financial ratios

advertisement

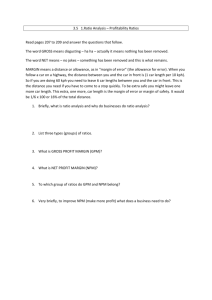

(NYSE: BREW) TEAM MEMBERS: Purvi Mittal Leiyi Huang Harout Sahakian Rakesh Venkatayogi AGENDA • • • • • • Business Overview Macro-Economic & Industry Overview Technical Analysis Financial Ratios Valuation Recommendation CRAFT BREW ALLIANCE – INTRODUCTION Business: A craft beer brewing company with a unique alliance between three craft beer brands Operates two segments: Beer related operations: Brewing and sale of craft beers and cider from six breweries Pubs operations: Operates 5 pubs for brand building Has master distribution partnership with Anheuser– Busch Market Cap Employees Annual production Capacity (000’s) Source: Company website and 10K_2013 $281mm ~725 1,075 barrels DEVELOPMENT STRATEGY National Portfolio Merger Integration National Portfolio Strategy and Building Business Development and Initial Market Model Foundation Introduction 12% Strategy Growth and Value Creation Volume Growth 8% 11% 4% 6% 2% 7% - 11% 6% 2% 0% 2008 2009 Redhook / Widmer Merger Source: CBA Investor Presentation 2010 2011 Kona Merger 2012 Sale of FSB Omission Launch 2013 2014 Square Mile Launch 2015 BRANDS • Launched in 1981 in Seattle • Distributed in all 50 states Source: Company website and 10K_2013 • Launched in 1984 in Portland • Distributed in all 50 states • Launched in 1994 in Hawaii • Distributed in 36 states • Launched in 2012 in Portland • First gluten free beer • Launched in 2013 • Distributed in 10 states and expanding BREWING FACILITIES Washington Brewery Annual / Max Capacity (000’s) 220 / 280 New Hampshire Brewery Annual / Max Capacity (000’s) Oregon Brewery Annual / Max Capacity (000’s) 630 / 650 Hawaii Brewery Annual / Max Capacity (000’s) Source: Company website and 10K_2013 10 / 10 215 / 280 ANHEUSER–BUSCH PARTNERSHIP Ownership Structure AnheuserBusch 32% Minority 43% Master Distribution Agreement Distribution of Kona, Widmer Brothers, Redhook, Omission and Square Mile in all states, territories and possessions of the US Widmer Brothers 12% Management and Board 4% Kona Founders 9% Source: Company website and 10K_2013 Distributor Agreement has a term that expires on December 31, 2018, subject to automatic renewal CBA pays margin fees, invoicing, staging and cooperage handling fees, and inventory manager fees HISTORICAL FINANCIAL ANALYSIS Net Sales Gross Margin 200 32.0 50 24.0 22 12 110 (%) $mm 100 24 24 150 127 16.0 25.6 155 146 30.3 29.6 28.1 2011 2012 2013 8.0 0 0.0 2010* 2011 2012 Beer related 2013 Pubs Compounded growth of ~11% , primarily 2010 Beer related During 2012 and 2013, product mix, because of shift in mix towards packaged, variable costs, supply chain challenges and which has a higher selling price per barrel pubs pressured gross margin than draft Expected 5‐year gross margin expansion of 500 to 700 basis points Source: 10K_2013 and investor presentation Note: does not include alternating proprietorship revenue MACRO & INDUSTRY OVERVIEW BEER INDUSTRY CHARACTERISTICS Success Factors Establishment of brand names Global Beer Market Distribution By Volume Control of distribution networks 3.40% Marketing of Products Effective Quality Control 7.40% 11.60% 43.90% Differentiation Factors Ingredients 33.70% Taste Price Packaging Supermarkets/Hypermarkets On-trade Specialist Retailers Convenience Stores Other Source: IBISWorld. Craft Beer Production in the US. August 2013; MarketLine Industry Profile: Global Beer. August 2013. CONSUMER EXPENDITURE ON BEER – % CHANGE YOY 13.79% 11.62% 10.84% 9.31% 9.61% 7.23% 5.91% 5.23% 3.17% 2.82% 2.65% 2010 -2.57% 2011 -0.54% -0.29% 2012 2013 -3.93% -7.83% Asia Pacific Eastern Europe Western Europe Source: Passport. Euromonitor International. Consumer Expenditure on Alcoholic Drinks. February 2014. North America THE CRAFT GROWTH RATE IN CRAFT BEER REVENUE FORECASTS Growth In Craft Breweries • 2011 – 1,970 • 2012 – 2,347 • 2013 – 2,483 Growth in Volume of Craft Beer • 2012 – 15% • 2013 – 18% Source: MarketLine. Craft Beer: A Fast Growing Market. September 2013; www.brewersassociation.org 14% 13% 12% 10% 9.30% 8% 7.20% 6% 4.60% 3.60% 4% 3.10% 2% 0% 2014 2015 2016 2017 2018 2019 SWOT ANALYSIS FOR BREW Strengths •Distribution to retailers through A-B agreement •Ability to test products in pubs before new launches •Quality control by using local suppliers Weaknesses •Majority ownership by Anheuser Busch limits some activities •Shipping costs associated with Kona brand products •Concentration in the Pacific Northwest Opportunities •New product launches •Expansion in domestic and international markets •Consolidation in the industry Threats •Changes in consumer preferences •Increases in regulation or taxes, especially the excise tax •Public relations and brand image FINANCIAL ANALYSIS TECHNICAL ANALYSIS Source: Yahoo Finance FINANCIAL RATIOS COMPARABLE COMPANIES RATIOS* CRAFT BREW RATIOS Liquidity Ratios Liquidity Ratios Current Ratio Quick Ratio Cash Ratio 2011 1.1 0.6 0.1 2012 1.2 0.6 0.3 2013 1.2 0.5 0.2 2011 2012 2013 3.6% 6.0% 6.1% 16.1% 3.0% 1.4% 1.5% 9.1% 2.1% 1.0% 1.2% 9.1% Profitability Ratios Operating Profit Margin Net Profit Margin ROA Cash Return on Equity Source: Brew 10K Operating Profit Margin Net Profit Margin ROA Cash Return on Equity 0.9 0.6 17.2% 14.3% 6.9% Solvency Ratios Solvency Ratios Debt/Assets Debt/Equity Interest overage Current Ratio Quick Ratio Profitability Ratios 2011 2012 2013 9.0% 13.7% 5.9 8.0% 12.3% 7.7 6.9% 10.6% 8.2 Debt/Assets Debt/Equity Interest overage 24.5% 57.6% 3.6 *Ratios calculated by taking averages of our comparable companies FINANCIAL RATIOS COMPARABLE COMPANIES RATIOS CRAFT BREW RATIOS Activity Ratios Fixed Assets Turnover Total Assets Turnover 2011 1.5 0.9 2012 1.7 1.0 2013 1.7 1.1 DuPont Analysis Tax Burden Interest Burden Operating Profit Margin Asset Turnover Leverage ROE Source: Brew 10K 2011 0.6 2.9 3.6% 1.0 1.5 10.0% 2012 0.6 0.9 3.0% 1.1 1.5 2.5% 2013 0.6 0.9 2.1% 1.1 1.5 1.9% Activity Ratios Fixed Assets Turnover Total Assets Turnover ROE 2.4 0.7 17.2% *Ratios calculated by taking averages of our comparable companies COMPARABLE COMPANIES Anheuser-Busch 20% Boston Beer Co. Inc. 30% Carlsberg 20% Molson Coors Co. 15% Heineken 15% COMPARABLE VALUATION P/E – 15% Forward P/E – 20% Estimated Share Price EV/Revenue – 15% EV/EBITDA – 15% Forward EV/EBITDA – 20% P/B – 15% $15.21 ASSUMPTIONS Assumptions 2009A 2010A 2011A 2012A 2013A 2014P 2015P 2016P 2017P 2018P 5.6% 13.3% 13.5% 5.8% 13.0% 10.0% 8.0% 8.0% 10.0% 6.4% 6.5% 7.3% 7.0% 6.9% 7.0% 8.0% 8.0% 8.0% 8.0% Gross Margin (% Sales) 20.6% 23.9% 28.1% 27.5% 26.1% 27.1% 28.1% 29.1% 30.1% 31.1% SG&A Margin (% Sales) 18.7% 21.3% 24.7% 24.7% 24.1% 23.5% 23.0% 23.0% 23.0% 23.0% 5.5% 5.5% 5.5% 5.5% 4.0% 3.8% 3.8% 4.0% 3.8% Sales Growth % Excise Tax Rate ( % of Sales) CapEx D&A ($) 5.5% 5.0% 4.5% 4.0% 4.2% 5.0% 5.3% 5.6% 6.0% 6.2% Interest Expenses 9.5% 6.1% 6.4% 5.0% 3.9% 4.0% 4.3% 4.1% 4.1% 4.2% DISCOUNTED CASH FLOW ANALYSIS WACC Cost of debt Cost of debt Marginal tax rate Cost of debt after tax shield Cost of equity Risk-Free Rate (rf) Market Risk Premium (rm-rf) CAPM Beta CAPM Cost of Equity BREW Realized Return Cost of Equity FCF Build 6.0% 40.0% 3.6% EBIT Less: Taxes Less: Capex Less: Change in NWC Plus: D&A Unleveled FCF 2.7% 7.0% 1.24 11.4% 21.1% 12.4% Capital structure Debt Market Cap Total 4.0% 96.0% 100.0% Weighted average cost of capital Business risk premium Discount Rate 12.0% 1.0% 13.0% 2014P 7,868.9 (2,918.0) (8,698.0) 81.9 10,872.5 2015P 12,243.7 (4,645.0) (9,089.4) (1,314.9) 12,677.3 7,207.3 9,871.7 2016P 15,806.5 (6,049.9) (9,816.5) (1,157.1) 14,466.5 13,249.4 2017P 19,861.0 (7,649.8) (11,159.8) (1,249.7) 16,739.8 2018P 24,916.0 (9,642.4) (11,662.0) (1,687.1) 19,027.5 16,541.4 20,952.1 Terminal Value Assumptions Discounted rate (WACC) 4.0% 13.01% 13.01% 13.01% 13.01% 13.01% Terminal Value 13.01% 241772.4 Discounted period (t) 1.00 2.00 3.00 4.00 5.00 5.00 Discount Factor 0.88 0.78 0.69 0.61 0.54 0.54 PV of FCFs (in thousands) % of Total EV Perpetuity Method 6,377.4 3.6% PV of FCFs ($ thousands) 44,792.3 7,729.3 4.4% 9,179.4 5.2% Terminal Value Enterprise Value ($ thousands) ($ thousands) 131,150.8 175,943.1 10,140.6 11,365.6 5.8% Net Debt ($ thousands) 3,357.6 6.5% 131,150.8 74.5% Equity Value ($ thousands) 172,585.5 Shares 18,972.247 Price $ 9.10 SENSITIVITY Enterprise Value - WACC vs. Perpetuity Growth Rate Perpetuity Growth Rate WACC 9.1 2.5% 3.0% 3.5% 4.0% 10.0% 11.8 12.5 13.3 14.3 11.0% 10.2 10.8 11.4 12.0% 9.0 9.4 13.0% 8.0 14.0% 4.5% 5.0% 5.5% 15.4 16.8 18.5 12.1 12.9 13.8 14.9 9.9 10.4 11.0 11.7 12.4 8.4 8.7 9.1 9.6 10.1 10.6 7.2 7.5 7.8 8.1 8.4 8.8 9.2 15.0% 6.6 6.8 7.0 7.2 7.5 7.8 8.2 16.0% 6.0 6.2 6.3 6.5 6.8 7.0 7.3 RECOMMENDATION Price Weight DCF $9.10 75% Comparable $15.21 25% Estimated Price $10.62 Current Price $14.64 Add to Watch List