Ch14

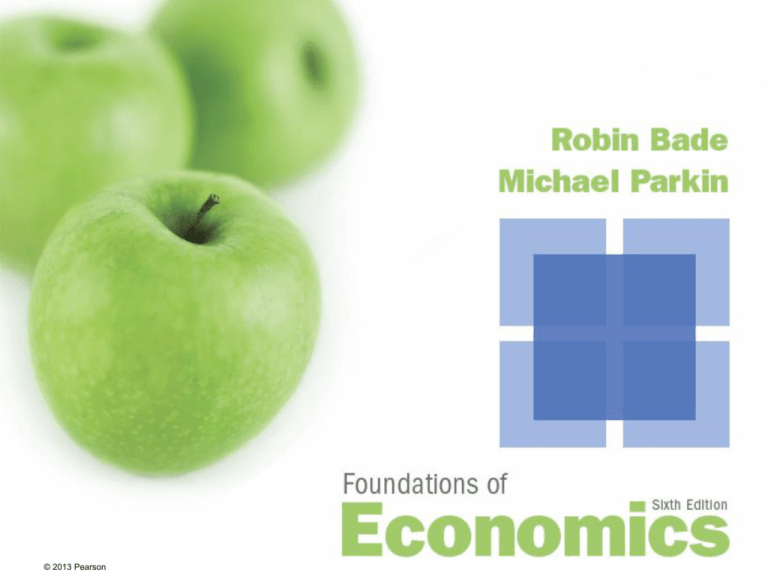

advertisement

Click on the button to go to the problem © 2013 Pearson Production and Cost 14 CHECKPOINTS © 2013 Pearson Click on the button to go to the problem Checkpoint 14.1 Clicker version Checkpoint 14.3 Checkpoint 14.4 Problem 1 Problem 1 Problem 2 Problem 2 Problem 2 In the news Problem 3 Problem 3 Checkpoint 14.2 In the news In the news Problem 1 Problem 1 Problem 2 Problem 3 In the news © 2013 Pearson Clicker version CHECKPOINT 14.1 Practice Problem 1 Lee is a computer programmer who earned $35,000 in 2007. But in 2007, he opened a body board manufacturing business. At the end of the first year of operation, he submitted the information in the table to his accountant. Calculate Lee’s explicit costs, implicit costs, and economic profit. He stopped renting out his cottage for $3,500 a year and used it as his factory. The market value of the cottage increased from $70,000 to $71,000. He spent $50,000 on materials, etc. He leased machines for $10,000 a year. He paid $15,000 in wages. He used $10,000 from his savings account, which earns 5% a year interest. He borrowed $40,000 at 10% a year. He sold $160,000 worth of body boards. Normal profit is $25,000 a year. © 2013 Pearson CHECKPOINT 14.1 Solution Lee’s explicit costs are costs paid with money: He stopped renting out his cottage for $3,500 a year and used it as his factory. The market value of the cottage increased from $70,000 to $71,000. • $50,000 on materials etc; He spent $50,000 on materials, etc. • $10,000 on leased He leased machines for $10,000 a year. machines; He paid $15,000 in wages. • $15,000 in wages; He used $10,000 from his savings account, which earns 5% a year interest. • $4,000 in bank interest He borrowed $40,000 at 10% a year. These items total $79,000. © 2013 Pearson He sold $160,000 worth of body boards. Normal profit is $25,000 a year. CHECKPOINT 14.1 Lee’s implicit costs are: • $35,000 in forgone wages; He stopped renting out his cottage for $3,500 a year and used it as his factory. The market value of the cottage increased from $70,000 to $71,000. • $2,500 in forgone rent less He spent $50,000 on materials, etc. the increase in the value of his cottage; • $500 in forgone interest on his savings account; • $25,000 in normal profit. He leased machines for $10,000 a year. He paid $15,000 in wages. He used $10,000 from his savings account, which earns 5% a year interest. He borrowed $40,000 at 10% a year. He sold $160,000 worth of body boards. These items total $63,000 © 2013 Pearson Normal profit is $25,000 a year. CHECKPOINT 14.1 Lee’s economic profit equals total revenue $160,000 minus total cost. He stopped renting out his cottage for $3,500 a year and used it as his factory. The market value of the cottage increased from $70,000 to $71,000. Total cost is the sum of explicit costs plus implicit costs. He spent $50,000 on materials, etc. Total cost = $79,000 + $63,000, or $142,000. He used $10,000 from his savings account, which earns 5% a year interest. So Lee’s economic profit is $160,000 – $142,000, or $18,000. © 2013 Pearson He leased machines for $10,000 a year. He paid $15,000 in wages. He borrowed $40,000 at 10% a year. He sold $160,000 worth of body boards. Normal profit is $25,000 a year. CHECKPOINT 14.1 Study Plan Problem Lee is a computer programmer who earned $50,000 in 2007. But in 2008, he opened a custom woodworking business. At the end of his first year, he submitted the information in the table to his accountant. His explicit costs are ____ and his implicit costs are ____. A. B. C. D. E. $50,000; $89,200 $86,200; $22,900 $89,200; $50,000 $22,900; $86,200 $22,900; $89,200 He stopped renting out his cottage for $3,500 a year and used it as his factory. The market value of the cottage increased from $70,000 to $71,000. He spent $50,000 on materials, etc. He leased machines for $10,000 a year. He paid $15,000 in wages. He used $10,000 from his savings account, which earns 5% a year interest. He borrowed $40,000 at 10% a year. He sold $160,000 worth of body boards. Normal profit is $25,000 a year. © 2013 Pearson CHECKPOINT 14.1 Lee is a computer programmer who earned $50,000 in 2007. But in 2008, he opened a custom woodworking business. At the end of his first year, he submitted the information in the table to his accountant. Lee’s economic profit is ____. A. B. C. D. E. –$9,000 $13,800 $35,000 $77,000 $9,000 He stopped renting out his cottage for $3,500 a year and used it as his factory. The market value of the cottage increased from $70,000 to $71,000. He spent $50,000 on materials, etc. He leased machines for $10,000 a year. He paid $15,000 in wages. He used $10,000 from his savings account, which earns 5% a year interest. He borrowed $40,000 at 10% a year. He sold $160,000 worth of body boards. Normal profit is $25,000 a year. © 2013 Pearson CHECKPOINT 14.1 Practice Problem 2 Lee is a computer programmer who earned $35,000 in 2007. But in 2007, he opened a body board manufacturing business. At the end of the first year of operation, he submitted the information in the table to his accountant. Lee’s accountant recorded the depreciation on Lee’s cottage during 2007 as $7,000. What did the accountant say Lee’s profit or loss was? © 2013 Pearson He stopped renting out his cottage for $3,500 a year and used it as his factory. The market value of the cottage increased from $70,000 to $71,000. He spent $50,000 on materials, etc. He leased machines for $10,000 a year. He paid $15,000 in wages. He used $10,000 from his savings account, which earns 5% a year interest. He borrowed $40,000 at 10% a year. He sold $160,000 worth of body boards. Normal profit is $25,000 a year. CHECKPOINT 14.1 Solution The accountant measures Lee’s profit as total revenue minus explicit costs minus depreciation. Profit = $160,000 – $79,000 – $7,000 Profit = $74,000 He stopped renting out his cottage for $3,500 a year and used it as his factory. The market value of the cottage increased from $70,000 to $71,000. He spent $50,000 on materials, etc. He leased machines for $10,000 a year. He paid $15,000 in wages. He used $10,000 from his savings account, which earns 5% a year interest. He borrowed $40,000 at 10% a year. He sold $160,000 worth of body boards. Normal profit is $25,000 a year. © 2013 Pearson CHECKPOINT 14.1 In the news What does it cost to make 100 pairs of running shoes? The Asian manufacturer of running shoes pays its workers $275 to make 100 pairs per hour. These workers use company-owned equipment that costs the company in forgone interest and economic depreciation $300 an hour. Materials cost $900. Source: washpost.com Which costs are explicit costs and which costs are implicit costs? If the total revenue from the sale of 100 pairs of shoes is $1,650, what is the manufacturer’s economic profit? © 2013 Pearson CHECKPOINT 14.1 Solution Explicit costs are wages of $275 and materials of $900. Implicit costs are the forgone interest and economic depreciation of $300. Economic profit equals total revenue minus total cost. Total cost is $1,475. So economic profit equals $1,650 minus $1,475, which is $175. © 2013 Pearson CHECKPOINT 14.2 Practice Problem 1 Tom leases a farmer’s field and grows pineapples. Tom hires students to pick and pack the pineapples. The table sets out Tom’s total production schedule. Calculate the marginal product of the third student and the average product of three students. © 2013 Pearson CHECKPOINT 14.2 Solution The marginal product of the third student is the change in total product that results from hiring the third student. When Tom hires 2 students, total product is 220 pineapples a day. When Tom hires 3 students, total product is 300 pineapples a day. © 2013 Pearson CHECKPOINT 14.2 Marginal product of the third student is the total product of 3 students minus the total product of the 2 students. That is, the marginal product of the third student is 300 pineapples – 220 pineapples a day, which equals 80 pineapples a day. © 2013 Pearson CHECKPOINT 14.2 Average product equals total product divided by the number of students. Average product of three students is the total product of three students divided by 3. That is, the average product of three students is 300 pineapples ÷ 3, which equals 100 pineapples a day. © 2013 Pearson CHECKPOINT 14.2 Practice Problem 2 Tom leases a farmer’s field and grows pineapples. Tom hires students to pick and pack the pineapples. The table sets out Tom’s total production schedule. Over what range of numbers of students does marginal product increase? © 2013 Pearson CHECKPOINT 14.2 Solution Marginal product of the first student is 100 pineapples a day. Marginal product of the second student is 120 pineapples a day. Marginal product of the third student is 80 pineapples a day. So marginal product increases when Tom hires the first and second students. © 2013 Pearson CHECKPOINT 14.2 Study Plan Problem Tom leases a farmer’s field and grows pineapples. Tom hires students to pick and pack the pineapples. The table sets out Tom’s total production schedule. Marginal product increases when Tom hires ________. A. B. C. D. E. the first and second students the first, second, and third students each additional student only the first student the first, second, third and fourth students © 2013 Pearson CHECKPOINT 14.2 Practice Problem 3 Tom leases a farmer’s field and grows pineapples. Tom hires students to pick and pack the pineapples. The table sets out Tom’s total production schedule. When marginal product increases, is average product greater than, less than, or equal to marginal product? © 2013 Pearson CHECKPOINT 14.2 Solution When Tom hires 1 student, marginal product is 100 pineapples per student and average product is 100 pineapples per student. © 2013 Pearson CHECKPOINT 14.2 When Tom hires 2 students, marginal product is 120 pineapples per student and average product is 110 pineapples per student. That is, when Tom hires the second student, marginal product increases and average product is less than marginal product. © 2013 Pearson CHECKPOINT 14.2 In the news Budget cuts bring layoffs to museums The Detroit Institute of Arts cut its staff by 56 full-time and 7 part-time employees and canceled some of this year’s planned exhibitions. Source: The New York Times, February 25, 2009 As the number of museum workers decreased and some planned exhibitions were canceled, how do you think the marginal product and average product of a museum worker changed in the short run? © 2013 Pearson CHECKPOINT 14.2 Solution With a decrease in the number of exhibitions, output of the museum (number of visitors to the museum) might fall, but the percentage decrease in output is probably less than the percentage cut in labor services. Marginal product per worker will increase and the increase in marginal product will lead to an increase in the workers’ average product. © 2013 Pearson CHECKPOINT 14.3 Practice Problem 1 Tom leases a farmer’s field for $120 a day and grows pineapples. He pays students $100 a day to pick and pack the pineapples and he leases capital at $80 a day. The table shows Tom’s daily output. What is Tom’s total cost and average total cost if he produces 300 pineapples a day? © 2013 Pearson CHECKPOINT 14.3 Solution Total cost = Total fixed cost + Total variable cost. Total fixed cost is cost of leasing the field ($120 a day) and cost of leasing the capital ($80 a day). Total fixed cost is $200 a day. © 2013 Pearson CHECKPOINT 14.3 Total variable cost is the wages paid. To produce 300 pineapples a day, Tom must hire 3 students at $100 a day, so total variable cost is $300 a day. Total cost = $200 + $300 Total cost = $500 a day. © 2013 Pearson CHECKPOINT 14.3 Average total cost is the total cost divided by total product. When Tom produces 300 pineapples a day, his total cost is $500 a day. So average total cost equals $500 ÷ 300 pineapples, which is $1.67 a pineapple. © 2013 Pearson CHECKPOINT 14.3 Practice Problem 2 Tom leases a farmer’s field for $120 a day and grows pineapples. He pays students $100 a day to pick and pack the pineapples and he leases capital at $80 a day. The table shows Tom’s daily output. What is the marginal cost of the 400th pineapple? © 2013 Pearson CHECKPOINT 14.3 Solution Marginal cost is the increase in total cost that results from picking and packing one additional pineapple a day. The TC column in the table shows the total cost of producing each output level. © 2013 Pearson CHECKPOINT 14.3 The total cost of producing 400 pineapples a day is $700. The total cost of producing 360 pineapples a day is $600. The increase in the number of pineapples is 40, and the increase in total cost is $100. Marginal cost is the increase in total cost divided by 40 and is $2.50 per pineapple. © 2013 Pearson CHECKPOINT 14.3 The MC column in the table shows the marginal cost of producing a pineapple. The marginal cost of the 380th pineapple a day is $2.50 and the marginal cost of the 410th pineapple a day is $5.00, so the marginal cost of the 400th pineapple is about $4.00. © 2013 Pearson CHECKPOINT 14.3 Practice Problem 3 Tom leases a farmer’s field for $120 a day and grows pineapples. He pays students $100 a day to pick and pack the pineapples and he leases capital at $80 a day. The table shows Tom’s daily output. At what output is Tom’s average total cost a minimum? © 2013 Pearson CHECKPOINT 14.3 Solution At the minimum of average total cost, average total cost equals marginal cost. Minimum average total cost is $1.67 a pineapple at 330 pineapples a day—midpoint between 300 and 360 pineapples. © 2013 Pearson CHECKPOINT 14.3 In the news Metropolitan Museum completes round of layoffs The museum has cut 74 jobs and 95 other workers retired. The museum also laid off 127 other employees in its retail shops. The cut in its labor costs is $10 million, but the museum expects no change in the number of visitors. Source: The New York Times, June 22, 2009 Explain how the job cuts will change the museum’s shortrun average cost curves and marginal cost curve. © 2013 Pearson CHECKPOINT 14.3 Solution A cut in labor but no change in output increases marginal product of labor and decreases marginal cost of producing the output. The MC, AVC, and ATC curves shift downward. The shop closures decrease total fixed cost and shift the AFC and ATC curves downward. © 2013 Pearson CHECKPOINT 14.4 Practice Problem 1 Tom can lease one field for $120 a day and capital for $80 a day or two fields for $240 a day and twice as much capital at $160 a day. He hires students at $100 a day. What is his average cost when he farms two fields and grows 220 pineapples a day? © 2013 Pearson The table shows his output with one field and two fields. CHECKPOINT 14.4 Solution Total cost is fixed cost of leasing two fields at $400 a day plus $100 a day for each student hired. Tom can produce 220 pineapples with 2 fields and 1 student, so total cost is $500 a day. © 2013 Pearson The table shows his output with one field and two fields. CHECKPOINT 14.4 Average total cost is the total cost divided by output. Average total cost of producing 220 pineapples a day is $500 divided by 220 and equals $2.27 a pineapple. © 2013 Pearson The table shows his output with one field and two fields. CHECKPOINT 14.4 Practice Problem 2 Tom can lease one field for $120 a day and capital for $80 a day or two fields for $240 a day and twice as much capital at $160 a day. He hires students at $100 a day. Make a graph of Tom’s average total cost curve and show the long-run average cost curve. Over what output range will Tom use 1 field and use 2 fields? © 2013 Pearson The table shows his output with one field and two fields. CHECKPOINT 14.4 Solution The table sets out Tom’s average total costs and the figure graphs the two ATC curves. © 2013 Pearson CHECKPOINT 14.4 Tom’s long-run average cost curve is the lower segments of the two ATC curves, highlighted in the figure. © 2013 Pearson CHECKPOINT 14.4 Practice Problem 3 Tom can lease one field for $120 a day and capital for $80 a day or two fields for $240 a day and twice as much capital at $160 a day. He hires students at $100 a day. Does Tom experience constant returns to scale, economies of scale, or diseconomies of scale? © 2013 Pearson The table shows his output with one field and two fields. CHECKPOINT 14.4 Solution Tom experiences economies of scale if he doubles both labor and capital, he produces more than double the output. The red arrows show that Tom experiences economies of scale up to an output of 740 pineapples a day. The black arrow shows diseconomies of scale. © 2013 Pearson The table shows his output with one field and two fields. CHECKPOINT 14.4 In the news GM restructuring plan released GM’s restructuring plan will close 11 plants and reduce output at 3 others. Source: boston.com, May 31, 2009 Explain the effects of the restructuring plan on GM’s total fixed cost, total variable cost, short-run ATC curve, and LRAC curve. © 2013 Pearson CHECKPOINT 14.4 Solution Closing 11 plants will lower GM’s total fixed cost. Closing 11 plants and decreasing output at 3 plants will lower GM’s total variable cost. With a smaller scale, GM will move to the ATC curve associated with that smaller scale and move left along its LRAC curve. © 2013 Pearson