Japan - Norges Bank

advertisement

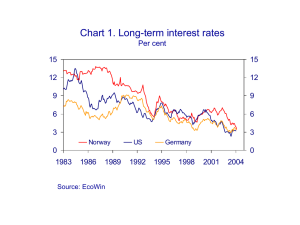

Norges Bank Executive Board Meeting 25 May 2005 1 Norges Bank GDP growth among trading partners Growth in volume on previous year. Per cent. Actual and projected 10 10 China1) 8 8 6 6 Global 1) 4 4 2 2 25 trading partners2) 0 0 1999 2000 2001 2002 1) 2003 Source: IMF 2004 2005 2006 2) Source: Norges Bank 2 Norges Bank Quarterly change in GDP US, euro area and UK Growth in volume, annualised. Seasonally adjusted. Per cent 8 8 6 4 6 US 4 UK 2 2 0 0 Euro area Japan -2 -2 -4 -4 -6 2001 Q1 -6 2002 Q1 2003 Q1 2004 Q1 2005 Q1 Sources: Eurostat, EcoWin\ Office for National Statistics, Bureau of Economic Analysis and Norges Bank 3 Norges Bank China • GDP grew 9.5 per cent from 2004 Q1 to 2005 Q1 – Growth somewhat more balanced, but still strong investment growth – Growing export surplus • Increased pressure on China to revalue 4 Norges Bank Forward exchange rate (12-month) Chinese yuan A rising value denotes a depreciating currency. 1.1 2003 – 24.5 2005 8.4 8.4 8.3 8.3 8.2 Fixed exchange rate against USD 8.1 8 8.2 8.1 8 7.9 7.9 Forward exchange rate against USD (12-month) 7.8 7.8 7.7 7.7 7.6 7.6 7.5 2003 7.5 2004 2005 Source: Bloomberg 5 Norges Bank Developments in international equity indices Total return. Indexed, 01.01.04 = 100 160 160 Norway, OSEBX 140 140 Europe, Stoxx 120 120 Japan, Topix US, S&P 500 100 80 Jan 04 100 Since previous monetary policy meeting May 04 Sep 04 Jan 05 80 May 05 Source: EcoWin 6 Norges Bank Developments in 10-year government bond yields 5 5 4.5 4.5 US 4 4 Norway 3.5 3.5 Germany 3 Jan 04 3 May 04 Sep 04 Jan 05 May 05 Source: EcoWin 7 Norges Bank CPI/HICP (core) in the US, the euro area, and Japan Percentage change on same month previous year 3 3 US 2 2 US1) 1 Euro area 0 1 0 Japan -1 -1 1) Personal consumption expenditures less food and energy -2 1998 -2 1999 2000 2001 2002 2003 2004 2005 Source: EcoWin / National statistics 8 Norges Bank CPI/HICP (core)1) in the UK, Sweden and Denmark Percentage change on same month previous year 4 4 Sweden 3 3 Denmark 2 2 1 1 UK 0 0 1) Excl. energy, food, alcohol and tobacco products -1 1998 -1 1999 2000 2001 2002 2003 2004 2005 Source: EcoWin / National statistics 9 Norges Bank Interest rate expectations 23 May 2005 6 5 6 5 UK Norway 4 4 Sweden 3 3 2 2 Euro area 1 1 US 0 Jun 03 0 Dec 03 Jun 04 Dec 04 Jun 05 Dec 05 Jun 06 Sources: Norges Bank and Reuters 10 Norges Bank Oil price Brent Blend and futures prices Daily figures, USD per barrel. January 2002 - May 2005 55 20 April 50 55 50 23 May 45 IR 1-05 45 40 40 35 35 30 30 25 25 20 20 15 2002 15 2003 2004 2005 2006 2007 Sources: Telerate, IPE and Norges Bank 11 Norges Bank Oil futures prices USD per barrel light crude. Daily figures. January 2001 – May 2005 60 60 55 55 50 50 45 45 40 40 Delivery in 1 month 35 35 30 30 25 Delivery in 6-7 years 25 20 20 15 2001 15 2002 2003 2004 2005 Source: EcoWin/ NYMEX 12 Norges Bank Global commodity prices, in USD Weekly figures. Indices, 2000=100 160 160 Metals 140 120 140 Commodities for manufacturing 120 Agricultural products excl. food 100 100 80 80 60 2002 60 2003 2004 2005 Sources: EcoWin / Economist 13 Norges Bank CPI-ATE. Total and distributed by imported and domestically produced goods and services Historical and projected IR 1/05 (broken line). 12-month rise. Per cent 4 4 3 3 2 Domestically produced goods and services (0.7) 2 1 1 0 0 -1 CPI-ATE -1 -2 -3 -2 Imported consumer goods (0.3) -3 -4 -4 -5 -5 Jul 03 Oct 03 Jan 04 Apr 04 Jul 04 Oct 04 Jan 05 Apr 05 Sources: Statistics Norway and Norges Bank 14 Norges Bank Expected consumer price inflation in 5 years Per cent. Quarterly figures. 02 Q2 - 05 Q2 4 3 4 Employers' organisations 2 3 Economists Employees' organisations 2 1 0 Jun 02 1 Dec 02 Jun 03 Dec 03 Jun 04 Dec 04 0 Jun 05 Source: TNS Gallup 15 Norges Bank Interest rate differential and import-weighted exchange rate (I-44) A fall in value denotes a depreciating currency. Daily figures 5 85 4 88 3 91 I-44 (right-hand scale) 2 94 1 97 24 May 05 0 -1 2002 100 Weighted interest rate differential (left-hand scale) 20 April 05 103 2003 2004 2005 2006 Sources: Norges Bank and Bloomberg 16 Norges Bank Number of foreigners from new EU countries on assignments in Norway 6000 5000 1 May 03 - 31 Mar 04 1 May 04 - 31 Mar 05 4000 3000 2000 1000 0 Forign enterprises with Registered employees Registered employees Registered employees assignments in Norway in foreign enterprises in Norwegian in Norwegian and enterprises foreign enterprises Source: Central Office - Foreign Tax Affairs 17 Norges Bank Growth in retail trade turnover and the retail sales index On same period previous year, February 2003 – December 2004 10 10 Turnover statistics 8 8 6 6 4 4 2 0 Jan-03 2 Retail sales index 0 May-03 Sep-03 Jan-04 May-04 Sep-04 Jan-05 Kilder: SSB og Norges Bank 18 Norges Bank Consumer confidence indicator Unadjusted and trend (level) Trend 30 30 15 15 0 0 -15 -15 Unadjusted -30 1992 -30 1994 1996 1998 2000 2002 2004 Source: TNS Gallup 19 Norges Bank Credith growth 12-month growth. Per cent 25 25 C3 Business sector Mainland Norway 20 20 C2 Households C3 Mainland Norway 15 15 10 10 5 5 0 0 -5 1997 -5 1998 1999 2000 2001 2002 2003 2004 2005 Source: Norges Bank 20 Norges Bank House prices from the real estate business Annualised 3-month centred moving rise. Seasonally adjusted figures. Per cent 25 20 15 10 5 0 -5 -10 Jan 02 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 Jan 05 Sources: Associations of Norwegian real estate agents (NEF, EFF) and Norges Bank 21 Norges Bank Housing starts (last 12 months) In thousands 40 40 30 30 20 20 10 10 0 1999 0 2000 2001 2002 2003 2004 2005 Source: Statistics Norway 22 Norges Bank Commercial building starts Area (1000 m2) 3-month moving average. Jan 2000 – Jan 2005 100 75 100 Manufacturing 75 Retail trade 50 50 25 25 0 Property management and commercial services 2000 2001 2002 2003 0 2004 2005 Sources: Statistics Norway and Norges Bank 23 Norges Bank 3-month money market rate, import-weighted krone exchange rate (I-44)1)2), projections for the CPI-ATE and output gap in the baseline scenario in IR 1/05 Quarterly figures. 2001 Q1 – 2008 Q4 7 6 5 Interest rate (left-hand scale) 100 3 3 98 2 2 CPI-ATE 1 1 4 96 3 94 0 0 92 -1 -1 90 -2 2004 2005 2006 2007 2008 -2 2 1 Output gap Import-weighted exchange rate (I-44) (right-hand scale) 0 2004 2005 2006 2007 2008 1) A 2) rising curve denotes a weaker krone exchange rate. The figures for 2005 Q1 are based on the average up to 10 March. Sources: Statistics Norway and Norges Bank 24 Norges Bank Executive Board Meeting 25 May 2005 25