Legal Terms Power Point

advertisement

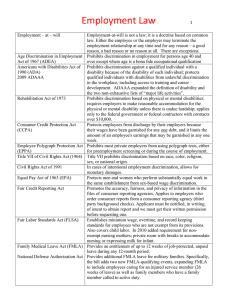

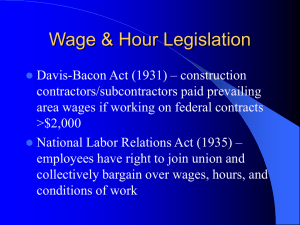

Legal Aspects of Business Taxes, Laws, and Acts Federal Unemployment Tax Act • Provides unemployment compensation for people who’ve lost their jobs • Payroll tax • Paid by employers on employee wages Securities and Exchange Commission • Regulates securities and protects investors Federal Communications Commission • Regulates radio, TV, wire, satellite communications • Both within and out of the U.S. Sherman Act • Anti monopoly • Eliminates merging of companies Federal Trade Commission • Protects against false advertisement and restricts unfair competition Taxes Proportional, Regressive, Progressive • Proportional-same percentage for all classes • Regressive-higher income pay lower percentage taxes, lower income pays higher taxes • Progressive- higher income pays higher taxes Internal Revenue Service • Tax collection and enforcement Food & Drug Administration • Regulates food and medication to assure safety Age Discrimination Act in Employment Act • Prohibits employee discrimination from ages 40-70 Licensing, Public Franchise, Building Codes, Zoning • Licensing-permit to operate • Public franchise-a right granted from the gov. to carry out specific commercial activities. • Building codes-regulation for construction • Zoning-regulates different types of land use for development Social Security Act • Deducts 6.2% from the employee and the employer each paycheck Equal Employment Opportunity Commission • Handles workplace discrimination Types of Bankruptcy • A legal proceeding that involves a person or business that is unable to pay outstanding debts • Chapter 7-individuals • Chapter 11- companies • Chapter 13- need court approval and courts monitor your finances State & Local Regulations Interstate & Intrastate • Interstate-trade between states and outside of • Intrastate- trade within the states Types of Taxes Income, Sales, Excise, Property • Income-largest annual source of income levied on personal income by the gov. • Sales-tax on retail goods and services • Excise- tax on specific goods (ex. Gas) • Property- annual amount paid by the landowner to the local gov. Environmental Protection Agency • Protects humans and environmental health Wheeler-Lea Act • Prohibits false advertisements i.e. food, drugs, cosmetics Fair Labor Standards Act • Regulates minimum wage, working hours, child labor, overtime, working conditions National Labor Relations Act • Protects the rights of workers to form unions Clayton Act • Prohibits merger to lessen competition • In addition to the Sherman anti-trust act Robinson-Patman Act • Prohibits anti-competitive practice by producers specifically price discrimination Federal Aviation Administration • Enforces air safety and traffic control • Inspects and rates aircrafts and pilots Americans with Disability Act • Prohibits discrimination against people with disabilities and employment, transportation, public accommodations, communications The Electronics Communications Privacy Act • Restricts the government to tap into computer databases Occupational Safety & Health Laws • Health and safety regulations in the workplace American Civil Liberties Union • Organization of lawyers that defend the civil rights of U.S citizens Right to Work States • Can’t be forced to join a labor union