A86045 Accounting & Financial Reporting Paul G. Smith

advertisement

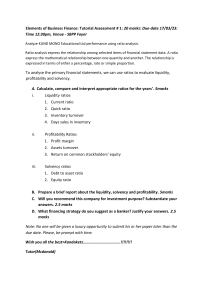

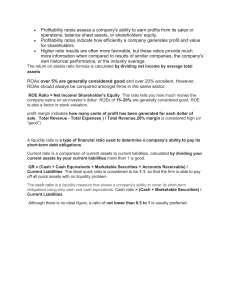

Financial Analysis – Exercises 1. What ratios are useful in analysing a company’s profitability? a. relative to sales b. relative to the amount invested in the company 2. What two ratios are commonly used to assess a company’s liquidity? What is a significance of each of these? 3. What five ratios are commonly used to evaluate how efficiently a company is using its assets? 4. What ratios do investors often use when analysing a company’s performance? 5. If a company’s gross margin increases from one year to another by 5% what are the possible reasons for this? 6. If a company has a liquidity ratio of less than 1 what does this signify? 7. Compare and contrast two companies using ratio analysis, trend analysis and common size analysis. a) Profitability b) Liquidity c) Efficiency d) Investment/capital gearing A86045 Accounting & Financial Reporting Paul G. Smith