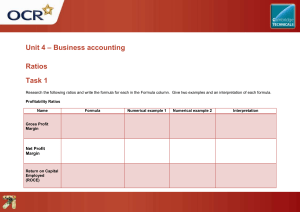

3.5 1 Ratio Analysis

advertisement

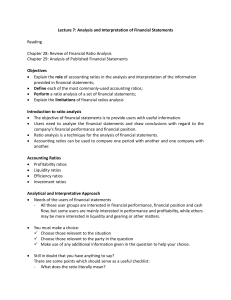

3.5 1.Ratio Analysis – Profitability Ratios Read pages 207 to 209 and answer the questions that follow. The word GROSS means disgusting – ha ha – actually it means nothing has been removed. The word NET means – no jokes – something has been removed and this is what remains. MARGIN means a distance or allowance, as in “margin of error” (the allowance for error). When you follow a car on a highway, the distance between you and the car in front is (1 car length per 10 kph). So if you are doing 60 kph you need to leave 6 car lengths between you and the car in front. This is the distance you need if you have to come to a stop quickly. To be extra safe you might leave one more car length. This extra, one more, car length is the margin of error or margin of safety. It would be 1/6 x 100 or 16% of the total distance. 1. Briefly, what is ratio analysis and why do businesses do ratio analysis? 2. List three types (groups) of ratios. 3. What is GROSS PROFIT MARGIN (GPM)? 4. What is NET PROFIT MARGIN (NPM)? 5. To which group of ratios do GPM and NPM belong? 6. Very briefly, to improve NPM (make more profit) what does a business need to do? 3.5 1.Ratio Analysis – Efficiency Ratios Read pages 209 to 210 and answer the questions that follow. 1. What are efficiency ratios? 2. How is RETURN ON CAPITAL EMPLOYED (ROCE) a measure of efficiency? (e.g. What does ROCE measure?) 3. Given the formula for ROCE, how can businesses improve ROCE? (e.g. what do they need to do in the business to make the numerator larger and the denominator smaller?) 3.5 1.Ratio Analysis – Liquidity Ratios Read pages 210 to 212 and answer the questions that follow. When businesses are “liquid” it means they have (a lot of) cash on hand. Cash includes specie (the bills and coins that we call money) as well as current account balances and debtors that can be quickly turned into cash. Firms that are liquid can pay their bills and are less likely to default on payments. (A good thing) 1. Identify and explain briefly two measures of liquidity. 2. How can the Current ratio be improved? 3. How can the Acid Test or Quick Ratio be improved? 4. Do workpoint 3.14 on page 212