Case Project 1

advertisement

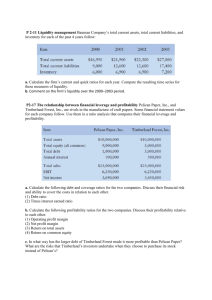

MBAC 6060 – Spring 2012 Financial Statement Analysis Case The objective of this case is to review financial statement analysis and to reinforce the meanings, interpretations, and effects of financial statement ratios. Please read the instructions below and use the associated financial statements in the Excel file to produce a group report answering the assignment question. Please include a print-out of the financial statements/spreadsheets produced and associated write-ups. These include A common-size income statement and balance sheet for BurritoJoint for 2009 and 2008 A common-size income statement and balance sheet for BurgerHaven in 2009 Financial Ratio Analysis sheet(s) for BurritoJoint for 2009 and 2008 Financial Ratio Analysis sheet(s) for BurgerHaven for 2009 Overview: As a financial manager working for BurritoJoint, a NYSE-listed company, you will compose an internal financial planning and analysis report for the firm. At your disposal are the 2009 and 2008 income statements and balance sheets for BurritoJoint and the 2009 income statement and balance sheet for BurgerHaven (also a NYSE-traded firm). You also have the price of both companies’ stocks on the day that financial statements were prepared. For each portion of the analysis compare BurritoJoint’s 2009 results to its 2008 results and compare BurritoJoint’s 2009 results to BurgerHaven’s 2009 results. Please work with your group to produce a printed report containing appropriate tables and financial statements along with relevant short written answers and insights to the questions and issues in the assigned analysis. Background: BurritoJoint, Inc. is a chain of fast-casual restaurants in the United States and Canada specializing in burritos and tacos. It was founded by Steve in 1993 and based in the Rocky Mountain Region. The restaurant is known for its large burritos, assembly line production, and use of natural ingredients. The company released a mission statement called Food with Integrity, which highlights its efforts in using organic ingredients, and serves more naturally raised meat than any other restaurant. BurritoJoint is one of the first chains of fast casual dining establishments. From 1998 to 2006, BurgerHaven Corp owned a majority interest in BurritoJoint, but fully divested its interest in 2006. BurritoJoint currently has more than 1000 locations, with restaurants in 38 states, the District of Columbia, Ontario, Canada, and London, England. Its net income in 2009 was US$126 million, and has a staff of 25,000 employees. BurritoJoint has had 23% average sales growth over the years 2007, 2008 and 2009. Background from Wikepedia. Names were changed to protect the innocent. 1 Part 1: Financial Statement Analysis & Free Cash Flow Determinants The goal is to compare BurritoJoint over time and to one of its comparable companies. 1. Use the Income Statement and Common-Size Income Statements to describe BurritoJoint’s operations in 2009 relative to 2008 and relative to BurgerHaven in 2009. Consider revenue and the relative level of expenses. Do you notice changes for BurritoJoint over time or differences between BurritoJoint and BurgerHaven? Describe whether or not the findings are consistent with what you may know about the companies. Use Profitability Ratios to address the relative of performance along the different levels of operations for each. 2. Use the Balance Sheets and Common-Size Balance Sheets to compare BurritoJoint’s asset mix in 2009 to its asset mix in 2008 and to BurgerHaven’s asset mix in 2009. Note the portion of short-term assets (and specifically cash) on the common-size balance sheets. How much cash does BurritoJoint hold at the end of 2009 relative to 2008 and relative to BurgerHaven? What might explain the change in cash over time and the difference between the two companies? Hint: Generally, if a mature firm (with a relatively high payout ratio) holds cash, it will have to support, or finance that level of additional assets (cash). From where, and what are the implications? Consider your analysis of the cash balance in this context. 3. Use the Balance Sheets and Common-Size Balance Sheets to compare BurritoJoint’s liability mix and debt-equity mix in 2009 to itself in 2008 and to BurgerHaven in 2009. To simplify the analysis, assume that securities (bonds) issued by the firm are Long-Term Debt and capitalized lease obligations of the firm are recorded as “Other Long-Term Liabilities.” 4. Use the balance sheets and income statements to calculate Days’ Sales in Inventory for BurritoJoint in 2009 and 2008 and BurgerHaven in 2009. Compare the results. What does this say about the frequency of food deliveries and storage expenses? Now assume that BurgerHaven chose the “correct” level of inventory relative to sales. Increased inventory hedges against unexpected sales volatility (to ensure there’s no shortage of burritos or burgers). If BurritoJoint increased its inventory to the same relative level as BurgerHaven (as measured by days’ sales in inventory) assume this would result in an increase in short-term debt in “Other Current Liabilities.” Calculate the increase in interest expense if the marginal short-term borrowing cost is 3.00%. 5. Use the balance sheets to calculate the Current, Cash and Quick Ratios for BurritoJoint in 2009 and 2008 and BurgerHaven in 2009. What is the difference between these ratios? What is excluded as the ratios change? Compare the results. What do these ratios tell us about BurritoJoint’s ability to meet its debt in the short run compared to BurgerHaven? 6. Use the balance sheet and income statements to calculate Earnings per Share, EBITDA, the Price-toEarnings Ratio, the Price-to-EBITDA Ratio, the Price-to-Sales Ratio and the Market-to-Book ratios for BurritoJoint in 2009 and 2008 and BurgerHaven in 2009. 2 Describe the differences between these valuation ratios. What’s being removed as you move from one price-numerator ratio to the next? Compare these relative valuation measures across time and companies. How is the market valuing BurritoJoint in 2009 compared to 2008 and to BurgerHaven in 2009? Which company does the market expect to grow more? 7. Use the balance sheet and income statements to calculate ROE, EM, ROA, AT and PM for BurritoJoint in 2009 and 2008 and BugerHaven in 2009. These are the components of the DuPont Identity and are used to decompose profitability. Compare BurritoJoint in 2009 to 2008. Did profitability increase or decrease? To what can the change be attributed? Compare BurritoJoint to BurgerHaven in 2009. Which had the greater profitability? To what can the difference be attributed? What are the implications of the difference? What recommendations might be made to BurritoJoint’s operations management in order to increase profitability? It is noted that you should find BurgerHaven is better at controlling expenses. Examine the income statements to determine which expenses are driving this result. Are your recommendations consistent with the BurritoJoint’s mission? 8. Calculate the current Plowback Ratio, the Internal Growth Rate and Sustainable Growth Rate for BurritoJoint. Briefly define each growth rate. What is the effect on the D/E ratio if the firm grows at the Internal Growth Rate? What is the effect on the D/E ratio if the firm grows at the Sustainable Growth Rate? 9. Calculate Net Operating Profit After-Tax, short-term and long-term operating capital requirements, and return on invested capital for BurritoJoint for both years and for BurgerHaven for 2009. Determine the net capital spending and free cash flow for BurritoJoint for 2009. Calculate and disclose what the uses of free cash flow were for BurritoJoint in 2009. 3 MBAC 6060 – Spring 2012 Growth/ Forecasting/Financing Case II Part 2: Growth Models The goal is to build a spreadsheet model to examine the effects of different growth rates and financing policies on the financial performance of BURRITOJOINT. 1. Calculate the components of External Financing Needed (EFN) and the EFN for BURRITOJOINT in 2009. Assume A/P is the only spontaneous liability. 2. Next, in cells M7 through N51, create regular and common-size 2010 pro-forma income statements and balance sheets for BURRITOJOINT that reference the growth rate entered into cell C79. Assume: Every item in the income statement grows proportionally with sales. This is the same as assuming no change in either sales or expense efficiency. Assume no change in dividend policy. This means all NI will be retained. All asset categories grow at the sales growth rate. This means the asset mix does not change. Only A/P grows at the sales growth rate (just like the assets). All other liabilities do not change. This is same as saying A/P is the only spontaneous liability. Retained Earnings in the pro-forma balance sheet increases by the “Increased RE from New Sales” calculated in cell C82. Use “Common Stock, Net” in cell M47 as the plug value. The plug value is the account adjusted in order to make the balance sheet “balance.” So enter a formula into “Common Stock, Net” such that it equals Total Assets less Total Liabilities less Retained Earnings. Enter a growth rate of 25% into cell C79. If your spread sheet works correctly, changing the “Projected Sales Growth” in cell C79 will cause the EFN in cell C83 and the values in the proforma balance sheet to change. Copy and paste the cells that calculate the short-term solvency ratios (Current, Quick and Cash Ratios) in the same rows under the new pro-forma financial statements (column M). Copy and paste the cells that calculate profit, leverage and efficiency (the DuPont Identity Cells ROE, EM, ROA, AT and PM) to column M. Note that ROA, PM and AT are not effected by sales growth. Why? 3. Use the model to examine the effects of different growth rates and financing policies on the financial performance of BURRITOJOINT. (a) As an exercise, first assume sales grows at exactly the Internal Growth Rate (which is 15.20%). To avoid a rounding error, set cell C79 equal to cell C76, don’t just type in the number. 4 Compare the EFN at the Internal Growth rate to the “Liabilities Automatically Created by New Sales” in cell C81. Explain your findings. What are the effects on the firm’s short term solvency if it grows at the internal growth rate? (Does short-term solvency improve or deteriorate?) Why? What are the effects on the firm’s profitability, leverage and efficiency if it grows at the internal growth rate? (Do these measures improve, stay the same, or deteriorate?) Why? (b) Now assume sales will grow at 25% (enter 25% into cell C79). Record the results for the liquidity, profitability and efficiency ratios from the projection in Table 2 on the “Tables” tab. 4. Now assume BURRITOJOINT is considering a change in its financing policy. It is considering using accumulated cash (from past and current retained earnings) to pay for new assets instead of selling new equity. This means you must adjust the model to account for the change in the financing policy. There are a number of ways to adjust your model. Here’s one that will preserve the original model so that you won’t lose those results: Right-click the sheet tab at the bottom of the spreadsheet and select “Move or Copy” Check the “Create a Copy” box and click OK Right-click the new tab and rename it “Cash Financing” (a) Adjust your pro form balance sheet to reflect the growth level and new financing policy. So now “Cash and Cash Equivalents” is the plug value. All assets (except cash) will grow at the sales growth rate, so the formulas do not change A/P still grows at the sales growth rate so M37 = C37*(1 + C$79) No other liabilities change values. Retained Earnings in the pro form balance sheet still increases by the “Increased RE from New Sales” calculated in cell C82 so M48 = C48 + C82. The new financing policy means new equity is not issued so M47 = C47. Set “Cash and Cash Equivalents” equal to “Total Liabilities and Equity” less all the non-cash assets. This is the plug value. So cell M24 = M51 – M33 – M27 – M26 – M25 = $261,445 (at 25% growth) Be sure that your “Totals” values are calculated correctly and that your balance sheet “balances.” Note that Total Assets in the pro-forma no longer equals 2009 Total Assets multiplied by one plus the growth rate. Why? Because BURRITOJOINT will use cash to buy new assets. Record the results for the liquidity, profitability and efficiency ratios from the projection in Table 2 on the “Tables” tab. (b) Next calculate the maximum sales growth BURRITOJOINT could finance using existing cash. Assume the minimum cash holdings can be no less than 10% of total assets (BURGERHAVEN holds less than 6%) and that any additional cash may be used to finance growth. (Note we will still assume that A/P growth is spontaneous, so that portion of growth will be financed by suppliers.) To do this, first copy and create a new spread sheet (called Max Growth) so you don’t lose the results from above. 5 Change the sales growth value in Cell C79 until the common-size pro-forma “Cash” in cell N24 is 10% of Total Assets. You may want to use the “Solver” or “Goal Seek” Excel functions instead of changing the cell manually. Record the results for the liquidity, profitability and efficiency ratios from the projection in Table 2 on the “Tables” tab. Part 3: Growth Analysis We now have the ability to compare the effects of differing growth rates and financing policies on the performance of the company. For each growth scenario, place the short-term solvency ratios and the profit, leverage and efficiency measures you calculated in Table 2 on the Tables tab. 1. Compare the short-term solvency for 25% sales growth under the 2 financing options (selling equity or using existing cash). Under which option does the firm have better short-term solvency? How does the resulting short term-solvency compare to the current 2009 values? How does it compare to BURGERHAVEN? Compare the long-term solvency (EM). Are the long-term solvency results consistent with the shortterm solvency results? 2. Compare the profitability (ROE) for 25% sales growth under the 2 financing options. Under which option is the profitability greater? Explain why. 3. Compare the overall efficiency (ROA) for 25% sales growth under the 2 financing options. Under which option is the ROA greater? Explain why. 4. Compare the components of overall efficiency (AT and PM) for 25% sales growth under the 2 financing options. How do the different financing options affect the components of efficiency? Explain why. 5. Look at the results for max growth using cash. How do the solvency, profitability and efficiency measures under this scenario compare to the other results? 6. Given your analysis, write a brief recommendation suggesting a financing policy. Support your recommendation with the results from the analysis. 6