, housing stock (building starts), unemployment, interest rate and expectation variable. Contributions in percentage points to 4-quarter growth 40 30 40 Wage income Unemployment Housing stock Expectations Interest rate House prices 30 20 20 10 10 0 0 -10 -10 -20 -20 03 Q1 03 Q3 04 Q1 04 Q3 05 Q1 05 Q3 Sources: NEF, EFF, FINN.no, ECON and Norges Bank Box: Distribution of household debt, income and financial assets Chart 1 Debt, disposable income and financial assets1). Average. Indebted households. Thousands of NOK. 1986-2003 700 700 600 600 500 Debt 400 500 400 300 Disposable income 200 300 200 Financial assets 100 100 0 0 1986 1988 1990 1992 1994 1996 1998 2000 2002 1) Exclusive group insurance claims Sources: Statistics Norway and Norges Bank Chart 2 Pre-tax income and debt in indebted households in 2003. Thousands of NOK 5000 4000 Debt above three times pre-tax income Debt 3000 2000 Debt below three times pre-tax income 1000 0 0 400 800 Pre-tax income Source: Statistics Norway and Norges Bank 1200 Chart 3 Share of debt distributed by debt burden. Per cent. 1987 and 2003 25 1987 2003 Per cent of debt 20 15 10 5 0 <1 1-2 2-3 3-4 4-5 5-6 6-7 7-8 >8 Debt burden Source: Statistics Norway and Norges Bank Chart 4 Debt and financial assets in indebted households in 2003. Thousands of NOK 5000 Debt 4000 3000 2000 1000 0 0 200 400 600 Financial assets Source: Statistics Norway and Norges Bank 800 1000 Share of financial wealth Chart 5 Share of financial wealth distributed by debt burden. Per cent. 1987 and 2003 35 30 25 20 15 10 5 0 1987 2003 No 0-0.5 0.5-1 debt 1-2 2-3 3-4 4-5 Debt burden Source: Statistics Norway and Norges Bank >5 No inc. Chapter 3 Chart 3.1 Banks’1) profit/loss. Percentage of average total assets. Annual figures. 2000 – 2005 4 3 2 1 0 -1 -2 -3 Q1 – Q3 2000 2001 2002 2003 2004 2004 2005 Net interest income Operating expenses Write-down etc. 1) Other operating income Loan losses Pre-tax profit/loss Excluding branches of foreign banks in Norway Source: Norges Bank 4 3 2 1 0 -1 -2 -3 Chart 3.2 Banks’1) gross stock of non-performing loans to households and enterprises. Percentage of gross lending to households, non-financial enterprises and municipalities. Quarterly figures. 00 Q1 – 05 Q3 2.0 2.0 1.5 1.5 Enterprises 1.0 1.0 0.5 0.0 2000 1) All 0.5 Households 0.0 2001 2002 banks in Norway Source: Norges Bank 2003 2004 2005 Chart 3.3 Banks’1) interest margin and 12-month growth in lending to households, non-financial enterprises and municipalities in per cent. Quarterly net interest income in billions. 01 Q4 – 05 Q3 4 3 Interest margin (left-hand scale) Growth in lending (right-hand scale) 14 12 10 Net interest income (right-hand scale) 2 8 6 4 1 2 0 0 Dec 01 Jun 02 Dec 02 Jun 03 Dec 03 Jun 04 Dec 04 Jun 05 1) All banks in Norway Source: Norges Bank Chart 3.4 Banks’1) other operating income. Billions of NOK. Annual figures. 1996 – 2005 8 8 Payment services Net other commission income 6 6 Other 4 4 2 2 Net capital gains 0 1996 1999 1) All banks in Norway 2) The 2005 Q3 figures are annualised Source: Norges Bank 2002 20052) 0 Chart 3.5 Banks’1) deposit and lending margins, and total interest margin.2) Per cent. Quarterly figures. 00 Q1 – 05 Q3 4 4 Total interest margin 3 3 Lending margin 2 1 1 Deposit margin 0 2000 0 2001 2002 1) All 2) 2 2003 2004 banks in Norway Moving average over the past four quarters Source: Norges Bank 2005 Chart 3.6 Banks’1) interest margins in the Scandinavian countries. Per cent. Quarterly figures for Norway and Sweden. 01 Q4 – 05 Q3. Annual figures for Denmark. 2001 – 2004 4 4 Sweden 3 3 Norway Denmark 2 2 1 1 0 0 des 01 jun 02 des 02 jun 03 des 03 jun 04 des 04 jun 05 1) All banks in Norway. The large banks in Sweden. About 50 of the largest banks in Denmark Sources: Sveriges Riksbank, Danmarks Nationalbank and Norges Bank Chart 3.7 Norwegian banks’1) capital adequacy and Tier 1 capital ratio. Per cent. Quarterly figures. 01 Q4 – 05 Q3 14 14 Capital adequacy 12 10 10 8 12 Tier 1 capital ratio 8 6 6 4 4 2 2 0 0 Dec 01 Jun 02 Dec 02 Jun 03 Dec 03 Jun 04 Dec 04 Jun 05 1) Excluding branches of foreign banks Source: Norges Bank Chart 3.8 Distribution of banks’1) lending to retail and corporate markets. Percentage of gross lending. Quarterly figures. 97 Q1 – 05 Q3 100 Retail market 90 80 70 60 Primary industries 50 40 Property management 30 Transport2) 20 Manufacturing and construction3) 10 Retail trade4) 0 1997 1999 2001 2003 2005 1) All 100 90 80 70 60 50 40 30 20 10 0 banks in Norway Includes other services 3) Includes electricity and water supply, mining and oil and gas production 4) Includes hotel and restaurant 2) Source: Norges Bank Chart 3.9 Growth in banks’1 ) lending to the corporate sector. Twelve-month growth. Per cent. Monthly figures. Dec 03 – Oct 05 25 20 Fokus Bank, Handelsbanken and SpareBank 1 SR-Bank 25 20 15 15 10 10 5 All banks 5 0 0 -5 -5 DnB NOR and Nordea -10 Dec 03 Mar 04 Jun 04 Sep 04 Dec 04 Mar 05 Jun 05 Sep 05 1) All banks in Norway Source: Norges Bank -10 Chart 3.10 Banks’1) lending to selected industries. 4-quarter growth. Per cent. 01 Q4 – 05 Q3 20 20 Construction, electricity- and water supply 15 10 Property management 5 0 -5 15 10 5 0 Manufacturing -10 -15 Retail trade, hotel and restaurant Dec 01 Jun 02 Dec 02 Jun 03 Dec 03 Jun 04 Dec 04 Jun 05 1) All banks in Norway Source: Norges Bank -5 -10 -15 Chart 3.11 Average daily turnover and liquidity in Norges Bank’s settlement system. In billions of NOK (left-hand scale) and as a ratio (right-hand scale). Annual figures. 2000 – 2005 250 3 200 2 150 100 1 50 0 0 2000 2001 2002 2003 2004 20051) Turnover Turnover / liquidity 1) Q1 – Q3 Source: Norges Bank Liquidity (start of day) Chart 3.12 Norwegian banks’1) financing. Percentage of gross lending. Quarterly figures. 00 Q1 – 05 Q3 40 30 40 Deposits from retail sector Deposits from corporate sector 30 Bonds 20 20 10 10 0 2000 Deposits/loans from financial institutions 2001 2002 1) All Notes and short-term paper 0 2003 2004 2005 banks except branches and subsidiaries of foreign banks in Norway Source: Norges Bank Chart 3.13 Developments in Norwegian banks’1) liquidity indicator. Quarterly figures. 00 Q1 – 05 Q3 110 110 DnB NOR 100 90 80 2000 100 Other Norwegian banks 90 80 2001 2002 1) All 2003 2004 2005 banks except branches and subsidiaries of foreign banks in Norway Source: Norges Bank Chart 3.14 Norwegian banks’1) short-term foreign debt.2) Percentage of gross lending. Quarterly figures. 00 Q1 – 05 Q3 25 25 DnB NOR 20 20 15 15 10 10 Other Norwegian banks 5 0 2000 5 0 2001 2002 1) All 2003 2004 2005 banks except branches and subsidiaries of foreign banks in Norway 2) Deposits and loans from other financial institutions and shortterm paper Source: Norges Bank Chart 3.15 Developments in interest margin for the five largest Norwegian banks1) in two scenarios. Per cent. Annual figures. 2003 – 2008 3 3 Normal scenario 2.5 2 2 Historical 1.5 2.5 Crisis scenario 1.5 1 1 0.5 0.5 0 0 2003 2004 2005 2006 2007 2008 DnB NOR Bank, SpareBank 1 SR-Bank, Sparebanken Vest, SpareBank 1 Nord-Norge and SpareBank 1 Midt-Norge 1) Source: Norges Bank Chart 3.16 Capital adequacy in per cent (left-hand scale) and profit/loss as a percentage of average total assets (right-hand scale) for the five largest Norwegian banks.1) Annual figures. 2005 – 2008 14 12 10 8 6 4 2 0 1.0 0.5 0.0 -0.5 -1.0 2005 2006 2007 2008 Capital adequacy normal scenario Capital adequacy crisis scenario Profit/loss normal scenario Profit/loss crisis scenario DnB NOR Bank, SpareBank 1 SR-Bank, Sparebanken Vest, SpareBank 1 Nord-Norge and SpareBank 1 Midt-Norge 1) Source: Norges Bank Box: Foreign banks in Norway Chart 1 Branches and subsidiaries of banks from other EEA countries. Percentage of total assets. 1997 and 2004 60 55 50 45 40 35 30 25 20 15 10 5 0 1997 2004 Germ. Sweden Netherl. Denm. Belgium UK Norway Ireland Finland1) The sharp rise in Finland in 2004 is due to Nordea, which became a Finnish rather than Swedish registered bank 1) Sources: ECB and Norges Bank