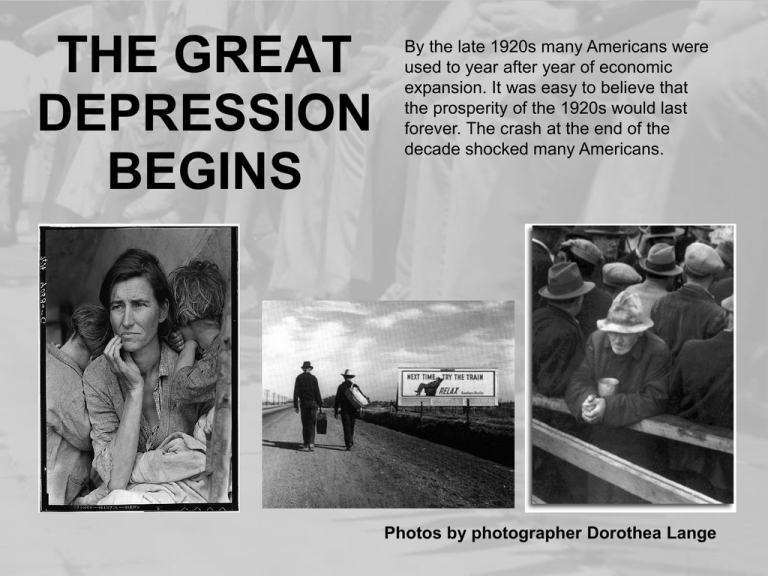

THE GREAT DEPRESSION BEGINS

advertisement

THE GREAT DEPRESSION BEGINS By the late 1920s many Americans were used to year after year of economic expansion. It was easy to believe that the prosperity of the 1920s would last forever. The crash at the end of the decade shocked many Americans. Photos by photographer Dorothea Lange LONG TERM CAUSES: THE NATION’S SICK ECONOMY As the 1920s advanced, serious problems threatened the economy while Important industries struggled, including: • • • • • • • • • Agriculture Railroads Textiles Steel Mining Lumber Automobiles Housing Consumer goods FARMERS STRUGGLE Photo by Dorothea Lange • No industry suffered as much as agriculture • During World War I European demand for American crops soared • After the war demand plummeted • Farmers increased production, sending prices further downward CONSUMER SPENDING DOWN • By the late 1920s, American consumers were buying less • Rising prices, stagnant wages and overbuying on credit were to blame • Most people did not have the money to buy the flood of goods factories produced GAP BETWEEN RICH & POOR • The gap between rich and poor widened • The wealthiest 1% saw their income rise 75% • The rest of the population saw an increase of only 9% • More than 70% of American families earned less than $2500 per year Photo by Dorothea Lange THE STOCK MARKET • By 1929, many Americans were invested in the Stock Market • The Stock Market had become the most visible symbol of a prosperous American economy • The Dow Jones Industrial Average was the barometer of the Stock Market’s worth • The Dow is a measure based on the price of 30 large firms STOCK PRICES RISE THROUGH THE 1920s • Through most of the 1920s, stock prices rose steadily • The Dow reached a high in 1929 of 381 points (300 points higher than 1924) • By 1929, 4 million Americans owned stocks New York Stock Exchange • The stock market: • the public invests in cos. by purchasing stocks; in return for this they expect a profit • b/c of booming 1920's economy, $ were plentiful, so banks were quick to make loans to investors • also investors only had to pay for 10% of the stock's actual value at time of purchase – this was known as BUYING ON MARGIN, and the balance was paid at a later date • this encouraged STOCK SPECULATION - people would buy and sell stocks quickly to make a quick buck • b/c of all this buying & selling, stock value increased (Ex: G.E stock $130 $396/share) • this quick turnover didn't aid cos. they needed long term investments so they could pay bills (stock value was like an illusion) • unscrupulous traders would buy and sell shares intentionally to inflate a given co.'s stock value • all of this gave a false sense of security/confidence in the American market PROBLEMS WITH THE RISING STOCK MARKET • By the late 1920s, problems with the economy emerged • Speculation: Too many Americans were engaged in speculation – buying stocks & bonds hoping for a quick profit • Margin: Americans were buying “on margin” – paying a small percentage of a stock’s price as a down payment and borrowing the rest THE 1929 CRASH • Stocks peaked in summer, 1929 • Prices started to drop as frightened investors who bought stocks on margin rushed to sell their stocks in order to pay off their loans • Tuesday, October 29th – Black Tuesday – stock market crashed because so many people wanted to sell and so few wanted to buy • People who had bought on margin (credit) were stuck with huge debts By mid-November, investors had lost about $30 billion • a 2nd major problem: uneven dist. of wealth • 0.1% at top owned as much as bottom 42% of American families (42% below poverty line) • of the 58% above the poverty line, most fell into the middle class category - they were not wealthy; they had jobs b/c of the industrialization & consumerization of the American market place • this middle class depended on their salaries and when productivity declined they lost their jobs • and b/c of low savings, they had to cut back on their purchases • this decline in consumption among the middle class ruined the whole country • Pres. Hoover’s responses… • he didn't believe that the gov't should play an active role in the economy • he persuaded bankers/business to follow his policy of VOLUNTARY NON - COERCIVE COOPERATION where he gave tax breaks in return for private sector economic investment • Hoover also organized some private relief agencies for the unemployed • he worked out a system with European powers that owed U.S. money as a result of WWI debts = HOOVER MORATORIUM - put a temporary stop to war debt & reparations payments • Euro. countries were to purchase American goods instead to stimulate American economy • in early 1931 these measures appeared successful, but then......the TARIFF WARS • Democrats in Congress passed a high tariff (SMOOT HAWLEY) to protect U.S. industry (hoped to stimulate purchasing of U.S. goods) • this turned out to be a fatal error... • Congress did not understand that the world had become a GLOBAL ECONOMY • in retaliation other countries passed high tariffs and no foreign markets purchased American goods, so U.S. productivity decreased again THE GREAT DEPRESSION Alabama family, 1938 Photo by Walter Evans • The Stock Market crash signaled the beginning of the Great Depression • The Great Depression is generally defined as the period from 1929 – 1940 in which the economy plummeted and unemployment skyrocketed FINANCIAL COLLAPSE • After the crash, many Americans panicked and withdrew their money from banks • Banks had invested in the Stock Market and lost money • In 1929- 600 banks failed • By 1933 – 11,000 of the 25,000 banks nationwide had collapsed Bank run 1929, Los Angeles