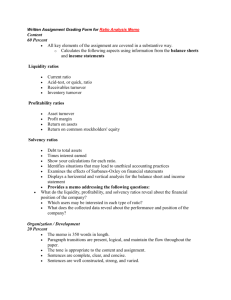

Financial Ratio Analysis Problems: Liquidity & Leverage

advertisement

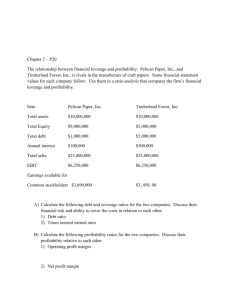

P 2-11 Liquidity management Bauman Company’s total current assets, total current liabilities, and inventory for each of the past 4 years follow: a. Calculate the firm’s current and quick ratios for each year. Compare the resulting time series for these measures of liquidity. b. Comment on the firm’s liquidity over the 2000–2003 period. P2-17 The relationship between financial leverage and profitability Pelican Paper, Inc., and Timberland Forest, Inc., are rivals in the manufacture of craft papers. Some financial statement values for each company follow. Use them in a ratio analysis that compares their financial leverage and profitability. a. Calculate the following debt and coverage ratios for the two companies. Discuss their financial risk and ability to cover the costs in relation to each other. (1) Debt ratio (2) Times interest earned ratio b. Calculate the following profitability ratios for the two companies. Discuss their profitability relative to each other. (1) Operating profit margin (2) Net profit margin (3) Return on total assets (4) Return on common equity c. In what way has the larger debt of Timberland Forest made it more profitable than Pelican Paper? What are the risks that Timberland’s investors undertake when they choose to purchase its stock instead of Pelican’s? P2-18 Ratio proficiency McDougal Printing, Inc., had sales totaling $40,000,000 in fiscal year 2003. Some ratios for the company are listed below. Use this informatik to determine the dollar values of various income statement and balance sheet accounts as requested. Calculate values for the following: a. Gross profits b. Cost of goods sold c. Operating profits d. Operating expenses e. Earnings available for common stockholders f. Total assets g. Total common stock equity h. Accounts receivable