Figurer til Inflasjonsrapporten 4/2000 Oppdatert sist

advertisement

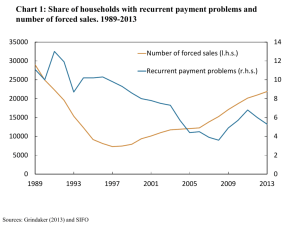

Charts for Inflation Report 2/2003 Summary Chart 1 Projected CPI-ATE and output gap1) with a sight deposit rate of 4 per cent and import-weighted krone exchange rate equal to the average for 3/6-19/6 (I-44= 93.5). Per cent 3 3 2 CPI-ATE 1 2 1 Output gap 0 0 -1 -1 -2 -2 2002 2003 2004 2005 1) The output gap is a measure of the difference between actual and trend output. See box in IR 1/03 Sources: Statistics Norway and Norges Bank Chart 2 Projected CPI-ATE and output gap1) with forward interest rate and gradual exchange rate depreciation of 3 per cent. Per cent 3 3 2 CPI-ATE 1 2 1 Output gap 0 0 -1 -1 -2 -2 2002 2003 2004 2005 1) The output gap is a measure of the difference between actual and trend output. See box in IR 1/03 Sources: Statistics Norway and Norges Bank Chart 3 Projected CPI-ATE with forward interest rate and gradual exchange rate depreciation of 3 per cent. 12-month rise. Per cent 4 3 4 Forward interest rate and forward exchange rate CPI-ATE 2 2 Forward interest rate and forward exchange rate without impact on wage growth 1 0 2001 3 1 0 2002 2003 2004 2005 Sources: Statistics Norway and Norges Bank Chart 1.1 Mainland GDP. In billions of 2000-NOK. Seasonally adjusted. 1998 Q1 - 2003 Q1 300 300 290 290 280 280 270 270 260 260 250 250 240 1998 240 1999 2000 Source: Statistics Norway 2001 2002 2003 Chart 1.2 Three-month money market rates in the US and Norway. Jan 1995 - May 2003 10 10 8 8 Norway 6 6 4 4 US 2 0 1995 2 0 1997 1999 Sources: EcoWin and Norges Bank 2001 2003 Chart 1.3 Employed persons according to LFS. In millions. Seasonally adjusted. Jan 98 - March 03 2.30 2.30 2.28 2.28 2.26 2.26 2.24 2.24 2.22 1998 2.22 1999 2000 Source: Statistics Norway 2001 2002 2003 Chart 1.4 Unemployed (LFS), registered unemployed and persons participating in labour market programmes. Percentage of labour force. Seasonally adjusted1). Jan 95 - May 03 8 8 Registered unemployed and labour market programmes 6 LFS unemployment 4 Registered unemployed 2 0 1995 1) LFS 6 4 2 0 1997 1999 2001 2003 unemployment: 3-month moving average Sources: Statistics Norway and the Directorate of Labour Chart 1.5 Annual wage growth in Norway. Including costs of additional vacation days. Per cent. 19962003 7 7 6 6 5 5 4 4 3 3 2 2 1 1 0 0 1996 1997 1998 1999 2000 2001 2002 2003 Sources: Technical Reporting Committee on Income Settlements (TRCIS) and Norges Bank Chart 1.6 Prices for consumer goods adjusted for tax changes and excluding energy products (CPI-ATE). Total1) and by supplier sector2). 12-month rise. Per cent. Jan 99 - May 03 6 6 Goods and services produced in Norway 4 4 2 CPI-ATE 0 0 -2 -2 Imported consumer goods -4 1999 -4 2000 2001 2002 2003 1) Norges Bank's estimates up to and including July 2000, thereafter figures published by Statistics Norway 2) 2 Norges Bank's estimates Sources: Statistics Norway and Norges Bank Chart 1.7 Prices for some imported consumer goods adjusted for tax changes. 12-month rise. Per cent. Jan 99 - May 03 6 6 Cars 3 0 Clothing and footwear -3 -6 0 -3 -6 Audio-visual equipment -9 -12 1999 3 -9 -12 2000 2001 2002 2003 Sources: Statistics Norway and Norges Bank Chart 1.8 Prices for some imported consumer goods adjusted for tax changes. Annual figures. Index. 1990=100 140 140 Footwear 120 120 Domestic appliances 100 80 Clothing Audio-visual equipment 60 100 80 60 1990 1992 1994 1996 1998 2000 2002 Sources: Statistics Norway and Norges Bank Chart 1.9 CPI-ATE. Goods and services produced in Norway. 12-month rise. Per cent. Jan 99 - May 03 8 8 Services with wages as dominating price factor 6 6 House rent 4 4 Other services 2 2 Consumer goods produced in Norway excluding energy products1) 0 0 1999 1) Excluding 2000 2001 2002 agricultural and fish products Sources: Statistics Norway and Norges Bank 2003 Chart 1.10 Consumer prices. Total and adjusted for tax changes and excluding energy products. 12-month rise. Per cent. Jan 99 - May 03 6 6 CPI-AT1) 5 5 4 4 3 3 2 2 CPI 1 0 1999 CPI-ATE1) 1 0 2000 2001 2002 2003 CPI-AT: CPI adjusted for tax changes CPI-ATE: CPI adjusted for tax changes and excluding energy products 1) Norges Bank's estimates up to and including July 2000, thereafter figures published by Statistics Norway Sources: Statistics Norway and Norges Bank Chart 1.11 Electricity prices. Index. 1 January 1998=100 350 350 300 300 Spot price including tax and grid rental 250 250 200 200 150 150 100 50 2000 100 Electricity in the CPI 50 2001 2002 2003 Sources: Statistics Norway, Nordpool, the Norwegian Water Resources and Energy Directorate and Norges Bank Chart 1.12 Import-weighted exchange rate (I-44), trade-weighted exchange rate index1) and interest rate differential against other countries. Jan 95 - May 03 5 3-month interest rate differential (left-hand scale) 4 3 90 I-44 (right-hand scale) 2 100 1 0 TWI (right-hand scale) -1 -2 1995 1) A rising 80 110 120 1997 1999 2001 curve denotes an appreciation of the krone Source: Norges Bank 2003 Chart 1.13 The krone exchange rate against EUR and USD1). Weekly figures. 12 Jan 02 - 19 June 03 6 7 6 NOK against EUR 8 9 7 8 NOK against USD 10 9 10 Jan 02 Apr 02 Jul 02 Oct 02 Jan 03 Apr 03 Jul 03 1) A rising curve denotes an appreciation of the krone Source: Norges Bank Chart 1.14 Effective exchange rates1). Index. Week 1/2002=100. Weekly figures. 4 Jan 02 -18 June 03 120 120 New Zealand 115 Euro area 115 Iceland 110 110 105 105 Norway 100 95 Jan 02 1) A rising Australia Jul 02 100 Canada Jan 03 95 Jul 03 curve denotes an appreciation of the exchange rate Source: EcoWin Chart 1.15 Three-month money market rates and forward rates, 1995-2013. Monthly figures 8 Actual Forward 6 8 6 Norway 4 4 Trading partners 2 Difference 0 -2 2 0 -2 95 97 99 01 03 05 07 09 11 13 Source: Norges Bank Chart 1.16 Developments on the Oslo Stock Exchange (OSEBX) and 5-year government bond yields. Daily figures, 01.06.02 -19.06.03 100 7 5-year government bond yields (right-hand scale) 80 6 5 60 4 OSEBX (left-hand scale) 40 Jun 02 3 Sep 02 Dec 02 Mar 03 Sources: EcoWin and Norges Bank Jun 03 Chart 1.17 Strategy intervals for the sight deposit rate and actual developments. Nov 02 - June 03 8.0 7.5 8.0 Interval in Strategy Document 3/02 7.5 7.0 7.0 6.5 6.5 6.0 Sight deposit rate 6.0 5.5 5.5 5.0 5.0 Interval in Strategy Document 1/03 4.5 4.0 Nov 02 Jan 03 Source: Norges Bank Mar 03 May 03 4.5 4.0 Chart 1.18 Interest rate expectations in the US. Actual developments and expected key rate1) 6 4 6 Key rate 1 July 02 4 24 Oct 02 2 7 Apr 03 2 28 May 03 19 June 03 0 0 1999 2000 2001 2002 2003 2004 2005 1) Based on Fed Funds futures and Eurodollar futures adjusted for the estimated spread between 3-month Libor and Fed Funds rates Source: Norges Bank Chart 1.19 Interest rate expectations in the euro area. Actual developments and expected key rate1) 6 6 Key rate 1 July 02 4 2 24 Oct 02 7 Apr 03 28 May 03 4 2 19 June 03 0 0 1999 2000 2001 2002 2003 2004 2005 1) Based on Euribor futures adjusted for the estimated spread between 3-month Euribor and Refi rates Source: Norges Bank Chart 1.20 Interest rate expectations in Norway. Actual developments and expected key rate1). 8 8 Key rate 1 July 02 25 Oct 02 6 6 7 Apr 03 4 26 May 03 4 19 June 03 2 1999 2 2000 2001 1) Based 2002 2003 2004 on FRA and currency swap markets, adjusted for estimated difference in level and credit risk in relation to the sight deposit rate Source: Norges Bank Chart 2.1 GDP growth in the US, Japan, the euro area and among Norway's trading partners combined. Seasonally adjusted growth in volume on previous quarter. Per cent 2 2 US Japan Euro area Trading partners 1 1 0 0 -1 -1 -2 -2 2001 2002 2003 Sources: EcoWin, US Department of Commerce, ESRI (Japan), EURO-OP Eurostat and Norges Bank Chart 2.2 The oil price and some financial market indicators. Index. Week 1 2002 = 100 180 160 140 180 Yield spread speculative corporate bonds/US government bonds Oil price (Brent Blend) 120 60 Jan 02 140 120 100 80 160 Long-term rates, US (10-year gov't) 80 Equities US (Wilshire 5000) Jul 02 100 60 Jan 03 Sources: EcoWin, IPE, S&P Credit Indices, Wilshire Associates and Norges Bank Chart 2.3 Projections for GDP growth among trading partners in 2003 made at different times 4 4 Consensus Forecasts 3 3 Norges Bank 2 2 1 1 0 Jan 02 0 Jul 02 Jan 03 Jul 03 Sources: Consensus Forecasts and Norges Bank Chart 2.4 Net wealth/disposable income and saving ratio in the US. Quarterly figures 19602003. Dashed lines show period averages 7 0 2 6 4 Net wealth/disposable income (left-hand scale) 6 5 8 10 4 3 1960 Saving ratio (inverted) (right-hand scale) 1970 1980 1990 12 14 2000 Sources: EcoWin, US Department of Commerce, Federal Reserve Board and Norges Bank Chart 2.5 EUR/USD exchange rate. 1 Jan 1999 - 19 June 2003 1.3 1.3 1.1 1.1 0.9 0.9 0.7 1999 0.7 2000 Source: EcoWin 2001 2002 2003 Chart 2.6 Unemployment as a share of the labour force. Seasonally adjusted. Jan 97 - May 03 15 15 Spain 13 13 Italy France 11 11 9 9 Germany 7 1997 1999 Euro area 2001 7 2003 Sources: EcoWin, EUR-OP Eurostat, Federal Labour Office (Germany), National Employment Agency (France), Istat (Italy) and Norges Bank Chart 2.7 Oil price, Brent Blend. USD per barrel. Daily figures. 40 40 IR 2/03 30 20 Futures prices 19 June 2003 10 0 1999 2000 2001 2002 2003 2004 Sources: Telerate, IPE and Norges Bank 30 20 10 0 Chart 2.8 Historical consumer price inflation and projections from Norges Bank. Annual percentage rise 1995-2005 4 4 US Euro area 2 2 Trading partners 0 0 Japan -2 1995 1997 1999 2001 2003 -2 2005 Sources: EcoWin, Bureau of Labor Statistics (US), Ministry of Public Management, Home Affairs, Posts and Telecom (Japan), EUR-OP Eurostat and Norges Bank Chart 2.9 Wage growth and rise in prices for services in the CPI. Percentage change on same quarter previous year 5 5 4 4 3 Euro area 2 1 3 2 US Services in the CPI Wage growth 1 0 0 1997 1998 1999 2000 2001 2002 2003 Sources: Datastream, EcoWin, EUR-OP Eurostat and Bureau of Labor Statistics (US) Chart 2.10 Rise in prices for goods in the CPI. Percentage change on same quarter previous year 3 3 US, excl. food and energy 2 Euro area, excl. food and energy 2 1 1 0 0 -1 -1 -2 UK Japan -2 -3 -3 1997 1998 1999 2000 2001 2002 2003 Source: Datastream Chart 2.11 Historical and expected key rates as of 19 June 20031) 6 6 4 UK Euro area 2 4 2 US Japan 0 1999 2000 2001 2002 2003 2004 1) See further details on calculation of interest rate expectations in Charts 1.18 and 1.19 Sources: EcoWin, Bloomberg, Bank of England, Bank of Japan and Norges Bank 0 Chart 3.1 Wage shares. Labour costs as a percentage of factor income 1993-2002 95 95 85 85 Manufacturing 75 65 75 Other market-oriented mainland industry 65 55 55 1993 1995 1997 1999 Sources: TRCIS and Statistics Norway 2001 Chart 3.2 Relative labour costs¹): Norway and trading partners. Deviation from average since 1970. Per cent. 1970-20032) 15 15 Local currency 0 0 Common currency -15 -15 1970 1980 1990 2000 1) Hourly labour costs in manufacturing for 2003. The estimate for relative labour costs for 2003 in a common currency is based on the exchange rate on 19 June 2003. 2) Estimates Sources: TRCIS, Ministry of Finance and Norges Bank Chart 3.3 Business confidence indicator for manufacturing. Seasonally adjusted diffusion index1). 1990 Q1 - 2003 Q1 15 15 10 10 5 5 0 0 -5 -5 -10 1990 1992 1994 1996 1998 2000 2002 1) A value -10 of less than 0 implies that the majority of manufacturing leaders expect a weaker outlook in the next quarter. Sources: Statistics Norway and Norges Bank Chart 3.4 Number of bankruptcies and vacancy rate in the office rental market1). 1991-20032) 12 6000 10 Average vacancy rate in Oslo (left-hand scale) 5000 8 4000 6 Bankruptcy proceedings initiated (right-hand scale) 4 1991 1994 3000 1997 2000 2003 1) Vacancy 2) The rate in office rental market in Oslo alone vacancy rate figure for 2003 is as of February Source: Statistics Norway and Eiendomspar AS Chart 3.5 Total domestic credit (C2) and credit to nonfinancial enterprises. 12-month growth. Jan 98 - Apr 03 20 20 Credit to non-financial enterprises 15 15 10 5 0 1998 10 Total domestic credit 5 0 1999 2000 Source: Norges Bank 2001 2002 2003 Chart 3.6 Household saving ratio and growth in real disposable income. 1990-2002 8 6 8 Saving ratio 6 4 4 2 2 Real disposable income 0 0 1990 1992 1994 1996 1998 2000 2002 Sources: Statistics Norway and Norges Bank Chart 3.7 Consumer confidence indicator1). Unadjusted figures. 1999 Q1 - 2003 Q2 45 45 Personal financial situation 30 30 15 15 0 0 -15 -30 1999 Country's economic situation Total -15 -30 2000 1) Provides 2001 2002 2003 an expression of the share with a positive assessment of the current situation and outlook for the future less the share with a negative assessment Source: TNS Gallup Chart 3.8 House prices and credit to households. 12-month rise. Per cent. Jan 98 - Apr 03 25 25 20 20 15 Credit to households 15 10 10 5 5 House prices 0 -5 1998 0 -5 1999 2000 2001 2002 2003 Sources: Norwegian Association of Real Estate Agents, Association of Real Estate Agency Firms, FINN.co, ECON and Norges Bank Chart 3.9 Household interest burden¹) and debt as a percentage of disposable income. 1980-2002 170 12 Interest burden (right-hand scale) 150 130 110 9 6 Debt (left-hand scale) 90 1980 1984 1988 1992 1996 2000 Interest expenses after tax as a percentage of disposable income plus interest expenses 1) Sources: Statistics Norway and Norges Bank 3 0 Chart 3.10 Change in structural non-oil budget balance1). 1990-2005 2 2 1 1 0 0 -1 -1 -2 -2 -3 -3 1990 1992 1994 1996 1998 2000 2002 2004 1) The budget balance as a percentage of trend mainland GDP; change on previous year. Source: Revised National Budget 2003 Chart 3.11 Structural non-oil deficit. Percentage of trend mainland GDP. 6 6 National Budget 2002 5 4 3 4 Revised National Budget 2003 3 National Budget 2003 2 5 2 1 1 0 0 2001 2003 2005 Source: The Ministry of Finance 2007 2009 Chart 3.12 Estimates for public consumption 20032004 made at different times. Annual percentage growth 4 4 3 3 2 1 2004 2003 2 1 0 0 Jan 01 Jul 01 Jan 02 Jul 02 Jan 03 Jul 03 Source: Norges Bank Chart 3.13 Job vacancies advertised per business day. Seasonally adjusted. Jan 00 - May 03 1200 1200 900 900 600 600 300 300 0 2000 0 2001 Source: Directorate of Labour 2002 2003 Chart 3.14 Change in employment on previous year. Per cent. Unemployment1) as a percentage of the labour force. 1980-2003 8 4 LFS unemployment (left-hand scale) 6 2 4 0 2 Employed (right-hand scale) -2 -4 0 1980 1) LFS 1985 1990 1995 2000 unemployment Sources: Statistics Norway and Norges Bank Chart 3.15 Change in labour force on previous year. Per cent. Labour force as a percentage of population aged 16-74 (labour force participation rate) 1980-2003 75 4 Change in labour force (right-hand scale) 73 2 71 0 69 -2 Labour force participation rate (left-hand scale) 67 1980 1985 1990 -4 1995 2000 Sources: Statistics Norway and Norges Bank Chart 4.1 Alternative assumptions for the money market rate. Forward rates1) and assumption of a sight deposit rate of 4 per cent2). 10 10 8 3-month money market rate 8 6 6 Constant interest rate2) 4 2 4 Forward interest rate 19 June 0 2000 2001 2002 2003 2004 2005 1) 3-month 2 0 money market rates up to and including May 2003. 3-month forward rates are estimated using 4 money market rates and 5 government bond yields with different maturities as observed on 19 June. 2) The money market rate is normally about ¼ percentage point higher than the sight deposit rate. Source: Norges Bank Chart 4.2 Alternative assumptions for the krone exchange rate (I-44). Forward rate and stable exchange rate equal to average 3/6-19/6 (I-44= 93.5). Index 110 110 Import-weighted exchange rate, I-44 100 100 Forward rate 19 June Average 3/6-19/6 90 80 1999 90 80 2001 Source: Norges Bank 2003 2005 Chart 4.3 Estimated effect of historical exchange rate movements on rise in prices for imported consumer goods. Contribution in percentage points to 4-quarter rise. 2001 Q1 - 2006 Q4 1.5 1.5 0.5 0.5 -0.5 -0.5 -1.5 -1.5 -2.5 -2.5 -3.5 -3.5 -4.5 2001 2002 2003 2004 2005 2006 -4.5 Source: Norges Bank Chart 4.4 Consumer prices and producer prices among trading partners. 1995-2005. Annual rise. Per cent 6 6 5 5 4 4 3 Consumer prices 3 2 2 1 1 0 0 Producer prices -1 -1 -2 -2 1995 1997 1999 2001 Sources: EcoWin and Norges Bank 2003 2005 Chart 4.5 Annual wage growth1) and unemployment rate2). 1993-2003. Per cent Annual wage growth 6 6 4 4 2 2 Unemployment rate 0 0 1993 1995 1997 1999 2001 2003 1) Average 2) for all groups. Including costs of additional vacation days Registered unemployed as a percentage of the labour force Sources: TRCIS, Directorate of Labour and Norges Bank Chart 4.6 Air fares. Adjusted for taxes. 12-month rise. Jan 01 - May 03. Per cent 30 30 25 25 20 20 15 15 10 10 5 5 0 0 -5 -5 -10 Jan 01 -10 Jul 01 Jan 02 Jul 02 Jan 03 Sources: Statistics Norway and Norges Bank Chart 4.7 Consumer prices for food and nonalcoholic beverages in Norway and Sweden. Not adjusted for taxes. Index. Jan 1990 = 100 135 135 125 125 115 Norway 105 95 115 105 Sweden 85 1990 1992 1994 1996 1998 2000 2002 Sources: EcoWin, Statistics Sweden and Statistics Norway 95 85 Chart 4.8 Expected consumer price inflation in 2 years 4 4 Employee organisations Employers' organisations 3 3 Experts 2 2 1 1 0 0 Jun 02 Sep 02 Source: TNS Gallup Dec 02 Mar 03 Jun 03 Chart 4.9 Expected consumer price inflation in 5 years 4 4 Employee organisations 3 2 3 Experts 2 Employers' organisations 1 1 0 0 Jun 02 Sep 02 Source: TNS Gallup Dec 02 Mar 03 Jun 03 Chart 4.10 Consumer price inflation. Historical developments and market participants' projections for future consumer price inflation according to a survey by Consensus Economics. Per cent 4 4 3 3 2 2 Inflation projection published in April 2003 1 0 1 0 2001 2004 2007 2010 Sources: Consensus Economics and Statistics Norway Chart 4.11 Monetary policy assumptions. Sight deposit rate of 4 per cent and import-weighted krone exchange rate equal to the average for 3/6-19/61) (I-44=93.5) 84 8 88 6 Money market rate (right-hand scale) 92 4 Krone exchange rate (I-44) (left-hand scale) 96 100 2 0 2002 1) A rising 2003 2004 2005 curve denotes an appreciation of the krone Source: Norges Bank Chart 4.12 Projections and uncertainty for CPI-ATE with a sight deposit rate of 4 per cent and importweighted krone exchange rate equal to the average for 3/6-19/6 (I-44= 93.5). 12-month growth. Per cent 5 5 30% 50% 70% 90% 4 4 3 3 2 2 1 1 0 2001 0 1) Adjusted 2002 2003 2004 2005 for tax changes and excl. energy products (CPI-ATE) The bands in the fan indicate different probabilities for consumer price inflation. Sources: Statistics Norway and Norges Bank Chart 4.13 Projected CPI-ATE and output gap1) with a sight deposit rate of 4 per cent and importweighted krone exchange rate equal to the average for 3/6-19/6 (I-44= 93.5). Per cent 3 3 2 CPI-ATE 1 2 1 Output gap 0 0 -1 -1 -2 -2 2002 2003 2004 2005 1) The output gap is a measure of the difference between actual and trend output. See box in IR 1/03 Sources: Statistics Norway and Norges Bank Chart 4.14 Interest rate in line with forward interest rate and gradual exchange rate depreciation of 3 per cent1) 84 8 88 6 Money market rate (right-hand scale) 92 Krone exchange rate (I-44) (left-hand scale) 96 4 2 100 0 2002 1)A rising 2003 2004 2005 curve denotes an appreciation of the krone Source: Norges Bank Chart 4.15 Projections and uncertainty for CPI-ATE with forward interest rate and gradual exchange rate depreciation of 3 per cent. 12-month rise. Per cent 5 5 30% 50% 70% 90% 4 4 3 3 2 2 1 1 0 2001 0 1) Adjusted 2002 2003 2004 2005 for tax changes and excl. energy products (CPI-ATE) The bands in the fan indicate different probabilities for consumer price inflation. Sources: Statistics Norway and Norges Bank Chart 4.16 Projected CPI-ATE and output gap1) with forward interest rate and gradual exchange rate depreciation of 3 per cent. Per cent 3 3 2 2 CPI-ATE 1 1 Output gap 0 0 -1 -1 -2 -2 2002 2003 2004 2005 1) The output gap is a measure of the difference between actual and trend output. See box in IR 1/03 Sources: Statistics Norway and Norges Bank Chart 4.17 Projections for CPI-ATE based on different interest rate and exchange rate assumptions. 12-month rise. Per cent 4 3 2 Forward interest rate and forward exchange rate without impact on wage growth Forward interest rate and forward exchange rate 3 2 CPI-ATE Interest rate of 4 per cent and exchange rate 3/6-19/6, I-44= 93.5 1 0 2001 4 1 0 2002 2003 2004 2005 Sources: Statistics Norway and Norges Bank Chart 4.18 Phillips curve. 2-year average Annual wage growth (incl. costs of additional vacation days) 7 7 6 98-99 5 6 02-03 5 00-01 4 96-97 04-051) 3 4 3 94-95 2 2 1 1 0 0 0 2 4 6 8 Registered unemployed and persons on labour market programmes as a percentage of the labour force 1) Estimates based on a sight deposit rate of 4 per cent and a constant krone exchange rate Source: Norges Bank Charts for boxes and annexes Low consumer price inflation Chart 1 CPI-ATE, projections and uncertainty in IR 2/02. 12-month rise. Per cent 5 5 30% 50% 70% 90% 4 4 3 3 2 2 1 0 2001 Average value April and May 2003: 1.4 1 0 2002 2003 2004 Sources: Statistics Norway and Norges Bank Chart 2 CPI-ATE Total1) and by supplier sector2). 12-month rise. Per cent. Jan 99 - May 03. 6 Goods and services produced in Norway 4 2 CPI-ATE 0 4 2 0 Imported consumer goods -2 -4 1999 -2 -4 2000 2001 2002 2003 Norges Bank's estimates up to and including July 2000, thereafter figures published by Statistics Norway 1) 2) 6 Norges Bank's estimates Sources: Statistics Norway and Norges Bank Chart 3 Import-weighted exchange rate (I-44)1) and interest rate differential against trading partners. Daily figures. 80 4 3-month interest rate differential (left-hand scale) 3 90 2 I-44 (right-hand scale) 1 0 2000 1) A rising 100 110 2001 2002 2003 curve denotes an appreciation of the krone Source: Norges Bank Chart 4 Isolated effect of historical exchange rate movements on rise in prices for imported consumer goods (blue line) and actual rise in prices for imported consumer goods, historical (red) and projections (green). Percentage points 1.5 1.5 0.5 0.5 -0.5 -0.5 -1.5 -1.5 -2.5 -2.5 -3.5 -3.5 -4.5 2001 2002 2003 2004 2005 2006 -4.5 Source: Norges Bank Chart 5 CPI-ATE projections in IR 2/02 and IR 2/03. Isolated effect of altered exchange rate. 3.5 3 3.5 Contribution to inflation from exchange rate 2.5 3 IR 2/02 2 2 1.5 IR 2/03 1 0.5 Jul 01 2.5 1.5 1 0.5 Jul 02 Jul 03 Jul 04 Sources: Statistics Norway and Norges Bank Chart 6 CPI-ATE projections in IR 2/02 and IR 2/03. Isolated effect of lower wage projections. 3.5 3.5 3 Contribution of lower wage estimates to inflation IR 2/02 2.5 2.5 2 2 1.5 IR 2/03 1 0.5 Jul 01 3 1.5 1 0.5 Jul 02 Jul 03 Jul 04 Sources: Statistics Norway and Norges Bank Chart 7 CPI-ATE projections in IR 2/02 and IR 2/03. Combined effect of actual exchange rate and lower wage projections (sum of Charts 5 and 6) 3.5 3.5 Shift: new exchange rate and lower wages*) 3 IR 2/02 2.5 2.5 2 2 1.5 1.5 IR 2/03 1 0.5 Jul 01 3 1 0.5 Jul 02 Jul 03 Jul 04 *) The green line shows how the projection from IR 2/02 would be changed by incorporating the exchange rate path and wage developments as they are incorporated today. Sources: Statistics Norway and Norges Bank Evaluation of inflation reports in inflationtargeting countries UK New Zeal. Brazil Thailand Chile Czech Rep. Iceland Norway Sweden Philippines Israel Canada Mexico Hungary Switzerland Poland South Africa Australia Peru Korea Chart 1 Overall evaluation (1 = poor, 10 = good) 10 9 8 10 9 8 7 6 5 4 3 7 6 5 4 3 2 1 0 2 1 0 Source: "How Do Central Banks Write?" Why does household debt growth remain high? Chart 1 Actual and estimated household gross debt. Percentage change over 4 quarters 12 10 12 10 Estimated debt growth 8 8 6 6 4 Actual debt growth 4 2 2 0 0 -2 1994 -2 1996 Source: Norges Bank 1998 2000 2002 Chart 2 Projection of household gross debt. Percentage change from previous year. 12 12 10 10 8 8 6 6 4 4 2 2 0 0 2002 2003 Source: Norges Bank 2004 2005 Levels of real capital in enterprises still too high? Chart 1 US GDP and investment. Growth on same quarter previous year. Two years before and two years after the trough of the economic cycle. Investments excluding housing 20 20 Previous recessions1) 10 0 8 6 10 Current recession -20 -1 yr 1) Non-weighted Trough +1 yr +2 yr average over the last 5 recessions Sources: EcoWin, NBER and Norges Bank Previous recessions1) Current recession 0 -2 -2 yr 6 4 2 -10 -20 8 4 0 -10 -2 yr GDP 2 0 -2 -1 yr Trough +1 yr +2 yr Chart 2 Private investment in the US, excluding housing. As a percentage of GDP. Volume 20 15 10 1982 20 Historical average 1982-2002 15 10 1986 1990 1994 1998 Sources: EcoWin, NBER and Norges Bank 2002 Strategy Document 1/03 Chart 1 Real interest rate. 1966-2002 10 10 8 8 6 6 4 4 Average 2 2 0 0 -2 -2 -4 -4 65 70 75 Source: Norges Bank 80 85 90 95 00 Chart 2 Real exchange rate. 1970-2002. 20 20 15 15 10 10 5 5 Average 0 0 -5 -5 -10 -10 70 75 80 Source: Norges Bank 85 90 95 00 Chart 3a Alternative 1: The krone exchange rate remains strong. 84 8 88 6 Money market rate (right-hand scale) 92 4 96 2 100 2002 Krone exchange rate (I-44) (left-hand scale) 0 2003 Source: Norges Bank 2004 2005 Chart 3b Alternative 1: The krone exchange rate remains strong. 3 3 2 CPI-ATE 1 2 1 Output gap 0 0 -1 -1 2002 2003 Source: Norges Bank 2004 2005 Chart 4a Alternative 2: The krone exchange rate weakens. Forward interest rate and forward exchange rate 84 8 88 Money market rate (right-hand scale) 6 92 4 96 2 100 2002 Krone exchange rate (I-44) (left-hand scale) 0 2003 Source: Norges Bank 2004 2005 Chart 4b Alternative 2: The krone exchange rate weakens. Forward interest rate and forward exchange rate 3 3 CPI-ATE 2 2 1 1 Output gap 0 0 2002 2003 Source: Norges Bank 2004 2005 Annexes 4 and 5 3-month money market rate and sight deposit rate. Monthly figures. Jan 1995 - May 2003 10 10 8 8 3-month money market rate 6 6 Sight deposit rate 4 4 2 2 0 1995 0 1996 1997 Source: Norges Bank 1998 1999 2000 2001 2002 2003 3-month rates in the US, the euro area and Japan. Per cent. Monthly figures, Jan 1995 - May 2003 7 7 6 6 5 5 4 Euro area1) 4 3 3 US 2 2 1 1 0 1995 Japan 1996 1) Theoretical 1997 1998 1999 ECU rate up to December 1998 Source: Norges Bank 2000 2001 2002 2003 0 115 Trade-weighted exchange rate index and import-weighted exchange rate I-44. Monthly figures, Jan 1995-May 2003 115 Trade-weighted exchange rate index, TWI (1990=100) 110 110 105 105 100 100 Import-weighted exchange rate, I-44 (1995=100) 95 95 90 90 85 1995 85 1996 1997 Source: Norges Bank 1998 1999 2000 2001 2002 2003 The credit indicator (C2), credit to households and total credit to the non-financial private sector and municipalities, mainland Norway (C3). 12-month rise. Per cent. Monthly figures, Jan 1995 - Apr 03. 2003. 15 15 Credit to households 10 C2 C3 mainland Norway 5 0 1997 10 5 0 1998 Source: Norges Bank 1999 2000 2001 2002 2003 Alternative assumptions for the krone exchange rate (I-44). Forward rate and stable exchange rate equal to average 3/6-19/6 (I-44= 93.5). Index 110 110 Import-weighted exchange rate, I-44 100 100 Forward rate 19 June Average 3/6-19/6 90 80 1999 90 80 2001 Source: Norges Bank 2003 2005 Alternative assumptions for money market rate. Forward rates1) and assumption of a sight deposit rate of 4 per cent2) 10 10 8 3-month money market rate 8 6 6 Constant interest rate2) 4 2 4 Forward interest rate 19 June 0 2000 2001 2002 2003 2004 2005 2 0 3-month money market rates up to and including May 2003. 3-month forward rates are estimated using 4 money market rates and 5 government bond yields with different maturities as observed on 19 June. 2) The money market rate is normally ¼ percentage point higher than the sight deposit rate. 1) Source: Norges Bank