The Great Depression Mr. Rosamilia's “A Series of Unfortunate

advertisement

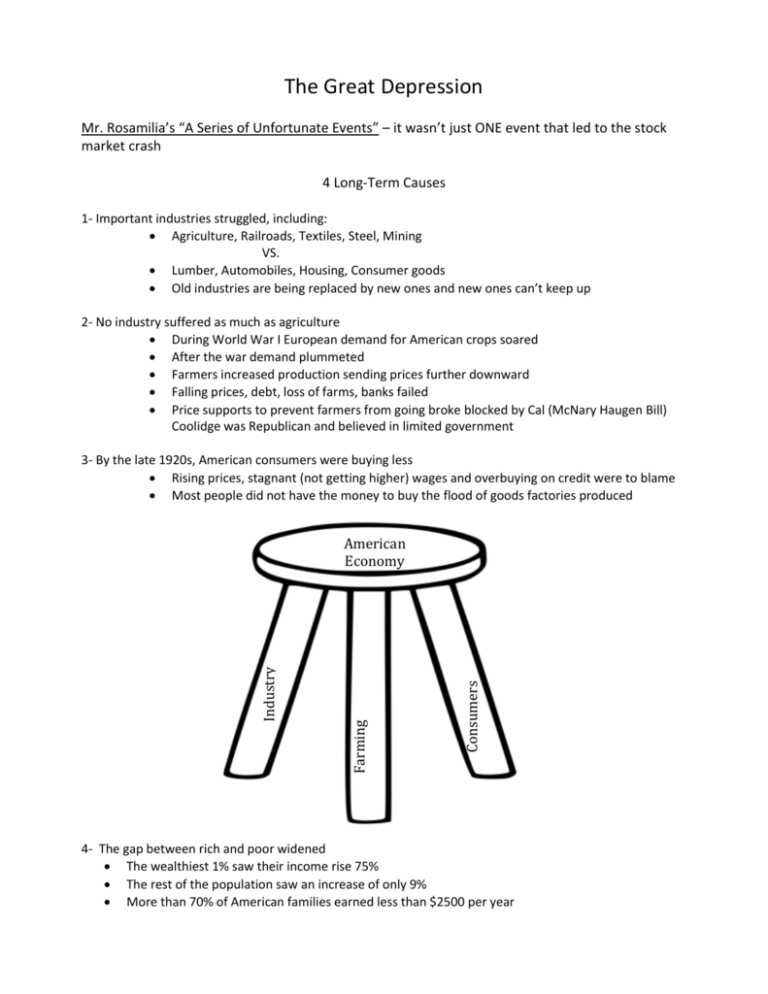

The Great Depression Mr. Rosamilia’s “A Series of Unfortunate Events” – it wasn’t just ONE event that led to the stock market crash 4 Long-Term Causes 1- Important industries struggled, including: Agriculture, Railroads, Textiles, Steel, Mining VS. Lumber, Automobiles, Housing, Consumer goods Old industries are being replaced by new ones and new ones can’t keep up 2- No industry suffered as much as agriculture During World War I European demand for American crops soared After the war demand plummeted Farmers increased production sending prices further downward Falling prices, debt, loss of farms, banks failed Price supports to prevent farmers from going broke blocked by Cal (McNary Haugen Bill) Coolidge was Republican and believed in limited government 3- By the late 1920s, American consumers were buying less Rising prices, stagnant (not getting higher) wages and overbuying on credit were to blame Most people did not have the money to buy the flood of goods factories produced Consumers Farming Industry American Economy 4- The gap between rich and poor widened The wealthiest 1% saw their income rise 75% The rest of the population saw an increase of only 9% More than 70% of American families earned less than $2500 per year Republican Herbert Hoover ran against Democrat Alfred E. Smith in the 1928 election Hoover emphasized years of prosperity under Republican administrations Hoover won an overwhelming victory The 1929 Crash During the 1920s, the U.S. stock market underwent rapid expansion, reaching its peak in August 1929, after a period of wild *speculation and *buying on margin. By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value. *speculation (to assume)- Speculation in stock means to buy stock with the assumption that it can always be sold at a profit *buying on margin- a person purchases a stock by using a bit of his or her own money and borrowing the rest. For example, to purchase a $100 stock the buyer might put up $20 and borrow $80 to make up the entire price. If the $100 price of the stock dropped to $70, then selling the stock at $70 would not even pay back the loan from the broker. The investor, owing $80 but having only $70, would have to come up with more cash. This is what happened not to one share but to millions of shares when the market dropped in October 1929. Investors could not come up with enough cash to meet their "margin calls," demands by the brokers for more cash. Black Tuesday (October 29), in which stock prices collapsed completely and 16,410,030 shares were traded on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors, and stock tickers ran hours behind because the machinery could not handle the tremendous volume of trading. The stock market crash was NOT a LONG TERM cause but an ___________________ one for the Great Depression. The Financial Collapse How did Americans respond to the crash? What happened to American banks? Hawley Smoot Tariff U.S. legislation (June 17, 1930) that raised import duties (tax collected on stuff coming into the U.S) to protect American businesses and farmers, adding considerable strain to the international economic climate of the Great Depression. Effects Between 1928-1932, the U.S. Gross National Product (GNP) – the total output of a nation’s goods & services – fell nearly 50% from $104 billion to $59 billion 90,000 businesses went bankrupt Unemployment leaped from 3% in 1929 to 25% in 1933 Was the Hawley Smoot Tarriff successful in protecting American businesses? Why?