Cornell Note Questions

advertisement

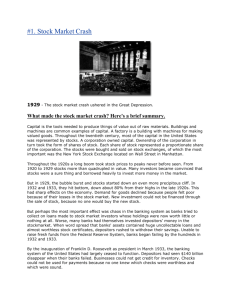

Cornell Note Questions Date: Cornell Notes: The Causes of the Great Depression in the 1930s ________________________– a prolonged downturn in the economy shown by a high unemployment rate and numerous business failures Introduction: The 1920s was one of the most exciting eras in United States history. Automobiles, radio, and jazz changed American life forever and it was a time of incredible economic prosperity. The “Roaring Twenties” ended however, with the stock market crash of 1929 which led to one of the worse times in United States history: the Great Depression of the____________________. I. The Election of 1928 A. Even though he could have been elected again, _______________________ chose not to run for reelection. He had a feeling that things were going to decline economically. The candidates were: Republican - ______________________________ Democrat - _______________________________ B. Campaign Issues: 1. Maintaining prosperity 2. Hoover favored Prohibition, Smith did not 3. Religious differences: Smith was a Catholic. Many people felt that if Smith won, the United States would be controlled by the Pope and the Catholic Church. President Herbert Hoover C. _________________________ easily wins and becomes President in 1929. As President he will face an incredibly troubling time: the Great Depression. II. Causes of the Great Depression The roots of the Great Depression of the 1930s can be found in the poor economic practices of the 1920s. Government Policies: A. High Tariffs on World Trade 1. __________________________________ – taxes on imported goods – reduced foreign trade. 2. The ______________________________________ raised import taxes to the highest level ever. This caused a decline in worldwide trade by ___________________ between 1929 and 1934. B. The Monetary Policy of the Federal Reserve – Words to Use: 66% 1930s Al Smith Calvin Coolidge Depression Federal Reserve Hawley-Smoot Tariff Herbert Hoover (2) High tariffs invest raised interest rates 1. The ________________________________________ – our nation’s central bank – was created in 1913 to prevent bank failure and regulate the economy. 2. The Fed did not regulate the economy in the 1920s and did not take the necessary steps to slow the economic downturn as we sank into the Great Depression. 3. In 1928 and 1929 the Fed ________________________________ to try to stop Wall Street speculation. This meant that it became more expensive to get loans and consumers began buying less items. Business Practices: C. The 1929 Stock Market Crash The stock market grew rapidly during the 1920s and people rushed to______________________ in the stock market so that they could become wealthy. Terms to know: 1. ________________________ - Shares of ownership in a corporation. A corporation is a large business owned by stock holders. 2. ____________________________ – a system for buying and selling stock. The main stock market location in the United States is Wall Street in New York City. Unfortunately, in the 1920s, many people engaged in two risky behaviors: 1. ______________________________ - With this practice, stock market investors only had to pay 10% of the price of a share of stock. The other 90% was borrowed. This made stocks affordable to most Americans and they rushed to buy stock even though this put them into debt. Waiting for information on Wall Street 2. __________________________ –When investors buy shares of stock in a company for the sole purpose of selling them once they increase in value. Americans rushed to buy stocks because they felt that the stock market would continue to rise. The strong market lasted as long as there were new investors. By late 1929, the market had reached its peak and then declined in a spectacular way: ____________________________ – October 24, 1929: The Stock Market Crashed – lost 12% its value. Many people who had invested in the stock market were left with nothing. __________________________ – October 29, 1929: The Stock Market lost $10-15 billion! By the end of the week the market lost 30% of its value! The value of the market continued to decline until 1933. By then it had lost about 85% of its value. The ripple effects of the Stock Market Crash were great: a. People lost all of their investments b. Businesses lost value c. Banks closed d. People lost their jobs e. People committed suicide D. Failure of the ___________________________: As banks began to fail (due to losing their investments in the Stock Market Crash), people rushed to the banks to pull out their money before it was lost to them too. When people rush to banks to pull out their money it is called a ______________________. Doing so caused even more People in line at their bank during a bank run Words to Use: Banking System bank run Black Thursday Black Tuesday buying on the margin speculation Stock Stock market weaknesses in the banking industry and the economy. Cornell Note Summary: ___________________________________________________________________ ___________________________________________________________________ C. _________________________________1. Too many goods were produced in the prosperous 1920s. Ultimately, there were not enough consumers to buy these products. 2. Since few people were buying their products, businesses began to _____________________________ and ______________________________. D. Debt – Many Americans went into_______________________(by using the installment plan) to buy the many new products of the 1920s such as radios, cars and washing machines. When stock market crashed, the banks failed, and people lost their jobs, many Americans owed substantial amounts of money. E. High Tariffs __________________________________ – taxes on imported goods – reduced foreign trade. The ______________________________________ raised import taxes to the highest level ever. This puts additional stress on the economy and causes a decline in world wide trade. F. The Inaction of the Federal Reserve – 1. The ________________________________________ – our nation’s central bank – was created in 1913 to prevent bank failure and regulate the economy. 2. The Fed did not regulate the economy in the 1920s and did not take the necessary steps to slow the economic downturn as we sank into the Great Depression. 3. In 1928 and 1929 the Fed raised interest rates to try to stop Wall Street speculation. This meant that it became more expensive to get loans and consumers began buying less items. Cornell Note Summary: ___________________________________________________________________ ___________________________________________________________________ In this space, list the six causes of the Great Depression: 1. _________________________________________________ 2. _________________________________________________ 3. _________________________________________________ 4. _________________________________________________ 5. _________________________________________________ 6. _________________________________________________