Lysbilde 1 - Norges Bank

advertisement

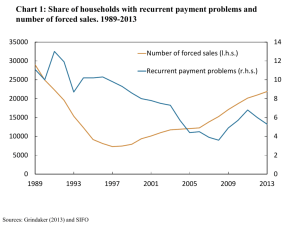

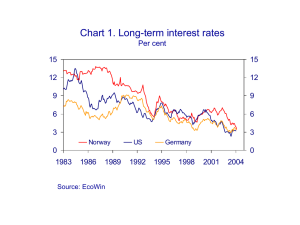

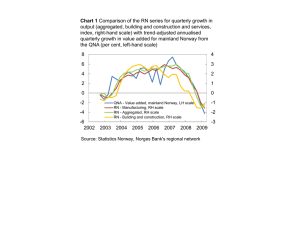

Charts FS 1/06 Chart 1 Banks’ Tier 1 capital ratio and pre-tax profit as a percentage of average total assets1). Annual figures. 1998 – 2005 1.5 10 Tier 1 capital ratio (right-hand scale) 1.2 0.9 0.6 8 6 Profit before loan losses (left-hand scale) Profit after loan losses (left-hand scale) 0.3 4 2 0 0 1998 1999 2000 2001 2002 2003 2004 2005 1) Excluding branches of foreign banks in Norway Source: Norges Bank Chart 2 Banks’ interest margin. Percentage points. Quarterly figures. 87 Q1 – 06 Q1 8 8 7 7 6 6 5 5 4 4 3 3 2 2 1 1 0 1987 0 1990 1993 Source: Norges Bank 1996 1999 2002 2005 Chart 3 Credit to mainland Norway. In percentage of mainland GDP. Quarterly figures. 87 Q1 – 05 Q4 180 180 170 170 160 160 150 150 140 140 130 130 120 120 110 110 1987 1990 1993 1996 1999 2002 2005 Sources: Statistics Norway and Norges Bank Chart 4 Credit to mainland Norway. 12-month growth in per cent. Monthly figures. Jan 97 – Apr 06 28 24 Households2) 20 Total credit (C3) 16 12 8 4 Non-financial enterprises1) 0 -4 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 1) All foreign credit to mainland Norway assumed given to enterprises 2) Household domestic debt Source: Norges Bank 28 24 20 16 12 8 4 0 -4 Chart 5 House prices (annual rise) and credit to households (C2, change in stock at the end of the year). Per cent. Annual figures. 1992 ― 20091) 15 15 Credit 10 10 5 5 House prices 0 0 -5 -5 -10 -10 1992 1996 2000 2004 2008 1) Projections for 2006 ― 2009 Sources: Statistics Norway, ECON, FINN.no, Association of Norwegian Real Estate Agents (NEF), Association of Real Estate Agency Firms (EFF) and Norges Bank Chart 6 Equity ratio and pre-tax return on equity for companies listed on Oslo Stock Exchange1). Per cent. Quarterly figures. 04 Q1 – 05 Q4 50 40 50 Equity ratio 40 30 30 Return on equity 20 20 10 10 0 0 -10 -10 -20 2002 -20 2003 2004 2005 1) Companies registered in Norway with the exception of banks, insurance companies, Statoil and Hydro Sources: Statistics Norway, Statoil, Hydro and Norges Bank Chart 1.1 Forecasts for GDP growth abroad1). Increase on previous year in per cent 10 10 8 2005 2006 2007 2008 8 6 6 4 4 2 2 0 0 US Euro area Japan China Trading partners 1) Forecasts in Inflation Report 1/06. Updated projections will be published in IR 2/06. Sources: IMF, EU Commission, Consensus Forecasts and Norges Bank Chart 1.2 International equity indices. 1 Jan 05 = 100. Daily figures. 3 Jan 00 – 30 May 06 190 Norway OSEBX 170 150 Europe Stoxx Japan Topix 130 110 90 70 US S&P 500 50 30 2000 2001 2002 2003 2004 2005 2006 Source: Reuters EcoWin 190 170 150 130 110 90 70 50 30 Chart 1.3 International equity indices. 1 Jan 05 = 100. Daily figures. 3 Jan 05 – 30 May 06 190 170 Norway OSEBX Japan Topix 190 170 150 150 130 130 Europe Stoxx 110 110 US S&P 500 90 2005 Source: Reuters EcoWin 90 2006 Chart 1.4 Forward-looking P/E1) for equity indices in Europe and the US. Yearly figures. 2000 - 2007 30 30 Europe 25 US 25 20 20 15 15 10 10 5 5 0 0 2000 2002 2004 2006 1) Based on expected earnings at the beginning of the year Source: Reuters EcoWin Chart 1.5 Household debt burden as percentage of disposable income. Annual figures. 1990 – 2004/2005 250 250 Netherlands 200 200 Iceland 150 Denmark Norway UK 100 US 150 100 Sweden 50 50 1990 1992 1994 1996 1998 2000 2002 2004 Sources: OECD, BIS, Bank of England, Sveriges Riksbank, Danmarks Nationalbank, Sedlabanki Island and Norges Bank Chart 1.6 Rise in house prices in selected countries. Annual average rise in per cent. 2001-2005 18.0 16.0 14.0 18 2001 - 2005 16 2005 14 12.0 12 10.0 10 8.0 8 6.0 6 4.0 4 2.0 2 0.0 0 Denmark Norway Sweden Source: Reuters EcoWin US UK Chart 1.7 Indicator for housing starts and annual sale of new homes in the US in thousands. Monthly figures. Jan 95 – May 06 80 1500 70 1250 60 1000 50 750 40 30 1995 New homes sale (right-hand scale) 1997 1999 2001 Housing starts1) (left-hand scale) 2003 2005 Sentiment indicator from National Association of Home Builders (NAHB). Higher values correspond to higher expectations. 50 corresponds to neutral sentiments. 1) Source: Reuters EcoWin 500 250 Chart 1.8 Balance of payments on current account. Projections 2006. Billions of USD 1200 Statistical divergence Germany Others UK Euro area except Germany 1000 800 Switzerland, Norway, Sweden, Denmark Japan China 600 400 Middle East US 200 Others 0 Deficit Source: IMF Surplus Chart 1.9 Implicit 5-year government bonds in 5 years. Weekly figures. Per cent. 1 Jan 95 – 26 May 06 10 8 10 UK 8 Norway US 6 6 4 4 Germany 2 1995 2 2000 Sources: Reuters EcoWin and Norges Bank 2005 Chart 1.10 Prices for gold, base metals1) and oil (Brent Blend). 1 Jan 05 = 100. Daily figures. 1 Jan 00 – 30 May 06 250 200 150 250 Base metals 150 Oil 100 50 200 100 Gold 50 0 0 2000 2001 2002 2003 2004 2005 2006 1) LMEX. Index based on the prices of six base metals Source: Reuters EcoWin Chart 1.11 Issuance of CDOs. Billions of USD. Yearly figures. 1995 - 2005 300 300 250 250 200 200 150 150 100 100 50 50 0 0 1995 Source: IMF 1997 1999 2001 2003 2005 Chart 1.12 Price1) for hedging against credit events related to loans issued by Icelandic banks. Basis points. Daily figures. 1 Feb 06 – 30 May 06 100 90 80 70 60 50 40 30 20 Kaupthing Landsbanki Feb 06 1) 100 90 80 70 60 50 40 30 20 Glitnir Mar 06 Apr 06 May 06 Jun 06 Based on the premium in CDS-contracts on 5-year bonds Source: Thomson Datastream Chart 2.1 Credit as a percentage of GDP. Quarterly figures. 87 Q1 – 05 Q4 180 180 Total credit to mainland Norway2) 170 170 160 160 150 150 140 140 130 120 Credit from domestic sources (C2)2) 130 Total credit (C3)1) 120 110 110 1987 1990 1993 1996 1999 2002 2005 1) 2) Percentage of GDP Percentage of mainland GDP Source: Norges Bank Chart 2.2 Output gap1) and oil price2). Annual figures. 1996 - 2009 4 3 Oil price (right-hand scale) Output gap (left-hand scale) 2 1 0 -1 -2 1996 1999 2002 2005 2008 1) Difference between actual and potential mainland GDP. Deviation in per cent. Projections 2006 – 2009 from Inflation Report 1/06 2) Brent Blend crude oil in USD. Spot price. Figures for 2006 – 2009 are forward prices on light crude oil as of 30 May 2006 Sources: Statistics Norway, Reuters EcoWin and Norges Bank 90 80 70 60 50 40 30 20 10 0 Chart 2.3 Housing turnover and housing starts in thousands. 12-month growth in house prices in per cent. Time needed to sell a dwelling measured in number of days. Monthly figures. Jan 99 – Apr 06 60 50 40 30 20 10 0 Housing turnover (total over past 12 months) 60 50 40 Time needed to sell a dwelling 30 Housing starts (total over past 12 months) House prices 20 10 0 -10 -10 1999 2000 2001 2002 2003 2004 2005 2006 Sources: Statistics Norway, ECON, FINN.no, Association of Norwegian Real Estate Agents (NEF), Association of Real Estate Agency Firms (EFF) and Norges Bank Chart 2.4 Deflated house prices. Indexed, 1985=100. Annual figures. 1985-2005 200 150 Deflated by house rent Deflated by CPI Deflated by building costs 0 150 100 100 50 200 Deflated by disposable income1) 50 0 1985 1988 1991 1994 1997 2000 2003 1) Disposable income less estimated reinvested dividends from 2000 Sources: Statistics Norway, NEF, EFF, ECON and FINN.no Chart 2.5 Credit to households. 12-month growth in per cent. Jan 98 – Apr 06 16 Domestic credit to 14 households Mortgage 12 loans 10 8 Other loans 6 4 2 0 -2 1998 1999 2000 2001 2002 2003 2004 2005 2006 Source: Norges Bank 16 14 12 10 8 6 4 2 0 -2 Chart 2.6 Household debt by type of loan. Billions of NOK. 1996, 2000 and 20061) 1600 1400 Mortgage loans Other loans 1428 bn 1200 1000 809 bn 800 600 587 bn 400 200 0 1996 1) By the end of March 2006 Source: Norges Bank 2000 2006 Chart 2.7 Average debt per household in indebted households by age group. In thousands of 2005-NOK. 1986-20051) 900 750 900 45-54 35-44 750 25-34 Total 600 600 450 300 450 55-66 150 17-24 67-80 0 150 0 1986 1990 1994 1998 2002 1) 80- 300 Estimates for 2004 and 2005 Sources: Statistics Norway and Norges Bank Chart 2.8 Household saving ratio. Per cent. Yearly figures. 1996 – 2005 14 14 12 12 National accounts unadjusted 10 8 10 National accounts adjusted1) 6 6 4 4 2 0 1996 8 2 National accounts + NB adjusted 1, 2) 1998 2000 2002 0 2004 1) Adjusted for estimated reinvested dividends from 2000 Norges Bank’s figures on net financial investments combined with Statistics Norway’s figures on fixed investments 2) Sources: Statistics Norway and Norges Bank Chart 2.9 Household financial assets by financial instrument. Billions of NOK. Quarterly figures. 95 Q4 – 05 Q4 2000 2000 1600 1600 1200 Insurance reserves 1200 Other 800 800 Securities 400 400 Coins, notes and bank deposits 0 1996 0 1998 Source: Norges Bank 2000 2002 2004 Chart 2.10 Household net financial wealth. Billions of NOK. Quarterly figures. 95 Q4 – 05 Q4 500 400 Net financial wealth Accumulated revaluations 500 400 300 300 200 200 100 0 1995 Accumulated net financial investments 1997 Source: Norges Bank 1999 2001 2003 100 0 2005 Chart 2.11 Model projections and uncertainty for house prices.1) 4-quarter rise. Per cent. 03 Q1 – 09 Q4 20 20 15 15 10 10 5 5 0 0 30% 50% 70% 90% -5 -10 2003 2004 2005 2006 2007 2008 2009 1) The bands in the fan chart indicate different probabilities for developments in house prices. The probabilities are computed based on factors such as the deviations between estimated and actual developments in house prices during the period 90 Q2 – 05 Q4 Sources: NEF, EFF, FINN.no, ECON and Norges Bank -5 -10 Chart 2.12 Household debt burden1). Per cent. Quarterly figures. 87 Q1 – 09 Q4 240 240 220 220 200 200 180 180 160 160 140 140 120 120 100 1987 100 1991 1995 1999 2003 Loan debt as a percentage of liquid disposable income less estimated reinvested dividends 1) Source: Norges Bank 2007 Chart 2.13 Household nominal and real debt. Total (in billions) and per household (in thousands). 1987-NOK. Yearly figures. 1987 - 20091) 2000 Nominal debt Debt deflated by CPI 1600 1200 Nominal debt per household 2000 1600 1200 800 800 400 400 Debt deflated by CPI per household 0 1987 1991 1995 1999 2003 2007 1) Projections for 2006-2009 Sources: Statistics Norway and Norges Bank 0 Chart 2.14 Household interest burden1) . Per cent. Quarterly figures. 87 Q1 – 09 Q4 14 14 12 12 10 10 High inflation scenario 8 8 6 6 4 4 Baseline scenario 2 0 1987 2 0 1991 1995 1999 2003 2007 Interest expenses after tax as a percentage of liquid disposable income less estimated reinvested dividends plus interest expenses 1) Source: Norges Bank Chart 2.15 The sight deposit rate in the baseline scenario with fan chart. Per cent. Quarterly figures. 04 Q1 – 09 Q4 8 7 8 30% 50% 70% 90% 6 5 7 6 High inflation scenario 5 4 4 3 3 2 2 1 Baseline scenario 0 2004 2005 2006 2007 2008 2009 Source: Norges Bank 1 0 Chart 2.16 Household debt-servicing in per cent of income1). Quarterly figures. 87 Q1 – 09 Q4 20 20 18 18 16 16 14 14 12 12 10 1987 10 1991 1995 1999 2003 2007 Estimated repayment and interest expenses as a percentage of liquid disposable income less estimated reinvested dividends plus interest expenses. Part payments defined as 1/20 of remaining debt per year 1) Source: Norges Bank Chart 2.17 Key figures for enterprise sector1). Annual figures. Per cent. 1989 – 20052) 100 80 60 Equity ratio (left-hand scale) Borrowing rate 20 Pre-tax return on equity Return on total assets 16 12 40 8 20 4 0 0 1989 1991 1993 1995 1997 1999 2001 2003 2005 Limited companies excluding enterprises in the oil and gas industry, financial sector and holding companies 2) Figure for 2005 estimated on the basis of already submitted annual accounts from 9200 firms 1) Source: Norges Bank Chart 2.18 Probability of default for large enterprises1). Per cent. Monthly figures. Jan 00 – Apr 06 16 16 14 14 90 percentile 12 12 10 10 8 75 percentile 8 6 6 4 4 2 Median enterprise 2 0 0 2000 2001 2002 2003 2004 2005 2006 Non-financial enterprises with annual turnover exceeding NOK 70 m. Probability of default within a year 1) Source: Moody’s KMV Chart 2.19 Bankruptcy rate and interest burden1) in non-financial enterprises2). Annual figures. 1991- 20093) 80 4 70 3.5 Interest burden (right-hand scale) 60 3 50 2.5 40 2 30 1.5 20 1 Bankruptcy rate (left-hand scale) 10 0.5 0 0 1991 1994 1997 2000 2003 2006 2009 Interest expenses in percentage of cash surplus. Cash surplus = gross product – labour costs + net financial income 2) Off-shore activities and international shipping excluded 3) Projections for 2006 - 2009 1) Sources: Statistics Norway and Norges Bank Chart 2.20 Growth in credit to mainland enterprises. 12-month growth. Per cent. Monthly figures. Jan 02 – Apr 06 20 20 Domestic credit 16 12 16 12 8 8 Total credit 4 4 0 0 -4 -4 -8 -12 2002 Credit from foreign sources -8 -12 2003 Source: Norges Bank 2004 2005 2006 Chart 2.21 Emission of shares on the Oslo Stock Exchange. Billions of NOK. Yearly figures. 1997 – 20061) 45 45 40 40 35 35 30 30 25 25 20 20 15 15 10 10 5 5 0 0 1997 1) 1999 2001 In 2006, January - April Source: Oslo Stock Exchange 2003 2005 Share of enterprises with dividend payments Chart 2.22 Share of enterprises with dividend payments by probability of bankruptcy. Per cent. Annual figures. 2003 – 20051) 70 70 60 60 2003 50 2004 2005 50 40 40 30 30 20 20 10 10 0 0 0 - 0,5 0,5 - 1 1-2 2-3 3 >> Bankruptcy probability in per cent 1) Estimate for 2005 based on a sample of already submitted annual accounts from 9200 firms Source: Norges Bank Chart 2.23 Changes in transaction price for offices in Oslo and employment. Price per square metre in constant 2005-prices and percentage deviation from trend. Annual figures. 1980-2005 6 35,000 Price for offices (left-hand scale) 5 4 30,000 3 Employment (right-hand 25,000 2 scale) 1 20,000 0 -1 15,000 -2 -3 10,000 1980 1984 1988 1992 1996 2000 2004 Sources: OPAK and Norges Bank Chart 2.24 Net rental yield on commercial property1) and 10-year interest rate swap. Per cent. Annual figures 1995-2003. Monthly figures Jan 04 – Jan 06 9 9 8 8 Net rental yield on commercial property 7 7 6 6 5 5 4 3 2 1 0 10-year swap rate 4 3 2 1 0 1995 2000 Feb-04 Jul-04 Dec-04 May-05 Oct-05 1) Net rental yield on investments in the prestige segment according to Akershus Eiendom (prior to Jan 04) and DnB NOR Næringsmegling (from Jan 04) Sources: Reuters EcoWin, Akershus Eiendom and DnB NOR Chart 2.25 Selected sub-indices on the Oslo Stock Exchange. 30 Nov 05 = 100. Daily figures. 2 May 05 – 30 May 06 170 170 Consumer staples Energy 145 145 OSEBX 120 120 95 95 Manufacturing/Materials Finance 70 May 05 70 Aug 05 Nov 05 Source: Reuters EcoWin Feb 06 May 06 Chart 2.26 Expected earnings in 2007 for listed companies. 30 Nov 05 = 100. Monthly figures. Jan 05 - May 06 120 110 120 Japan US 100 90 80 70 Jan 05 110 100 90 Europe 80 Norway 70 Jul 05 Source: Reuters EcoWin Jan 06 Chart 2.27 Implied volatility in various equity markets. Daily figures. 1 Jan 04 – 30 May 06 35 30 35 Europe (Stoxx) Norway (OBX) 30 25 25 20 20 15 15 10 10 5 2004 US (S&P 500) 5 2005 2006 Sources: Reuters EcoWin and Oslo Stock Exchange Chart 2.28 Enterprises’ assessments of the largest risk related to future profitability1). In per cent 100 100 90 90 80 80 70 70 60 60 50 50 40 40 30 30 20 20 10 10 0 0 Industry Construction Retail trade Services Wage costs Costs of intermediary goods Interest rates Stronger NOK Oil price Competition Changed external conditions Lower demand Other 1) Survey conducted by Norges Bank’s regional network in March 2006 Source: Norges Bank Chart 3.1 Banks’1) profit/loss in percentage of average total assets 4 3 2 1 0 -1 -2 -3 Q1 2001 2002 2003 2004 2005 2005 2006 Net interest income Operating expenses Write-down etc. 1) Other operating income Loan losses Pre-tax profit/loss Excluding branches of foreign banks in Norway Source: Norges Bank 4 3 2 1 0 -1 -2 -3 Chart 3.2 OSEBX and sub-indices for banks on the Oslo Stock Exchange1). 1 Jan 01 = 100. Daily figures. 3 Jan 01 - 30 May 06 350 350 300 300 Primary capital certificate index 250 250 Bank index 200 200 150 150 100 100 50 0 2001 50 OSEBX 0 2002 2003 2004 2005 2006 Gjensidige NOR was moved from the primary capital certificate index to the bank index and was included in OSEBX from 13 Sept 02 1) Source: EcoWin Reuters Chart 3.3 Banks’1) gross stock of non-performing loans. Percentage of gross lending to sector. Quarterly figures. 96 Q1 – 06 Q1 5 5 Enterprises 4 4 All sectors 3 3 2 2 1 1 Households 0 1996 1) All 0 1998 2000 banks in Norway Source: Norges Bank 2002 2004 2006 Chart 3.4 Banks’1) total interest margin split into deposit and lending margin2). Percentage points. Quarterly figures. 96 Q1 – 06 Q1 4 4 3.5 3 2.5 Total interest margin Lending margin 2.5 2 1.5 2 1.5 1 0.5 0 1996 1 0.5 Deposit margin 1998 1) All 2) 3.5 3 2000 2002 banks in Norway Moving average over the past four quarters Source: Norges Bank 2004 0 2006 Chart 3.5 Norwegian banks’1) capital adequacy and Tier 1 capital ratio. Per cent. Quarterly figures. 02 Q1 – 06 Q1 14 Capital adequacy 12 12 10 10 8 14 Tier 1 capital ratio 8 6 6 4 4 2 2 0 2002 1) 2003 2004 2005 Excluding branches of foreign banks in Norway Source: Norges Bank 0 2006 Chart 3.6 Growth in banks’ and mortgage companies’1 ) lending to the corporate sector. 12-month growth. Per cent. Monthly figures. Dec 03 – Apr 06 40 40 Fokus Bank2) and Handelsbanken 30 20 10 0 30 20 All banks and mortgage companies DnB NOR2) and Nordea Norge2) 10 0 -10 -10 Dec Mar Jun Sep Dec Mar Jun Sep Dec Mar 03 04 04 04 04 05 05 05 05 06 1) All 2) banks and mortgage companies in Norway Included mortgage companies in the same financial group Source: Norges Bank Chart 3.7 Banks’ and mortgage companies’1) lending to selected industries. Four-quartergrowth. Per cent. 02 Q1 – 06 Q1 25 20 25 Property management and commercial services 20 Construction, electricity and water supply 15 10 15 10 Retail trade, hotel and restaurant 5 5 0 0 -5 Manufacturing -10 2002 1) All -5 -10 2003 2004 2005 banks and mortgage companies in Norway Source: Norges Bank 2006 Chart 3.8 Distribution of banks’1) lending to retail and corporate markets2). Percentage of gross lending. Annual figures. 2003 - 2005 Others Construction Manufacturing Retail trade 2005 Primary industries 2004 Transport 2003 Services Property management 0 1) All 5 10 15 20 25 30 35 40 banks i Norway 2) Includes loans to households involved in one man companies Source: Norges Bank Chart 3.9 Norwegian banks’ 1) financing. Percentage of gross lending. Quarterly figures. 00 Q1 – 06 Q1 40 30 40 Deposits from retail sector Deposits from corporate sector 30 Bonds 20 20 10 10 0 2000 Deposits/loans from financial institutions 2001 2002 1) All Notes and short-term paper 2003 2004 2005 0 2006 banks except branches and subsidiaries of foreign banks in Norway Source: Norges Bank Chart 3.10 Developments in Norwegian banks’1) liquidity indicator. Quarterly figures. 00 Q1 – 06 Q1 110 110 DnB NOR 100 90 100 Small banks2) 90 Medium-sized banks2) 80 2000 2001 2002 1) All 2003 2004 2005 80 2006 banks except branches and subsidiaries of foreign banks in Norway 2) The dividing-line between small and medium-sized banks stand at NOK 10bn at end-2005 Source: Norges Bank Chart 3.11 Norwegian banks’1) short term foreign debt2). Percentage of gross lending. Quarterly figures. 00 Q1 – 06 Q1 25 25 DnB NOR 20 20 15 15 10 Medium-sized banks3) 5 10 5 Small banks3) 0 2000 2001 2002 1) All 2003 2004 2005 0 2006 banks except branches and subsidiaries of foreign banks in Norway 2) Short-term paper debt, deposits and loans from other financial institutions 3) The dividing-line between small and medium-sized banks stand at NOK 10bn at end-2005 Source: Norges Bank Chart 3.12 Life insurance companies’ buffer capital1) and asset mix. Percentage of total assets. Quarterly figures. 01 Q1 – 06 Q1 40 Bonds "held to maturity" 30 Bonds and shortterm paper Equities and shares 20 Real estate 10 40 30 20 10 Buffer capital 0 2001 0 2002 2003 2004 2005 2006 Buffer capital is defined as the sum of the Adjustment Fund, supplementary provisions with an upward limit of one year and surplus of Tier 1 capital. 1) Source: Kredittilsynet (The Financial Supervisory Authority of Norway) Boxes Long-term real interest rates and house prices Chart 1 Long-term real interest rate1) and neutral real interest rate. Per cent. House prices deflated by house rent index in the CPI. Indexed, 96 Q1 = 1. Quarterly figures. 96 Q1 – 06 Q1 6 6 Long-term real interest rate 5 5 4 4 3 3 2 Interval for neutral real interest rate House prices deflated by house rent 1 0 1996 2 1 0 1998 2000 2002 2004 2006 1) Implicit yield on 5-year government bonds in 5 years less longterm inflation expectations Sources: NEF, EFF, FINN.no, ECON and Norges Bank Household housing wealth and financial assets Chart 1 Housing wealth and financial assets in billions of NOK. Indexed house prices, 2001 = 100. Annual figures. 2001 - 2005 3500 150 3000 140 2500 2000 1500 Housing wealth (lefthand scale) 130 Indexed house prices (right-hand scale) Financial assets (left-hand scale) 1000 2001 2002 120 110 2003 2004 100 2005 Sources: Statistics Norway, ECON, FINN.no, Association of Norwegian Real Estate Agents (NEF), Association of Real Estate Agency Firms (EFF) and Norges Bank Chart 2 Household debt and wealth by categories. Billions of NOK. 2005 6000 5000 4000 3000 6000 Other claims Securities Insurance reserves Notes, coins and bank deposits 4000 3000 Housing wealth 2000 1000 5000 Other loans 2000 1000 Mortgages 0 0 Debt Wealth Sources: Statistics Norway, ECON, FINN.no, Association of Norwegian Real Estate Agents (NEF), Association of Real Estate Agency Firms (EFF) and Norges Bank Household margins Chart 1 Household income after tax by use. Billions of 2003-NOK. Annual figures.1987-2003 600 600 500 500 400 400 300 200 100 0 1987 *) 300 Living costs Loan installments Interest Margin 1991 1995 200 100 0 * 1999 2003 Revision of SIFO’s standard budget in 2001 Sources: Statistics Norway, SIFO (National Institute for Consumer Research) and Norges Bank Chart 2 Share of households by margins1). In per cent and in thousands of NOK. 2003 20 15 10 20 17% of debt 13% of households 15 10 5 0 0 500 450 400 350 300 250 200 150 100 50 0 -50 -100 -150 -200 -250 5 Margins = Income after tax – standard living costs – debt servicing 1) Sources: Statistics Norway, SIFO (National Institute for Consumer Research) and Norges Bank Chart 3 Total household margins in billions of NOK.1) Share of households with negative margins and corresponding share of total debt in per cent.2) Annual figures and projections 1986-2009 50 40 300 Margins (right-hand scale) 200 30 20 10 Debt (left-hand scale) 100 Households (left-hand scale) 0 0 1986 1990 1994 1998 2002 2006 Margins = Income after tax – standard living costs – debt servicing 2) Demography and financial situation of households as of 2003 1) Sources: Statistics Norway, SIFO (National Institute for Consumer Research) and Norges Bank Chart 4 Effects of borrowing rates on margins1). Share of households with negative margins and corresponding share of total debt2). In per cent and billions of NOK 60 300 Margins (righthand scale) 50 2003 borrowing rate 250 40 200 30 150 Debt (lefthand scale) 20 Households (left-hand scale) 10 100 50 0 0 0 2 4 6 8 10 12 14 Margins = Income after tax – standard living costs – debt servicing 2) Demography and financial situation of households as of 2003 1) Sources: Statistics Norway, SIFO (National Institute for Consumer Research) and Norges Bank How do banks price corporate credit risk? Chart 1 Estimated lending rate for non-financial enterprises. Weighted average in per cent. Yearly figures 1989-2005 18 18 16 16 14 14 12 12 10 10 8 8 6 6 4 4 SEBRA median Bank statistics SEBRA weighted average 2 2 0 0 1989 1991 1993 1995 1997 1999 2001 2003 2005 Source: Norges Bank Chart 2 Estimated premium on loans1) in various categories of risk. By probability of bankruptcy (=p). Per cent. Yearly figures. 1989-2005 Very low (p < 0,5%) Low (0,5% < p < 1%) High (2% < p < 5%) Very high (p > 5%) 5 4 3 2 1 0 -1 -2 -3 -4 -5 Average (1% < p < 2%) 5 4 3 2 1 0 -1 -2 -3 -4 -5 1989 1991 1993 1995 1997 1999 2001 2003 2005 1) Premium on loans = r – t – a – (1-e)*f r = estimated borrowing rate t = estimated loss (likelihood of bankruptcy * bank debt * 0,45) a = estimated administrative costs of loans e = equity ratio f = cost of loan capital (weighted average of deposit rate, money market rate and bond yields) Source: Norges Bank Chart 3 Estimated premium on loans to enterprises. Weighted average in per cent. Yearly figures. 1989-2005 2 2 1.5 1.5 1 1 0.5 0.5 0 0 -0.5 -0.5 -1 -1 1989 1991 1993 1995 1997 1999 2001 2003 2005 Source: Norges Bank Chart 4 Share of enterprises in various categories of risk. By probability of bankruptcy (=p). Per cent. Yearly figures 1990, 1995, 2000 and 2004 70 60 Very low (p < 0,5% ) Average (1% < p < 2% ) Very high (p > 5% ) Low (0,5% < p < 1% ) High (2% < p < 5% ) 70 60 50 50 40 40 30 30 20 20 10 10 0 0 1990 Source: Norges Bank 1995 2000 2004 The significance of Norges Bank’s key rate and competitive conditions for banks’ interest rates Chart 1 Banks’ lending rates, the sight deposit rate and 3-month interbank rate (NIBOR). Per cent. 91 Q1– 06 Q1 16 16 14 14 12 10 Lending rate (all loans) Sight deposit rate1) 12 10 8 8 6 6 4 2 Deposit rate (all deposits) 4 NIBOR 3-month rate (effective)1) 2 0 0 1991 1993 1995 1997 1999 2001 2003 2005 1) Quarterly average Source: Norges Bank Chart 2 Changes in the sight deposit rate and banks’ lending rates. Percentage points. Quarterly figures. 02 Q2 – 05 Q4 Sight deposit rate Mortgage loans Enterprises Deposits 03.11.05 1) 01.07.05 12.03.04 2) 18.12.03 3) 18.09.03 4) 26.06.03 06.03.03 04.07.02 -2 -1.5 -1 -0.5 0 0.5 1 Incl. changes in the sight deposit rate 29.1.04 and 12.3.04 2) Incl. changes in the sight deposit rate 14.8.03 and 18.9.03 3) Incl. changes in the sight deposit rate 1.5.03 and 26.6.03 1) 4) Incl. changes in the sight dep. rate 12.12.02, 23.01.03 and 6.3.03 Source: Norges Bank Chart 3 Average mortgage and deposit rates. Norwegian and foreign banks in Norway. Per cent p.a. Quarterly figures. 04 Q1 - 06 Q1 5 5 Mortgage rates Norwegian banks 4 3 Mortgage rates Foreign banks 3 Deposit rates Foreign banks 2 1 0 04 Q1 Deposit rates Norwegian banks 04 Q3 Source: Norges Bank 4 05 Q1 05 Q3 2 1 0 06 Q1 Equity market valuation Chart 1 Forward-looking P/E. Expected earnings next 12 months. Monthly figures. Jan 96 – May 06 30 30 25 25 US 20 15 10 20 15 Europe Norway 10 5 5 0 0 96 97 98 99 00 01 02 03 04 05 06 Sources: Reuters EcoWin and Norges Bank Chart 2 Historical P/E. Four-quarter earnings. Quarterly figures. 81 Q1 – 06 Q1 35 35 US 30 25 30 25 Europe 20 20 15 15 10 10 5 Norway 0 5 0 81 83 85 87 89 91 93 95 97 99 01 03 05 Sources: Thomson Datastream and Norges Bank Chart 3 Price-to-book ratio. Quarterly figures. 96 Q1 – 06 Q1 7 7 6 6 US 5 5 4 4 3 3 2 1 2 Europe Norway 0 1 0 96 97 98 99 00 01 02 03 04 05 06 Sources: Reuters EcoWin and Norges Bank Chart 4 Yield gap1). Per cent. Monthly figures. Jan 99 – May 06 10 10 Norway 8 6 8 6 Europe 4 4 US 2 2 0 0 -2 -2 99 00 01 02 03 04 05 06 1) Yield gap defined as E/P less inflation-adjusted interest rate on 5-year government bonds Sources: Reuters EcoWin, Consensus Forecasts and Norges Bank