01-15 Stock Scavenger Hunt-Kelly Lynch

Economics—Kleinfelder

January 2014

Stock Market Scavenger Hunt

NAME: Kelly Lynch

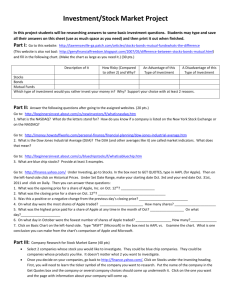

1. Name five major industries within the stock market and give two examples of companies for each.

1. Basic Materials a. Exxon Mobil Corporation (XOM) b. Chevron Corp. (CVX)

2. Health Care a. Johnson & Johnson (JNJ) b. Pfizer Inc. (PFE)

3. Services a. Walmart Stores Inc. (WMT) b. Amazon.com Inc. (AMZN)

4. Technology a. Google Inc. (GOOG) b. Microsoft Corporation (MSFT)

5. Consumer Goods a. Apple Inc. (AAPL) b. Procter & Gamble Co. (PG)

2. Name and provide the symbol for two companies on the NYSE, two companies on the NASDAQ.

What is the difference between the two, and why would a company or an investor prefer one over the other?

NYSE Companies

-Bank of America (BAC)

-Coca-Cola (KO)

NASDAQ

-Costco (COST)

-Amazon.com, Inc. (AMZN)

The main difference between the NYSE and the NASDAQ is that the NASDAQ is a dealer’s market, in which the shareholders buy directly from a dealer; the NYSE is an auction market in which the shareholders are buying and selling amongst themselves. The NASDAQ has a reputation of serving high-tech companies dealing with internet or electronics, while the NYSE has a more established reputation and companies that have been around for a long time typically trade on there. Additionally, the NYSE has much higher listing fees than the NASDAQ. For example to list 75 million shares, the NYSE has an initial fee of $80,000 and annual fee of $27,500; the NASDAQ has an initial fee of $300,000 and annual fee of $69,750.

3. Name a stock (symbol and company name) that traded more than 250,000 shares (volume) yesterday. (1/13) What did it trade?

Sirius XM Holdings Inc. (SIRI). 110,887,445.

4. Name a stock (symbol and company name) that trades at more than $100 per share yesterday. (1/13)

What does it trade at?

Google Inc. (GOOG). $1,122.98.

5. Name a stock (symbol and company name) that has gone down in value in the past day (1/14). How much has it decreased by? (Identify it’s value and how much it has decreased) Based on analysts, news reports, and recent trends, can you make any guesses as to why the stock went down?

Blackberry Ltd (BBRY) has decreased by .07 (.83%) in the past day and is currently at 8.33. I believe that this stock decreased because Blackberry Ltd has not produced new smart phones that have gained the same amount of popularity as Apple, Android, or Microsoft. Additionally, on December 20, the company reported a loss of 4.4 billion dollars so people are losing faith in the company.

6. a. Fill in the blanks with the stocks and their price according to December 1 closing price:

1200 shares of Apple Inc. (AAPL) Price on 12/1 = 551.23 x 1200 = 661,476.00

500 shares of Microsoft Corporation (MSFT) Price on 12/1= 38.37 x 500 = 19,185.00

10 shares of PepsiCo Inc. (PEP) Price on 12/1= 83.70 x 10 = 837.00

100 shares Coca-cola Co (KO) Price on 12/1= 40.08 x 100 = 4,008.00

b. Now figure how much it would have cost to buy the same number of shares yesterday’s closing price.

1200 shares of Apple Inc. (AAPL) Price on 1/13 = 535.73 x 1200 = 642,876.00

500 shares of Microsoft Corporation (MSFT) Price on 1/13 = 34.98 x 500 = 17,490.00

10 shares of PepsiCo Inc. (PEP) Price on 1/13 = 82.37 x 10 = 823.70

100 shares Coca-cola Co (KO) Price on 1/13 = 39.53 x 100 = 3,953.00

c. Have the companies made or lost money in the past day? Is this in keeping with the trends of the past 5 days?

Disney: Lost, -2.12.

Yes, Disney has been declining consistently over the past five days.

Microsoft: Lost, -1.06.

Over the past five days Microsoft’s stock has remained relatively static in which the value averages around 35.

Kraft Foods: Lost, -0.31.

The Kraft Foods stock began increasing two days ago, yet for the three days before it was declining.

Coca-cola: Lost, -0.60.

Yes, the stock has been declining over the past five days.

7. What is a mutual fund? What are the pros and cons of investing in a mutual fund? Give an example and provide it’s recent history.

A mutual fund is an investment program that is funded by shareholders, but professionally managed and has holds diverse stocks. Pros of a mutual fund are: diverse holdings which are more stable, professionally managed, convenience, and they are overseen by the government. Cons are fees, less predictability that typical, and no opportunity to choose which stocks you want to invest in.

An example of a mutual fund is American Funds Washington Mutual Investors Fund Class A (AWSHX)

and its 52-week low was on January 16, 2013 at 32.00, while the 52-week high was on December 18,

2013 at 39.69. It closed at 39.10 on January 14, 2014, which was an increase of .26 from the previous day.

8. What is the 52-week low for McDonald’s? What is the 52-week low? What does this imply?

The 52-week lowest price that the stock has been traded at over the past year. For McDonalds, it occurred on January 16, 2013 and the low was 91.10.

9. What is the P/E ratio (in your own words!!). Identify a company with a good P/E ratio and explain why this is a helpful statistic in evaluating the given company.

The P/E ratio is also known as the Price-Earnings ratio, which is a comparison between a company’s current share price and the earnings per-share. Apple Inc. (AAPL) has a good P/E ratio of

51.26 (546.39/10.66), which is over double the average P/E ratio which is between 20 and 25. This is helpful in choosing whether or not to invest in a company because a high P/E ratio can show possible high earnings in the future for a company’s shareholders.

10. What is the difference between the Dividend Yield and the Dividend Share? Which number is more helpful? Explain using an example from the stock market.

The Dividend Yield is a ratio that shows the relationship between the dividends that a company pays out each year compared to its share price while the Dividend Share is the ratio between the total dividends per year compared to the number of outstanding ordinary shares issued. The Dividend Share is more helpful because it demonstrates the possible dividends that a shareholder can obtain by investing in a company. For example, the Dividend Yield of The Walt Disney Company (DIS) is 1.16.